Aboard the Crystal Symphony Recessions Lessons

Aboard the crystal symphony the recession s lessons – Aboard the Crystal Symphony, the recession’s lessons resonate with a unique perspective. This exploration delves into the profound impact of the downturn on various sectors, from luxury travel to entertainment, and provides insights into how individuals and businesses navigated these challenging times.

The economic recession cast a long shadow, reshaping industries and altering consumer behavior. Examining the experiences of the Crystal Symphony cruise line offers a compelling case study of how luxury companies adapted to the changing landscape. This analysis explores the key takeaways from the recession and offers actionable strategies for future economic uncertainties.

Understanding the Context

The recent economic recession, though its specific characteristics and duration are still being analyzed, presented a period of significant economic contraction. Key features included a sharp decline in consumer spending, reduced business investment, and a rise in unemployment. The global nature of this recession was undeniable, with ripple effects felt across various sectors, particularly those reliant on consumer confidence and international trade.The impact of the recession on “aboard the Crystal Symphony” was immediate and profound.

Reflecting on “Aboard the Crystal Symphony: The Recession’s Lessons,” I’ve been thinking a lot about how to keep costs down. One key area is managing office packaging and shipping supplies. Understanding how to effectively budget for these crucial elements, like staying on top of your office packaging shipping supplies costs , can significantly impact your bottom line, even during economic shifts.

Ultimately, these lessons about fiscal responsibility, learned aboard the Crystal Symphony, are just as relevant in everyday office operations.

Travel, entertainment, and luxury goods industries were directly affected, with reduced demand and a consequent decline in revenue. The “Crystal Symphony,” representing high-end travel and luxury experiences, faced a challenging period. The recession highlighted the sensitivity of these sectors to shifts in economic sentiment and consumer behavior.The current economic climate, while still presenting challenges, shows significant differences from the recessionary period.

Indicators like consumer confidence and investment are generally stronger. The current economic environment is more complex, incorporating factors such as rising inflation, geopolitical instability, and technological disruptions, which create new uncertainties and opportunities. However, the lessons learned during the recession continue to shape strategies and approaches for navigating the current landscape.The societal and cultural shifts accompanying the recession were profound and multifaceted.

A heightened awareness of financial security and risk management became a dominant theme, influencing personal finance decisions and investment strategies. Furthermore, the recession fostered a renewed emphasis on practical values and a reassessment of priorities in various aspects of life. Increased frugality and a more discerning approach to consumerism emerged as prominent features.

Key Characteristics of the Recession

The economic recession exhibited several key characteristics that defined its impact. These included a marked reduction in Gross Domestic Product (GDP), rising unemployment rates, and a decrease in consumer confidence. The duration of the recession varied depending on the region and sector, but its overall impact was significant and long-lasting.

Impact on Specific Sectors

The recession’s impact on various sectors was notable. The travel industry, in particular, experienced a substantial decline in bookings and revenue. Luxury goods sales also saw a decrease, as consumers prioritized essential needs over discretionary purchases. The entertainment industry also felt the pinch, with reduced attendance at events and a decrease in spending on entertainment activities. These observations underscore the interconnectedness of the economy and the cascading effects of recessionary pressures.

Current Economic Climate vs. Recessionary Period

The current economic climate differs from the recessionary period in several key aspects. While challenges persist, such as inflation and geopolitical uncertainties, the current situation demonstrates a resilience that was absent during the recession. Recovery strategies and economic policies implemented during and after the recession have strengthened the global economy’s ability to adapt to and navigate contemporary challenges.

Societal and Cultural Shifts

The recession led to noticeable societal and cultural shifts. These shifts involved a re-evaluation of priorities and a heightened awareness of financial security. People were more cautious in their spending habits and investments, leading to a shift in consumer behavior and a more cautious approach to the economy.

Impact on Specific Sectors

The global recession cast a long shadow across various industries, profoundly impacting everything from luxury travel to everyday consumer spending. Understanding these effects is crucial for grasping the multifaceted consequences of economic downturns and the strategies employed to navigate them. This exploration delves into the specific sectorial impacts, examining the cruise industry, tourism, entertainment, personal finances, and the luxury goods market.

