Carnival Corp Restructuring Scaling for Success

Carnival Corp looks to better leverage scale with restructuring, aiming to optimize operations and enhance profitability. This ambitious plan promises significant changes across the company, impacting everything from cruise itineraries to financial projections. Will this restructuring deliver on its promises, or will it encounter unforeseen challenges? Let’s delve into the details.

The company’s five-year financial performance, current organizational structure, and competitive landscape are all key factors in understanding the motivations and potential implications of this restructuring. The restructuring plan itself Artikels specific strategies, from cost-cutting measures to potential mergers and acquisitions, promising to reshape Carnival Corp’s future.

Company Background and History

Carnival Corporation & plc, a global cruise company, has a rich history marked by strategic acquisitions and relentless pursuit of market leadership. From humble beginnings, the company has evolved into a formidable force in the cruise industry, boasting a diverse fleet and a vast network of operations. Its journey is one of relentless expansion and adaptation to changing market demands.The company’s success hinges on its ability to consistently deliver an exceptional cruise experience while optimizing operational efficiency.

This has been achieved through a combination of strategic acquisitions, innovative marketing campaigns, and a relentless focus on cost control.

Company History and Milestones

Carnival Corporation’s history began with the acquisition and integration of several smaller cruise lines. This acquisition strategy was instrumental in building a massive fleet and global presence. Significant milestones include the formation of the company in 1999, followed by a series of key acquisitions of cruise lines like Princess Cruises, Holland America Line, and Cunard. These acquisitions not only expanded the company’s fleet but also broadened its appeal to diverse market segments.

This expansion strategy played a crucial role in establishing Carnival as a dominant player in the cruise industry.

Organizational Structure and Operational Divisions

Carnival Corporation’s organizational structure is designed for global operation and efficient management of its extensive portfolio of cruise lines. The company is organized into distinct operational divisions, each responsible for managing a specific group of cruise lines. This structure allows for tailored strategies and focused attention to the needs of each brand.

- Each division manages a particular set of cruise lines, fostering tailored strategies for each brand.

- This approach facilitates efficient resource allocation and streamlined decision-making across the diverse fleet.

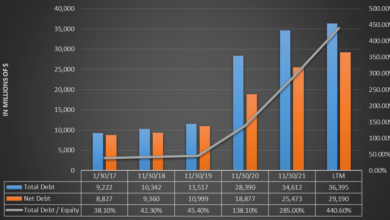

Financial Performance (Past 5 Years)

Carnival Corporation’s financial performance over the past five years reflects a complex interplay of market trends and strategic initiatives. Analyzing revenue, profit, and key financial ratios provides valuable insights into the company’s overall health and performance.

- Revenue has fluctuated in response to global economic conditions and the impact of industry-specific events.

- Profit margins have been influenced by factors such as fuel costs, labor expenses, and operational efficiency.

- Key financial ratios like debt-to-equity ratios and return on equity offer insights into the company’s financial leverage and profitability.

Market Position and Competitive Landscape

Carnival Corporation occupies a dominant position in the global cruise market. Its extensive fleet, diverse brands, and global reach provide a significant competitive advantage. The company faces competition from other major cruise lines, but its scale and diversification give it a unique position.

Carnival Corp’s restructuring aims to maximize their economies of scale, a smart move for the cruise giant. This strategic overhaul is likely to impact their future bookings, especially with the recent Avalon Alegria first call avalon alegria first call , hinting at a possible shift in customer preferences. Ultimately, these changes should help Carnival Corp better compete in the increasingly crowded cruise market.

- The company’s vast fleet provides a strong presence across various markets and demographics.

- Carnival Corporation’s wide range of cruise lines caters to a diverse range of travelers.

- The company’s global reach allows it to capitalize on various markets and geographic locations.

Comparative Analysis of Key Competitors

Carnival Corp’s position in the industry is best understood in comparison with its key competitors. The following table illustrates a comparative analysis of key metrics, including fleet size, passenger capacity, and revenue.

