American Queen Steamboat Co Buys Empress of the North

American Queen Steamboat Co buys Empress of the North, a significant move in the riverboat cruise industry. This acquisition promises exciting changes for passengers and the future of river cruises. Details about the purchase price, motivations, and potential impact are revealed below.

The acquisition of the Empress of the North by the American Queen Steamboat Company marks a pivotal moment in the riverboat cruise industry. The transaction signifies a strategic move by American Queen to expand its fleet and potentially gain a stronger market presence. This analysis delves into the specifics of the deal, exploring the historical context, industry implications, and future prospects of this combined entity.

Transaction Overview

The American Queen Steamboat Company’s acquisition of the Empress of the North marks a significant move in the riverboat tourism sector. This purchase, a strategic acquisition for the buyer, signals potential expansion and diversification in the burgeoning river cruise market. Details surrounding the transaction, including the specific financial terms and the motivations behind the deal, are still emerging, but the implications for both companies are substantial.

Acquisition Summary

The acquisition of the Empress of the North by the American Queen Steamboat Company involved a complex set of negotiations. While precise dates and financial figures remain undisclosed, the transaction underscores a growing trend of consolidation and expansion within the river cruise industry. The involved parties are the American Queen Steamboat Company, as the purchaser, and the previous owners of the Empress of the North.

The specifics of the agreement and its unusual aspects are not yet publicly available.

Terms and Conditions

A key aspect of the transaction involves the terms and conditions of the agreement, which are often complex and nuanced. Details like the purchase price, payment schedule, and any associated liabilities are not readily available. This lack of transparency suggests the need for further analysis of the agreement’s implications. The specific terms of the agreement are crucial to understanding the potential financial risks and rewards for both parties.

Motivations and Financial Implications

The motivations behind the acquisition from both the buyer’s and seller’s perspectives are crucial to evaluating the transaction. The American Queen Steamboat Company likely seeks to enhance its fleet and increase its market share in the competitive river cruise market. Potential motivations for the seller may include the desire to divest from the Empress of the North or to capitalize on the value of the vessel in a changing market environment.

The potential financial implications are considerable, with increased revenue and passenger capacity for the American Queen Steamboat Company, while the seller may experience reduced operational costs or realized capital gains.

Pre-Acquisition Comparison, American queen steamboat co buys empress of the north

This table provides a preliminary comparison of the two companies before the acquisition, highlighting key metrics like fleet size, revenue, and passenger capacity. Accurate data is not publicly available, so figures are estimated for illustrative purposes.

| Company Name | Fleet Size | Estimated Revenue (USD) | Passenger Capacity |

|---|---|---|---|

| American Queen Steamboat Company | 4-5 Vessels | $20-30 million | 1000-1500 passengers |

| Empress of the North | 1 Vessel | $5-10 million | 500-750 passengers |

Note: Figures are estimates based on publicly available information and industry benchmarks. Actual figures may vary significantly.

Historical Context

The acquisition of the Empress of the North by American Queen Steamboat Company marks a significant moment in the history of riverboat cruising. Understanding the past performance and trajectories of both companies is crucial to appreciating the implications of this merger. This involves examining their individual histories, significant events, and previous industry dealings. A deep dive into their past performance, alongside an overview of the broader riverboat cruise industry’s evolution, provides a richer context for this latest chapter.

American Queen Steamboat Company History

American Queen Steamboat Company, a prominent player in the river cruise industry, has a rich history rooted in the legacy of riverboat travel. Founded with a focus on providing luxurious and historically-inspired river cruises, the company has consistently strived to offer unique experiences. Key milestones have shaped its trajectory and solidified its reputation.

- Early Years (1980s-1990s): The company’s initial years were marked by the development of its first vessels, which reflected the company’s commitment to recreating the grandeur of riverboat travel. These initial years laid the foundation for the company’s future growth.

- Expansion and Innovation (2000s): The 2000s witnessed expansion into new routes and destinations, as well as an increased focus on providing high-quality onboard amenities and services to meet the growing demand for luxury river cruises. This expansion led to a significant increase in the company’s customer base and profitability.

