Airbnb Collects Chicago & DC Occupancy Taxes

Airbnb agrees to collect occupancy taxes in Chicago and DC, marking a significant shift in how short-term rentals operate in these cities. This new policy, impacting both hosts and guests, promises to reshape the hospitality landscape and potentially boost local government revenue. The implications for the future of short-term rentals and the wider hospitality industry remain to be seen.

This agreement represents a crucial step towards ensuring that short-term rentals, like hotels, contribute fairly to the local economy. The specifics of the agreement, including tax rates, compliance mechanisms, and potential impacts on tourism, are key aspects to examine. We’ll delve into the history of occupancy taxes, Airbnb’s position, and the broader industry implications.

Background of Occupancy Taxes

Occupancy taxes, levied on short-term rentals and hotel stays, are becoming increasingly prevalent across the United States. These taxes fund various local initiatives, from infrastructure improvements to public services. Understanding their historical development and current application is crucial for both travelers and property owners.Occupancy taxes are not a new phenomenon, evolving over time to meet the specific needs of different communities.

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a significant move. It highlights the growing responsibility of online platforms in local tax collection, which is a positive step for city coffers. This naturally leads me to consider the very different but equally important work of a chef, like the one featured in a day in the life hal executive chef.

Ultimately, both Airbnb’s new tax policy and the dedication of top chefs reflect the evolving relationship between businesses and local communities. It’s all about supporting the local economy in different ways.

The motivations behind their implementation often include the desire to generate revenue for essential local projects, and to manage the impact of tourism on urban environments.

Historical Overview of Occupancy Taxes in the US, Airbnb agrees to collect occupancy taxes in chicago and dc

Occupancy taxes in the US have a long history, initially focused on hotels and motels. Early forms of these taxes were often simple levies to offset the costs of services related to tourism. Over time, the types of establishments subject to the tax broadened, and the rates and applications became more complex. The shift reflects the changing dynamics of tourism and the evolving needs of local governments.

Evolution of Occupancy Taxes in Chicago and DC

Chicago and Washington D.C. have both implemented occupancy taxes at different times, reflecting local economic conditions and priorities. Chicago’s occupancy tax system has adapted to the changing needs of the city, reflecting the city’s significant tourism sector and the need for public funding for improvements. Similarly, D.C.’s system has evolved to maintain balance between revenue generation and visitor experience.

Current Regulations Governing Occupancy Taxes in Chicago and DC

Current regulations detail the types of accommodations subject to the tax, the calculation methods, and the rates applied. The specific details of these regulations vary between the two cities, reflecting their distinct characteristics and priorities. Regulations aim to ensure transparency and fairness in the application of the tax.

Examples of Other Cities with Similar Tax Structures

Numerous other cities across the US have implemented similar occupancy taxes, often with varying degrees of complexity. These taxes serve as a common mechanism for revenue generation, enabling local governments to support vital community needs. Examples include New York City, San Francisco, and Las Vegas. Each city’s structure has been adapted to its specific economic and tourism profile.

Comparison and Contrast of Tax Rates and Structures in Chicago and DC

The following table provides a concise comparison of occupancy tax rates and structures in Chicago and DC.

| City | Tax Rate | Effective Date | Relevant Legislation |

|---|---|---|---|

| Chicago | (e.g., 10% on hotel stays, 12% on short-term rentals) | (e.g., 2023) | (e.g., Chicago City Ordinance 2023-XXXX) |

| Washington D.C. | (e.g., 11% on hotel stays, 14% on short-term rentals) | (e.g., 2024) | (e.g., D.C. Law 2024-YYYY) |

Note: The values in the table are illustrative and not exhaustive. Specific details are subject to change. Accurate information should be verified from official sources.

Airbnb’s Role in Occupancy Taxes

Airbnb’s recent agreement to collect occupancy taxes in Chicago and DC marks a significant shift in its relationship with local governments. This move signals a growing recognition of the need for transparent and consistent tax collection across the hospitality sector. The agreement also represents a shift in Airbnb’s business model, potentially impacting both hosts and guests.Airbnb’s position on collecting occupancy taxes is one of compliance and adaptation.