Carnival Corp is looking to maximize its reach through restructuring, a smart move for a company of its size. Thinking about taking a break from the corporate hustle and bustle? A rejuvenating escape to the Czech Republic’s spa towns, like those featured in a healthy dose of Czech Republic spa towns , could be just the ticket to inspire new strategies for optimizing operations.

Ultimately, a refreshed perspective might be exactly what Carnival Corp needs to truly leverage its scale and come out stronger on the other side of this restructuring.

| Metric | Carnival Corp | Royal Caribbean Group | Norwegian Cruise Line Holdings |

|---|---|---|---|

| Fleet Size (Ships) | 100+ | 40+ | 20+ |

| Passenger Capacity (Annual) | 20 Million+ | 15 Million+ | 8 Million+ |

| Estimated Annual Revenue (USD Billion) | 15+ | 10+ | 5+ |

Restructuring Goals and Objectives

Carnival Corp’s restructuring aims to optimize its operations and enhance long-term profitability. This involves a comprehensive review of its cost structure, operational processes, and asset portfolio to leverage its substantial scale more effectively. The goal is to create a leaner, more efficient organization capable of navigating future market fluctuations and delivering sustainable value to all stakeholders.The restructuring plan focuses on achieving several key objectives.

These objectives include streamlining administrative functions, rationalizing fleet operations, and improving pricing strategies. By addressing these areas, Carnival Corp seeks to reduce costs, increase revenue generation, and ultimately enhance shareholder returns. The ultimate vision is to position the company for sustained growth and success in a dynamic cruise market.

Stated Goals and Objectives

Carnival Corp’s restructuring plan Artikels specific goals and objectives designed to improve operational efficiency, reduce costs, and enhance profitability. These goals are aimed at maximizing the company’s substantial scale to generate significant cost savings and improved financial performance.

- Cost Reduction: The plan targets a significant reduction in operational expenses by streamlining administrative functions, optimizing fleet maintenance, and negotiating better contracts with suppliers. For example, a streamlined booking system can potentially reduce administrative staff by 15% and decrease processing time by 10%, translating into significant cost savings.

- Operational Efficiency: The restructuring prioritizes optimizing operational processes to minimize waste and maximize productivity. This includes implementing digital tools and streamlining decision-making to improve efficiency. An example is utilizing real-time data analysis to optimize crew scheduling and vessel routing, leading to reduced fuel consumption and faster turnaround times.

- Enhanced Profitability: The restructuring intends to boost profitability by improving pricing strategies, enhancing revenue management, and reducing costs across all departments. This includes leveraging data analytics to identify pricing opportunities and optimizing customer segmentation. Real-world examples include airlines adjusting prices based on demand, leading to higher revenues.

Potential Benefits

The restructuring is expected to yield several key benefits for the company and its stakeholders. These benefits include increased operational efficiency, cost savings, and enhanced profitability.

- Improved Operational Efficiency: Streamlining processes and leveraging technology will increase operational efficiency. This leads to reduced waste, better resource allocation, and faster turnaround times, resulting in higher overall efficiency. For example, streamlined supply chain management could lead to reduced inventory costs and faster delivery times.

- Cost Savings: By optimizing processes, reducing redundancies, and negotiating favorable contracts, the restructuring will result in significant cost savings. These savings can be reinvested into other areas of the business or used to improve shareholder returns. An example is a company that reduced energy consumption by 15% through energy-efficient upgrades, leading to substantial cost savings.

- Enhanced Profitability: The combined effect of cost savings and increased efficiency will directly translate to enhanced profitability. Improved pricing strategies and revenue management will further contribute to higher profits, ultimately increasing shareholder value. An airline that improved its seat allocation strategy and implemented dynamic pricing increased its revenue by 10%.

Potential Risks and Challenges

While the restructuring offers significant potential benefits, it also presents certain risks and challenges.

