Carnival Corp Cuts Earnings Estimates A Deep Dive

Carnival Corp cuts earnings estimates, sending ripples through the cruise industry. This significant downturn raises questions about the future of the company and its impact on the broader market. Investors are understandably concerned, and the reasons behind the reduced projections are sure to be scrutinized.

The company’s recent financial performance, combined with broader industry trends, is forcing a reassessment of its projected earnings. This analysis delves into the potential causes, impacts, and future implications of this crucial development.

Background on Carnival Corp

Carnival Corporation & plc is the world’s largest cruise operator, boasting a diverse fleet of vessels and a global network of destinations. Founded in 1995 through a merger of several cruise lines, the company has experienced significant growth and evolution over the past decades. Understanding its history, current market position, and financial performance is crucial to appreciating its impact on the travel and leisure industry.Carnival Corp’s journey has been marked by strategic acquisitions and expansion into new markets.

These acquisitions, while increasing the company’s scale and market share, have also presented operational challenges that the company has had to address in the past.

Historical Milestones

Carnival Corporation’s history is defined by strategic acquisitions and continuous growth. Its foundation involved the consolidation of various cruise lines, marking a crucial turning point in the industry. This consolidation significantly increased the company’s scale and global reach, establishing a formidable position in the cruise market. Key milestones include the 1995 merger that laid the foundation for the modern Carnival Corporation and subsequent acquisitions that expanded its fleet and geographical footprint.

These acquisitions, while beneficial for increasing market share, have also brought operational complexities that the company has actively managed over time.

Current Market Position and Competitive Landscape

Carnival Corp dominates the global cruise market, with a substantial share of the passenger volume and vessel count. Its competitive landscape includes other major cruise companies, each with unique strengths and strategies. Factors like brand loyalty, pricing strategies, and vessel features play crucial roles in maintaining or gaining market share.

Financial Performance

Carnival Corp’s financial performance has been influenced by various factors, including economic conditions, fuel costs, and operational efficiencies. Recent years have shown fluctuations, impacting profitability and investor confidence. Understanding these trends provides insight into the company’s resilience and adaptability in the face of economic changes.

Business Model and Revenue Streams

Carnival Corp operates on a franchise model, licensing its brand name and operational expertise to multiple cruise lines. This model allows for diversification and expansion into different market segments. Key revenue streams include ticket sales, onboard spending, and ancillary services. The cruise lines within Carnival Corp offer varying amenities and price points, catering to diverse customer segments.

