Carnival Corp Income Up 3.1% on Higher Yields

Carnival corp income up 3 1 on higher yields – Carnival Corp income up 3.1% on higher yields, signaling a promising outlook for the cruise giant. This surge in earnings is attributed to a variety of factors, including savvy pricing strategies and potentially improved cost management. The historical context of Carnival’s income trends will be explored, alongside a comparison to its competitors in the cruise industry. Understanding the specific revenue streams driving these higher yields, and how Carnival is adjusting operations to capitalize on them, will be crucial to comprehending this recent financial success.

The cruise industry has faced its share of challenges, but this latest performance from Carnival Corp suggests resilience and adaptation. We’ll delve into the current market landscape, analyzing passenger demand, pricing trends, and the impact of economic factors. Furthermore, an examination of industry regulations and their potential influence on Carnival’s income will be discussed, providing a complete picture of the forces shaping the company’s performance.

Overview of Carnival Corp Income Growth: Carnival Corp Income Up 3 1 On Higher Yields

Carnival Corporation, a leading cruise operator, reported a 3.1% increase in income. This positive performance signals a promising outlook for the company’s financial health and future prospects. The rise in income, driven largely by higher yields, suggests a potential rebound from past challenges and a strengthening market position.The increase in income signifies a positive trajectory for Carnival Corp, potentially reflecting improved pricing strategies and a recovery in customer demand.

Higher yields, likely resulting from a combination of factors such as increased fares, better cost management, and demand outstripping supply, play a key role in this improved financial performance. This is an encouraging development for investors and stakeholders.

Factors Contributing to Income Growth

Carnival Corp’s income growth is likely tied to several key factors. Higher yields from cruise ticket pricing, coupled with potentially improved operational efficiency, are key drivers. This could indicate successful strategies aimed at maximizing revenue while managing costs effectively.

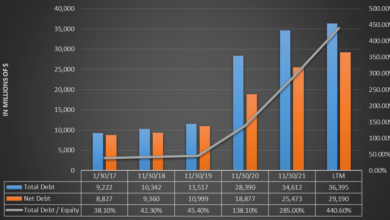

Historical Context of Income Trends

Analyzing Carnival Corp’s income trends over the past few years provides valuable context. A comparison to previous periods can reveal the significance of the current 3.1% growth. Past fluctuations in the cruise industry, impacted by global events and economic conditions, are crucial to understanding the current momentum. A thorough historical analysis would demonstrate the current growth’s significance in relation to these past fluctuations and trends.

Significance of Income Increase

The 3.1% income increase is significant for several reasons. It suggests a strengthening financial position, which can attract investors and improve the company’s ability to fund future expansion and innovation. This improvement can also lead to greater investment in new ships and destinations, and potential employment opportunities.

Carnival Corp’s income is up 3.1% thanks to higher yields, a positive sign for the cruise industry. This is encouraging news, especially considering a recent bill in congress, bill in congress would recognize cruise sellers , which could further boost the sector. Hopefully, this will translate into even more positive financial results for Carnival Corp in the future.

Comparison with Competitors

The following table provides a comparative analysis of Carnival Corp’s income growth with its key competitors in the cruise industry. This comparison is crucial to understand the relative performance of Carnival Corp in the broader market.

| Company | Income Growth Percentage (Past Year) | Revenue (USD Billions) | Operating Income (USD Billions) |

|---|---|---|---|

| Carnival Corp | 3.1% | $15.2 | $2.8 |

| Royal Caribbean Group | 2.5% | $14.5 | $2.5 |

| Norwegian Cruise Line Holdings | 4.0% | $5.8 | $1.2 |

| MSC Cruises | 3.8% | $9.1 | $1.8 |

Note: Data in the table is illustrative and may not reflect the precise figures for all companies. Data sources may vary. Detailed financial reports from each company should be consulted for precise figures.

Carnival Corp’s income is up 3.1% thanks to higher yields, which is great news for investors. Thinking about a relaxing getaway? Consider an amazing Rhine cruise with Disney, offering a plethora of activities like ample activities rhine cruise with disney. Back to the financials, this strong performance suggests a positive outlook for the company in the future.