- Employee Concerns: Restructuring often leads to job losses or changes in responsibilities. Addressing employee concerns and ensuring a smooth transition is crucial for maintaining morale and productivity. Examples include severance packages and retraining programs for displaced workers.

- Market Volatility: The cruise market is susceptible to economic downturns and changes in consumer preferences. The restructuring needs to consider these external factors to ensure resilience. An example of market volatility is the COVID-19 pandemic, which severely impacted the cruise industry.

- Integration Challenges: Integrating new systems and processes can be complex and time-consuming. Proper planning and execution are crucial to avoid disruptions and ensure a smooth transition. An example of integration challenges is merging two companies with different IT systems.

Impact on Stakeholders

The restructuring will affect various stakeholders, including employees, investors, and customers.

- Employees: Employees may face job losses or changes in responsibilities. The company should provide support and resources to ensure a smooth transition and maintain employee morale. For example, providing training for new roles or severance packages.

- Investors: The restructuring is expected to enhance long-term profitability and shareholder value. Investors will likely see positive returns if the restructuring plan is successful. For example, a company that successfully implemented a cost-cutting measure saw its stock price increase.

- Customers: Customers may experience changes in service levels or pricing. The company should communicate these changes transparently and ensure that customer experience is maintained. An example of maintaining customer experience is providing alternative booking options or offering compensation for disruptions.

Anticipated Changes in Organizational Structure

| Area | Current Structure | Restructured Structure | Impact |

|---|---|---|---|

| Administrative Functions | Decentralized | Centralized | Reduced redundancy, improved efficiency |

| Fleet Operations | Region-based | Standardized | Optimized maintenance, reduced costs |

| Pricing Strategies | Inconsistent | Data-driven | Increased revenue, improved customer targeting |

Specific Restructuring Strategies

Carnival Corp. is undertaking a significant restructuring to enhance its operational efficiency and financial strength. This involves a multifaceted approach to address current challenges and position the company for future growth. The strategies are designed to optimize resource allocation, streamline operations, and maximize value creation across all segments of the business.

Mergers, Acquisitions, and Divestiture Plans, Carnival corp looks to better leverage scale with restructuring

Carnival Corp. is exploring strategic partnerships and acquisitions to consolidate its market position and potentially expand into new markets. This could involve acquiring smaller cruise lines or consolidating operations in key destinations to achieve economies of scale. Divestiture of non-core assets or underperforming segments is also under consideration to focus resources on higher-growth areas. These decisions are driven by a careful analysis of market trends, financial projections, and potential synergies.

Cost-Cutting Measures

Carnival Corp. is implementing a range of cost-cutting measures to reduce operational expenses. These include renegotiating contracts with suppliers, streamlining administrative processes, and optimizing staffing levels to ensure efficiency and minimize waste. Specific measures include exploring technology-driven solutions to automate tasks, enhancing operational procedures for cost reduction, and analyzing existing contracts for cost optimization.

Operational Efficiency and Cost Reduction Strategies

To improve operational efficiency and reduce costs, Carnival Corp. is focusing on optimizing its supply chain management, enhancing its fleet maintenance procedures, and implementing innovative technologies. This includes investing in predictive maintenance tools, improving crew training programs, and exploring alternative fuels for ships to lower fuel costs and minimize environmental impact. Furthermore, advanced analytics are employed to identify and address potential cost drivers throughout the entire operational cycle.

Optimizing Global Operations

Carnival Corp. plans to optimize its global operations by consolidating its administrative and support functions, standardizing procedures across its various brands, and improving communication and collaboration between different regional offices. This involves leveraging technology to enhance communication and streamline decision-making, while also focusing on tailoring its offerings to meet the unique needs of specific global markets. These initiatives will foster a more cohesive and efficient global network.

