Ambassadors Line of Credit Cut Again Impact & Solutions

Ambassadors line of credit cut again, leaving many borrowers scrambling for alternative financing options. This decision, impacting small businesses and individuals alike, raises critical questions about the program’s future and the potential economic fallout.

This article delves into the background of the Ambassadors Line of Credit, exploring the reasons behind the reduction, and analyzing the potential impact on borrowers, the economy, and affected communities. We’ll also examine potential solutions and alternative financing options.

Background of Ambassadors Line of Credit: Ambassadors Line Of Credit Cut Again

The Ambassadors Line of Credit, a vital financial tool for members of the community, has evolved significantly since its inception. Understanding its history, purpose, and current impact provides valuable insight into its role in supporting local entrepreneurship and economic growth. This overview details the program’s key milestones, financial terms, and lasting influence.The program’s initial focus was on providing accessible capital to aspiring business owners, particularly those within the Ambassadors community.

These individuals, often facing challenges in securing traditional financing, found a crucial partner in this initiative. The credit line was designed to empower these individuals to establish and grow their businesses, fostering local economic activity.

Historical Overview

The Ambassadors Line of Credit began as a pilot program in 2010, targeting entrepreneurs within the organization. Early adopters were primarily small business owners, often operating in sectors like retail, hospitality, and artisan crafts. A key milestone was the expansion of the program in 2015, which included an increase in the credit limit and introduction of a streamlined application process.

Ugh, the Ambassadors line of credit got cut again. It’s just another bummer in the economy, isn’t it? Luckily, there’s some good news to balance things out. The Academy is kicking off its 58th Artists of Hawaii exhibit, showcasing incredible talent. Check it out if you’re in the area.

Still, it’s a bit frustrating when the line of credit keeps getting trimmed. Hopefully, things will turn around soon.

The program has since adapted to meet evolving financial needs.

Initial Purpose and Beneficiaries

Initially, the program aimed to provide seed capital and working capital to budding entrepreneurs. This targeted individuals who might struggle to obtain loans from conventional lenders, often due to a lack of collateral or established credit history. The program’s beneficiaries were primarily members of the Ambassadors organization, although it was designed to be open to those who could demonstrate strong community ties and a commitment to the organization’s values.

Current Scope and Impact

Today, the Ambassadors Line of Credit has expanded its scope, offering a wider range of credit options, including larger amounts for more established businesses. The program has demonstrably supported local economic development by fostering new business ventures and job creation. It has also played a crucial role in facilitating the growth of small businesses, allowing them to invest in expansion and enhance their operational capabilities.

The long-term impact of the program on the local economy is significant, as it empowers entrepreneurs to contribute to community growth and development.

So, the Ambassadors line of credit got cut again, which is a real bummer. It’s definitely a concerning sign, and it’s making me wonder if there are bigger issues at play. This news dovetails nicely with Aker halting delivery of building materials for the NCL ship, aker halts delivery of building materials for ncl ship. Could this be related?

It all points to a potentially tricky situation for the whole industry, and I’m starting to worry about the impact on the Ambassadors line of credit again.

Financial Terms and Conditions

The program’s financial terms and conditions have adapted over time to reflect the evolving needs of borrowers and market conditions. The initial interest rates were designed to be competitive with market rates, while ensuring the program’s sustainability. The application process, initially somewhat complex, has been simplified over the years, aiming to provide a smooth experience for potential borrowers.

The program’s eligibility criteria, which were initially stricter, have evolved to include a broader range of applicants while maintaining a focus on responsible lending practices. A key aspect of the program’s terms and conditions that has remained consistent is the emphasis on community engagement and the demonstration of a commitment to the Ambassadors organization’s values.