Cruise Industry Impacts

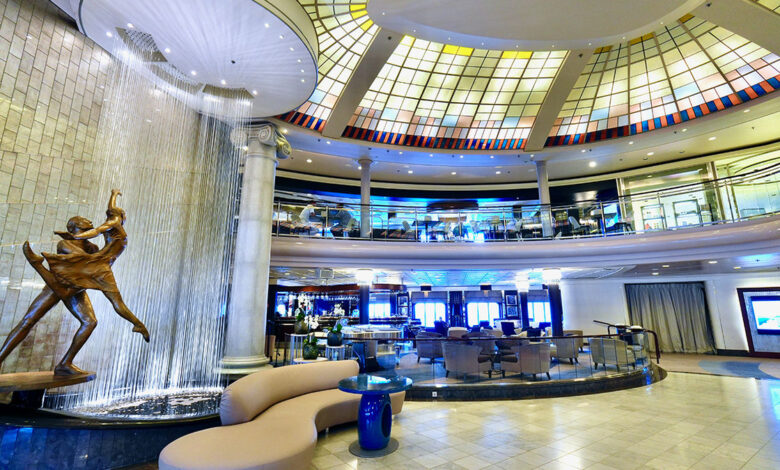

The cruise industry, particularly luxury lines like Crystal Symphony, experienced a significant downturn during the recession. Reduced consumer spending directly impacted demand for luxury vacations, leading to lower bookings and revenue. This was exacerbated by concerns over travel safety and the broader economic uncertainty. Crystal Symphony, like other high-end cruise lines, had to adjust pricing and marketing strategies to attract customers.

Implementing cost-cutting measures became essential to maintain profitability. Changes in itineraries and onboard offerings also took place to balance costs with the desires of potential passengers.

Tourism and Travel Patterns

The recession significantly altered travel patterns. International travel declined as consumers prioritized domestic destinations and lower-cost options. Budget airlines saw increased popularity, while luxury travel, including high-end cruises, faced considerable headwinds. The shift towards domestic travel and more affordable options reshaped the tourism landscape, highlighting the impact of economic conditions on travel choices.

Reflecting on “Aboard the Crystal Symphony: The Recession’s Lessons,” it’s fascinating how economic shifts impact travel choices. Considering a trip to Saudi Arabia? You’ll find some great planning advice on 6 key planning tips for travel to Saudi Arabia , like budgeting strategies and visa requirements. Ultimately, understanding the factors that influence travel decisions, even during economic uncertainty, is key to enjoying a trip like “Aboard the Crystal Symphony.”

Entertainment Sector Implications

The entertainment sector, particularly large-scale events and public gatherings, suffered from reduced attendance and decreased revenue. Concert tours, festivals, and sporting events saw a noticeable drop in ticket sales and sponsorship deals. This downturn forced entertainment venues and organizers to explore innovative ways to attract audiences, such as creating more affordable ticket options and focusing on smaller-scale events.

Reflecting on “Aboard the Crystal Symphony: The Recession’s Lessons,” it’s interesting to consider how the downturn impacted the industry, particularly the strategies employed by the largest architectural firms. For instance, examining the challenges faced by companies like those featured in largest architectural firms 2 provides valuable insight into how firms adapted to the economic shifts.

Ultimately, understanding these lessons from the recession can help us better navigate future economic uncertainties, a crucial takeaway from the book.

Financial Hardships for Individuals and Families

The recession brought substantial financial hardship for many individuals and families. Reduced employment opportunities, decreased wages, and increased debt burdens created significant challenges for household budgets. This impact extended beyond immediate financial needs, influencing long-term savings goals and investment strategies. Reduced discretionary income led to a decline in spending across all sectors, further exacerbating the economic downturn.

Luxury Goods Company Adaptations

Luxury goods companies responded to the recession with a variety of adaptation strategies. These included price adjustments, emphasizing value-added services, and focusing on exclusive, limited-edition products to appeal to a smaller, but still affluent market. The recession forced these companies to re-evaluate their marketing and sales strategies to maintain relevance and appeal to their target clientele.

