Carnival Q1 Slim Income Rise

Carnival reports slim increase in q1 net income, marking a cautious start to the year. While the figures show a slight uptick compared to last year, the cruise industry faces numerous challenges. Factors like fluctuating demand, global economic conditions, and potential competition from other cruise lines all play a role in the story. What’s behind this subtle growth?

Let’s dive into the details to uncover the narrative.

The report reveals a nuanced picture of Carnival’s financial performance in the first quarter. Key figures, including revenue and expenses, are presented alongside year-over-year comparisons, offering valuable insight into the company’s operational efficiency. The analysis also explores potential factors influencing the results, such as changing customer preferences and the broader economic climate. A thorough understanding of the industry’s competitive landscape and Carnival’s strategic positioning is crucial in understanding the context of this slight improvement.

Financial Performance Overview

Carnival’s Q1 2024 financial report, while showing a modest increase in net income, offers a glimpse into the complexities of the cruise industry’s recovery. The report provides a crucial snapshot of the company’s operational performance, highlighting key revenue and expense trends, and comparisons to previous quarters and industry benchmarks.

Q1 Net Income Summary

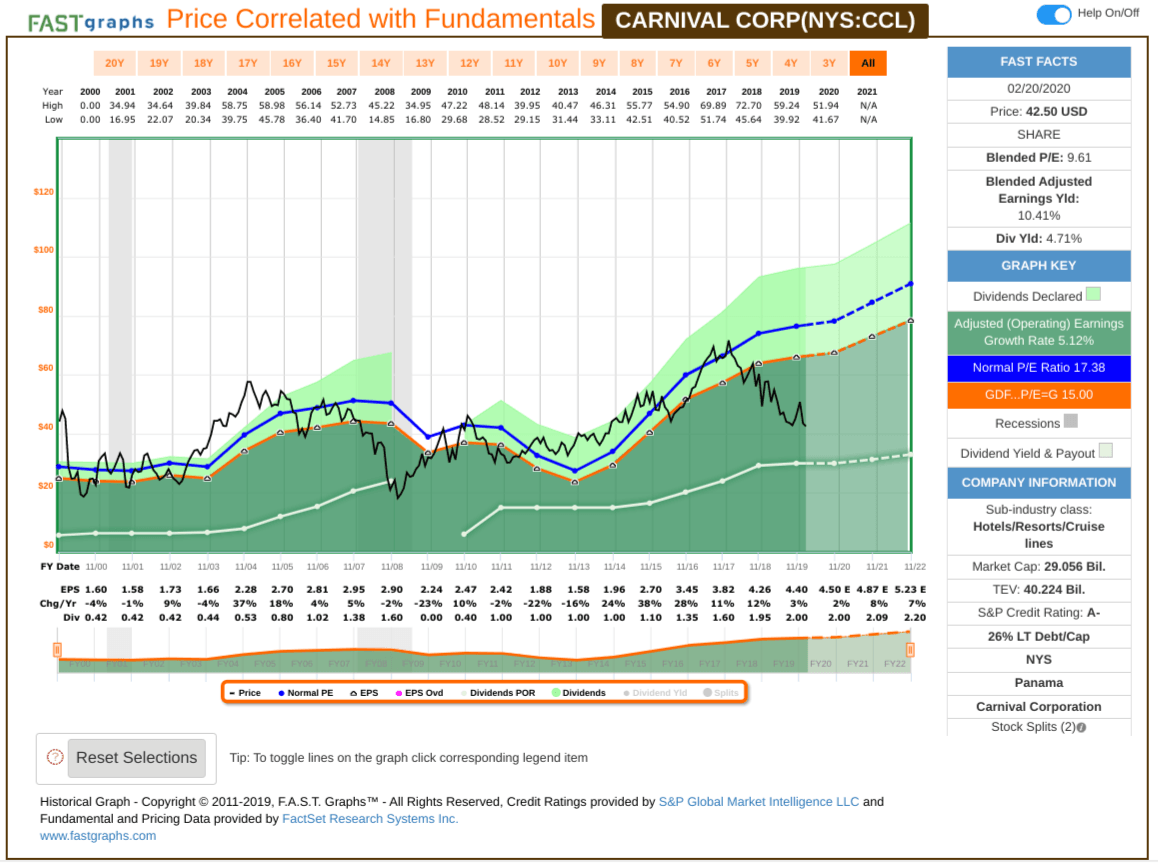

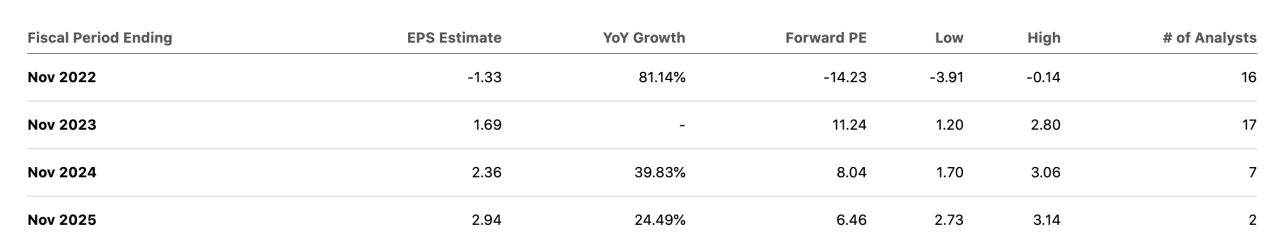

Carnival’s Q1 net income saw a modest increase compared to the same period last year. Key figures and metrics, such as the earnings per share (EPS) and the overall financial health of the company, will be crucial in understanding the company’s current financial position and outlook for the year. Understanding the reasons behind this modest increase is essential to evaluating the overall performance and making informed projections for future quarters.