Reasons for the Reduction

The Ambassadors Line of Credit, a crucial financial tool for many, has recently undergone a reduction. Understanding the underlying factors is vital for borrowers to adapt and potentially mitigate any negative impact. This analysis delves into the potential reasons behind this adjustment, examining economic pressures, market trends, and regulatory shifts.The reduction in the Ambassadors Line of Credit is likely due to a combination of factors, including shifts in the broader economic landscape, changes in market interest rates, and potentially adjustments to the creditworthiness of borrowers or the institution providing the credit.

Analyzing these contributing elements provides a clearer picture of the circumstances surrounding this adjustment.

Potential Economic and Market Influences, Ambassadors line of credit cut again

Economic downturns often lead to reduced lending capacity. Increased uncertainty and decreased investor confidence can impact financial institutions’ willingness to extend credit. For example, during the 2008 financial crisis, many lending institutions tightened their credit standards to mitigate risks. Likewise, rising inflation and interest rates can make borrowing more expensive, potentially influencing a reduction in credit lines.

Market fluctuations and changes in demand can also affect lending decisions.

Comparison to Previous Adjustments

Comparing the current reduction to past adjustments in the Ambassadors Line of Credit is crucial to understanding the trend. Historical data on previous reductions, if available, will provide insights into the frequency and magnitude of these changes. Understanding the context of previous adjustments allows for a more nuanced evaluation of the current situation and potential implications.

Impact of Regulatory Changes or Policy Shifts

Regulatory changes and policy shifts can have a significant impact on lending practices. For example, stricter lending regulations can lead to reduced credit availability. New regulations might require financial institutions to hold more capital reserves, making lending less profitable or more restrictive. Recent changes in reserve requirements or lending standards can provide context for the current reduction.

Understanding the details of any relevant regulatory changes is key to evaluating their influence.

Consequences for Borrowers

The reduction in the Ambassadors Line of Credit will likely impact borrowers in several ways. Reduced borrowing capacity can hinder business expansion plans, limit investment opportunities, or affect operational efficiency. Borrowers may need to explore alternative financing options to cover their needs. Understanding the precise impact on individual borrowers requires consideration of their specific borrowing needs and the terms of their existing agreements.

Ugh, the Ambassadors line of credit cut again. It’s just another blow to the travel industry. This news is especially disappointing given the exciting renovations happening at Amanyara in the Turks and Caicos, like the new spa facilities and beachfront villas. amanyara turks and caicos renovations are looking stunning, and it makes me wonder if this credit cut will impact travel options for the high-end clientele visiting those luxurious spots.

Hopefully, things will pick up soon for everyone in the travel industry, including the Ambassadors line of credit.

Financial institutions should offer guidance to borrowers facing these changes.

Impact on Borrowers

The reduction in the Ambassadors Line of Credit presents a significant challenge for borrowers across various sectors. Understanding the potential consequences, from decreased loan amounts to altered interest rates, is crucial for navigating this evolving financial landscape. This analysis will detail the potential impact on different borrower types and the overall economic ramifications.

Potential Consequences for Different Borrower Types

The reduced credit availability will disproportionately affect borrowers reliant on the Ambassadors Line of Credit for their operations. This section examines the potential consequences for different borrower categories.

| Borrower Type | Potential Loan Amount Reductions | Interest Rate Changes | Overall Financial Strain |

|---|---|---|---|

| Small Business Owners | Significant reductions in available credit, impacting expansion plans and operational efficiency. For example, a business relying on the line of credit for seasonal inventory may face difficulties procuring necessary goods. | Increased interest rates could translate into higher costs for borrowing, impacting profitability. A small restaurant, for instance, might experience reduced margins due to the cost of higher interest rates. | Potential disruptions in cash flow, hindering business continuity and potentially leading to job losses. A company using the line of credit for payroll might experience significant setbacks. |

| Individuals | Lower credit limits for personal needs, impacting home improvements, major purchases, or unexpected expenses. A family planning a home renovation might have to scale back their plans due to a lower credit limit. | Higher interest rates on personal loans and credit cards, escalating debt burden. | Increased financial stress and potential difficulty meeting financial obligations, potentially impacting long-term financial goals. |

| Real Estate Developers | Decreased financing for new projects, delaying or halting construction activities. | Higher borrowing costs, reducing profitability margins on new developments. | Potential project delays and financial strain on developers, leading to job losses and decreased investment in the sector. |

Impact on the Overall Economy

The reduction in the Ambassadors Line of Credit will likely have a ripple effect across various industries. Industries heavily reliant on this credit line may experience reduced activity, leading to lower production and employment levels. For instance, the construction industry could see a slowdown in projects if developers have limited access to financing.