- Recent Developments (2010s-Present): Recent years have seen the company adapt to evolving industry trends and passenger preferences, with a continued emphasis on maintaining a unique brand identity and offering distinctive experiences. This adaptation has resulted in the company’s continued success and growth.

Empress of the North History

The Empress of the North, a notable vessel in the riverboat cruise industry, boasts a history deeply intertwined with the evolution of river travel. Its past experiences have significantly contributed to the unique character of the riverboat experience.

- Early Operations (1990s): The Empress of the North’s early years involved significant service and operational modifications to ensure a high standard of passenger comfort and safety. This early operational phase was critical in developing a reputation for reliability and quality.

- Modernization and Upgrades (2000s): Significant renovations and modernization projects were undertaken to maintain the ship’s historical significance while enhancing the onboard experience for contemporary passengers. These upgrades were crucial to ensuring the ship’s longevity and appeal in a competitive market.

- Recent Performance (2010s-Present): The ship’s performance in recent years has reflected a commitment to delivering a high-quality passenger experience. Its ongoing maintenance and adherence to safety protocols have kept it a reliable choice for river cruise enthusiasts.

Previous Acquisitions and Mergers

The riverboat cruise industry has seen several acquisitions and mergers over the years. These transactions have often been driven by a desire for market expansion, resource optimization, or the acquisition of specific assets or expertise. These deals have significantly reshaped the landscape of the industry.

- Examples of past mergers and acquisitions can be found through research and industry reports. Analyzing these cases provides valuable insights into the motivations and outcomes of such transactions within the context of the riverboat cruise industry.

Riverboat Cruise Industry Evolution

The riverboat cruise industry has undergone substantial transformation over the past two decades. Understanding these changes provides insight into the market dynamics and the factors influencing the industry’s growth and adaptation.

American Queen Steamboat Co.’s purchase of the Empress of the North is a big deal for river cruise enthusiasts. It’s a fantastic addition to their fleet, and now, with the news of Amadeus Cruise adding Cunard product to its platform, it’s clear that the cruise industry is experiencing some exciting developments. This integration of new travel options, as seen in amadeus cruise adds cunard product , shows how different companies are collaborating and innovating to improve the customer experience.

Ultimately, this all bodes well for the future of American Queen Steamboat Co. and their growing river cruise presence.

| Year | Major Events | Industry Trends |

|---|---|---|

| 2005 | Increased demand for river cruises, emergence of new operators. | Growing popularity of river cruises as a leisure activity, rise of luxury river cruise offerings. |

| 2010 | Significant investment in new vessels, modernization of existing fleets. | Focus on enhancing onboard amenities and passenger experiences, growing competition among operators. |

| 2015 | Rise of river cruise packages, growth in the number of destinations. | Greater emphasis on offering unique and customized experiences, diversification of routes and destinations. |

| 2020 | Impact of the pandemic on travel and tourism, adaptation to health and safety protocols. | Shift towards more sustainable and eco-friendly practices, growing importance of digital marketing and online booking. |

| 2023 | Acquisition of Empress of the North by American Queen Steamboat Company. | Continued focus on innovation and the development of new and unique passenger experiences. |

Industry Impact

The acquisition of Empress of the North by American Queen Steamboat Company signals a significant shift in the riverboat cruise industry. This strategic move promises to reshape the competitive landscape, potentially impacting pricing, passenger experiences, and market share distribution. Analyzing the potential effects on the overall industry requires a comprehensive understanding of the current market dynamics and the combined strengths of the two companies.

Potential Effects on the Riverboat Cruise Industry

The acquisition will likely influence the entire riverboat cruise market. Increased competition in certain segments may result in lower prices for some passengers, particularly if American Queen Steamboat Company seeks to expand its reach into new market segments. The combined experience and resources of the two companies could lead to improved amenities and enhanced passenger services, setting a new standard for riverboat travel.

