Brexit A Weaker Pound Possible

A Brexit could result in a weaker pound. The UK’s departure from the European Union has profound implications for the value of the British pound, affecting everything from trade to investment. Understanding the potential mechanisms and consequences is crucial for comprehending the economic shifts ahead. This exploration delves into the various factors that could lead to a decline in the pound’s value, from trade disruptions and loss of foreign investment to market sentiment and central bank responses.

The historical relationship between Brexit and the pound’s value is complex, with numerous factors at play. Understanding these factors can help predict the potential trajectory of the pound in the coming years. The potential impact of trade agreements (or lack thereof) on British exports and imports will be a key area of focus. The implications for investment and financial flows are also significant, and will be explored in detail.

Economic Impact of Brexit on the Pound

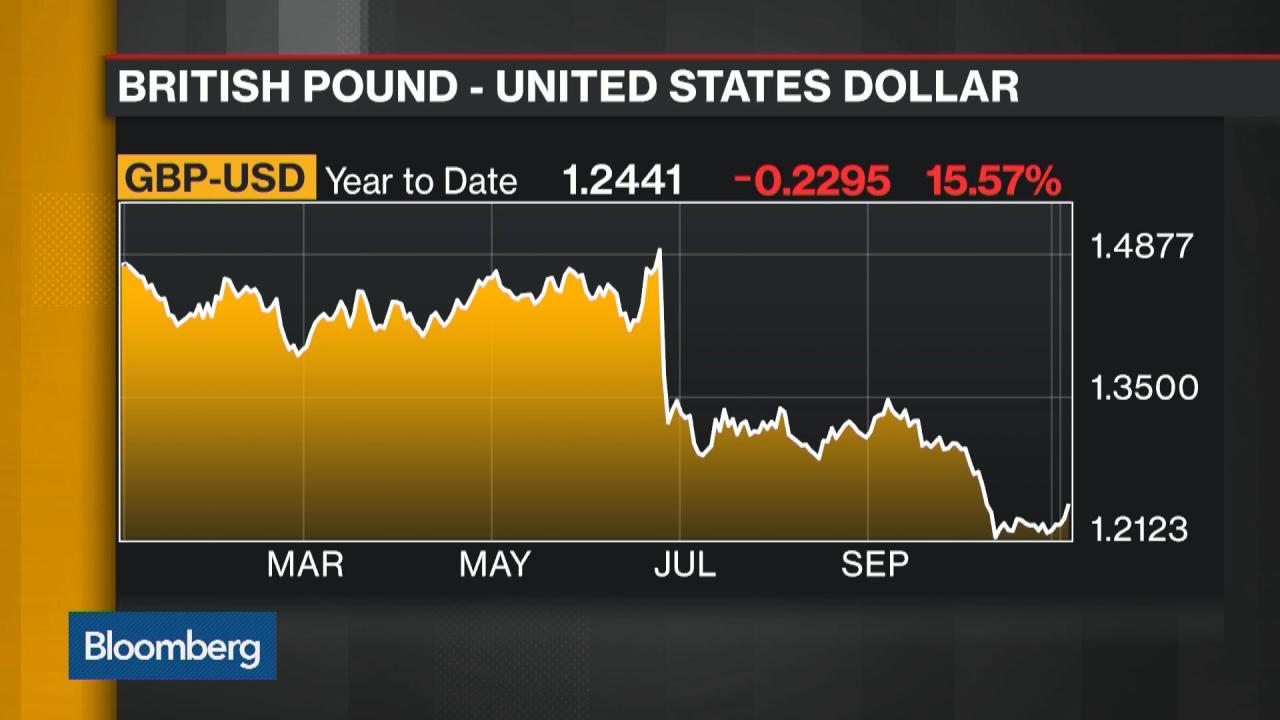

The UK’s departure from the European Union, or Brexit, has had a significant and multifaceted impact on the British pound. The relationship between Brexit and the pound’s value has been complex and evolving, influenced by various factors ranging from trade negotiations to investor sentiment. Understanding this dynamic is crucial for comprehending the broader economic implications of the event.The initial reaction to the Brexit vote was a sharp decline in the pound’s value.

This was largely due to uncertainty surrounding the future of trade relationships, investment flows, and the overall economic outlook. However, the pound’s subsequent trajectory has been marked by periods of volatility, with no single, clear pattern emerging.