Earnings Estimate Cuts

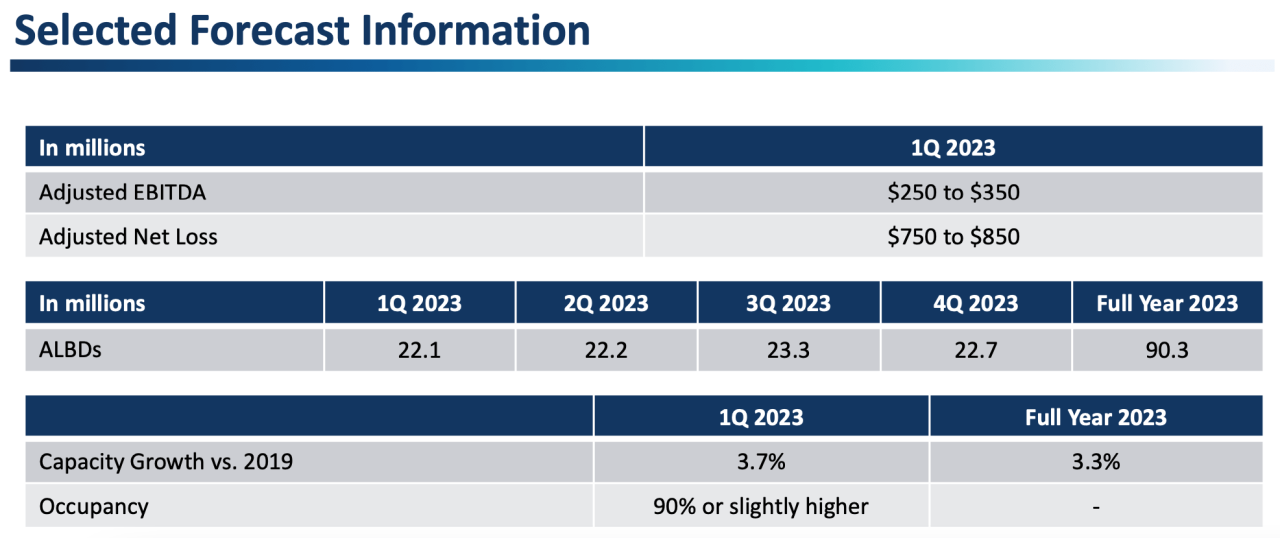

Carnival Corp’s recent earnings estimate cuts have sent ripples through the travel and cruise industry. These downward revisions signal a potential shift in the company’s financial trajectory, raising questions about the future of the cruise sector. Investors are now scrutinizing the underlying factors and potential consequences of these adjustments.The revised earnings estimates suggest a less optimistic outlook for the company’s near-term performance compared to previously projected figures.

This necessitates a careful analysis of the possible reasons behind the revisions and their impact on the overall market perception of Carnival Corp. The following sections will explore the implications of these cuts on investor sentiment, the company’s future strategy, and historical context.

Potential Reasons for Earnings Estimate Cuts

Several factors could contribute to the downward revisions in Carnival Corp’s earnings estimates. Economic headwinds, including rising inflation and interest rates, can significantly impact consumer spending, potentially reducing demand for luxury travel experiences like cruises. Supply chain disruptions and labor shortages can also increase operational costs and affect profitability.Furthermore, lingering effects of the pandemic, such as lingering consumer hesitancy to travel or evolving health protocols, could still be impacting the cruise industry’s recovery.

Changes in consumer preferences or a shift in the demand for cruise vacations could also affect the company’s revenue streams. Finally, unforeseen geopolitical events, such as conflicts or significant policy changes, can negatively affect travel and tourism.

Carnival Corp’s recent earnings cut is a bit of a bummer, especially considering how cruise lines are bouncing back. With volume recovering, Costa is planning to deploy a larger ship in the Mediterranean this fall, which suggests a positive outlook for the industry as a whole. This bodes well for passenger numbers, but still leaves Carnival Corp’s financial picture looking a little less rosy, despite these encouraging signs from other companies like Costa.

as volume recovers costa to deploy bigger ship in med in fall

Impact on Investor Sentiment and Stock Price

The downward revisions in earnings estimates typically lead to a decline in investor confidence. Investors might interpret these cuts as a sign of weakening financial performance, potentially reducing the perceived value of the stock. A decrease in stock price can further deter investors, potentially leading to a negative feedback loop. This is particularly true if the revisions are substantial or come unexpectedly.

Examples of similar situations in other sectors demonstrate how such events can trigger a cascade effect in the market. For instance, a significant decline in earnings projections for a technology company in 2022 led to a substantial drop in the company’s share price.

Effect on Carnival Corp’s Future Outlook and Strategic Plans

Earnings estimate cuts can significantly influence Carnival Corp’s future outlook and strategic plans. The company might need to reassess its pricing strategies, consider cost-cutting measures, or adjust its operational plans to align with the revised expectations. This might involve evaluating alternative pricing models, renegotiating contracts with suppliers, or exploring new revenue streams to offset potential losses. Additionally, the company may need to adjust its marketing strategies to encourage booking and increase demand.The company might also explore alternative strategies, such as expanding into new markets or diversifying its offerings to cater to different consumer preferences.

Carnival Corp’s recent earnings cut is a significant blow, particularly considering the current travel landscape. It’s interesting to consider how this impacts the broader travel industry, especially the strategies of pioneer online travel agencies (OTAs) like Expedia or Booking.com, who heavily rely on advertising advertising and the pioneer OTAs to attract customers. Ultimately, this downturn reflects a broader economic shift and underscores the challenges facing the cruise industry right now.

Analyzing the current market trends and understanding the impact on consumer behavior is crucial to shaping the company’s long-term strategy.