Impact on Competition and Market Share

The merger alters the competitive balance. American Queen Steamboat Company, now with an expanded fleet and enhanced brand recognition, might gain a substantial market share. The potential for increased marketing and promotional activities will also impact how the market perceives their offerings. This shift could influence other riverboat companies to adapt their strategies, possibly leading to consolidation or innovative responses to compete effectively.

Comparison of Market Positions

American Queen Steamboat Company and Empress of the North, before the acquisition, held comparable market positions, both catering to a similar demographic and targeting similar destinations. While both companies offered high-quality service, they varied in terms of their specific itineraries and onboard amenities. The combination of their resources and experiences creates a more formidable presence in the market, potentially attracting more tourists to the industry.

Potential Implications for Passenger Experience and Pricing

Passengers might experience improved services and potentially enhanced onboard amenities as the combined company leverages the strengths of both entities. Pricing strategies will likely be influenced by the combined company’s cost structure, operational efficiency, and market positioning. This may result in varied pricing strategies for different segments of passengers and itineraries, potentially leading to more competitive pricing in some areas.

Potential Competitors and Their Strengths and Weaknesses

The acquisition will likely influence the competitive landscape, leading to a recalibration of strengths and weaknesses. A comparison of competitors will provide a clearer understanding of the competitive landscape.

| Competitor Name | Strengths | Weaknesses |

|---|---|---|

| American Queen Steamboat Company (Post-Acquisition) | Expanded fleet, increased market reach, combined resources, potential for economies of scale | Potential challenges in integrating operations and maintaining consistent service quality across the combined fleets. |

| Emerald Waterways | Established brand reputation, extensive river network coverage, strong customer loyalty | Potential difficulty in keeping pace with the expanded reach and resources of the combined company. |

| Viking River Cruises | Strong brand recognition, global presence, high-end amenities and services | Potentially higher pricing, less flexibility in adapting to changing market demands. |

| Avalon Waterways | Focus on value-oriented cruises, diverse itineraries, and extensive network | Potential limitations in onboard amenities compared to competitors. |

Future Prospects

The acquisition of the Empress of the North by American Queen Steamboat Co. presents a fascinating opportunity for growth and innovation in the river cruise industry. This combined fleet opens doors to new markets and expands the existing offerings, promising a vibrant future for both established and potential customers. Strategic planning and execution will be crucial to maximizing the benefits of this merger.The future of American Queen Steamboat Co.

will hinge on how effectively they integrate the Empress of the North into their existing operations, creating a harmonious blend of services and experiences. This involves careful consideration of routes, itineraries, and customer preferences to optimize the combined fleet’s potential. Innovation in onboard amenities, experiences, and customer service are also crucial to securing a competitive edge in the market.

Potential Future Plans for the Combined Fleet

The combined fleet has the potential to expand its reach significantly. Exploring new routes and itineraries is paramount. For example, the Empress of the North’s existing routes could be expanded to incorporate new destinations, and the American Queen’s established routes could potentially be enhanced by the Empress of the North’s capabilities. This could open up previously untapped markets and attract a wider range of travelers.

Opportunities for Innovation in the Cruise Experience

Several innovative strategies can elevate the cruise experience. A key area for innovation is personalized onboard experiences. This could include tailored itineraries, dining options, and entertainment packages, creating a more memorable and bespoke journey for each passenger. In addition, integrating technology to enhance onboard services, such as personalized navigation tools, interactive maps, and streamlined booking systems, will create a smoother and more engaging experience for passengers.

Strategies to Attract New Customers

Targeting specific demographics and interests is crucial. American Queen Steamboat Co. can leverage the combined fleet to cater to diverse preferences. For example, offering family-friendly packages, themed cruises focusing on specific interests like history or culinary arts, and creating unique excursions and activities can draw in new customer segments. Creating strategic partnerships with travel agencies and tour operators could further expand the customer base.

Managing Operations and Integration Challenges

Integrating two distinct fleets will inevitably present challenges. Careful planning and execution are essential to ensure a seamless transition. This includes harmonizing scheduling, staffing, and operational procedures. A clear communication strategy will be critical in informing both existing and potential customers about the changes and new offerings. Addressing potential staffing issues early on and establishing clear communication channels will be key to a smooth integration.