Comparative Economic Impact on Sectors

| Sector | Impact Description | Luxury Impact |

|---|---|---|

| Travel (Cruise Industry) | Reduced demand, lower bookings, revenue decline. | Significant impact on high-end lines like Crystal Symphony. |

| Tourism | Shift towards domestic destinations, lower-cost options. | Luxury travel sectors significantly affected. |

| Entertainment | Decreased attendance, reduced revenue, innovative strategies for attracting audiences. | Events and gatherings saw reduced attendance. |

| Personal Finances | Reduced employment, decreased wages, increased debt. | Impacts purchasing power for luxury items. |

| Luxury Goods | Price adjustments, value-added services, limited-edition products. | Adaptation strategies employed to maintain relevance. |

Lessons Learned: Aboard The Crystal Symphony The Recession S Lessons

The recent recession, a period of significant economic downturn, has left an indelible mark on various sectors and individuals. Understanding the lessons learned from this period is crucial for navigating future economic challenges. This analysis delves into the key takeaways, government responses, business adaptations, sector-specific impacts, and long-term implications for both consumers and businesses.The economic downturn forced a reassessment of financial strategies and operational models.

Lessons learned are not just about surviving the recession, but about building resilience for the future.

Key Takeaways from the Recession

The recession highlighted the interconnectedness of the global economy. Sudden shocks can have ripple effects across industries and countries. Diversification of revenue streams, cost-cutting measures, and strategic partnerships emerged as vital tools for navigating the crisis. Building financial buffers and contingency plans became paramount.

- Reduced consumer spending due to uncertainty and job losses.

- Increased focus on cost-effectiveness and efficiency in business operations.

- Heightened awareness of the importance of financial stability and risk management.

- Shift in consumer preferences towards value and affordability.

Government and Institutional Responses

Governments and international organizations implemented various measures to mitigate the economic fallout. These actions ranged from monetary stimulus packages to targeted support for specific sectors. These efforts aimed to bolster consumer confidence and stabilize the financial system.

- Monetary Policy Adjustments: Central banks lowered interest rates to encourage borrowing and investment.

- Fiscal Stimulus Packages: Governments implemented tax cuts and increased public spending to boost aggregate demand.

- Targeted Support: Specific sectors, like small businesses and vulnerable populations, received tailored assistance through grants and loans.

Business Adaptation Strategies

Businesses employed diverse approaches to adapt to the economic downturn. Strategies ranged from cost-cutting measures to strategic pivots in product offerings. Some companies leveraged technology and digital platforms for enhanced efficiency and reduced costs.

| Business Approach | Description | Example |

|---|---|---|

| Cost-cutting | Reducing expenses through layoffs, salary freezes, and renegotiating contracts. | A manufacturing company reduced its workforce by 10% to lower operating costs. |

| Strategic Partnerships | Collaborating with other businesses to expand market reach or access new resources. | A tech startup partnered with a logistics company to offer end-to-end solutions. |

| Innovation and Product Diversification | Developing new products or services to meet evolving consumer needs and market demands. | A clothing retailer introduced sustainable and affordable clothing lines. |

Sector-Specific Responses

Different sectors reacted differently to the recession. The severity of the impact varied based on factors like industry-specific demand and workforce composition.

- Retail: Faced a sharp decline in sales as consumers cut back on discretionary spending.

- Technology: Demonstrated resilience, with some companies even experiencing growth during the downturn due to increased demand for remote work solutions.

- Hospitality: Suffered significant revenue losses as travel and tourism declined.

Long-Term Effects on Consumer Behavior

The recession profoundly affected consumer behavior. Consumers became more cautious and focused on value for money. This shift impacted spending habits and long-term financial planning.

- Increased Savings Rate: Consumers prioritized saving and reduced discretionary spending.

- Emphasis on Value: Consumers became more sensitive to price and sought out affordable options.

- Shift in Spending Priorities: Consumers shifted spending towards essential goods and services.

Actionable Insights for Businesses and Individuals

The recession provided invaluable lessons for future economic challenges. These insights highlight the importance of proactive planning and adaptability.