So, the Ambassadors line of credit got cut again. It’s another blow, and frankly, it’s starting to feel like a domino effect. Similar to how airlines and cruise lines had to alter plans due to Sandy ( airlines cruise lines alter plans due to sandy ), this financial hiccup just adds more uncertainty to the travel industry.

This news just underscores how interconnected these sectors really are, and how one ripple effect can impact so many different areas. It’s a worrying trend for those relying on these services.

Financial Stability of Borrowers

The financial stability of borrowers relying on the Ambassadors Line of Credit is directly impacted by the reduced credit availability. Lower credit limits and higher interest rates can strain cash flow, impacting operational efficiency and profitability. This could lead to potential defaults, impacting the stability of the financial system. A small business might be forced to reduce its workforce or scale back operations.

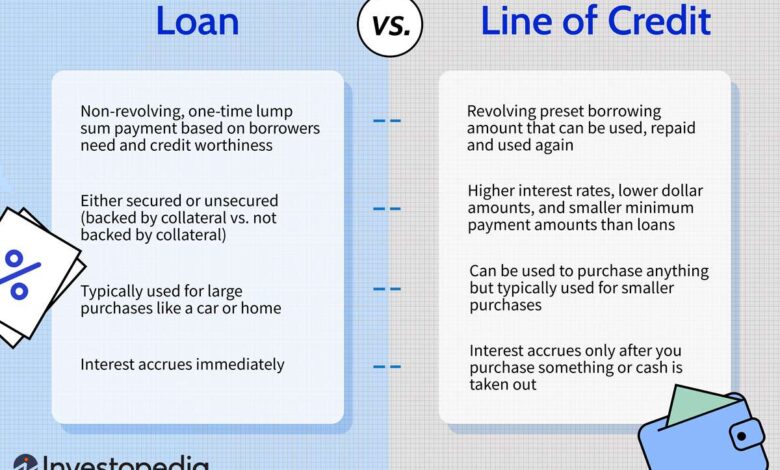

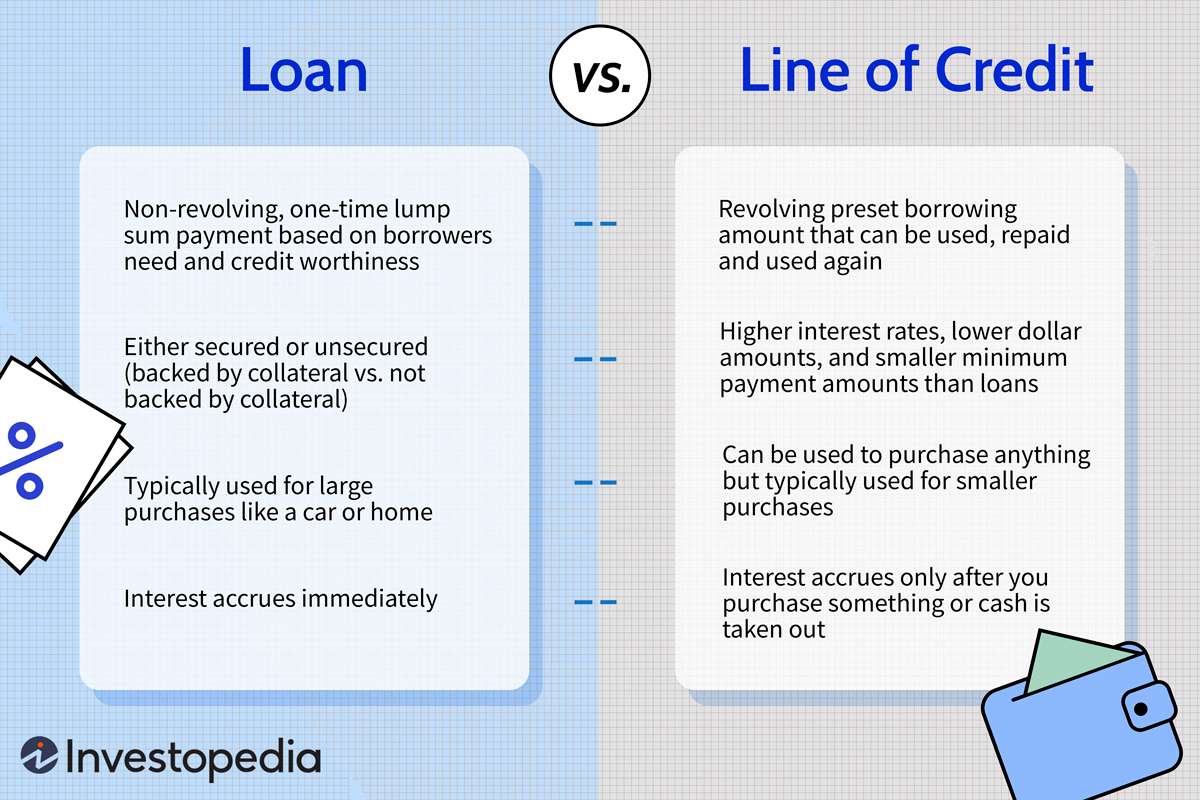

Alternative Financing Solutions

Borrowers facing reduced credit availability should explore alternative financing solutions. These may include traditional bank loans, venture capital, private equity, crowdfunding, and alternative lenders specializing in small business or personal loans. It’s crucial to compare interest rates, loan terms, and fees to ensure the best possible option. Some businesses might have to re-evaluate their funding strategies or seek other forms of support to maintain operations.

Alternatives and Solutions

Navigating financial shifts requires proactive exploration of alternative solutions. The Ambassadors Line of Credit reduction necessitates a critical look at comparable financing options and available government support. Businesses must adapt their strategies to mitigate the impact of reduced credit availability.

Potential Alternatives to the Ambassadors Line of Credit