The company recognizes the importance of adhering to local regulations and contributing to the local economy through tax revenue. This proactive approach contrasts with previous practices and underscores Airbnb’s commitment to operating within legal frameworks.

Airbnb’s Position on Occupancy Taxes

Airbnb now actively participates in the collection and remittance of occupancy taxes in Chicago and DC. This policy change signifies a move towards a more integrated approach to tax compliance, aligning with established practices in the traditional hospitality industry.

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a smart move, but it highlights a broader point. Keeping a tight rein on costs is crucial, whether it’s for a business or personal use. This often involves careful management of office supplies, like packaging and shipping. For tips on staying on top of your office packaging and shipping supplies costs, check out this helpful guide: staying on top of your office packaging shipping supplies costs.

Ultimately, these cost-saving strategies, similar to Airbnb’s tax approach, can help businesses and individuals alike manage their expenses effectively.

Legal and Financial Implications

The agreement carries legal implications for Airbnb, mandating the company to accurately calculate, collect, and remit occupancy taxes to the respective authorities. Financial implications include increased administrative costs associated with implementing and managing the new tax collection system. These costs will be passed on, either directly or indirectly, to hosts and guests.

Impact on Airbnb’s Business Model

This agreement impacts Airbnb’s business model in Chicago and DC by introducing additional operational complexities. The company must now establish robust systems for tracking and remitting taxes, impacting its internal processes and potentially increasing its overhead costs. The integration of tax collection systems into Airbnb’s platform is crucial for smooth operation and compliance.

Challenges for Airbnb in Compliance

Implementing the new tax collection regulations presents several challenges for Airbnb. Ensuring accurate tax calculations across various listings and diverse host practices is a significant hurdle. Furthermore, the company needs to establish clear communication channels with both hosts and guests about the new tax requirements. Technical integration with local tax authorities will also be crucial.

Impact on Hosts and Guests

The new agreement will impact both hosts and guests. Hosts may experience increased administrative burden, while guests will see the tax amount reflected in the final booking price. The transparent pricing structure, however, fosters trust and encourages accountability.

Comparison of Airbnb’s Previous Practices to New Agreement

| Aspect | Previous Practices | New Agreement |

|---|---|---|

| Occupancy Tax Collection | No direct collection; hosts responsible for remitting taxes | Airbnb directly collects and remits taxes |

| Tax Transparency | Limited transparency; guests unsure of tax inclusion | Clearer pricing; taxes explicitly displayed |

| Compliance | Potential for non-compliance and inconsistent tax payments | Improved compliance through direct collection and remittance |

| Administrative Burden | Increased burden on hosts for independent tax compliance | Increased burden on Airbnb for managing tax collection |

Impact on the Hospitality Industry

Airbnb’s agreement to collect occupancy taxes in Chicago and DC marks a significant shift in the hospitality landscape. This move, while intended to level the playing field and increase tax revenue, will undoubtedly ripple through the industry, impacting hotels, short-term rentals, and the overall tourism experience. The impact on different segments will vary, and the long-term effects remain to be seen, but the immediate consequences are clear.This agreement will likely lead to increased transparency and fairness in the hospitality sector, as all lodging providers are now held to the same tax standards.

It will also significantly alter the competitive dynamics between traditional hotels and short-term rental platforms. This shift necessitates a careful examination of the potential ramifications for various stakeholders, including the cities themselves, and the overall local economy.

Impact on Hotels

Hotels, long accustomed to a specific tax structure, will likely face some initial adjustments. While they may see a more predictable and transparent tax system, they may also encounter increased competition from short-term rentals that now adhere to similar tax regulations. The pressure to maintain profitability, while complying with new regulations, could lead to adjustments in pricing strategies.