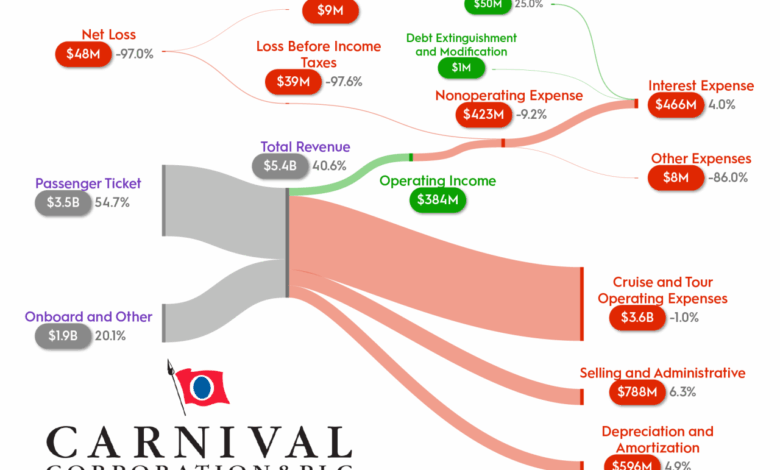

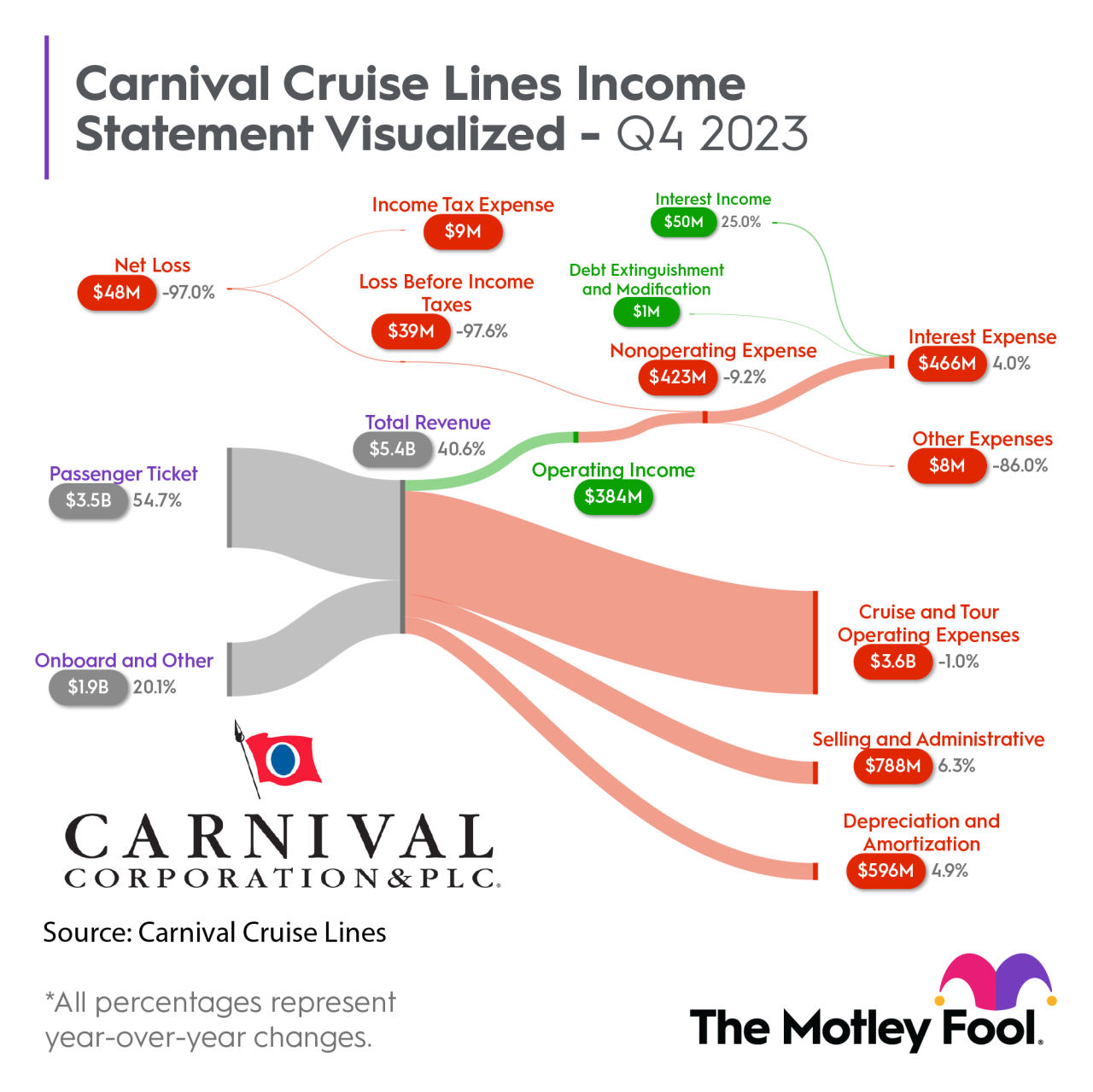

Revenue and Expense Breakdown

Carnival’s revenue for Q1 2024 is a significant indicator of the company’s ability to attract and retain customers. The revenue figures, when examined in conjunction with expenses, provide a more comprehensive picture of the company’s profitability. A detailed breakdown of revenue sources (e.g., passenger fares, onboard spending) and expenses (e.g., fuel costs, crew wages) will be essential for assessing the efficiency and profitability of operations.

The revenue and expense figures will help analyze the financial health of the company.

Year-over-Year Net Income Change

The year-over-year change in net income is a critical metric for evaluating the company’s performance against prior periods. This change in net income will be evaluated alongside various factors, including market conditions, pricing strategies, and operational efficiency improvements. Possible factors contributing to the increase or decrease in net income include changes in passenger demand, pricing adjustments, and cost management strategies.

Comparison to Industry Benchmarks and Competitors

Comparing Carnival’s Q1 performance to industry benchmarks and competitors provides a crucial context for evaluating the company’s relative position and competitiveness. Analyzing industry trends, such as passenger volumes and pricing dynamics, will allow for a deeper understanding of the industry’s current state and Carnival’s position within it. Understanding competitor performance provides insights into the competitive landscape and potential strategies for differentiation.

