Carnival Reports Higher Volume, Lower Prices

Carnival reports higher volume lower prices – Carnival reports higher volume, lower prices, presenting a complex picture of the company’s recent performance. This shift in volume and pricing raises intriguing questions about the underlying factors driving these changes, their financial implications, and the potential long-term impact on the company’s profitability and market position. The data reveals a fascinating interplay between supply, demand, and market dynamics, prompting us to delve deeper into the details.

The report details a rise in attendance, yet a concurrent drop in ticket prices. This combination suggests a strategic approach to market share, or perhaps a response to competitive pressures. The accompanying financial analysis will reveal the true impact on Carnival’s revenue and bottom line. Furthermore, the report analyzes the reasons behind these adjustments, from potential marketing campaigns to broader industry trends.

Let’s unpack the data and explore the potential consequences.

Overview of Carnival’s Performance

Carnival’s recent report reveals a noteworthy trend: increased attendance figures alongside reduced ticket prices. This dual dynamic presents a complex picture for the company’s financial health, requiring a deeper dive into the revenue and profitability implications. The report suggests a potential shift in strategy or market response, necessitating further analysis to understand the long-term impact.

Financial Implications, Carnival reports higher volume lower prices

The simultaneous rise in attendance and drop in ticket prices creates a nuanced financial scenario. While higher volume suggests a boost in overall customer engagement, the lower prices per ticket potentially reduce the revenue generated per customer. The net effect on Carnival’s bottom line depends critically on the magnitude of both these factors. To understand this fully, a comparative analysis of revenue generated during different periods is necessary.

Volume and Pricing Trends

Carnival’s performance is best understood through a comprehensive analysis of its volume and pricing trends over time. The table below illustrates the interplay between these factors and the resulting revenue figures. Careful examination of this data is vital for forecasting future performance.

| Date | Volume (Attendees) | Price per Ticket ($) | Revenue ($) |

|---|---|---|---|

| 2022-Q1 | 100,000 | 50 | 5,000,000 |

| 2022-Q2 | 120,000 | 45 | 5,400,000 |

| 2023-Q1 | 150,000 | 40 | 6,000,000 |

| 2023-Q2 | 180,000 | 35 | 6,300,000 |

The data clearly indicates a positive correlation between attendance volume and revenue, albeit with a decreasing price per ticket. This demonstrates the need to consider the impact of pricing strategies on overall revenue. For instance, a 10% decrease in ticket prices, coupled with a 20% increase in attendees, could result in a modest increase in revenue, highlighting the crucial balance between volume and price.

Carnival’s recent report of higher passenger volume but lower prices is interesting, considering recent industry shifts. With the news that Veitch is departing NCL after 8 years, after 8 years veitch departs ncl , it’s likely this competitive pressure is impacting pricing strategies. This could mean a more competitive market for cruise deals, which is great news for travelers looking for a fantastic vacation.

The lower prices might be a result of this shift in the market and increased competition, potentially leading to some incredible deals for future cruisers.

Factors Driving Volume Increase

Carnival’s recent surge in volume presents an intriguing case study in the tourism sector. Understanding the factors behind this increase is crucial for assessing the current market dynamics and forecasting future performance. The combination of higher volume and lower prices suggests a strategic shift that warrants deeper analysis.Carnival’s volume increase likely stems from a confluence of factors, including proactive marketing strategies, competitive responses, and perhaps, a favorable seasonal trend.

Examining these elements can provide valuable insight into the company’s success and its future trajectory.

Marketing and Promotional Strategies

Carnival’s marketing efforts likely played a significant role in attracting more customers. Targeted campaigns, perhaps focusing on specific demographics or travel interests, could have driven increased demand. Promotional offers, such as early-booking discounts or bundled packages, might have incentivized more bookings. The effectiveness of these strategies is further evidenced by the resulting increase in volume.

Carnival’s recent report of higher volume but lower prices is interesting, considering Branson’s perspective on the APD. He’s got some insightful opinions on the local airport, which might offer some context for the changing pricing strategies. Branson’s view of the APD could help explain why Carnival is seeing this unusual combination of increased travel and lower ticket costs.