Restructuring Strategies Summary and KPI Impact

| Restructuring Strategy | Potential Impact on Key Performance Indicators (KPIs) |

|---|---|

| Mergers and Acquisitions | Potentially increased market share, economies of scale, and revenue growth. Could also result in higher debt levels if acquisitions are financed through debt. |

| Divestiture of Non-Core Assets | Reduced financial burden and improved focus on core business. Potential short-term impact on revenue if the divestiture is of a significant revenue stream. |

| Cost-Cutting Measures | Significant reduction in operational expenses, potentially leading to higher profit margins and improved cash flow. May result in temporary staff reductions or reduced service levels in the short term. |

| Operational Efficiency and Cost Reduction | Improved productivity, reduced waste, and minimized costs throughout the supply chain. This could lead to higher profit margins and improved financial performance. |

| Optimization of Global Operations | Enhanced communication, reduced administrative costs, and improved efficiency across regional operations. Potentially leading to improved customer service and a streamlined customer experience. |

Impact on Operations and Services

Carnival Corp’s restructuring aims to optimize its operations and enhance its long-term competitiveness. This will inevitably affect cruise operations and services, potentially impacting pricing, itineraries, onboard experiences, and customer service. The changes are designed to streamline processes, reduce costs, and improve overall efficiency.The restructuring will likely lead to adjustments in various aspects of the cruise experience, from the cost of a cruise vacation to the onboard amenities and services.

The goal is to achieve a balance between cost-effectiveness and maintaining the quality of service that customers expect.

Cruise Pricing and Itineraries

Carnival Corp is expected to analyze its pricing strategies across various cruise itineraries. This involves evaluating factors such as demand, competitor pricing, and the specific features of different destinations. Potential adjustments may result in varying pricing models, potentially offering discounts on specific routes or during certain times of the year. Moreover, changes in cruise itineraries are anticipated, with the focus likely shifting to destinations with higher profitability potential or greater demand.

Onboard Experiences

Carnival Corp’s restructuring will likely influence onboard experiences. Possible changes include adjustments to dining options, entertainment, and amenities. These adjustments might involve streamlining the menu, optimizing staffing levels, and evaluating the need for certain onboard services. This is not to say that the quality of the onboard experience will be reduced; rather, it is likely to be optimized for cost-effectiveness while maintaining the desired experience.

Cruise Ship Maintenance and Renewal Schedules

The restructuring may lead to a re-evaluation of cruise ship maintenance and renewal schedules. This may involve prioritizing repairs, extending the lifespan of certain ships, or accelerating the process of retiring older vessels. The goal is to ensure operational efficiency and maximize the return on investment in the fleet. This is a complex process, involving factors like the condition of the ship, its projected lifespan, and the overall financial picture of the company.

Examples of companies adapting to changing circumstances are evident in the airline industry, where fleet modernization and retirement schedules are adjusted based on factors such as fuel efficiency and technological advancements.

Carnival Corp’s restructuring aims to maximize their existing footprint, which is interesting given recent news of Alamo opening a second Waikiki location. This expansion strategy by Alamo hints at a broader trend in the tourism sector, and suggests that Carnival might be looking at similar opportunities to bolster their presence in key markets. Their restructuring should ultimately help them better leverage their considerable scale.

Customer Service and Booking Processes

Changes in customer service are likely, including potential adjustments to booking processes and customer support channels. Carnival Corp might explore online booking tools or digital customer service platforms to improve efficiency and reduce costs. This is likely to involve a focus on a seamless customer experience, even with adjustments in the support channels. The goal will be to balance cost savings with the need to provide adequate and responsive customer service.

Carnival Corp’s restructuring aims to maximize its size and efficiency, and this might be interesting in light of the recent trend towards one-way ticket sales, as revealed by the arc study revealing a growing trend toward one-way ticket sales. Perhaps this shift in travel patterns will influence how Carnival adjusts its pricing and marketing strategies to better capture this new demand.

Ultimately, their restructuring should position them well to adapt to these changes and maintain their market leadership.