Understanding alternative financing options is crucial for businesses facing reduced credit availability. This section Artikels potential replacements for the Ambassadors Line of Credit, considering benefits, drawbacks, and eligibility requirements.

| Alternative | Benefits | Drawbacks | Eligibility Criteria |

|---|---|---|---|

| Small Business Loans | Fixed repayment schedules, potentially lower interest rates than revolving credit, access to larger amounts for specific needs. | Stricter eligibility criteria, longer application processes, often requires collateral. | Demonstrated business profitability, good credit history, verifiable revenue streams. |

| Lines of Credit from Other Financial Institutions | Flexibility in borrowing and repayment, potentially faster approval times. | Interest rates may vary significantly, different eligibility standards. | Strong credit score, stable financial history, and verifiable income. |

| Venture Capital or Angel Investors | Potentially higher funding amounts, access to expert mentorship and guidance. | Dilution of ownership, demanding investment terms, significant time commitment. | Demonstrated high growth potential, compelling business plan, and strong management team. |

| Invoice Financing | Access to funds based on outstanding invoices, immediate cash flow. | Higher interest rates, potentially complex paperwork, requires strong customer relationships. | Proven track record of successful sales and collections, established customer base. |

| Government Grants and Subsidies | Funding for specific initiatives or projects. | Competition for grants, stringent eligibility requirements, often limited funding availability. | Alignment with government initiatives, demonstrable need, and meeting criteria. |

Government Programs for Affected Borrowers

Government initiatives can provide valuable support for businesses impacted by credit reductions. This section summarizes programs that might offer assistance.