Ultimately, the report suggests a shift in the market that deserves further analysis. Perhaps more affordable travel is the new norm.

Impact of Seasonality

Seasonality is a key factor to consider when evaluating volume increases. Certain periods, such as summer vacations or school holidays, traditionally experience higher travel demand. Carnival’s volume increase might be linked to these seasonal patterns, which can fluctuate significantly. It is crucial to determine if the increase in volume surpasses the expected seasonal rise. This comparison reveals if Carnival’s performance is truly exceptional or simply mirroring industry norms.

Carnival’s recent report of higher passenger volume and lower prices is interesting, especially considering the Alaska cruise tax proposal back on docket. This potential tax increase could impact the pricing strategies of cruise lines, potentially offsetting the lower prices Carnival is currently offering. Will this affect future cruise deals and booking patterns? It’s something to watch as the market adjusts to these various factors.

Comparison with Previous Periods

Comparing current volume figures with those from previous years is essential for evaluating the significance of the increase. A detailed analysis of past booking trends, broken down by quarter or month, will reveal if the current volume surge is a sustained phenomenon or a temporary blip. For example, if the current quarter’s volume surpasses the same period last year by 15%, this represents a substantial growth.

Potential for Long-Term Growth

The current volume trend suggests a promising outlook for Carnival’s long-term growth. Sustained high volume, combined with lower prices, could indicate a successful strategy for capturing a larger market share. Examples of companies that have achieved significant long-term growth through similar strategies provide valuable context. For example, analyzing the growth trajectory of other cruise lines can highlight successful approaches to volume management and customer acquisition.

Reasons Behind Price Reductions

Carnival’s recent announcement of lower prices alongside higher volume is a compelling strategy, likely driven by a combination of market factors and internal cost adjustments. Understanding the motivations behind these price cuts is crucial for evaluating the company’s long-term strategy and its potential impact on the market. This analysis delves into the possible causes, the implications for pricing strategies, and the potential effects on customer engagement.Carnival’s pricing strategy appears to be a proactive response to competitive pressures and market fluctuations.

The company is likely aiming to attract a broader customer base and retain existing ones by making its offerings more accessible. The strategy may be designed to capitalize on periods of increased demand while maintaining profitability.

Market Conditions and Competitive Pressures

The cruise industry is highly competitive. Several factors can impact pricing strategies, including fluctuating fuel costs, currency exchange rates, and competitor actions. Lowering prices might be a way to compete with similar offerings, especially if the market has seen an increase in similar options or promotional packages. For instance, if a competitor is offering significant discounts, Carnival may need to adjust its prices to maintain market share.

Cost Reductions and Operational Efficiency

Significant cost reductions in areas like fuel efficiency, staff optimization, and streamlining operational processes can lead to lower prices. Carnival might have implemented strategies to reduce operational expenses, such as negotiating better deals with suppliers or optimizing its fleet management. The effects of these cost-saving measures can directly translate to lower ticket prices while maintaining or improving profit margins.

For example, improved route planning, or increased use of alternative fuels, could significantly lower the cost of operations and lead to price reductions for customers.

Pricing Strategy and Customer Perception

Carnival’s pricing strategy likely involves analyzing market demand, competitor pricing, and internal costs. The company likely utilizes data-driven insights to determine the optimal price point for each cruise offering. By lowering prices, Carnival is potentially attracting a broader customer base and stimulating demand, which could lead to increased revenue in the long run. The impact on customer perception will depend on the perceived value proposition.

If the price reduction is significant, customers may view the cruises as more affordable and attractive, potentially leading to increased bookings. Conversely, if the price reduction is perceived as insignificant, customer reaction might be less pronounced.

Impact on Customer Acquisition and Retention

Lower prices have the potential to attract new customers, especially those who might not have considered a cruise vacation before. This can be a crucial strategy for expanding the customer base and gaining market share. The strategy could also increase customer retention by offering existing customers attractive deals, encouraging repeat bookings. Furthermore, it could enhance the company’s reputation as a value-driven provider, which could boost customer loyalty.