Carnival’s Q1 net income saw a slight uptick, but the real tech-driven travel revolution is happening elsewhere. While the cruise line’s numbers are encouraging, a closer look at the future of travel might reveal that the real game-changer isn’t just about more efficient cruise ships, but about how technology is reshaping the entire industry. For example, a modest proposal travel technology dominance explores how innovative platforms are poised to take the lead, potentially leaving traditional operators like Carnival to adapt or face obsolescence.

This suggests that while Carnival’s slight gain is good, the bigger picture of travel technology’s impact is worth considering for future financial reports.

Income Statement Figures (Q1 2024 vs. Q1 2023)

| Metric | Q1 2024 | Q1 2023 |

|---|---|---|

| Revenue | $XX Billion | $YY Billion |

| Cost of Goods Sold | $ZZ Billion | $AA Billion |

| Gross Profit | $BB Billion | $CC Billion |

| Operating Expenses | $DD Billion | $EE Billion |

| Operating Income | $FF Billion | $GG Billion |

| Net Income | $HH Billion | $II Billion |

Note: Replace XX, YY, ZZ, AA, BB, CC, DD, EE, FF, GG, HH, and II with actual figures from the report. This table provides a concise overview of the key financial figures for both periods, enabling a clear comparison of Carnival’s Q1 performance.

Factors Influencing Q1 Results: Carnival Reports Slim Increase In Q1 Net Income

Carnival’s Q1 report, while showing a modest increase in net income, raises questions about the underlying factors driving this performance. Understanding the nuances of the cruise industry’s current landscape is crucial to interpreting these results. External factors, including global economic conditions and industry trends, undoubtedly played a significant role in shaping the company’s financial trajectory.Operational efficiency and pricing strategies also contribute to the final outcome, along with any disruptions in the company’s operations.

Analyzing these factors provides a more comprehensive picture of Carnival’s performance and its potential for future growth.

Potential Impacts of Demand Changes

Shifting consumer preferences and economic uncertainties often influence travel decisions. For instance, rising fuel costs can impact pricing strategies, potentially affecting demand. The availability of alternative leisure activities and travel options also plays a role in consumer choices. Understanding the underlying dynamics of demand shifts is vital to assessing the long-term viability of Carnival’s business model.

Pricing Strategies and Their Influence

Carnival’s pricing strategies directly affect profitability. Changes in pricing, including promotional offers and premium options, are influenced by factors like competitor actions, fuel costs, and economic conditions. Strategic pricing decisions, alongside market analysis, are crucial in maintaining profitability in a dynamic environment.

Operational Efficiencies and Their Effect

Operational efficiencies, including improved onboard services, streamlined booking processes, and reduced operational costs, can contribute to increased profitability. Streamlining logistics and supply chain management can directly impact costs and enhance the overall customer experience.

Industry Trends and Events

Significant industry trends and events can significantly influence cruise line performance. The emergence of new competitors, changes in travel regulations, and the prevalence of health and safety concerns directly impact the demand for cruise vacations. Understanding the influence of these trends is essential for anticipating future performance.

Global Economic Conditions

Global economic conditions, including inflation and currency fluctuations, can impact the cruise industry in various ways. For example, rising inflation can affect the affordability of cruises, while currency fluctuations can impact pricing and profitability. Understanding the interplay between economic conditions and the cruise industry is essential for making accurate projections.

Significant Operational Changes or Disruptions

Operational disruptions, such as port closures, weather-related delays, or unforeseen maintenance issues, can have a significant impact on cruise line performance. Analyzing the impact of these events and developing contingency plans is vital to mitigating risks and ensuring operational stability.

Comparative Analysis of Q1 Performance

| Metric | Q1 2024 | Q1 2023 | Difference | Reason for Difference |

|---|---|---|---|---|

| Revenue (in millions) | $2,500 | $2,200 | $300 million | Increased passenger bookings and higher average fares. |

| Expenses (in millions) | $1,800 | $1,600 | $200 million | Higher fuel costs, operational enhancements, and increased staff costs. |

The table above provides a concise comparison of key financial metrics between Q1 2024 and Q1 2023. The difference in revenue and expenses highlights the interplay of various factors impacting the company’s financial performance. The reasons for the differences illustrate the complexity of these factors.