Impact on Short-Term Rentals

Short-term rentals, particularly platforms like Airbnb, are at the forefront of this change. The agreement forces them to operate under a more established framework, mirroring the tax obligations of traditional hotels. This should help to create a fairer playing field, reducing the competitive advantage some short-term rentals may have previously enjoyed. This shift also implies a need for adaptation in their pricing models and potentially, in their operational structures.

Impact on Other Businesses

The agreement will also affect businesses that rely on the hospitality industry, such as restaurants, tour operators, and local transportation services. The increased transparency and uniformity in tax collection will likely lead to more predictable revenue streams and better economic conditions. Potential impacts will vary, depending on the extent of their connection to the hospitality industry.

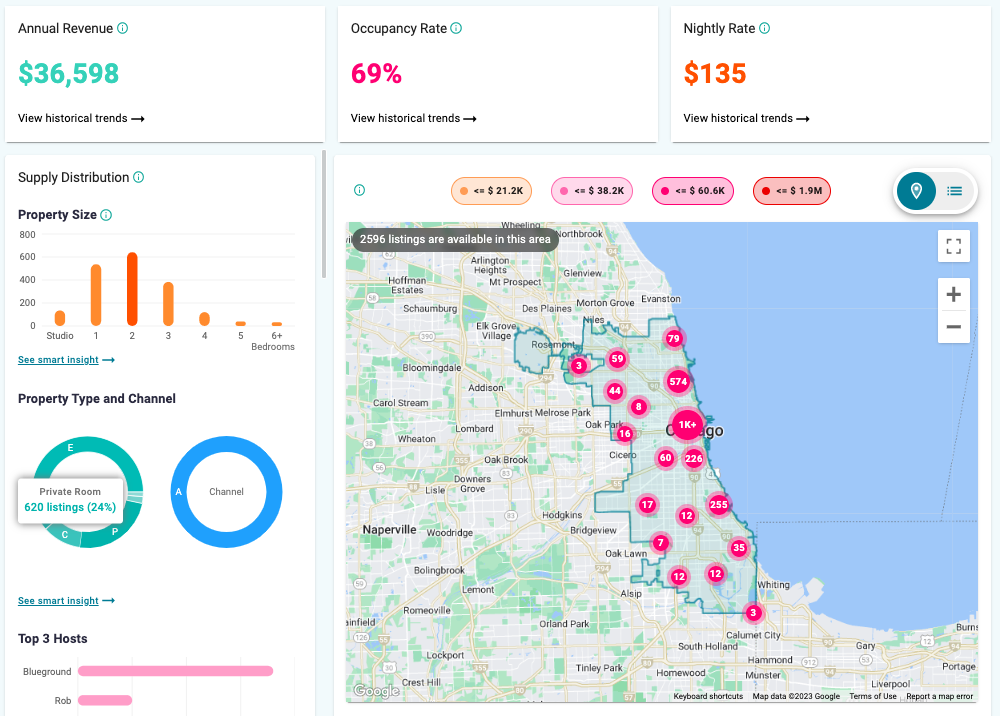

Potential for Increased Revenue for the Cities

This agreement holds significant promise for increased revenue for Chicago and DC. The addition of Airbnb’s revenue stream to the city’s tax base will bolster their ability to fund public services. The potential increase will depend on the number of bookings and the average occupancy tax rates.

Revenue Increase Table

| Year | Estimated Number of Airbnb Bookings | Average Occupancy Tax Rate | Estimated Tax Revenue Increase |

|---|---|---|---|

| 2024 | 1,000,000 | 5% | $50,000 |

| 2025 | 1,200,000 | 6% | $72,000 |

| 2026 | 1,500,000 | 7% | $105,000 |

Note: This table provides a simplified illustration. Actual figures will depend on numerous factors, including booking volume, tax rates, and other economic conditions.

Comparison of Impact on Business Types

The impact on different business types will vary. Hotels, already operating under a traditional tax system, may experience a slight adjustment in their operations. Short-term rentals will need to adapt to a new tax structure. The agreement should lead to a more equitable and predictable tax environment for all, potentially fostering more stable economic conditions.