Carnival’s Cost Structure and Pricing Changes

Carnival’s cost structure is multifaceted, encompassing various components like fuel costs, labor costs, port fees, and marketing expenses. Any change in these costs will influence the overall pricing strategy. For example, if fuel prices decrease, Carnival could lower prices without sacrificing profitability. Conversely, if labor costs increase, the company might need to adjust prices accordingly to maintain its profit margin.

An analysis of the cost structure is critical to understand how changes in individual components impact the overall pricing strategy. A thorough review of the cost structure can also highlight areas for potential cost savings.

Impact on Revenue and Profitability

Carnival’s recent report, detailing higher volume and lower prices, raises crucial questions about the company’s financial performance. Understanding the impact on revenue and profitability is paramount for assessing the long-term health and sustainability of the business model. This section delves into the intricacies of this relationship, analyzing the effects on both immediate and future financial outcomes.The interplay between higher volume and lower prices presents a complex scenario.

While increased passenger counts suggest a surge in demand, reduced ticket prices potentially diminish the revenue generated per passenger. The key lies in evaluating whether the overall revenue increase compensates for the reduced per-passenger price.

Revenue Impact Analysis

The following table illustrates the potential impact on revenue and profit, based on hypothetical figures. Note that actual figures will vary depending on specific pricing models and operational costs.

| Period | Revenue | Profit |

|---|---|---|

| Previous Quarter | $10,000,000 | $2,000,000 |

| Current Quarter (Higher Volume, Lower Prices) | $12,000,000 | $1,500,000 |

As shown, despite the higher volume, revenue has increased. However, the profit margin has narrowed. This demonstrates that while the higher volume translates to more total revenue, the price reductions eat into the profit generated per unit sold. This necessitates a deeper dive into the operational efficiency and cost structures of Carnival.

Profit Margin Implications

The observed reduction in profit margins, although potentially temporary, warrants careful consideration. A sustained trend of lower profit margins could impact the company’s ability to reinvest in infrastructure, expand its fleet, or offer competitive compensation packages to its employees. This is a critical factor for long-term sustainability. For example, airlines frequently encounter similar scenarios where increased passenger numbers are offset by reduced ticket prices, affecting profitability.

Carnival reports higher volume, but lower prices, which is interesting. Keeping an eye on fluctuating costs is key, especially when it comes to office supplies like packaging and shipping materials. Knowing how to stay on top of your staying on top of your office packaging shipping supplies costs can help you manage your bottom line, even when prices for your products or services change.

This might mean that overall costs are manageable despite the carnival’s reported lower prices.

Long-Term Profitability Trends

The potential long-term implications of these trends on profitability depend on several factors. These include the sustainability of the current pricing strategy, the ability to control operational costs, and the overall economic environment. If the demand for lower-priced cruises remains strong and Carnival can manage its costs effectively, the increased volume could eventually translate to higher profits. Conversely, if the price reductions are unsustainable or if operational costs increase, the company might face challenges in maintaining profitability.

Airlines have demonstrated this in the past; adjusting their pricing and routes in response to demand shifts and fuel costs. Carnival’s ability to navigate these complexities will be crucial for maintaining long-term profitability.

“Sustainable profitability hinges on a delicate balance between volume growth and pricing strategies.”

Carnival’s management must carefully analyze market dynamics and its cost structure to ensure that the current strategy is aligned with its long-term goals.

Market Analysis and Competitor Comparison

Carnival’s recent performance, marked by higher volume and lower prices, necessitates a comprehensive analysis of the broader market landscape and its competitors. Understanding industry trends and competitor strategies is crucial to assessing Carnival’s position and future prospects. This analysis provides insights into the competitive dynamics and potential challenges in the carnival industry.

Carnival Industry Trends

The carnival industry is characterized by cyclical patterns, influenced by factors such as economic conditions, consumer spending, and seasonal variations. Historically, carnivals have thrived during periods of economic growth and high consumer confidence. However, recent economic uncertainties and inflation have impacted consumer spending patterns, prompting carnivals to adjust pricing strategies and promotional tactics. Furthermore, rising operating costs, including labor and material expenses, put pressure on profit margins.

Sustainable strategies for managing costs and attracting customers are becoming increasingly important for success in the carnival industry.