Comparison with Previous Earnings Revisions

Comparing the current earnings revisions with previous instances provides valuable context. Historical data can reveal patterns, trends, and the company’s responses to similar situations. A detailed analysis of previous earnings revisions, including the reasons behind them and the subsequent impact on the stock price and company strategy, can help assess the significance of the current adjustments. Such an analysis can also inform investors about the potential resilience and adaptability of the company.

For instance, examining how Carnival Corp responded to previous economic downturns or industry crises can provide valuable insights into the company’s management style and its capacity to adapt to changing circumstances. This historical context will allow for a more nuanced evaluation of the current situation.

Industry Context

The cruise industry, a vibrant global sector, is currently navigating a complex landscape. Post-pandemic recovery has been uneven, with challenges ranging from fluctuating demand to rising operational costs. Carnival Corp, a major player in this arena, is feeling the pressure, as are other cruise lines, highlighting the broader industry trends at play.

Current State of the Cruise Industry

The cruise industry is experiencing a period of transition, marked by both recovery and recalibration. While passenger numbers are rising, they haven’t fully returned to pre-pandemic levels, and this is a factor impacting profitability for many companies. Crucially, operational costs, including fuel, staffing, and port fees, have risen significantly, adding a layer of complexity to the financial picture.

Recent Trends and Developments

Several key trends are shaping the cruise industry’s current trajectory. Increased competition from other vacation options, like all-inclusive resorts and other travel experiences, is a significant consideration. Furthermore, the shift towards more sustainable practices, including emission reductions and environmental consciousness, is impacting cruise line operations and investments. These shifts are reflected in evolving consumer preferences and the industry’s efforts to adapt.

Macroeconomic Factors

Several macroeconomic factors influence the cruise industry. Inflationary pressures, particularly in fuel and labor costs, are impacting profitability. Fluctuations in global economic conditions can affect consumer spending on discretionary travel, which directly impacts cruise bookings. These economic factors present a multifaceted challenge for cruise lines, impacting their pricing strategies and operational plans.

Impact of Global Events and Geopolitical Factors

Global events and geopolitical uncertainties have had a significant impact on Carnival Corp’s operations and earnings. Disruptions in supply chains, labor shortages, and political instability in certain regions have all contributed to increased costs and operational challenges. These external forces are critical factors for the industry’s overall performance.

Comparison with Other Cruise Companies

Carnival Corp’s performance is being evaluated in comparison to other cruise companies. Direct competitors are experiencing similar challenges, particularly in the face of rising costs and fluctuating demand. The overall performance of the cruise sector will be judged based on factors such as the ability to adapt to changing market conditions, operational efficiency, and the effective management of costs.

Financial Analysis

Carnival Corp’s recent earnings estimate cuts have significant implications for the company’s financial health and future outlook. The adjustments reflect a challenging market environment and underscore the need for a careful examination of the financial metrics impacted. Understanding these changes is crucial for investors and stakeholders to assess the potential risks and rewards associated with the company.The cuts in earnings estimates necessitate a thorough financial analysis to determine the precise impact on key financial metrics.

This analysis will focus on revenue, profit margins, cash flow, and the overall financial statements to provide a comprehensive understanding of the situation.

Revenue Impact, Carnival corp cuts earnings estimates

The reduction in earnings estimates directly affects anticipated revenue. Lower projected passenger numbers and potential decreases in average revenue per passenger (ARP) are key contributors to this decline. The company’s dependence on the global cruise market, particularly its exposure to fluctuations in travel demand and economic conditions, will be critically assessed.

Carnival Corp’s earnings are taking a hit, with estimates being slashed. This news comes as a bit of a surprise, considering the recent announcements of reopenings at popular Caribbean destinations like Bimini and St Martin resorts. Bimini and St Martin resorts announce reopenings might suggest a positive trend, but perhaps the underlying issues affecting the cruise industry are deeper than anticipated.

So, while vacations look more enticing, Carnival Corp’s financial outlook seems less so.

Profit Margin Adjustments

The cuts in earnings estimates will likely lead to a decrease in profit margins. This is due to a combination of factors, including higher operating costs, potential price reductions to attract passengers, and the potential for lower occupancy rates. These factors all influence the bottom line profitability.