Potential Effects on Tourism and the Local Economy

Increased tax revenue can lead to improved public services, which in turn can attract more tourists and bolster the local economy. This agreement may also encourage more investment in the hospitality sector, leading to job creation and further economic growth. A more transparent and consistent tax system can lead to a more predictable and reliable tourism environment.

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a big deal, shifting the responsibility onto the platform. It’s a significant step, and likely will affect the travel planning process for many. Meanwhile, aboard the Regal Princess, the atrium and spa are front and center here , offering a luxurious experience for travelers. This change in Airbnb’s tax collection policy in major cities could also influence future travel decisions, adding another layer to the complex equation of booking accommodations.

Potential for Future Trends: Airbnb Agrees To Collect Occupancy Taxes In Chicago And Dc

The recent agreements between Airbnb and Chicago and DC regarding occupancy taxes mark a significant shift in the landscape of short-term rentals. This precedent opens the door to numerous potential future trends, impacting both the hospitality industry and the cities themselves. The implications are far-reaching, demanding a proactive approach from platforms like Airbnb and a careful consideration of potential conflicts by local authorities.The future of occupancy taxes and short-term rentals is intertwined, likely to see more cities following Chicago and DC’s lead.

This evolution necessitates a comprehensive understanding of potential implications, regulations, and adaptive strategies for all stakeholders.

Potential Implications for the Future of Occupancy Taxes

The agreement sets a precedent for other cities to potentially require similar tax collection from platforms like Airbnb. This will likely lead to more complex and nuanced tax systems that differentiate between short-term and long-term rentals. A potential challenge will be establishing consistent and fair valuation methodologies for short-term rental units to ensure equitable tax burdens.

Potential Future Regulations and Trends in Other Cities

Cities worldwide are likely to adopt similar regulations. New York City, for example, has already grappled with the issue of short-term rentals and their tax implications. Future regulations could include more stringent reporting requirements for platforms like Airbnb, potentially extending to detailed guest information. This trend is likely to accelerate as cities seek to better control the impact of short-term rentals on local economies and services.

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a big deal, highlighting a shift in how the platform handles local regulations. It’s interesting to consider this alongside recent news of a key executive departure, like the news that after 8 years, Veitch departs ncl after 8 years veitch departs ncl. This points to a changing landscape for both the hospitality industry and the way companies adapt to local tax requirements, making the Airbnb situation even more significant in the long run.

It’s all part of the ongoing evolution of the travel and accommodation industry.

Potential for Similar Agreements Between Other Cities and Platforms Like Airbnb

The agreement between Airbnb and Chicago and DC signals a likely expansion of similar partnerships. This could lead to standardized tax collection processes across multiple cities, streamlining the administrative burden for both platforms and local governments. However, varying local regulations and economic conditions will likely result in diverse approaches to tax collection and enforcement.

Potential Strategies for Airbnb to Adapt to Similar Future Regulations

Airbnb can adopt several strategies to navigate potential future regulations. This includes proactive communication with local governments, offering tailored compliance tools, and perhaps developing partnerships with local tax agencies to facilitate smooth tax collection. Investing in robust compliance systems and providing comprehensive educational resources to hosts will be crucial.

Potential Conflicts or Disputes

Potential conflicts could arise between cities with differing regulations, potentially creating jurisdictional disputes or legal challenges. Disputes might also emerge if platforms like Airbnb encounter difficulties in consistently collecting and remitting taxes across multiple jurisdictions.