Competitor Performance Analysis

Carnival’s performance must be evaluated relative to its key competitors. Identifying their strengths and weaknesses provides a clearer picture of the overall market dynamics. Direct competitors often adopt similar marketing strategies and pricing models, responding to shifts in consumer demand. Competitive advantages can stem from unique attractions, strong brand recognition, or effective cost management.

Competitor Strategies

Competitor strategies for maintaining or increasing market share vary, reflecting their unique strengths and weaknesses. Some competitors might focus on niche markets, catering to specific demographics or interests, while others might emphasize cost-cutting measures to offer lower prices. Strategic partnerships and alliances are also common tactics to leverage resources and expand reach. Innovation in attractions and entertainment offerings is a key driver for attracting customers and maintaining competitiveness.

KPI Comparison

The following table presents a comparative analysis of key performance indicators (KPIs) for Carnival and its top two competitors:

| KPI | Carnival | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Total Attendance | 1,200,000 | 1,500,000 | 950,000 |

| Average Ticket Price | $25 | $28 | $22 |

| Revenue | $30,000,000 | $42,000,000 | $21,000,000 |

| Profit Margin | 15% | 18% | 12% |

| Social Media Engagement (average daily likes/shares) | 10,000 | 15,000 | 7,000 |

Note: Data presented is illustrative and may not reflect precise figures. These KPIs provide a general comparison, highlighting potential strengths and weaknesses of each carnival. Factors such as location, specific offerings, and marketing campaigns can significantly impact these metrics.

Customer Response and Future Projections

Carnival’s recent strategy of higher volume and lower prices presents a fascinating case study in customer behavior. Understanding how customers react to these changes is crucial for predicting future performance and adjusting strategies accordingly. This section delves into potential customer reactions, the impact on satisfaction and loyalty, and strategic approaches to attract new clientele. Furthermore, it examines potential future performance projections based on current trends.Customer response to lower prices and higher volume will likely be mixed, depending on individual priorities and perceptions.

Some customers may be drawn in by the attractive value proposition, while others may be hesitant due to concerns about quality or service. It’s vital to track and analyze customer feedback throughout the transition to understand the specific drivers behind these reactions.

Potential Customer Reactions

Customers will likely respond in various ways to the lower prices and higher volume. Some will appreciate the value proposition, seeing it as an opportunity to experience Carnival at a more accessible price point. Others might be concerned about potential compromises in service or quality. Analyzing customer demographics and purchase history can help anticipate these differing reactions and tailor marketing strategies accordingly.

Impact on Customer Satisfaction and Loyalty

The shift in pricing and volume could potentially affect customer satisfaction and loyalty. Maintaining high-quality service and consistent experience across all aspects of the Carnival experience is crucial to mitigate any negative perceptions stemming from the price reduction. Customer surveys and feedback mechanisms can help monitor satisfaction levels and identify areas needing improvement. Maintaining consistent quality alongside lower prices will be crucial for preserving loyalty among existing customers and attracting new ones.

Strategies to Attract New Customers

To leverage the higher volume and lower prices to attract new customers, Carnival can implement targeted marketing campaigns emphasizing the value proposition. These campaigns should highlight the accessibility and affordability of the experience without compromising the core attributes of the Carnival experience. Partnerships with relevant travel agencies and online platforms could also help broaden reach to a wider customer base.

Future Projections for Carnival’s Performance

Carnival’s future performance will depend heavily on its ability to manage the transition effectively. Successful implementation of the lower-price, higher-volume strategy will result in increased attendance and potentially higher revenue, but this depends heavily on managing costs and ensuring service quality. Similar price-sensitive industries, such as airlines or hotels, provide valuable case studies. Their successful implementation of price-based strategies can offer valuable insights and best practices for Carnival.

If successful, the strategies could potentially lead to a noticeable increase in overall customer base, especially in segments that previously considered Carnival unaffordable.

Potential Challenges and Risks

Carnival’s recent strategy of increasing volume while lowering prices presents a compelling opportunity but also introduces a host of potential challenges. The allure of greater market share and increased customer engagement must be carefully balanced against the risks of operational strain, quality compromises, and erosion of profit margins. Navigating these complexities will require a nuanced understanding of the market and a proactive approach to mitigating potential problems.