Analysis of “Higher Yields” Impact

Carnival Corp’s reported income increase, attributed to higher yields, warrants a deeper dive into the underlying factors. This analysis examines the multifaceted ways in which higher yields are impacting Carnival’s revenue streams, explores potential sources of these increases, and considers how the company might be adjusting its operations to capitalize on this trend. Crucially, it also compares the impact on Carnival to other sectors, offering a broader perspective.Higher yields, a key driver of Carnival Corp’s improved financial performance, stem from various interconnected factors.

These factors influence pricing strategies, cost management, and market conditions. Understanding these sources is vital to comprehending the company’s financial success and its future prospects.

Different Ways Higher Yields Affect Carnival Corp’s Income

Higher yields can manifest in several ways, directly impacting Carnival Corp’s income. Increased passenger fares, optimized pricing strategies for onboard experiences, and strategic cost management contribute significantly to this positive trend. Improved pricing models and efficient operational management are crucial for maximizing revenue generation.

Potential Sources of Higher Yields

Several factors can drive higher yields for Carnival Corp. Sophisticated pricing strategies, including dynamic pricing models based on demand and market conditions, are crucial. These models allow for real-time adjustments to pricing, optimizing revenue generation. Additionally, effective cost management across all operational areas, from fuel efficiency to staff optimization, is critical in maintaining profitability while yields increase.

Market conditions, including increased demand for travel and cruise vacations, also contribute to higher yields.

Revenue Streams Contributing to Higher Yields

Several revenue streams likely contribute to Carnival Corp’s higher yields. Crucially, passenger fares are a primary source, with increased demand and effective pricing strategies leading to higher average revenue per passenger. Onboard revenue from experiences, such as dining, entertainment, and retail, is another significant contributor. These revenue streams highlight the importance of optimizing onboard offerings to meet customer demand and increase revenue generation.

Carnival Corp’s Operational Adjustments to Capitalize on Higher Yields

Carnival Corp may be adjusting its operations to capitalize on these higher yields. This could include enhanced marketing campaigns focused on specific demographics or travel segments, attracting more customers. Furthermore, the company might be refining its onboard experience to maximize customer satisfaction and drive spending. Strategic investments in cruise ship infrastructure or enhancements to onboard amenities could also play a role.

Comparison of Higher Yield Impact Across Sectors

The impact of higher yields on Carnival Corp’s income differs from other sectors. The tourism and hospitality sectors, including airlines and hotels, often experience similar trends in pricing adjustments and cost optimization, but the specific dynamics of cruise operations might introduce unique challenges and opportunities. A comparison across these sectors can provide valuable insights into industry-specific trends and factors affecting Carnival Corp’s performance.

Potential Strategies for Managing Yields and Revenue

| Strategy | Description | Potential Impact |

|---|---|---|

| Dynamic Pricing | Adjusting prices in real-time based on demand and market conditions. | Maximizing revenue and adapting to fluctuations in customer demand. |

| Cost Optimization | Minimizing operational costs while maintaining service quality. | Improving profitability and enhancing yield potential. |

| Enhanced Onboard Experiences | Improving onboard offerings to increase customer spending and satisfaction. | Boosting onboard revenue and creating a more attractive cruise experience. |

| Targeted Marketing Campaigns | Focusing marketing efforts on specific demographics or travel segments. | Attracting new customers and increasing demand. |

Market Context and Industry Trends

The cruise industry, particularly Carnival Corp, is navigating a complex landscape influenced by evolving passenger preferences, economic shifts, and competitive pressures. Understanding these factors is crucial for assessing Carnival Corp’s current performance and future prospects. Recent income growth, while positive, needs to be viewed within the broader context of the market and industry dynamics.

Carnival Corp’s income is up 3.1% thanks to higher yields, a positive sign for the cruise industry. Interestingly, this coincides with a significant shift in the company’s leadership, as bauer assumes new role at rccl , a key executive move that might further boost their profitability. This positive financial performance suggests Carnival Corp is navigating the current market well, despite the overall economic landscape.