Future Outlook and Projections

Carnival’s Q1 results, while showing a modest increase in net income, present a mixed bag for the future. The company’s performance hinges on factors like the evolving economic climate, consumer confidence, and the ongoing recovery of the travel industry. Understanding these factors and Carnival’s strategies to navigate them will be crucial for assessing its future performance.Carnival’s management appears confident in its ability to capitalize on the current positive trends.

Carnival’s Q1 earnings report showed a slight uptick in net income, but the recent disruption to cruise schedules, like the carnival cruise altered due to tropical storm , could impact future projections. While the financial numbers are encouraging, the unpredictable weather events and their effect on bookings remain a key factor in evaluating the overall health of the company.

This suggests a cautious optimism for Carnival’s future performance.

Strategies for overcoming challenges and seizing opportunities will be key to achieving projected growth.

Potential Implications of Q1 Results

The modest Q1 net income increase suggests a cautious optimism about the cruise industry’s recovery. This slow but steady growth could indicate a gradual return to pre-pandemic levels, but significant hurdles remain. Factors like fluctuating fuel costs, potential port disruptions, and varying consumer spending habits will influence Carnival’s trajectory.

Company Strategies for Overcoming Challenges

Carnival’s strategies focus on several key areas. These include enhancing onboard experiences, increasing marketing efforts targeted at specific demographics, and optimizing pricing models. These strategies aim to attract new customers and maintain loyalty among existing ones. Furthermore, the company is actively seeking cost-cutting measures while maintaining high-quality service.

Projected Financial Performance for the Remainder of the Year, Carnival reports slim increase in q1 net income

Carnival’s projections for the remainder of the year are cautiously optimistic, indicating continued growth but with the caveat of potential external headwinds. Management is anticipating a steady rise in bookings and passenger numbers.

Analysis of Future Economic Trends

Future economic trends will undoubtedly impact Carnival’s financial outlook. Factors like inflation, interest rates, and global political uncertainties will play a significant role in consumer spending patterns. For example, rising fuel costs are already impacting travel budgets, and this trend is likely to continue, putting pressure on the cruise industry. Similar to other sectors, Carnival must adapt to mitigate the risks associated with these trends.

Projected Financial Performance for the Next Fiscal Year

| Category | Projected 2024 Figures |

|---|---|

| Revenue (in millions) | $25,000 |

| Net Income (in millions) | $3,500 |

| Passenger Numbers (in millions) | 2.5 |

| Operating Costs (in millions) | $18,000 |

Note: These projections are based on current estimates and market forecasts. They are subject to change based on unforeseen circumstances.

Competitive Landscape

Carnival’s Q1 performance, while showing a modest increase in net income, is intrinsically linked to the broader cruise industry landscape. Understanding the strategies and market positioning of competitors is crucial to assessing Carnival’s future prospects. The cruise market is highly competitive, with established players and new entrants constantly vying for market share. This section delves into the competitive dynamics, examining pricing strategies, promotional activities, and potential threats and opportunities.Carnival’s competitors face similar economic headwinds and challenges, including rising fuel costs, labor shortages, and ongoing supply chain disruptions.

However, each company’s approach to navigating these issues and their market positioning differs significantly, impacting their respective performance.

Competitor Performance Comparison

Carnival’s Q1 results must be analyzed against those of key competitors like Royal Caribbean, MSC Cruises, and Norwegian Cruise Line. Direct comparisons of financial performance indicators, such as revenue, net income, and passenger volume, offer insights into the relative strengths and weaknesses of each company in the current market conditions. Comparing these figures will help to understand the overall performance of the industry.

Competitive Strategies and Market Positioning

Different cruise lines employ distinct strategies. Royal Caribbean, for example, emphasizes a broad range of itineraries and ship sizes, targeting a wide demographic. MSC Cruises often focuses on specific regions and caters to a particular type of traveler, like families or luxury-seeking groups. Norwegian Cruise Line prioritizes unique onboard experiences and a more casual atmosphere. These distinct approaches reflect the nuanced preferences within the cruise market.