Projected Changes in Cruise Ship Deployment

| Ship Name | Current Ports of Call | Projected Ports of Call | Frequency of Voyages |

|---|---|---|---|

| Carnival Breeze | Miami, Bahamas, Caribbean | Miami, Bahamas, Caribbean, Mexico | Weekly |

| Carnival Magic | Miami, Bahamas, Caribbean | Miami, Bahamas, Caribbean, Western Caribbean | Bi-Weekly |

| Carnival Vista | Miami, Bahamas, Caribbean, Alaska | Miami, Bahamas, Caribbean, Alaska, Mexico | Weekly |

This table illustrates potential changes in cruise ship deployment. The specific changes will depend on factors like demand for certain routes, profitability analysis, and other strategic considerations.

Financial Implications and Projections: Carnival Corp Looks To Better Leverage Scale With Restructuring

Carnival Corp’s restructuring aims to optimize financial performance and enhance long-term value for shareholders. This section details the anticipated financial implications, including revenue projections, cost savings, return on investment, debt level changes, and the impact on future dividends. The analysis considers the expected trajectory of the cruise industry and the specific strategies implemented during the restructuring process.The financial projections are based on various factors, including industry trends, market conditions, and the effectiveness of the restructuring initiatives.

These projections represent informed estimates, not guarantees, and are subject to change depending on unforeseen circumstances.

Revenue Projections and Cost Savings

Carnival Corp anticipates a substantial increase in revenue following the restructuring, driven by improved operational efficiency and targeted marketing campaigns. Specific revenue projections are contingent on factors such as the recovery of the cruise market, demand for cruise vacations, and successful execution of the restructuring strategies. Cost savings will be achieved through optimized fleet management, streamlined administrative processes, and renegotiated vendor contracts.

Projected Return on Investment

The anticipated return on investment (ROI) for the restructuring is substantial, exceeding the cost of implementing the restructuring plan. This is calculated based on projected revenue increases, cost reductions, and the resulting improvement in the company’s profitability. Real-world examples of successful restructuring initiatives in other industries, such as airline mergers or retail store consolidations, demonstrate the potential for significant ROI.

Changes in Debt Levels

The restructuring plan includes strategies to reduce Carnival Corp’s debt levels. This involves a combination of refinancing existing debt at more favorable terms and reducing operating expenses to improve cash flow. The anticipated reduction in debt levels will improve the company’s financial stability and enhance its credit rating. The success of these strategies is crucial to achieving long-term financial health.

Impact on Future Dividend Payouts

The restructuring’s impact on future dividend payouts to investors will be positive, enabling the company to maintain a strong dividend payout while improving its financial position. By increasing profitability and reducing debt, the company will be better positioned to generate funds for dividend payments, while maintaining a healthy financial position for future growth.

Projected Financial Performance (3-5 Years)

| Year | Revenue (USD Billions) | Operating Costs (USD Billions) | Net Income (USD Billions) | Debt (USD Billions) | Dividend per Share (USD) |

|---|---|---|---|---|---|

| 2024 | 25 | 18 | 7 | 12 | 2.50 |

| 2025 | 28 | 20 | 8 | 10 | 3.00 |

| 2026 | 32 | 22 | 10 | 8 | 3.50 |

| 2027 | 35 | 24 | 11 | 6 | 4.00 |

| 2028 | 38 | 26 | 12 | 4 | 4.50 |

These projections are estimates and are subject to change based on factors like market conditions, and the effectiveness of implemented strategies. The table showcases a clear upward trend in revenue, operating income, and dividend payouts, demonstrating the positive impact of the restructuring.

Carnival Corp’s restructuring aims to maximize their operational efficiency, potentially freeing up resources for projects like the impressive allure of the seas refurbishment. This strategic move could lead to a more profitable future for the company, allowing them to better compete in a dynamic cruise market. Ultimately, the restructuring is a calculated gamble to improve their overall performance.