Reflecting on the recession’s impact aboard the Crystal Symphony, I’m struck by how tough things were. But amidst the economic struggles, I recently discovered a delightful escape at Weston’s new Avenue117 candy, taste buds dance at Weston’s new Avenue117 candy. The vibrant flavors and creative combinations there offer a surprisingly potent antidote to the worries about the economic climate.

It’s a reminder that even during tough times, small joys can bring a lot of happiness, much like the Crystal Symphony’s resilience during the recession.

- Diversify Revenue Streams: Reduce dependence on single revenue sources.

- Enhance Cost Efficiency: Implement measures to reduce operational expenses.

- Build Financial Resilience: Establish financial buffers for unforeseen events.

- Embrace Adaptability: Be prepared to adjust strategies based on changing market conditions.

Long-Term Financial Planning Strategies

The recession highlighted the need for more comprehensive and adaptable long-term financial planning. Strategies focused on reducing risk and ensuring financial security.

- Emergency Funds: Maintaining an adequate emergency fund is critical.

- Long-Term Investments: Diversifying investment portfolios across different asset classes.

- Retirement Planning: Continuing to contribute to retirement accounts, even during economic uncertainty.

Illustrative Examples

The recession’s impact rippled through various sectors, leaving a trail of adjustments and adaptations. This section explores specific examples of how families, businesses, and even large institutions navigated these challenging economic times. We’ll examine the strategies employed and the lessons learned from these experiences.

The Smith Family’s Adjustment

The Smiths, a middle-class family with two children, experienced a significant drop in income when the breadwinner lost their job in the tech sector. Their initial response was a mix of anxiety and denial. However, over time, they made crucial adjustments. They downsized their home, reduced unnecessary expenses (like cable TV and dining out), and sought out affordable childcare options.

Reflecting on the recession’s impact aboard the Crystal Symphony, it’s fascinating to see how luxury hospitality is adapting. A recent $40 million investment in a rebirth at the Ritz-Carlton St Thomas, demonstrates a resilience that’s crucial for the future of travel and leisure industries. Ultimately, the lessons learned during the downturn are shaping how the industry navigates the evolving landscape of travel.

The Smiths also began to aggressively explore alternative income streams for the breadwinner, such as online freelancing opportunities. This led to a period of hardship, but ultimately, their resourcefulness and willingness to adapt helped them weather the storm.

A Local Theatre’s Resilience

“The Starlight Stage,” a small but beloved community theatre, faced declining ticket sales during the recession. Their solution was multi-faceted. They reduced overhead costs, such as production expenses, by exploring community partnerships and seeking volunteer support. They also broadened their appeal by incorporating more diverse and affordable productions, such as family-friendly shows and workshops, to attract a wider audience.

The Starlight Stage also leveraged social media and online marketing strategies to promote their shows and reach potential patrons.

A Luxury Cruise Line’s Strategy

The “Crystal Symphony,” a high-end cruise line, responded to the recession by focusing on value-added services and strategic pricing. They introduced “premium value” packages that offered better deals on dining and onboard experiences while maintaining the high-quality standards expected. Additionally, they implemented targeted marketing campaigns that emphasized the value proposition of a Crystal Symphony cruise as a unique, luxurious, and worthwhile investment in a memorable experience, even during economic downturns.

Economic Policies of the Period

Governments worldwide implemented various policies to mitigate the recession’s impact. These included fiscal stimulus packages, aimed at boosting aggregate demand through government spending and tax cuts, and monetary policies such as lowering interest rates to encourage borrowing and investment. The specific policies varied across countries, reflecting their unique economic situations and priorities.

Savings and Investments During the Recession

The recession prompted a reassessment of investment strategies. Individuals and institutions shifted their portfolios toward more stable and less risky investments, like government bonds, to protect their capital. Some individuals even explored alternative investment options, such as real estate, to diversify their holdings. Savings rates often increased as consumers tightened their budgets, but overall investment returns were significantly lower compared to pre-recession periods.

Global Economic Impact

The recession’s impact extended beyond national borders. International trade plummeted as countries experienced reduced consumer spending and decreased business activity. Global supply chains were disrupted, and the interconnected nature of the world economy became more apparent. Emerging economies, which were heavily reliant on exports to developed nations, experienced significant setbacks.