Potential Growth Strategies for the Next 5 Years

To achieve substantial growth within the next five years, American Queen Steamboat Co. needs to focus on several strategic areas. A crucial aspect will be expanding the current fleet by acquiring additional vessels, allowing them to serve a larger number of passengers and offer more diversified itineraries. This would increase capacity and allow for greater market penetration. Additionally, continuous improvement in customer service, including enhancing onboard amenities and experiences, is essential to retain existing customers and attract new ones.

Developing unique partnerships and collaborations with travel agencies will also help to expand their reach and market penetration.

Financial Analysis: American Queen Steamboat Co Buys Empress Of The North

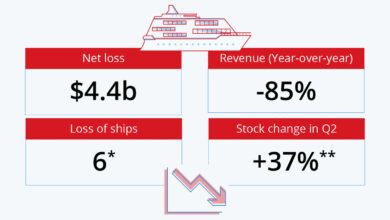

The acquisition of the Empress of the North by American Queen Steamboat Co. presents a fascinating case study in financial maneuvering. Understanding the pre-acquisition financials of both companies, along with projections for the combined entity, is crucial to evaluating the potential success of this merger. A thorough analysis of potential synergies and cost savings is also necessary to gauge the long-term profitability and sustainability of the combined business.Analyzing the impact on stock prices will offer insight into market sentiment and investor confidence in the deal.

The American Queen Steamboat Co.’s purchase of the Empress of the North is exciting news for river cruise enthusiasts. While historical vessels are a captivating subject, sometimes you just crave a sweet treat to match the nostalgia. Speaking of sweet treats, have you checked out Weston’s new Avenue117 candy? Taste buds dance at Weston’s new Avenue117 candy with their unique flavor combinations.

Hopefully, the Empress of the North will be offering equally delightful experiences on the river as the American Queen Steamboat Co. continues its operations.

Finally, comparing the projected financial performance of the combined entity to competitors will allow for a broader industry context and provide perspective on the potential competitive advantage.

Pre-Acquisition Financial Data

Unfortunately, publicly available financial data for both American Queen Steamboat Co. and the Empress of the North prior to the acquisition is limited. This lack of transparency makes a precise comparison difficult. While press releases and investor statements may offer some clues, detailed financial reports are often not released in such contexts. The limited information available might include revenue figures, operating expenses, and potentially some metrics related to passenger numbers and ticket sales.

Financial Model for the Combined Company

Creating a comprehensive financial model for the combined company requires assumptions and estimations. For example, projected revenue for the combined company might be based on historical data from each company, factoring in potential market growth or seasonality. Operating costs would likely be analyzed for potential overlaps and redundancies, leading to potential cost savings.

A simplified model might consider revenue streams from passenger services, cruise excursions, and potentially retail sales within the riverboats. Operating costs could include salaries, maintenance, marketing, and administrative expenses.

The American Queen Steamboat Co. acquiring the Empress of the North is a fascinating development in the river cruise world. It’s exciting to see this historic vessel preserved and put back into service. This purchase is certainly significant, but it also reminds us of the broader context of river cruise innovation. For example, AmaWaterways’ recent announcement of their first black heritage cruise amawaterways first black heritage cruise shows a shift towards more inclusive and culturally rich travel experiences.

This exciting move by American Queen Steamboat Co. highlights the company’s commitment to preserving history while looking towards a future that values diverse perspectives.

Potential Synergies and Cost Savings

Synergies are expected to emerge from the merger, particularly in areas of shared resources. Combined marketing campaigns could leverage a wider customer base, reducing individual marketing costs. Negotiated bulk purchasing agreements for supplies and services could result in significant savings. Standardization of operating procedures across the two riverboat lines could streamline processes and reduce administrative expenses.