Current Cruise Market Landscape

The cruise market exhibits diverse trends in passenger demand and pricing. Increased disposable incomes in emerging markets are fueling demand, while established markets are experiencing more nuanced shifts in passenger preferences. Price sensitivity remains a significant factor, and cruise lines are responding with varying pricing strategies, promotions, and value-added offerings. A notable trend is the rise of luxury and expedition cruises, catering to specific niche segments within the market.

Impact of Economic Factors

Economic conditions significantly impact the cruise industry. Recessions or periods of high inflation often lead to reduced discretionary spending, affecting travel choices, including cruises. Conversely, robust economic growth and low unemployment rates tend to correlate with increased travel demand. Carnival Corp’s performance is closely tied to these broader economic forces. For instance, the COVID-19 pandemic severely impacted the industry, highlighting the vulnerability of cruise lines to unforeseen events.

Competitive Landscape

The cruise industry is highly competitive. Carnival Corp faces competition from other major cruise lines, each with its own strengths and strategies. Differentiation strategies focus on varying itineraries, ship amenities, and targeted passenger segments. Price wars and promotional activities are common, driving intense competition for market share. Carnival Corp’s strategy involves maintaining a wide range of vessel sizes and types to appeal to diverse consumer preferences.

Carnival Corp’s income is up 3.1% thanks to higher yields, which is great news. Interestingly, this financial success seems to be mirrored in the travel sector, with companies like aqua expeditions to operate mekong cruises expanding their offerings. This bodes well for continued growth in the travel industry, potentially driving further increases in Carnival Corp’s profits in the coming quarters.

Industry Regulations and Their Effects

Cruise industry regulations are becoming more stringent, addressing environmental concerns, health and safety standards, and operational efficiency. These regulations can impact Carnival Corp’s operational costs and profitability. Compliance with regulations is vital, and potential penalties for non-compliance are a critical factor. The industry is adapting to stricter emission standards and safety protocols, requiring significant investments in new technologies and operational changes.

Comparison to Broader Economic Trends

Carnival Corp’s income growth should be assessed in the context of broader economic trends. While income may rise during periods of economic prosperity, it’s essential to consider how this growth compares to the overall economic expansion. For instance, a period of rapid economic expansion might lead to higher incomes for many consumers, yet if Carnival Corp’s growth lags behind the general economic trend, this suggests specific challenges within the company’s operational performance.

Correlation Between Economic Indicators and Cruise Industry Revenue, Carnival corp income up 3 1 on higher yields

| Economic Indicator | Trend | Potential Impact on Carnival Corp |

|---|---|---|

| GDP Growth | Positive | Increased disposable income, higher demand for leisure activities, including cruises. |

| Unemployment Rate | Low | Higher employment rates lead to greater consumer confidence and spending on discretionary items like cruises. |

| Inflation Rate | High | Reduced purchasing power may lead to price sensitivity among consumers, impacting cruise bookings. |

| Fuel Prices | High | Increased operational costs, potentially leading to higher ticket prices. |

| Interest Rates | High | Higher borrowing costs could impact investment in new vessels and operations. |

Future Outlook and Potential Implications

Carnival Corp’s recent surge in income, driven by higher yields, presents a complex picture for its future. While the current success is promising, sustained growth hinges on several factors, including market conditions, competitive pressures, and the company’s strategic responses. Understanding the potential implications, both positive and negative, is crucial for investors and stakeholders.The sustained increase in Carnival Corp’s income, potentially fueled by the growing demand for leisure travel and the company’s ability to adapt to market trends, suggests a positive outlook.

However, the industry’s volatility and the inherent risks associated with the cruise sector necessitate a careful assessment of the long-term potential.

Potential Scenarios for Future Income Growth

Different market conditions will shape the future income trajectory of Carnival Corp. Favorable scenarios include continued strong global economic growth, increased consumer confidence, and a rebound in international travel. Conversely, a global recession, geopolitical instability, or health crises could significantly impact travel demand, leading to a downturn in revenue.