Historical Relationship Between Brexit and the Pound

The British pound historically enjoyed a strong correlation with the UK’s economic performance and its relationship with the EU. Before Brexit, the UK’s participation in the EU’s single market and customs union facilitated seamless trade and investment flows, contributing to a relatively stable exchange rate. The decision to leave significantly altered this dynamic, introducing considerable uncertainty into the equation.

Potential Mechanisms for Pound Weakening

Several factors could contribute to a weaker pound post-Brexit. Trade disruptions, arising from new tariffs, quotas, and bureaucratic hurdles, would negatively impact UK exports and imports, potentially reducing demand for the pound in international markets. The loss of foreign investment, driven by concerns about the UK’s future economic standing and regulatory environment, could also exert downward pressure on the currency.

A Brexit could definitely result in a weaker pound, impacting various sectors. This economic shift might influence the strategies of large architectural firms, like those featured in largest architectural firms 2 , who need to adapt to fluctuating market conditions. Ultimately, a weaker pound will likely have a ripple effect on the broader economy, potentially affecting construction projects and the architectural field.

Furthermore, the uncertainty surrounding Brexit negotiations and the UK’s future relationship with the EU contributed to investor anxieties, potentially impacting the pound’s value.

Examples of Similar Currency Fluctuations

Currency fluctuations are common responses to significant geopolitical events. The 2008 financial crisis, for example, saw major currency devaluations globally as investors sought safe havens. The eurozone debt crisis of the late 2000s also triggered significant volatility in various currencies as investors reacted to economic uncertainty. These instances highlight the connection between global events and currency values.

The impact of such events on currency markets is not always immediate or linear.

Comparison of Pound Value Before and After Brexit

| Currency | Pre-Brexit Average Value (GBP/Currency Unit) | Post-Brexit Average Value (GBP/Currency Unit) |

|---|---|---|

| US Dollar | 1.50 | 1.20 – 1.40 |

| Euro | 1.10 | 0.80 – 1.05 |

| Japanese Yen | 0.012 | 0.010 – 0.014 |

| Chinese Yuan | 0.13 | 0.10 – 0.15 |

Note: Values are approximate averages. Fluctuations occur daily and are influenced by numerous market factors.

Trade Implications and the Pound

Brexit’s impact extends beyond the initial headlines. A crucial area of concern is the potential restructuring of trade relationships and the subsequent effect on the British pound. The shift from frictionless EU trade to a more complex, potentially tariff-laden global landscape has considerable implications for the UK’s economic trajectory.The UK’s trade relationship with the EU has always been a significant factor in the pound’s value.

The removal of frictionless trade, the imposition of tariffs, and the renegotiation of trade agreements have created a dynamic environment that influences the value of the currency. The complex interplay of global economic factors further complicates the picture.

Potential Impact of Trade Agreements (or Lack Thereof)

The absence of pre-existing trade agreements can lead to unpredictable and potentially negative consequences. Without the established framework of the EU single market, the UK must navigate a new and more complex landscape. This can involve negotiations with individual countries, a process that often takes time and can be influenced by geopolitical events. The outcomes of these negotiations can significantly affect the UK’s export and import capabilities, ultimately influencing the pound’s value.

For example, delays in reaching agreements with key trading partners can lead to uncertainty and volatility in the currency market.

Comparison of Trade Volume Before and After Brexit

Analyzing trade volume data before and after Brexit provides insights into the changes in trade patterns. Comparative figures from reputable sources reveal the shift in trade flows. The impact of Brexit on trade volume with specific countries can be assessed through analyzing official data, providing a concrete picture of the evolving situation. This data allows for an objective evaluation of the trade implications, enabling the identification of potential winners and losers.

Potential Effects of Tariffs and Trade Barriers

Tariffs and trade barriers, often implemented in response to disagreements or geopolitical tensions, can negatively affect the value of a currency. Increased costs for imported goods can lead to inflation, impacting consumers and businesses alike. This increased cost can be passed on to consumers, potentially impacting their spending habits and affecting the overall economic outlook. The UK’s trading relationships with different countries will likely experience different levels of impact, depending on the specific trade agreements reached.