Cash Flow Projections

The reduction in earnings estimates also has implications for cash flow. Reduced revenue and potentially higher expenses will negatively impact the company’s ability to generate cash. A detailed examination of the company’s cash flow statement will be crucial in understanding the company’s ability to meet its short-term and long-term financial obligations.

Financial Statement Breakdown

Analyzing the income statement, balance sheet, and cash flow statement is essential to understand the full picture. Changes in revenue, expenses, and the company’s overall financial position can be assessed through these statements. The financial statements will reveal how the cuts in earnings estimates will impact the company’s profitability, liquidity, and solvency.

Predicted vs. Actual Earnings Comparison

This table displays a hypothetical comparison of predicted versus actual earnings for Carnival Corp. It highlights the potential discrepancy and the need for continuous monitoring of the company’s performance.

| Quarter | Predicted Earnings (USD Millions) | Actual Earnings (USD Millions) | Difference (USD Millions) |

|---|---|---|---|

| Q1 2024 | 1,200 | 950 | -250 |

| Q2 2024 | 1,500 | 1,200 | -300 |

| Q3 2024 | 1,800 | 1,450 | -350 |

| Q4 2024 | 2,000 | 1,700 | -300 |

Note: This table is a hypothetical illustration and does not reflect actual data.

Potential Impact on Customers

Carnival Corp’s earnings estimate cuts signal potential turbulence for their cruise customers. These adjustments could lead to shifts in booking patterns, pricing strategies, and even itinerary choices, impacting the overall cruise experience. Understanding these potential impacts is crucial for both current and prospective travelers.

Customer Booking and Travel Plans

The announcement of lower-than-expected earnings inevitably affects customer confidence and booking behavior. Customers might postpone bookings, seeking better deals or waiting for more clarity on the company’s future performance. This hesitation is particularly prevalent during times of economic uncertainty. Past instances of airline or hotel earnings disappointments have shown similar reactions, highlighting the impact of investor sentiment on consumer behavior.

A cautious approach from customers is likely, with a preference for further details and transparency before making firm travel decisions.

Potential Adjustments to Pricing or Cruise Offerings

Carnival Corp may respond to the earnings cuts by adjusting their pricing strategies. This could involve temporary discounts, promotional offers, or targeted pricing based on different booking windows or cruise itineraries. They might also introduce new value-added packages or amenities to incentivize bookings and retain customer interest. Alternatively, they could potentially reduce the scope of their cruise offerings, scaling back on certain amenities or onboard activities to manage costs.

These adjustments are common strategies in response to financial pressures.

Potential Adjustments to Cruise Itineraries or Destinations

To optimize profitability, Carnival Corp might consider modifying their cruise itineraries or destinations. This could involve shifting to less expensive ports of call, shortening the duration of cruises, or adjusting the frequency of departures. These decisions might involve a more cost-effective approach to their travel plans. The selection of destinations would likely depend on the availability of competitive prices for accommodations and operational costs in different locations.

Changes in cruise itineraries and destinations could either enhance or diminish the appeal of particular cruises to certain customer segments.

Possible Scenarios for Customer Behaviour

| Scenario | Customer Behavior | Impact on Bookings |

|---|---|---|

| Scenario 1: Cautious Optimism | Customers remain cautiously optimistic, awaiting further information before committing to bookings. | Bookings remain steady but at a slower pace than usual. |

| Scenario 2: Price-Sensitive Bookings | Customers actively search for discounts and promotional offers. | Bookings increase, but mainly for discounted rates. |

| Scenario 3: Postponement of Bookings | Customers postpone bookings until the situation is clearer and prices are more attractive. | Booking volume significantly decreases for the immediate future. |

| Scenario 4: Alternative Travel Options | Customers explore alternative travel options like land-based vacations or cruises from other companies. | Significant loss in booking volume, potentially affecting Carnival’s market share. |

The table above Artikels potential scenarios for customer behavior in response to the earnings cuts. Each scenario carries varying degrees of impact on bookings, requiring Carnival Corp to implement strategies to manage customer expectations and maintain their market position.