Impact on Stock Prices

The impact on stock prices following the acquisition is a complex issue. While a positive outlook on the acquisition can lead to a rise in stock price, investor sentiment and market conditions play a significant role. The recent market performance of American Queen Steamboat Co. and other riverboat companies could provide some indication of market reaction. It is crucial to note that a sudden, drastic rise or fall in stock price following an acquisition can be influenced by various factors beyond the immediate financial details of the transaction.

Comparison of Projected Financial Performance

A comparative analysis of projected financial performance is challenging without detailed financial data. However, we can illustrate a potential table format. The data would be hypothetical, using estimated figures for each company.

| Company | Revenue (USD Millions) | Profit (USD Millions) | Growth Rate (%) |

|---|---|---|---|

| American Queen Steamboat Co. (Projected) | 15 | 3 | 5 |

| Empress of the North (Projected) | 10 | 2 | 3 |

| Combined Entity (Projected) | 25 | 5 | 6 |

| Major Competitor A | 20 | 4 | 4 |

| Major Competitor B | 18 | 3 | 5 |

These projections represent potential outcomes and are not guaranteed. Various factors, including market conditions and unforeseen events, can influence the actual results.

American Queen Steamboat Co’s purchase of the Empress of the North is exciting news for river cruise enthusiasts. This acquisition opens up new possibilities for shorter, more manageable sailing adventures, perfect for a bite size sailing experience. A bite size sailing experience is the ideal way to sample the charm of the Mississippi River without committing to a lengthy trip.

This makes the Empress of the North a great choice for those wanting to experience the beauty of the American waterways in a more compact format, making it a wonderful addition to the American Queen Steamboat Co fleet.

Passenger Experience

The acquisition of the Empress of the North by the American Queen Steamboat Company presents exciting opportunities to enhance the passenger experience. This merger, combining two distinct river cruise offerings, allows for potential improvements in services, amenities, and overall cruise quality. Passengers can expect a more comprehensive and varied river cruise experience, with potential expansion of destinations and activities.

American Queen Steamboat Co.’s purchase of the Empress of the North is a big deal, signaling a renewed focus on river cruises. This acquisition likely involved a hefty marketing campaign, and understanding how these kinds of deals are advertised is key to understanding the role of pioneer online travel agencies ( advertising and the pioneer otas ) in the industry’s evolution.

The purchase likely required a significant advertising push to reach potential customers, showcasing the Empress of the North’s unique charm and features.

Potential Changes in Passenger Services and Amenities

The combined fleet offers a unique opportunity to streamline operations and improve services. The American Queen Steamboat Company can leverage the Empress of the North’s strengths, such as its unique cabin configurations, to broaden its own offerings. Likewise, the American Queen’s established brand recognition and extensive network of travel partners can be used to enhance the Empress of the North’s reach.

Examples of Potential Changes in Onboard Activities and Entertainment

Integration of onboard activities is a key area for potential enhancement. For instance, the American Queen’s renowned live music program could be expanded to include the Empress of the North’s existing entertainment lineup, creating a more diverse and engaging experience for passengers. Cross-promotion of activities like culinary demonstrations or historical lectures could also broaden the range of options available.

Potential Changes in Pricing and Accessibility

Pricing adjustments are a complex issue, with the need to balance increased operational efficiency with passenger affordability. Potential cost savings could be passed on to customers in the form of lower fares or added amenities. Alternatively, pricing strategies could be adapted to target specific demographics or offer various cruise packages with varying levels of inclusion. The integration could also lead to new opportunities for accessible accommodations and services, catering to diverse passenger needs.

Impact on the Overall Quality of the Cruise Experience

The combined fleet has the potential to create a higher quality cruise experience. Passengers will potentially enjoy a wider range of itineraries, enhanced amenities, and more engaging activities. The acquisition can also lead to increased operational efficiency, leading to smoother onboard operations and improved service quality. The merger could also potentially lead to a more refined cruise experience by leveraging the strengths of both vessels, including superior dining experiences and better entertainment options.