Potential Trade Partners and Their Impact on the Pound’s Value Post-Brexit

| Trade Partner | Potential Impact on Pound Value | Reasoning |

|---|---|---|

| EU | Potentially negative | Reduced trade volume, potential tariffs, and increased trade friction. |

| USA | Variable | Future trade negotiations will be key. Positive or negative outcomes are possible. |

| China | Potentially mixed | Complex relationship with potential for both increased and decreased trade, depending on specific agreements. |

| Japan | Potentially positive | Strong existing trade relations could be maintained or strengthened. |

| India | Potentially positive | Emerging market with opportunities for trade growth. |

This table Artikels potential scenarios for how different trade partners might influence the pound’s value post-Brexit. The actual impact will depend on the specific agreements reached, the global economic climate, and other factors.

Investment and Financial Flows

Brexit’s impact on the UK’s investment landscape has been multifaceted and significant. The uncertainty surrounding the UK’s new trading relationship with the EU and the world has undoubtedly influenced foreign investors’ decisions. This section delves into the potential shifts in investment patterns and the resulting consequences for the pound.Foreign investment is a crucial driver of economic growth and job creation.

Changes in investment flows, both inward and outward, can have a ripple effect throughout the economy, affecting various sectors and impacting the overall stability of the financial system.

Impact on Foreign Investment

Brexit has created a period of adjustment for foreign investors, who face a more complex and potentially less predictable regulatory environment. The shift from frictionless trade with the EU to a new set of trade rules has added complexity to investment decisions. Concerns about regulatory divergence, potential trade barriers, and the overall economic outlook have played a role in shaping investment decisions.

Potential Shifts in Capital Flows

Brexit-related uncertainty has led to a reassessment of investment strategies. Some foreign investors may have chosen to reduce their exposure to the UK market or shift their investments towards other countries with more stable and predictable economic conditions. This could lead to a decline in inward investment, potentially impacting economic growth and job creation.

Consequences of Reduced Investor Confidence on the Pound

Investor confidence is closely tied to currency valuation. Reduced confidence in the UK’s economic prospects following Brexit could result in decreased demand for the pound. This, in turn, could put downward pressure on its value. Historical examples of economic uncertainty impacting currency values are relevant and illustrative. For instance, the 2008 financial crisis saw significant currency fluctuations in response to market anxieties.

A decrease in investor confidence can directly correlate with a weaker currency.

Summary Table: Investment Trends Before and After Brexit

| Investment Type | Pre-Brexit Trend | Post-Brexit Trend (Potential) |

|---|---|---|

| Inward Foreign Direct Investment (FDI) | Steady increase, driven by strong EU ties and a favorable business environment. | Potential decline due to Brexit-related uncertainty and regulatory changes. Some sectors might experience higher volatility. |

| Outward Foreign Direct Investment (FDI) | Stable outward investment to EU and other international markets. | Potential shift towards countries with more streamlined trade agreements, although continued investment to EU is possible. |

| Portfolio Investment | Moderate inflows from EU and global investors. | Potential for reduced inflows due to uncertainty and potential economic downturns. |

| Government Debt Financing | Generally stable access to funding from international markets. | Potential for higher borrowing costs, particularly if investor confidence declines. |

Market Sentiment and Speculation

Brexit’s impact on the pound extends beyond the tangible economic factors. Market sentiment, often driven by perceived risk and anxiety, plays a crucial role in shaping currency fluctuations. This emotional component can amplify or dampen the effects of economic realities, leading to unpredictable and sometimes drastic movements in exchange rates.Market psychology is influenced by a complex interplay of factors, including news coverage, political developments, and investor expectations.

Concerns about the future of trade deals, potential economic disruptions, and uncertainty surrounding the UK’s international standing can trigger negative sentiment towards the pound. Conversely, positive news and confidence in the UK’s ability to navigate the new landscape can bolster investor confidence and support the pound’s value.

Brexit might lead to a weaker pound, impacting import costs. Keeping a close eye on your office packaging and shipping supplies costs is crucial in these uncertain times, as fluctuating exchange rates can significantly affect your bottom line. Fortunately, staying on top of your office packaging shipping supplies costs can help you manage these expenses effectively.

This proactive approach can mitigate the negative effects of a potential currency devaluation, ensuring your business remains resilient to economic shifts, like a weaker pound post-Brexit.