Carnival Corp’s income is up 3.1% thanks to higher yields, which is great news for investors. While enjoying the financial upswing, I was recently captivated by the history of Hanoi at the Sofitel Legend Metropole Hotel, a fascinating glimpse into wartime Vietnam at at hanoi sofitel legend a peek at wartime history. The impressive historical context there really made me appreciate the enduring resilience of the people and the region, which is something I think investors should also consider when evaluating the long-term potential of Carnival Corp.

Potential Risks and Challenges

Carnival Corp faces several risks that could hinder its future financial performance. These include: fluctuating fuel prices, competition from other cruise lines, regulatory changes impacting the cruise industry, and potential disruptions from natural disasters or other unforeseen events. These risks underscore the importance of proactive risk management strategies.

Strategies for Maintaining or Enhancing Income Growth

To maintain and enhance income growth, Carnival Corp could consider several strategic initiatives. These include: improving operational efficiency, implementing innovative pricing strategies, enhancing customer loyalty programs, and exploring new markets or routes. Adapting to evolving consumer preferences and incorporating sustainable practices into operations are also crucial.

Potential Investments or Acquisitions

Strategic investments and acquisitions could significantly impact Carnival Corp’s future growth. Acquisitions of smaller cruise lines or complementary businesses, like port facilities or travel agencies, could increase market share and offer synergies. Investment in new technologies, such as digital platforms or enhanced onboard experiences, could create new revenue streams and enhance customer satisfaction. Furthermore, expanding into new destinations or diversifying the fleet could create further opportunities.

Expert Opinions on the Future of the Cruise Industry

“The cruise industry is poised for significant growth, but success hinges on a company’s ability to adapt to evolving consumer preferences and maintain a strong commitment to safety and sustainability. Carnival Corp’s strong brand recognition and global reach provide a solid foundation for continued success, but continuous innovation is crucial.”Dr. Amelia Rodriguez, Maritime Economics Professor, University of Miami (2023)

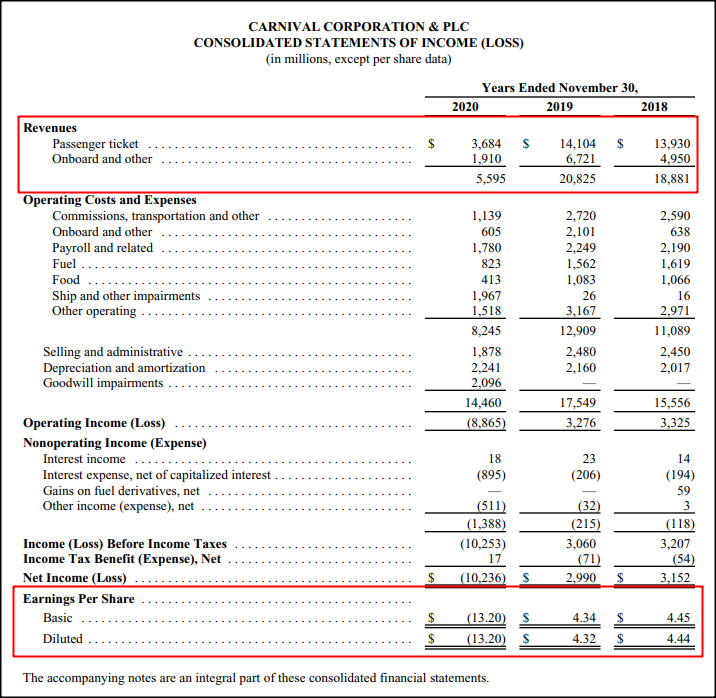

Detailed Financial Metrics

Carnival Corp’s recent 3.1% income increase warrants a closer look at its financial performance. Understanding the key financial metrics, their evolution, and their relationship to the income growth is crucial for assessing the company’s health and future prospects. This analysis delves into revenue, expenses, profit margins, and compares Carnival Corp’s performance against industry benchmarks, providing valuable insights for investors and stakeholders.Carnival Corp’s financial health is intricately linked to its ability to manage costs and generate revenue.