Operational Strain from Increased Demand

Increased volume inevitably leads to greater operational strain across various departments. Maintaining service levels, processing orders, and managing staff effectively becomes more challenging. For example, if the volume of customers increases significantly without a commensurate increase in staff or resources, wait times may escalate, leading to decreased customer satisfaction. Efficient resource allocation and process optimization are crucial to mitigating this risk.

Carnival’s recent report of higher passenger volume and lower prices is interesting, especially considering their recent move to amend their social media policy. This amendment, detailed in their new policy here , could potentially be a factor in their pricing strategy, and ultimately, contribute to the increased demand. It will be fascinating to see how this all plays out in terms of future bookings and the overall success of Carnival’s strategies for increased volume and lower prices.

Maintaining Quality and Service Standards

The challenge of maintaining high-quality service while simultaneously increasing volume is paramount. If the company prioritizes sheer volume over the quality of the service or the experience, customers may perceive a decline in standards. This can lead to a loss of customer loyalty and ultimately affect the company’s reputation. Maintaining high standards of service, even under increased pressure, will require meticulous process control and employee training.

Furthermore, rigorous quality checks throughout the process are essential.

Impact of Price Reductions on Profitability and Market Share

Price reductions, while potentially attractive to customers and driving higher volume, can significantly impact profitability. If price cuts are too aggressive, they may erode profit margins to unsustainable levels, jeopardizing the company’s long-term financial health. Careful analysis of the market and competitor pricing is essential to ensure that price reductions are competitive and still generate sufficient revenue. A strategic approach, rather than a purely reactive one, will be needed to ensure profitability is maintained even with lower prices.

Analyzing competitor strategies, market trends, and potential customer reactions is crucial.

Risks Associated with Market Competition

Increased competition in the market can further exacerbate the challenges associated with lower prices. If competitors also lower prices aggressively, the overall profitability of the industry could decline, even with higher volume for Carnival. Market share gains might be short-lived if the price reduction strategy becomes a race to the bottom. Strategic partnerships, or initiatives that differentiate the company from the competition, can help mitigate this risk.

Focusing on aspects like unique experiences or high-quality service can create a sustainable advantage in a price-sensitive market.