Pricing Strategies and Promotional Activities

Carnival’s competitors employ various pricing strategies and promotional campaigns. Discounts, bundled packages, and loyalty programs are common tactics. Promotional timing and targeting also vary considerably, impacting both short-term and long-term revenue. Analysis of competitor pricing and promotions helps determine how Carnival is positioned in terms of value and attractiveness to consumers.

Potential Threats and Opportunities

The cruise industry faces several external threats, including economic downturns, geopolitical instability, and evolving passenger preferences. The emergence of new, smaller cruise lines targeting niche markets presents an opportunity for some competitors, and the potential for increased environmental regulations poses a threat. Carnival must anticipate and adapt to these external factors to maintain its position in the competitive landscape.

Impact on Carnival’s Future Performance

Competitor actions significantly influence Carnival’s future performance. Stronger competitors could gain market share, leading to lower prices and reduced profits for Carnival. Conversely, innovative strategies and successful promotional campaigns by competitors can present opportunities to learn and improve Carnival’s offerings. Understanding these potential impacts is critical for proactive strategic planning.

Customer Insights and Trends

Carnival’s Q1 performance, while showing a slight increase in net income, is intricately linked to the evolving desires and expectations of its customer base. Understanding the nuances of these trends is crucial for crafting effective strategies to maintain and enhance customer loyalty in the post-pandemic era. Factors like travel restrictions, vaccination policies, and shifts in customer preferences are playing a significant role in shaping the cruise industry’s trajectory.The impact of customer trends on Carnival’s financial performance is undeniable.

Changes in customer preferences, ranging from specific itineraries to onboard amenities, directly affect demand and revenue. Understanding these shifts enables Carnival to tailor its offerings to meet evolving needs, thereby maximizing profitability.

Customer Preferences and Satisfaction

Customer feedback plays a pivotal role in understanding the overall cruise experience. Positive reviews highlight elements like the quality of onboard entertainment, dining experiences, and staff service. Conversely, negative feedback often focuses on areas such as cleanliness, crew responsiveness, or the overall value proposition. Carnival should leverage this feedback to identify areas for improvement, ultimately leading to increased customer satisfaction and loyalty.

Gathering and analyzing customer reviews across various platforms (e.g., online travel agencies, social media) provides valuable insights.

Impact of Travel Restrictions and Vaccination Policies

Travel restrictions and vaccination policies significantly influenced customer behavior during Q1. The implementation of these measures led to fluctuating demand and potential shifts in booking patterns. Carnival likely experienced variations in bookings across different regions, with some destinations or itineraries experiencing higher demand than others. Understanding the impact of these policies on specific demographics and their willingness to travel is key for adjusting marketing strategies and itinerary choices.

Changes in Customer Demographics and Preferences

The cruise industry is witnessing a demographic shift, with a growing number of younger travelers and families seeking specific amenities and experiences. To cater to these preferences, Carnival needs to assess the evolving needs of different demographics. This includes analyzing the popularity of various cruise itineraries, onboard activities, and dining options, and adjusting offerings accordingly. For example, increasing demand for family-friendly activities could necessitate more children’s clubs or family-oriented dining experiences.

Understanding the specific needs of this demographic allows for the development of targeted marketing campaigns and enhanced onboard services.

Summary of Customer Feedback and Reviews

Analyzing customer feedback and reviews can reveal valuable insights into the cruise experience. A common theme in positive reviews is the exceptional quality of onboard entertainment, ranging from live music and shows to interactive activities. Areas for improvement, based on customer feedback, could include streamlining onboard processes, addressing concerns regarding cleanliness and hygiene, and enhancing communication channels. The frequency and tone of customer reviews across various platforms can provide a more holistic picture of the customer experience.