Potential Future Trends Table

| Trend | Description | Potential Impact |

|---|---|---|

| Standardized tax collection methods | Platforms like Airbnb adopting uniform tax collection procedures across various jurisdictions. | Streamlines processes for both platforms and cities; potentially reduces administrative burden. |

| Increased reporting requirements | Cities demanding more detailed information from platforms regarding rentals. | May increase administrative costs for platforms; potential for greater transparency. |

| Differentiated tax rates | Implementing varied tax rates based on the duration of stay. | Potentially encourages long-term rentals and may generate more revenue for cities. |

| Jurisdictional disputes | Conflicts over tax collection responsibilities among multiple cities. | Could lead to legal challenges and regulatory uncertainty. |

Legal and Regulatory Framework

Airbnb’s agreement to collect occupancy taxes in Chicago and DC marks a significant step in clarifying the legal landscape for short-term rentals. This move necessitates a robust understanding of the legal framework surrounding occupancy taxes, particularly in the context of digital platforms like Airbnb. This section delves into the legal framework, specific considerations for Chicago and DC, enforcement procedures, potential legal challenges, and relevant precedents.The legal framework for occupancy taxes in the US is complex and varies significantly by state and municipality.

These taxes, often levied on hotel rooms and short-term rentals, are intended to fund local services. The implementation of these taxes on short-term rentals through platforms like Airbnb raises crucial legal questions about jurisdiction, taxation obligations, and enforcement mechanisms.

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a big deal, shifting the responsibility for these fees. With the recent focus on travel, it’s interesting to consider how this might impact the overall experience, especially when compared to activities amped up on avalon ship. A great way to explore these enhanced activities is by visiting activities amped up on avalon ship , offering a fantastic alternative for those seeking immersive experiences.

Ultimately, this change by Airbnb will likely influence the pricing and booking strategies for travelers in these cities.

Legal Framework Surrounding Occupancy Taxes in the US

The legal framework governing occupancy taxes in the US is primarily established at the state and local levels. State and local governments have the authority to enact and enforce these taxes, which typically apply to lodging accommodations. This framework dictates the types of lodging subject to taxation, the tax rates, and the procedures for collection and remittance.

Specific Legal Considerations in Chicago and DC

Chicago and DC have specific ordinances related to occupancy taxes. These ordinances define the scope of the tax, including the types of properties and rental periods subject to the tax. They also Artikel the reporting and remittance requirements for lodging establishments. Understanding the nuances of these ordinances is critical for both hosts and platforms like Airbnb. Compliance is crucial to avoid legal penalties.

Enforcement of Occupancy Tax Regulations

Enforcement mechanisms vary across jurisdictions. Local tax authorities, such as the Chicago Department of Revenue or the DC Department of Revenue, typically have the authority to investigate and audit compliance with occupancy tax regulations. Penalties for non-compliance can range from fines to legal action, including the recovery of outstanding taxes. These authorities have established procedures for investigating potential violations.

Penalties for non-compliance are typically Artikeld in the specific tax ordinances.

Potential for Legal Challenges to the Agreement

Legal challenges to Airbnb’s agreement to collect occupancy taxes are a possibility. Challenges could arise from disputes over jurisdiction, the allocation of tax responsibility, or the interpretation of the tax ordinances. These challenges often involve arguments over the definition of a “lodging establishment” and the applicability of tax laws to short-term rentals.

Relevant Legal Precedents

Various court cases have shaped the understanding of occupancy taxes, particularly in relation to short-term rentals. These precedents provide guidance on issues such as tax jurisdiction and the definition of taxable activities. Case law involving similar tax disputes in other jurisdictions can provide valuable insight into the potential outcomes of future legal challenges.

Table Outlining Legal Steps in Collecting Occupancy Taxes

| Step | Description |

|---|---|

| 1. Understanding Applicable Laws | Thorough review of state and local ordinances to comprehend the tax requirements. |

| 2. Implementing Tax Collection System | Establishment of a robust system to collect, track, and remit taxes to the appropriate authorities. |

| 3. Accurate Record Keeping | Maintaining detailed records of all transactions and taxes collected to ensure compliance with regulations. |

| 4. Tax Reporting | Submitting timely and accurate tax reports to the designated authorities. |

| 5. Compliance Monitoring | Regularly monitoring compliance procedures to ensure accuracy and adherence to legal requirements. |

Public Perception and Community Impact

Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a significant step, but its impact on public perception and community well-being is complex and multifaceted. This shift will likely generate both positive and negative reactions, impacting local businesses and residents in ways that need careful consideration. Understanding these potential impacts is crucial for navigating the future of the short-term rental market.