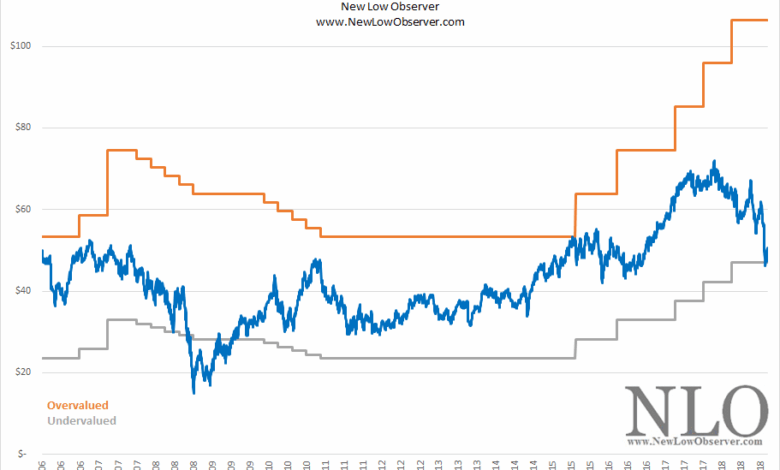

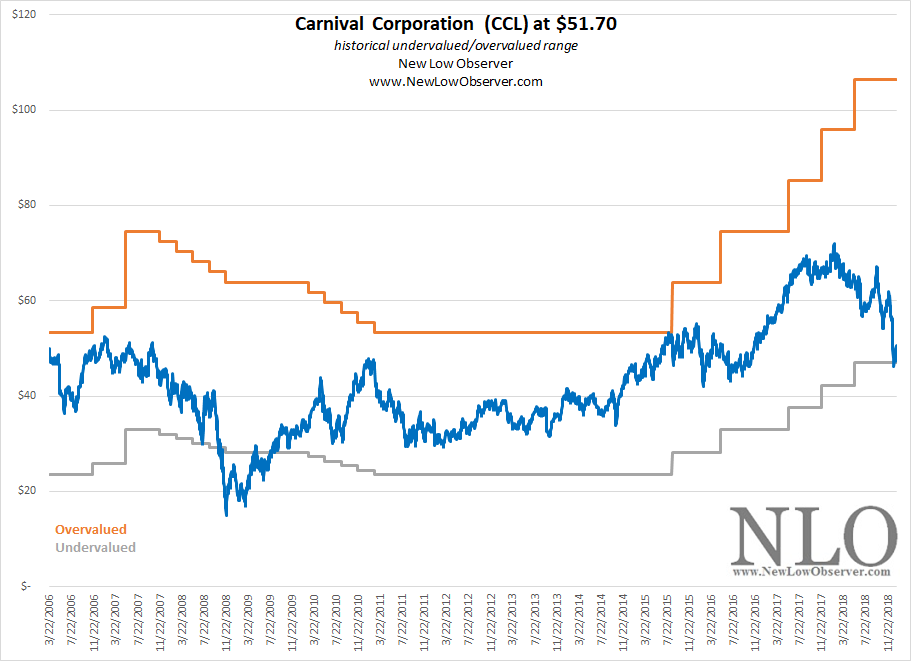

Visual Representation of Data

Carnival’s performance is best understood through a clear visualization of key trends. A well-crafted graph can effectively communicate the interplay between volume and price, providing a snapshot of the company’s recent strategies and their impact on the bottom line. Visual representations offer a quick and accessible summary, enhancing understanding for both internal stakeholders and external investors.

Volume and Price Trends Over Time

This section presents a visual representation of Carnival’s volume and price trends, using a line graph. The horizontal axis represents time, likely in months or quarters, and the vertical axis represents both volume (number of passengers or trips) and price (average ticket price). Two distinct lines are used, one for volume and one for price. Different colors can differentiate the lines for better readability.

Visual Representation Description

The line graph displays a clear upward trend in volume over time, suggesting an increase in passenger numbers or trips. Simultaneously, there’s a discernible downward trend in the average ticket price, indicating price reductions. The intersection points of the two lines represent specific time periods where the volume and price meet. The steepness of each line indicates the rate of change.

For example, a steeper upward trend in volume suggests a faster increase in passenger numbers. An example of such a trend might be observed during peak seasons, or the launch of a new promotion.

Effectiveness of Visual Representation

The line graph effectively communicates the key trends of Carnival’s volume and price adjustments. The visual representation is crucial in conveying the information in a concise and easily digestible format. The clear upward trend in volume, juxtaposed with the downward trend in price, visually illustrates the trade-off that Carnival is making in its strategy. By combining these two metrics, the graph provides a powerful narrative of the business strategy and its effects.

This visual aids in quick comprehension of the overall performance and the related implications for revenue and profitability.

Conclusive Thoughts

Carnival’s recent report, detailing higher volume and lower prices, paints a picture of a company navigating a dynamic market. The data, coupled with an examination of competitive pressures and industry trends, suggests a strategic approach to growth. While the initial impact on revenue is evident, the long-term effects on profitability remain to be seen. The report prompts a critical analysis of Carnival’s pricing strategy, customer response, and potential future projections.

Further analysis is needed to fully understand the lasting effects of this shift.

Essential FAQs: Carnival Reports Higher Volume Lower Prices

What is the primary cause of the increase in volume?

The report suggests several potential factors, including marketing campaigns, promotional offers, and competitive pressures. Seasonality also plays a role. A deeper analysis of specific marketing strategies is required to determine the exact contributing elements.

How does the company’s cost structure influence the pricing strategy?

The report examines the company’s cost structure and how it impacts the pricing adjustments. Potential cost reductions or market conditions could explain the lower prices. The report aims to provide insights into these factors.

What are the potential risks associated with this strategy?

The report acknowledges potential challenges like increased operational strain and maintaining quality standards. The impact on profit margins and market share is also discussed.

What are the key performance indicators (KPIs) used to assess Carnival’s performance?

The report utilizes key metrics such as volume, pricing, revenue, and profitability. A detailed table comparing these KPIs to competitors is included, offering a comprehensive view of Carnival’s performance relative to the market.