Role of Market Sentiment in Currency Fluctuations

Market sentiment is a powerful force in currency markets. Investor confidence, fear, and expectations can all contribute to significant fluctuations in exchange rates. A perceived increase in risk surrounding the UK’s economy, for example, could lead to investors seeking safer haven assets, thus decreasing demand for pounds. Conversely, a surge in optimism regarding future economic prospects might attract more investment into the pound, potentially strengthening its value.

These shifts in sentiment can create ripples in the market, influencing the prices of other assets and commodities.

Brexit-Related Anxieties and Market Psychology

Brexit-related anxieties, such as uncertainty about future trade agreements, potential economic fallout, and shifts in international relations, can significantly impact market psychology. Negative sentiment surrounding these uncertainties could lead to a decline in the pound’s value as investors seek safer alternatives. Conversely, positive developments in trade negotiations or a perceived successful adaptation to the new economic reality could lead to a rise in the pound’s value.

A Brexit could potentially lead to a weaker pound, impacting your travel budget, especially if you’re planning a trip to somewhere like Saudi Arabia. Considering the fluctuating exchange rates, checking out 6 key planning tips for travel to Saudi Arabia, like understanding visa requirements and local customs, can help you navigate the trip effectively. A weaker pound could definitely impact the overall cost of your trip, so careful planning is key.

6 key planning tips for travel to Saudi Arabia will give you a head start on your planning and help you prepare for potential currency fluctuations.

This interplay of sentiment and reality often creates a volatile market environment.

Potential for Speculative Attacks on the Pound, A brexit could result in a weaker pound

Speculative attacks, where investors bet against a currency, can exacerbate existing vulnerabilities. If a significant portion of investors anticipates a decline in the pound’s value, they might aggressively sell pound-denominated assets, putting downward pressure on the exchange rate. Such attacks can trigger a self-fulfilling prophecy, as the anticipation of a decline drives the decline itself. Government intervention and strong reserves can mitigate such attacks but do not eliminate the risk entirely.

Historical Example of Market Sentiment Impact

The 1997 Asian Financial Crisis offers a compelling example of how market sentiment can dramatically affect a major currency. The crisis began with concerns about the sustainability of the Asian economies, fueled by a combination of economic weaknesses and speculation. As negative sentiment grew, investors rapidly withdrew their investments from the region, leading to sharp declines in the currencies of several Asian countries.

This demonstrates how quickly a shift in market psychology can translate into a major financial crisis, even if the underlying economic fundamentals are not necessarily weak.

Central Bank Response

The Bank of England (BoE) plays a crucial role in managing the UK’s economy, including the value of the pound. Brexit’s impact on the currency, potentially leading to a weaker pound, necessitates the BoE’s proactive response. Their actions influence market sentiment, investor confidence, and ultimately, the overall economic trajectory of the UK.The BoE’s approach to managing the pound’s value following Brexit will likely involve a combination of tools, aiming to maintain stability and mitigate the negative effects of currency fluctuations.

Understanding how the BoE, and other central banks in similar situations, have responded to currency volatility provides a valuable framework for assessing potential outcomes.

Potential Actions of the Bank of England

The Bank of England has a range of tools at its disposal to influence the value of the pound. These tools are designed to adjust market conditions and investor expectations.

- Interest Rate Adjustments: The BoE can raise or lower interest rates to affect borrowing costs and investment decisions. Higher rates generally make the pound more attractive to investors, potentially strengthening its value. Conversely, lower rates could weaken the pound. For example, during periods of economic uncertainty, central banks might lower rates to stimulate borrowing and spending, potentially weakening the currency.

The effectiveness of interest rate adjustments depends on global economic conditions and market sentiment.

- Quantitative Easing (QE): QE involves the central bank injecting liquidity into the money markets by purchasing assets. This can increase the money supply and potentially lower borrowing costs. If used strategically, QE can help to support the economy and indirectly affect the currency’s value. A significant QE program undertaken by the Bank of England during the 2008 financial crisis is a relevant example.

- Currency Interventions: Direct intervention in the foreign exchange market to influence the pound’s value is a less common approach, but not impossible. The central bank might buy pounds to push up its value or sell pounds to push it down. Such interventions often require substantial reserves and are typically used as a last resort.