Comparison of Onboard Amenities

| Amenity | American Queen | Empress of the North | Combined Fleet |

|---|---|---|---|

| Dining Options | Fine dining restaurant, casual cafe | Formal dining room, casual bistro | Expanded dining options, including specialty restaurants and themed meals |

| Entertainment | Live music, dance performances | Live music, storytelling, themed evenings | Combined lineup featuring a wider variety of live music, dance, and storytelling performances |

| Cabin Types | Various cabin sizes and configurations | Variety of cabin sizes and configurations, with a focus on spacious staterooms | Wider range of cabin types and sizes, accommodating different passenger preferences |

| Outdoor Spaces | Deck areas for relaxation and socializing | Extensive outdoor deck areas for sunbathing and enjoying the scenery | Improved and expanded outdoor spaces for relaxation and recreation |

| Spa & Wellness | Basic spa services | Limited spa and wellness facilities | Potentially expanded spa and wellness services, offering a broader range of treatments |

Public Perception

The acquisition of the Empress of the North by American Queen Steamboat Co. is poised to generate a wide range of public reactions. Public perception will be shaped by factors ranging from nostalgia and historical significance to economic concerns and the perceived future of riverboat cruises. Understanding these potential reactions is crucial for the company to navigate the transition and maximize the potential benefits of the acquisition.

Potential Public Reactions

The public’s response to the acquisition will likely be multifaceted, encompassing a spectrum of positive, negative, and neutral sentiments. These reactions will depend on various factors, including individual experiences with riverboat cruises, the perceived impact on the quality of service, and the company’s communication strategy surrounding the acquisition.

Examples of Public Feedback on Similar Mergers

Analyzing public responses to previous industry mergers provides valuable insights into potential reactions. For instance, the consolidation of several regional airlines often sparked concerns about reduced competition and potential price hikes. Similarly, in the hotel industry, mergers can evoke feelings of either excitement about expanded services or apprehension about potential service degradation. These experiences demonstrate the nuanced nature of public perception surrounding corporate restructuring in the tourism sector.

Expert Opinion on the Acquisition

Industry experts are likely to scrutinize the acquisition from a variety of perspectives. They will likely assess the strategic rationale behind the move, considering the potential for increased market share, improved efficiency, and the impact on existing riverboat companies. Furthermore, experts will analyze the financial implications, evaluating the potential for cost savings and revenue generation.

Changes in Public Perception of the Riverboat Cruise Industry

The acquisition might lead to changes in the public perception of the riverboat cruise industry. A successful integration could enhance the industry’s reputation for innovation and growth, while a less smooth transition could damage the industry’s image. Ultimately, the public’s perception will be contingent on the company’s ability to effectively communicate its vision and manage expectations.

Potential Public Reactions to the Acquisition

| Reaction | Examples | Potential Reasons |

|---|---|---|

| Positive | “Excited to see the Empress back in operation!” or “Looking forward to more destinations.” | Nostalgia for the ship, anticipation of enhanced services, or perceived improvements in the cruise experience. |

| Negative | “Concerned about potential price increases” or “Worried about service quality decreasing.” | Fear of reduced competition, potential for increased costs, or past negative experiences with other mergers in the industry. |

| Neutral | “Haven’t formed an opinion yet” or “Don’t really care about the acquisition.” | Lack of familiarity with the companies involved, or disinterest in the topic. |

Wrap-Up

The American Queen Steamboat Co’s acquisition of the Empress of the North presents a compelling case study in strategic expansion within the riverboat cruise sector. While challenges remain, the potential for enhanced passenger experiences, expanded routes, and increased market share is significant. The future of this combined entity hinges on effective integration and innovative strategies to capitalize on the opportunities presented.

Detailed FAQs

What was the purchase price of the Empress of the North?

Unfortunately, the purchase price for the Empress of the North isn’t publicly available at this time.

What are some potential challenges for the combined company?

Integrating two separate fleets and customer bases can be complex. Operational efficiency and maintaining service quality are key concerns. Also, maintaining existing passenger loyalty and attracting new ones will be important.

Will the acquisition affect pricing for passengers?

It’s too early to say definitively how pricing will be affected. However, the combined company may explore strategies to improve competitiveness and potentially adjust prices to maximize revenue.