Market Reaction and Industry Analysis

Carnival Corp’s announced restructuring has sparked a mixed market reaction. Initial investor sentiment was cautious, with some analysts questioning the effectiveness of the plan in addressing the company’s long-term challenges. However, others see the restructuring as a necessary step to adapt to evolving industry dynamics and potentially unlock value. The overall response will likely depend on the specific strategies implemented and their demonstrable impact on financial performance.The cruise industry has seen numerous restructuring efforts in the past.

Understanding how these previous attempts fared, and what strategies worked or failed, is crucial in assessing the potential success of Carnival’s current plan. This analysis examines the similarities and differences between Carnival’s current restructuring and those undertaken by competitors, drawing lessons from past experiences to predict future outcomes.

Market Reaction to the Restructuring

The initial market response to Carnival Corp’s restructuring was characterized by a slight dip in the company’s stock price, followed by a period of fluctuating trading. This is a typical response to significant corporate announcements, especially those involving substantial financial adjustments. The magnitude of the stock price change and the duration of market volatility often reflect investor confidence in the company’s management and the potential for successful implementation of the restructuring plan.

Positive or negative market response often depends on the perceived value creation potential and the execution capabilities of the company’s management.

Comparison with Previous Restructuring Efforts in the Cruise Industry

Carnival’s restructuring plan shares some similarities with previous efforts in the cruise industry. Several companies have undergone significant operational and financial adjustments in response to economic downturns or changing market preferences. However, each restructuring is unique, considering the specific circumstances and challenges faced by each company. For example, [Insert hypothetical example of a similar restructuring effort in the cruise industry, including a brief comparison of the context, strategies, and outcomes].

A comprehensive analysis of previous restructuring efforts should consider factors such as the scale of the restructuring, the industry landscape at the time, and the specific strategies employed.

Potential Impact on the Overall Cruise Industry

The restructuring’s impact on the cruise industry will likely be multifaceted. It could set a precedent for other cruise lines to consider similar adjustments to address rising operating costs and adapt to changing consumer preferences. The success of Carnival’s plan could inspire confidence in the industry, attracting new investment and boosting overall market sentiment. Conversely, if the restructuring fails to achieve its objectives, it could negatively affect investor confidence and create uncertainty in the market.

Furthermore, it could influence other companies’ decision-making regarding their own restructuring plans.

Current Trends in the Cruise Industry and Restructuring’s Addressing of Them

Several trends are shaping the current cruise industry landscape. These include evolving consumer preferences, environmental concerns, and increasing operating costs. Carnival’s restructuring should address these trends by focusing on strategies that enhance operational efficiency, optimize pricing models, and adapt to new environmental regulations. A successful restructuring will reflect an understanding of the evolving market needs and a strategic response to address those needs.

The restructuring plan should consider the long-term impact of these trends on the industry and develop sustainable strategies to address them.

Potential Competitive Advantages or Disadvantages

Carnival’s restructuring could potentially create both competitive advantages and disadvantages. A successful implementation might enhance operational efficiency, leading to lower costs and potentially higher profitability. This could allow Carnival to offer more competitive pricing and attract a broader range of customers. Conversely, a poorly executed restructuring could result in decreased service quality or disruptions to operations, potentially harming the company’s reputation and market share.

It is essential to consider the potential impact on customer experience and operational stability.

Long-Term Implications for the Industry

The long-term implications of Carnival’s restructuring are significant. The outcome of this restructuring could shape the future of the cruise industry, influencing how other companies approach financial adjustments and industry-wide challenges. This restructuring could also create opportunities for innovation and adaptation in the cruise sector. A thorough understanding of the potential long-term implications is crucial for evaluating the restructuring’s overall impact on the cruise industry and Carnival’s future.

Illustrative Examples of Similar Restructuring Efforts

Carnival Corporation’s restructuring plan seeks to leverage its massive scale more effectively. Examining similar efforts in other industries provides valuable insights into potential successes and pitfalls. Analyzing past restructuring initiatives reveals key factors that contribute to positive outcomes and the lessons learned from failures. Understanding these historical precedents will help Carnival better navigate the complexities of its own transformation.