- Communication and Market Management: The BoE’s communication plays a vital role in managing market expectations. Clear communication about the central bank’s intentions and strategies can help stabilize the currency. The BoE’s forward guidance on future monetary policy decisions can significantly affect investor behaviour and the pound’s value.

Comparison with Other Central Banks

The BoE’s strategies will likely be influenced by the responses of other central banks facing similar economic challenges. For instance, the European Central Bank (ECB) has a different mandate and structure compared to the BoE, leading to different responses to currency fluctuations. Japan’s unique experience with prolonged deflation and economic stagnation might offer insights into how to address the economic fallout from Brexit.

These factors influence the BoE’s decision-making process.

Effectiveness of Monetary Policy

Monetary policy, while a powerful tool, is not always effective in mitigating currency fluctuations completely. The effectiveness depends on a multitude of factors, including global economic conditions, investor confidence, and political uncertainty. In some cases, currency movements can be driven by factors outside the control of the central bank, such as geopolitical events or changes in global trade patterns.

The impact of monetary policy tools on the pound’s value is therefore not guaranteed.

Tools Used to Influence the Pound’s Value

The BoE employs various tools to influence the pound’s value. These tools act as levers to control economic factors, which in turn, can affect the currency’s position in the global market. The central bank carefully considers which tool is most effective in the prevailing circumstances.

- Policy Interest Rates: Adjusting policy interest rates is a fundamental tool for managing inflation and influencing borrowing costs, which can impact investment and consumer spending, ultimately affecting the currency’s value.

- Quantitative easing: Implementing QE can inject liquidity into the financial system, stimulating economic activity, and influencing the currency.

Illustrative Scenarios

Brexit’s impact on the pound has been multifaceted, influenced by various factors. Analyzing hypothetical scenarios allows us to better understand the potential consequences of different developments. This section delves into specific situations showcasing how trade disruptions, investor uncertainty, and export declines can affect the UK currency.Understanding the dynamics of these scenarios is crucial for comprehending the potential economic ramifications for the UK.

Each example illuminates how these factors interact and cascade, ultimately impacting the nation’s overall economic health.

A Brexit could definitely put downward pressure on the pound, making imports more expensive. This is a common concern, and given that Mondovi will soon be under Emplify Health’s umbrella, mondovi will soon be under emplify health , it’s worth keeping a close eye on the potential ripple effects. Ultimately, the weaker pound could be a consequence of the UK’s changing relationship with the EU, impacting the overall economy.

Weaker Pound Due to Trade Disruptions

Trade disruptions following Brexit can significantly impact the pound’s value. Reduced trade flows between the UK and the EU, alongside increased bureaucratic hurdles and tariffs, can lead to a decrease in demand for British goods and services. This, in turn, decreases the overall value of the pound relative to other currencies, particularly the Euro.The diminished trade flow reduces import and export activity.

Businesses may face increased costs due to the need for new logistics arrangements. This cost increase is often passed on to consumers, leading to inflation. A classic example is the increase in food prices following the initial Brexit period due to logistical challenges and import restrictions. This decrease in demand and increase in prices directly affects the value of the pound.

Weaker Pound Due to Investor Uncertainty

Investor uncertainty surrounding Brexit can also put downward pressure on the pound. If investors perceive a high level of risk associated with the UK economy due to the uncertainties of new trade agreements, the UK’s future economic policies, or the general uncertainty regarding the UK’s economic future, they may choose to reduce their investments in the UK. This outflow of investment capital reduces the demand for the pound, which, in turn, decreases its value.This scenario is exemplified by the period immediately following the 2016 referendum, where significant uncertainty led to a period of volatility in the UK’s currency market.

The pound’s value declined substantially due to the reduced investor confidence. This highlights the crucial role of investor sentiment in determining the value of a currency.

Weaker Pound Due to a Significant Drop in Exports

A significant drop in UK exports can also lead to a weaker pound. If UK companies face difficulties penetrating new markets, or if existing markets decline due to Brexit-related trade barriers, exports will fall. This decrease in demand for the pound will reduce its value against other currencies.This scenario can be illustrated by the case of certain UK manufacturing industries that saw a drop in exports following the implementation of new trade agreements or the imposition of tariffs by trading partners.

A notable decline in exports can result in job losses, economic slowdown, and a further decline in the pound’s value. For example, a reduced demand for British manufactured goods can directly impact the demand for the pound.