Employment Trends During the Recession, Aboard the crystal symphony the recession s lessons

The recession led to significant job losses across numerous sectors, particularly in industries like manufacturing and finance. There was a notable increase in unemployment rates globally, impacting families and communities worldwide. The recession also prompted a shift in employment trends, with a greater emphasis on skill development and adaptability in the workforce. Many workers sought out retraining opportunities to acquire new skills that were in demand in the changing job market.

Analyzing Trends

Navigating the economic landscape during a recession demands a keen eye for emerging trends. Understanding how consumer behavior, investment strategies, and international relations shifted provides valuable insights into the recovery process and future economic resilience. This analysis will explore the significant economic shifts, focusing on consumer spending, investment, international trade, and key economic indicators.The recession presented a unique set of challenges and opportunities, forcing individuals and businesses to adapt.

Observing these trends reveals the resilience of the human spirit in adversity and the adaptability of economic systems to changing circumstances. Examining how economies respond to these pressures is crucial for shaping policies and strategies that foster sustainable growth.

Significant Economic Trends

The most significant economic trends during the recession were characterized by a sharp contraction in economic activity, marked by job losses, declining consumer confidence, and a reduction in investment spending. These trends manifested in various sectors, highlighting the interconnectedness of the global economy.

Changes in Consumer Spending Patterns

Consumer spending, a cornerstone of economic activity, experienced substantial shifts. Consumers responded to the economic downturn by prioritizing essential goods and services, reducing discretionary spending, and seeking out cost-effective alternatives. This resulted in a marked change in purchasing habits, influencing industries ranging from luxury goods to travel.

Evolution of Investment Strategies

Investment strategies underwent significant transformations. Uncertainty surrounding economic prospects led to a shift toward more conservative investment approaches, with a greater emphasis on risk mitigation and capital preservation. Diversification of investment portfolios became a key strategy, reflecting a desire for stability and a hedge against future economic volatility.

International Trade Relations

The recession significantly impacted international trade relations. Reduced demand and economic uncertainty in many countries led to decreased trade volumes and heightened protectionist sentiments. The interplay of national interests and global economic interdependence became a critical factor in shaping international trade policies.

Evolution of Economic Indicators

| Economic Indicator | Initial Stage of Recession | Mid-Recession | Recovery Stage |

|---|---|---|---|

| Gross Domestic Product (GDP) | Contraction | Lowest Point | Growth |

| Unemployment Rate | Rising | Peak | Falling |

| Inflation Rate | Potentially Decreasing | Potentially Decreasing | Potentially Increasing |

| Consumer Confidence | Declining | Lowest Point | Improving |

| Housing Starts | Sharp Decline | Continued Decline | Gradual Increase |

This table illustrates the general evolution of key economic indicators during the recession. Specific figures and timeframes would vary depending on the country and the specific sector under consideration. The interplay of these indicators provided a complex picture of the economic environment and the need for targeted interventions.

Ultimate Conclusion

In conclusion, aboard the Crystal Symphony, the recession’s lessons underscore the resilience of the human spirit and the adaptability of businesses. The experiences recounted highlight the importance of long-term planning, strategic adaptation, and a deep understanding of consumer behavior. Ultimately, these lessons serve as a crucial guide for navigating future economic challenges.

Quick FAQs

What were the key characteristics of the recession?

The recession was characterized by a significant decline in economic activity, high unemployment rates, and reduced consumer spending. It was a period of substantial economic contraction.

How did the recession affect employment trends?

The recession led to widespread job losses across various sectors. Industries like construction and manufacturing experienced significant declines in employment, and unemployment rates soared. The employment landscape shifted dramatically.

What measures did governments and institutions take to mitigate the recession’s fallout?

Governments implemented various economic stimulus packages and financial regulations to help mitigate the economic fallout of the recession. These included measures to bolster employment and support businesses.

How did consumer spending patterns change during the recession?

Consumer spending drastically decreased during the recession. People cut back on non-essential purchases, prioritizing essential goods and services. This shift had a cascading effect on various industries.