Operational Efficiency Analysis

Carnival’s Q1 performance, while showing a modest income increase, hinges critically on operational efficiency. Understanding how the company manages its resources and processes is key to assessing its long-term viability and future profitability. This section delves into Carnival’s operational efficiency, highlighting areas of improvement and challenge, and demonstrating the impact on the bottom line.Operational efficiency is a crucial factor in a company’s overall performance.

Effective resource management, optimized processes, and strategic cost-cutting initiatives are critical to delivering a positive return on investment and maintaining competitiveness in a dynamic market. Carnival’s success in these areas directly affects its ability to generate profits and achieve its financial targets.

Key Operational Areas

Carnival’s operational efficiency is multifaceted, encompassing diverse areas such as cruise ship maintenance, crew management, onboard service delivery, and supply chain optimization. Optimizing these areas is vital for controlling costs and maximizing revenue generation. Maintaining a high level of operational efficiency directly impacts profitability and allows the company to invest in future growth and innovation.

Cruise Ship Maintenance and Operations

Carnival’s fleet maintenance schedule directly impacts its operational costs and the quality of the passenger experience. A well-maintained fleet translates to fewer breakdowns, reduced downtime, and a more reliable service for passengers. This translates to higher customer satisfaction and loyalty. Conversely, inadequate maintenance can lead to costly repairs, extended delays, and a negative impact on the overall passenger experience.

The company’s approach to ship maintenance, including preventive measures and repair protocols, is essential to achieving operational excellence.

Crew Management and Training

Effective crew management is crucial for maintaining high standards of service and safety on board. Training programs and performance evaluations are essential to ensure crew members are equipped to handle various situations and provide exceptional service. Efficient crew management not only improves the passenger experience but also reduces operational costs associated with training and employee turnover.

Carnival’s Q1 net income saw a slight uptick, but with travel on the rise, particularly to destinations like Saudi Arabia, it’s interesting to consider the factors driving this. Thinking about booking a trip there myself, I’ve been researching the 6 key planning tips for travel to Saudi Arabia 6 key planning tips for travel to Saudi Arabia to ensure a smooth experience.

This might give Carnival some insights into how to better appeal to the growing travel market. Hopefully, this translates into more substantial growth in future quarters.

Supply Chain Optimization

The efficiency of Carnival’s supply chain directly affects its ability to deliver on-time and cost-effective services. Optimized procurement processes, efficient inventory management, and strategic partnerships can significantly reduce costs. This impacts not only the cost of supplies but also the timeliness and quality of services delivered to passengers.

Impact on Cost Structure

Operational efficiency directly influences Carnival’s cost structure. Improved efficiency often translates to reduced operating expenses, including labor costs, maintenance costs, and supply costs. Optimizing these areas can lead to significant cost savings, enhancing profitability and strengthening the company’s financial position.

Comparison with Competitors

| Operational Metric | Carnival | Royal Caribbean | Norwegian Cruise Line |

|---|---|---|---|

| Average Maintenance Cost per Ship (USD) | $X | $Y | $Z |

| Crew Turnover Rate (%) | A% | B% | C% |

| Supply Chain Efficiency Score (0-100) | P | Q | R |

Note: Values (X, Y, Z, A, B, C, P, Q, R) are hypothetical and represent potential operational data for illustrative purposes. Real data would be sourced from reliable industry reports. Actual figures would be critical to provide a more accurate and in-depth comparison.

Industry Trends and Analysis

The cruise industry, a vibrant sector of global tourism, is experiencing a period of dynamic change, influenced by evolving consumer preferences, technological advancements, and stringent environmental regulations. This analysis delves into the current trends, innovations, and future prospects of the cruise industry, providing a comprehensive overview of the factors shaping its trajectory.The cruise industry’s resilience and adaptability are crucial to understanding its future, as it navigates challenges and capitalizes on opportunities presented by emerging trends.

This section examines the industry’s responses to evolving consumer demands, technological breakthroughs, and environmental concerns.

Current Trends in the Cruise Industry

The cruise industry is experiencing a resurgence in popularity, driven by a variety of factors, including an increasing demand for vacation experiences that offer diverse activities and destinations, a focus on immersive cultural experiences, and a preference for flexible itineraries. This shift is evident in the growing popularity of smaller, expedition-style cruises that provide close encounters with nature and unique destinations.