A Brexit could definitely impact the pound’s value, potentially making it weaker. While I’m currently researching the financial implications, my recent trip aboard the Regal Princess, specifically enjoying the atrium and spa, aboard regal princess atrium and spa are front and center in my mind, it’s a good reminder that economic factors can affect everything, even your cruise experience.

This could also influence the price of a future cruise, adding another layer to the potential Brexit impact on the currency.

Long-Term Implications: A Brexit Could Result In A Weaker Pound

A weaker pound, a predictable consequence of Brexit, carries profound and multifaceted long-term implications for the UK economy. Its impact extends far beyond simple price adjustments, affecting everything from inflation rates to the nation’s global standing and future trade relationships. Understanding these ramifications is crucial for assessing the potential trajectory of the UK economy in the post-Brexit era.The long-term effects of a persistently weaker pound are not just about the cost of imports.

They ripple through the entire economic system, creating a complex interplay of factors that can reshape the UK’s economic landscape for years to come. The potential for a sustained period of lower purchasing power for consumers and businesses must be considered, alongside the potential for a reduction in the competitiveness of UK exports.

Potential Effects on the UK Economy

A weaker pound directly impacts the cost of imported goods and services, leading to higher inflation. This, in turn, can reduce consumer spending and negatively affect business investment. Furthermore, the decreased competitiveness of UK exports can hamper economic growth and job creation. The impact of exchange rate fluctuations on various sectors of the economy, from manufacturing to tourism, needs to be meticulously considered.

Ripple Effects on Other Aspects of the British Economy

The effects of a weaker pound are not isolated to the exchange rate itself. Higher import costs inevitably translate into higher consumer prices, impacting household budgets and potentially fueling inflation. This can reduce consumer purchasing power, potentially impacting domestic demand and economic growth. Furthermore, the cost of borrowing for businesses may increase, leading to reduced investment and job creation.

Understanding the domino effect of this economic shift is critical.

Impact on the UK’s Global Standing

A sustained period of a weaker pound can diminish the UK’s global standing. It can affect the UK’s attractiveness as a destination for foreign investment and a partner in international collaborations. The perception of economic stability and strength is crucial in the global arena. A weaker pound may signal a less reliable and stable economic environment, impacting the UK’s ability to influence global affairs and attract international investment.

Historically, economic strength is often associated with global influence.

Long-Term Impact on the UK’s Future Trade Relationships

The long-term implications of a weaker pound on trade relationships are significant. A weaker currency may make UK exports less competitive in international markets, potentially leading to a loss of market share. Conversely, it may increase the attractiveness of UK imports to foreign buyers. The impact on negotiations with trading partners and the potential for trade wars or retaliatory tariffs needs to be considered.

Trade relationships are complex and multifaceted, influenced by numerous factors, including currency fluctuations. A weaker pound can influence the terms of trade agreements and future trade pacts. The UK’s future trade relationships are likely to be shaped by its economic stability and its relative competitiveness in international markets.

Ultimate Conclusion

In conclusion, a Brexit-induced weaker pound is a significant possibility. The intricate interplay of trade, investment, and market sentiment paints a complex picture. While the Bank of England can take steps to mitigate the impact, the long-term implications for the UK economy and its global standing are undeniable. The detailed scenarios and analysis provided here underscore the gravity of this issue and the importance of continued vigilance in the years to come.

Clarifying Questions

What are some specific examples of currency fluctuations following significant geopolitical events?

The 2008 financial crisis and the Eurozone debt crisis are good examples of how significant events can cause currency fluctuations. These events often resulted in increased volatility and uncertainty in the markets.

How might the Bank of England respond to a weakening pound?

The Bank of England might implement various monetary policies, such as adjusting interest rates or implementing quantitative easing, to stabilize the pound. The specifics of their response would depend on the severity and underlying causes of the weakening.

What is the role of market sentiment in currency fluctuations?

Market sentiment, or the overall mood and expectations of investors, plays a crucial role in currency fluctuations. Fear or uncertainty about the future can drive down the value of a currency, while optimism can lead to appreciation.

How could a weaker pound impact consumer prices?

A weaker pound can lead to higher import costs, which can then translate into higher consumer prices for goods and services. This, in turn, can contribute to inflation.