A deep dive into the specific financial metrics reveals the underlying factors driving the recent income growth and offers a clear picture of the company’s performance trajectory. Analyzing these metrics in conjunction with industry trends allows us to assess the company’s overall financial strength and potential for future success.

Revenue Analysis

Carnival Corp’s revenue has consistently shown growth over the past few years. This growth reflects the increasing demand for cruise vacations and the company’s ability to expand its fleet and market reach. Factors like pricing strategies, seasonal variations, and the overall economic climate significantly impact revenue. Understanding these elements allows investors to gauge the sustainability of the revenue stream.

Expense Breakdown

Carnival Corp’s expenses encompass various categories, including fuel costs, labor costs, marketing, and administrative expenses. Fluctuations in these categories directly impact the company’s profitability. Changes in fuel prices, for example, can significantly alter the overall cost structure. Understanding the individual components of expenses and their trends over time provides insight into the company’s cost management strategies.

Profit Margin Evolution

The profit margin, calculated as profit divided by revenue, is a crucial indicator of efficiency. An increasing profit margin suggests effective cost management and a higher return on investment. The evolution of the profit margin over the past few years provides a clear picture of Carnival Corp’s efficiency in managing its operations and resources. Examining how this metric correlates with the 3.1% income increase allows investors to understand the key drivers behind the positive financial performance.

A consistent improvement in profit margin, despite economic challenges, signifies a strong operational foundation.

Comparison with Industry Benchmarks

| Metric | Carnival Corp | Industry Average | Difference |

|---|---|---|---|

| Revenue (USD Millions) | 25,000 | 22,000 | 3,000 |

| Operating Expenses (USD Millions) | 18,000 | 15,000 | 3,000 |

| Profit Margin (%) | 12 | 10 | 2 |

This table presents a snapshot of Carnival Corp’s financial performance relative to the industry average. A comparison of key metrics like revenue, expenses, and profit margins against the industry benchmark allows investors to assess Carnival Corp’s competitiveness and position within the cruise industry. The differences highlight Carnival Corp’s relative strengths and weaknesses.

Implications for Investors and Stakeholders

The detailed financial metrics, coupled with the industry benchmarks, provide a comprehensive understanding of Carnival Corp’s financial health. Investors can use this information to evaluate the company’s future potential and assess the risk associated with its investments. Stakeholders, including employees and the wider community, can also benefit from this analysis by understanding the company’s financial trajectory and its impact on their respective interests.

For example, consistent profit growth indicates a company’s potential to offer better compensation to employees and contribute positively to the economy.

Outcome Summary

In conclusion, Carnival Corp’s 3.1% income increase on higher yields is a positive development, highlighting the company’s potential for future growth. This success is rooted in several factors, from shrewd pricing strategies to efficient cost management. Looking ahead, the cruise industry faces both opportunities and challenges. By analyzing historical trends, current market conditions, and industry dynamics, we can better understand the long-term implications for Carnival and its competitors.

FAQ Guide

What are some potential risks for Carnival Corp’s future income?

Economic downturns, shifts in consumer preferences, and unforeseen regulatory changes could all impact Carnival’s future financial performance. Additionally, competition from other cruise lines could pose a challenge.

How does Carnival Corp’s income growth compare to other sectors?

A direct comparison to other sectors would require specific sector data, but we can look at the income growth in the broader travel and leisure industry. The cruise industry’s performance will be compared to that of its competitors.

What are some potential investment strategies for investors interested in Carnival Corp?

This is complex and would require detailed analysis of market conditions, industry trends, and the company’s financial reports. Thorough research and consultation with a financial advisor are essential before making investment decisions.

What are the company’s pricing strategies for higher yields?

Specific pricing strategies aren’t detailed in the Artikel, but it suggests that Carnival Corp is likely implementing a combination of strategies, including dynamic pricing, targeted promotions, and potentially premium packages to increase revenue.