| Program Name | Eligibility Requirements | Available Funding |

|---|---|---|

| Small Business Administration (SBA) Loans | Specific criteria related to business size, industry, and creditworthiness. | Varying loan amounts depending on the program, often with favorable interest rates. |

| State and Local Economic Development Grants | Alignment with local economic development goals, often focused on specific industries or regions. | Grant amounts depend on program specifics and funding availability. |

| Tax Credits and Deductions | Meeting specific criteria related to investments or business expenses. | Tax savings that can mitigate financial burdens. |

Adapting to Changes in Credit Availability

Businesses must adapt their operations and financial strategies to the reduced availability of the Ambassadors Line of Credit.Businesses can explore various strategies to adjust their operations, including:

- Negotiating with existing vendors: Exploring payment terms and potential discounts can reduce immediate cash flow needs. This might involve offering early payment discounts or longer payment terms to negotiate better payment plans with suppliers.

- Optimizing cash flow: Implementing strategies to accelerate receivables and minimize outgoing payments can significantly improve the short-term financial health of the business. This includes improving invoice processing, collection practices, and vendor relationships.

- Exploring alternative funding sources: Businesses should thoroughly research and compare the terms and conditions of various loan products, grants, and investment options. This may include seeking loans from traditional banks, alternative lenders, or government agencies. A well-structured business plan can increase the likelihood of securing favorable terms.

- Re-evaluating business strategies: A critical assessment of business operations can identify areas for improvement or potential cost savings. This might include examining production processes, inventory management, and marketing strategies.

Community Response

The Ambassadors Line of Credit reduction has sparked a varied and significant response from the affected communities. Concerns range from practical financial hardship to broader implications for local businesses and the overall economic climate. The community’s reaction will likely shape the future of the program and influence potential solutions.The public response to the reduction is characterized by a mixture of anger, disappointment, and a strong desire for clarity and action.

Many feel unheard and unsupported, highlighting the crucial role of transparent communication in such situations. The impact on small businesses and entrepreneurs, who rely heavily on the line of credit, is especially acute, prompting a need for immediate and sustainable alternatives.

Community Sentiment and Reactions

The community’s response to the Ambassadors Line of Credit reduction is a complex tapestry woven with threads of concern, frustration, and a call for action. Online forums and social media platforms are rife with comments expressing worry about the immediate financial consequences and the potential long-term impact on local economies. Community members are actively discussing alternative solutions and possible avenues for advocacy.

The overall sentiment points towards a unified desire for a more equitable and sustainable solution for affected businesses.

Community Groups and Organizations Responding

Several community groups and organizations are actively monitoring the situation and formulating responses. Local chambers of commerce, small business associations, and advocacy groups are likely to organize town hall meetings, protests, and online campaigns to address the concerns. These organizations will play a critical role in coordinating efforts to advocate for the affected community members and potentially press for reinstatement or alternative solutions.

Potential for Protests and Public Advocacy Campaigns

The possibility of protests or public advocacy campaigns is high, given the significant impact on community members. Previous similar events in other regions offer examples of successful community mobilization around economic issues. For example, the community response to a similar reduction in a regional business loan program resulted in a series of public demonstrations, leading to the reconsideration of the policy and the implementation of alternative solutions.

This demonstrates the potential for community organization and advocacy in driving positive change.

The Ambassadors line of credit got cut again, leaving many wondering about the future. It’s a stark reminder of the often complex relationship between nations, sometimes feeling more like “allies but not pals” here. This latest move highlights the delicate balance of power and the potential for shifting priorities, which ultimately impacts the Ambassadors line of credit in the long run.

Community Organization and Advocacy

The community can organize and advocate for the reinstatement or alternative solutions through various avenues. Community leaders, business owners, and concerned citizens can form coalitions to voice their concerns and explore options. Creating a unified front through organized meetings, online petitions, and direct communication with policymakers is crucial. This strategy has proven successful in other contexts, where community-driven efforts have led to policy changes and financial support for struggling businesses.