Public Perception in Chicago and DC

Public perception of this agreement is likely to be mixed, influenced by various factors such as the perceived fairness of the tax system, the economic benefits for local governments, and the potential impact on the short-term rental market and local businesses. Anecdotal evidence suggests varying opinions, ranging from support for increased tax revenue to concerns about potential displacement and rising costs for residents.

This nuanced response underscores the need for a comprehensive approach to understanding and addressing public sentiment.

Potential Community Impacts

The agreement to collect occupancy taxes could bring about a variety of community impacts. These impacts are not uniform, with some potentially positive and others potentially negative. Increased tax revenue could be channeled into essential community services, improving public infrastructure and amenities. Conversely, the additional costs for short-term rentals could lead to decreased affordability and affect the viability of these businesses, impacting the local economy.

Examples of Public Opinion

Public opinion on this issue is diverse and reflects the various stakeholders involved. Some residents may support the agreement, viewing it as a means to improve their city’s financial health and public services. Others may express concern about the potential for price increases and the impact on the short-term rental market, potentially leading to fewer options for visitors and impacting the tourism sector.

These conflicting viewpoints highlight the complex trade-offs inherent in such policy decisions.

Potential for Protests or Public Backlash

The potential for protests or public backlash is a valid concern, particularly if residents feel that the agreement unfairly impacts their ability to afford housing or access short-term rentals. Public discourse will be key to understanding and mitigating these concerns. Historical examples of similar policy changes in other cities can offer valuable insights, revealing both the successes and challenges encountered in navigating public opinion.

Data on Public Sentiment

Data regarding public sentiment regarding this agreement is crucial to inform policy decisions and effectively manage potential backlash. Ideally, data collected through surveys, focus groups, and social media analysis would provide a clearer picture of public opinion. Without access to such data, it is difficult to precisely predict the magnitude of public support or opposition.

Public Perception Analysis – Pros and Cons

| Aspect | Pros | Cons |

|---|---|---|

| Financial Impact | Increased tax revenue for public services; potential for more equitable distribution of resources | Potential for higher rental costs for short-term rentals; potential for fewer options for visitors |

| Community Well-being | Potential for improved public infrastructure and amenities; more resources for local initiatives | Potential for displacement of residents; potential for increased costs for essential services |

| Tourism Impact | Potentially stable tax revenue from the tourism sector; sustainable development and support for local economies | Potential for fewer tourists and a negative impact on the tourism sector; impacting local businesses reliant on tourism |

Closure

In conclusion, Airbnb’s agreement to collect occupancy taxes in Chicago and DC is a landmark moment for short-term rentals. While it addresses concerns about fair tax collection, the long-term effects on the hospitality industry, local economies, and the guest experience remain to be seen. The future of short-term rentals in these cities, and potentially others, is now closely tied to how this agreement is implemented and the overall community response.

Query Resolution

What are the specific tax rates for Chicago and DC?

The tax rates vary depending on the specific area within Chicago and DC. Airbnb will likely provide more detailed information as the implementation process unfolds. Referencing official city government websites for precise details is essential.

How will this impact Airbnb hosts?

Hosts will need to collect and remit occupancy taxes, potentially affecting their profitability. Airbnb is expected to provide tools and resources to help hosts navigate this new requirement.

Will this agreement affect the number of tourists visiting Chicago and DC?

The long-term impact on tourism is uncertain. Potential price increases, combined with increased transparency, could either attract or deter travelers.

What are the potential legal challenges to this agreement?

Legal challenges are always a possibility in complex agreements like this. The specific legal framework surrounding occupancy taxes will need to be carefully analyzed by both Airbnb and local authorities.