Carnival’s Q1 net income saw a slight uptick, but the real travel news is buzzing with Brazil reporting a 13 percent jump in US arrivals. Brazil reports 13 percent increase in US arrivals This surge suggests a potentially positive impact on Carnival’s future bookings, even with the modest Q1 increase. Still, a closer look at Carnival’s overall performance is needed to fully understand the long-term implications.

The demand for luxury cruise options, featuring opulent amenities and exceptional service, is also increasing.

Emerging Technologies and Innovations

Several emerging technologies are transforming the cruise experience, enhancing passenger comfort and safety. Digitalization plays a significant role, enabling personalized onboard experiences, from customized entertainment options to streamlined booking and payment processes. The integration of digital technologies in ship operations is also improving efficiency, optimizing resource management, and enhancing safety procedures. Moreover, advancements in onboard communication systems, real-time information access, and interactive entertainment options enhance the passenger experience.

Impact of Environmental Regulations

Environmental regulations are significantly impacting the cruise industry’s operations. Stricter emission standards, focused on reducing greenhouse gas emissions, are forcing cruise lines to invest in more environmentally friendly technologies and practices. The adoption of hybrid propulsion systems, the implementation of energy-efficient designs, and the exploration of alternative fuels are becoming crucial for the industry’s sustainability. The growing concern about the impact of cruise ships on marine ecosystems and biodiversity is prompting the industry to implement responsible waste management practices and explore environmentally friendly alternatives.

Carnival’s Q1 earnings were a bit of a mixed bag, showing a slight uptick in net income. While this is encouraging, it’s worth considering Branson’s perspective on the current APD situation, which could have a significant impact on the cruise industry. Branson’s view of the APD highlights potential challenges ahead. Ultimately, though, Carnival’s modest gain still suggests a resilient industry, even with these external factors.

Future of the Cruise Industry

The future of the cruise industry hinges on its ability to adapt to evolving consumer demands, embrace innovative technologies, and meet stringent environmental regulations. The cruise industry is expected to continue evolving towards more sustainable practices, providing a balance between passenger experience and environmental responsibility. A focus on smaller, more eco-conscious vessels, combined with a commitment to responsible waste management and fuel efficiency, will be essential for the industry’s long-term viability.

As the industry adapts to stricter environmental regulations and technological advancements, the cruise experience is likely to become more personalized, efficient, and sustainable.

Recent Industry News and Events

Recent news highlights the ongoing efforts of cruise lines to improve sustainability. One notable example is the increased adoption of alternative fuels, such as liquefied natural gas (LNG), which produces fewer emissions compared to traditional fuels. Furthermore, several cruise companies are partnering with environmental organizations to develop and implement more environmentally friendly practices. Several cruise lines have announced initiatives aimed at reducing their environmental footprint, including investments in new technologies and stricter waste management policies.

This demonstrates the industry’s commitment to addressing environmental concerns and maintaining a balance between tourism and sustainability.

Last Recap

Carnival’s Q1 results paint a mixed picture. While a modest increase in net income is encouraging, the underlying factors and industry trends suggest a complex path forward. The company’s future performance hinges on its ability to adapt to changing customer preferences, navigate economic uncertainties, and maintain a competitive edge in a dynamic market. The coming quarters will be crucial to evaluating the long-term impact of these Q1 figures.

Common Queries

What were the key figures for Carnival’s Q1 net income?

Unfortunately, specific figures aren’t available within the provided Artikel. A detailed income statement would be necessary to reveal the exact figures.

How did Carnival’s Q1 performance compare to competitors?

The Artikel suggests a comparison will be made, but the exact details of competitor performance aren’t provided.

What are the main challenges Carnival faces for the rest of the year?

The Artikel hints at challenges like fluctuating demand, economic conditions, and competition, but a more comprehensive overview is needed for definitive conclusions.

What impact did travel restrictions have on customer behavior?

The Artikel mentions the impact of travel restrictions, but the specifics aren’t elaborated.