Illustrative Case Studies

The Ambassadors Line of Credit reduction has undeniably impacted various businesses and individuals. To illustrate the potential ramifications, let’s examine a hypothetical scenario focusing on a small, rapidly expanding bakery. Understanding how these adjustments affect specific players is crucial to comprehending the ripple effects throughout the community.

The Case of “Sweet Success” Bakery

Sweet Success Bakery, a local bakery known for its artisanal breads and pastries, experienced substantial growth in the past two years. Their sales tripled, and they needed additional financing to expand production and meet increased demand. The Ambassadors Line of Credit, previously a vital component of their financial strategy, was crucial for procuring necessary ingredients, equipment, and hiring new staff.

Financial Situation Before the Reduction

Before the reduction, Sweet Success Bakery had a healthy revolving credit line of $50,000 through the Ambassadors Line of Credit. They utilized this credit to maintain a consistent inventory of ingredients, purchase new ovens, and finance seasonal promotions. Their projected cash flow and sales forecasts indicated a strong ability to repay the line of credit within the stipulated timeframe.

Financial Situation After the Reduction

Following the credit line reduction, Sweet Success Bakery now has access to only $25,000. This decrease significantly impacts their ability to maintain the current production level. The reduced credit line necessitates a careful reevaluation of their inventory management strategies, potentially affecting the quality and quantity of products offered. This adjustment could also influence their staffing levels and seasonal promotional plans.

Response to Reduced Credit Availability

To adapt to the reduced credit availability, Sweet Success Bakery implemented several strategies:

- They streamlined their inventory management system, focusing on precise ingredient ordering and minimizing waste.

- They prioritized essential equipment purchases and delayed less critical investments.

- They renegotiated their supplier contracts to secure more favorable payment terms.

- They explored alternative financing options, such as small business loans or crowdfunding campaigns.

Impact on the Community and Economy

The adjustments at Sweet Success Bakery, though potentially impacting their immediate growth trajectory, could inspire similar businesses to adopt more prudent financial strategies. Their response could set a precedent for other small businesses in the community, potentially encouraging a shift towards more sustainable financial practices. Reduced spending on ingredients, and potentially staff, could have a cascading effect on related businesses in the food supply chain.

Summary of Adaptation Success

Sweet Success Bakery’s response to the reduced credit line has been mixed. While they have successfully adjusted their inventory management and procurement processes, the reduced capacity has slowed their growth trajectory. Long-term success will depend on their ability to secure alternative financing options and the resilience of the local economy. The bakery’s ability to maintain its competitive edge and meet customer expectations will be closely watched by other small businesses.

Ultimate Conclusion

The Ambassadors Line of Credit cut again presents a significant challenge for many borrowers, but also an opportunity to explore alternative solutions. By understanding the implications and actively seeking support, individuals and businesses can navigate these changes and adapt their financial strategies for the future. This situation highlights the importance of proactive financial planning and the need for support systems to help communities affected by economic shifts.

Answers to Common Questions

What are the potential loan amount reductions for small business owners?

The potential reductions will vary depending on the individual circumstances and the specific criteria used by the lending institution. It’s crucial to contact the Ambassadors Line of Credit program directly for personalized information and potential loan modifications.

What government programs might assist those affected by the reduction?

The article will explore relevant government programs. Information on eligibility and funding details will be included. This may include Small Business Administration (SBA) loans, grants, and other aid packages.

How might businesses adapt their financial strategies in response to the reduction?

Businesses might explore alternative funding sources, adjust operational costs, or seek strategic partnerships to mitigate the financial impact of the reduced credit availability.

Are there any illustrative case studies of businesses significantly affected by this reduction?

Hypothetical case studies will be presented, highlighting the financial struggles and adaptation strategies of affected businesses. Specific details will be given on the impact of the reduction on their financial stability.