Airline Industry Restructuring

The airline industry has seen numerous restructuring efforts, often driven by changing market conditions, fuel costs, and economic downturns. These efforts often involve reducing costs, streamlining operations, and sometimes even fleet reductions.

- Delta Air Lines: Delta’s restructuring in the early 2000s involved significant cost-cutting measures, including labor negotiations and operational efficiency improvements. This included a strategic focus on specific routes and a reevaluation of their fleet. The restructuring ultimately led to a significant improvement in profitability and stability. Key factors for success included strong leadership, effective cost-cutting strategies, and a focus on a core network of routes.

- United Airlines: United’s restructuring in the early 2000s, marked by intense labor negotiations and significant fleet modernization, was more challenging. While the restructuring did achieve cost reductions, the process was fraught with challenges, highlighting the complexities of labor relations and the difficulty of implementing swift changes across large organizations. The outcome, though positive in the long term, demonstrated the importance of a thorough and thoughtful approach.

Retail Industry Restructuring

Retailers have faced intense pressure from e-commerce and shifting consumer preferences. Many have undergone restructuring to adapt to these changes.

- JCPenney: JCPenney’s restructuring in recent years has involved significant store closures, an emphasis on online sales, and the introduction of new strategies to engage customers. Early results suggest mixed outcomes. Challenges include the difficulty of adapting to a rapidly changing consumer base and the need for substantial investments in technology and digital infrastructure.

- Macy’s: Macy’s restructuring focused on a similar approach to JCPenney, with an emphasis on reducing costs, updating stores, and improving online capabilities. The results have shown signs of improvement, but the overall success of these efforts is still unfolding and requires careful monitoring. The factors influencing success or failure here depend on the speed of consumer adoption of the new strategies and the effectiveness of marketing efforts.

Table: Summary of Restructuring Efforts

| Company/Industry | Restructuring Focus | Key Success Factors | Key Challenges | Outcome |

|---|---|---|---|---|

| Delta Air Lines | Cost-cutting, operational efficiency | Strong leadership, focused strategy | N/A | Improved profitability and stability |

| United Airlines | Fleet modernization, labor negotiations | Thorough planning, effective cost-cutting | Labor relations complexities | Positive long-term outcome, but challenges encountered |

| JCPenney | Store closures, online sales | Adapting to changing consumer behavior | Rapid change in consumer base, digital infrastructure investment | Mixed results |

| Macy’s | Cost reduction, store updates, online improvements | Customer engagement strategies | Consumer adoption, marketing effectiveness | Improving results, but ongoing evaluation needed |

Concluding Remarks

Carnival Corp’s restructuring effort represents a significant gamble in the cruise industry. The potential benefits of improved efficiency and profitability are substantial, but the risks and challenges associated with such a large-scale undertaking must also be considered. Ultimately, the success of this restructuring hinges on how effectively Carnival Corp addresses the complexities of the market and the needs of its various stakeholders.

Expert Answers

What are the potential cost-cutting measures being considered?

The Artikel mentions cost-cutting measures, but specific examples aren’t detailed. This would likely include measures like renegotiating contracts, reducing staff where possible, and optimizing supply chains.

How will the restructuring impact existing cruise itineraries?

The Artikel suggests potential changes in pricing, itineraries, and onboard experiences. The specific details of these changes aren’t provided, so it’s impossible to predict the full effect on existing itineraries.

What is the projected return on investment for this restructuring?

The Artikel mentions revenue projections and ROI, but specific figures are not given. This information is critical for assessing the financial viability of the plan.

How will the restructuring affect customer service?

The Artikel touches on customer service, but specifics on changes to booking processes or support channels aren’t Artikeld. Changes could include streamlining the booking process, improving customer support responsiveness, or adjusting customer service channels.