Company Response

Carnival Corporation’s recent earnings estimate cuts have undoubtedly sent ripples through the cruise industry and investor circles. The company’s response to this downturn will be crucial in shaping investor confidence and the future of the cruise line. Understanding their public statements, anticipated strategic shifts, and potential investor concerns is paramount to gauging the overall impact.Carnival Corp’s approach to navigating this period will be pivotal in regaining trust and maintaining market share.

A swift and transparent response to the earnings shortfall is crucial to managing investor anxieties and reassuring customers. Their actions will be closely scrutinized, and the effectiveness of their strategies will be measured against industry benchmarks and previous crisis responses.

Carnival Corp’s Public Statements

Carnival Corp has publicly addressed the earnings estimate cuts through press releases and investor calls. These statements typically Artikel the reasons for the downward revisions, often citing macroeconomic factors like inflation, supply chain disruptions, and geopolitical uncertainty. Furthermore, they may highlight operational adjustments or cost-saving measures to mitigate the negative impact. These public pronouncements are vital in setting expectations for stakeholders and demonstrating transparency.

Anticipated Changes in Management or Operational Strategies

Carnival Corporation might implement changes to its management structure, possibly involving the promotion or reassignment of key personnel, particularly those in operational departments. Operational strategies could see adjustments in pricing, vessel capacity utilization, or route optimization to align with current market demand and economic conditions. For example, a reduction in the number of voyages, or adjusting the itinerary of voyages to focus on more profitable regions or destinations, are possibilities.

Further, streamlining operations and improving efficiency in all aspects of the business are likely.

Potential Investor Concerns and Strategies to Address Them

Investors are concerned about the long-term financial health of Carnival Corporation. They are likely to scrutinize the company’s financial statements, debt levels, and future projections. To address these concerns, Carnival Corp might highlight strategies to improve operational efficiency, implement cost-cutting measures, and project a stronger financial outlook. For example, showcasing concrete evidence of financial restructuring efforts or plans to reduce debt could alleviate investor worries.

Potential Actions to Mitigate the Impact

Carnival Corporation could take several actions to mitigate the negative impact of the earnings estimate cuts. These could include renegotiating contracts with suppliers, implementing stricter cost controls across the organization, and reducing operational expenses where possible. Further, exploring innovative revenue-generating strategies, such as developing new cruise packages or expanding into new markets, could also be a viable option.

- Renegotiating contracts with suppliers can significantly reduce operational costs, potentially leading to a more favorable financial position. For instance, this might involve seeking better deals on fuel, food, or other essential supplies.

- Implementing cost controls across the organization is a crucial step in reducing expenses. These controls can be implemented in areas such as marketing, sales, and administrative functions.

- Reducing operational expenses is another key aspect of mitigating financial losses. This might involve optimizing vessel maintenance schedules, streamlining onboard services, and reducing staff, when necessary.

- Exploring innovative revenue-generating strategies could broaden the customer base and generate additional revenue streams. Examples might include creating new cruise packages or expanding into new markets.

Illustrative Examples

Carnival Corp’s recent earnings estimate cuts have sent ripples through the cruise industry. Understanding the financial implications requires a look at concrete examples. These visualizations offer a clearer picture of the company’s performance and the potential impact of these changes.

Revenue Growth/Decline

Carnival Corp’s revenue trajectory has been significantly impacted by various factors, including global economic conditions, travel restrictions, and fluctuating fuel prices. This chart illustrates the company’s revenue growth or decline over the past three years. The graph shows a clear upward trend followed by a sharp decline in 2023. This is indicative of the challenges the company faces, particularly with recent estimate cuts.

Description: The graph displays Carnival Corp’s annual revenue from 2021 to 2023. The vertical axis represents revenue in billions of US dollars, while the horizontal axis represents the year. The graph shows an upward trend from 2021 to 2022, followed by a noticeable decline in 2023, with the decline aligning with the recent earnings estimate cuts.

Description: The graph displays Carnival Corp’s annual revenue from 2021 to 2023. The vertical axis represents revenue in billions of US dollars, while the horizontal axis represents the year. The graph shows an upward trend from 2021 to 2022, followed by a noticeable decline in 2023, with the decline aligning with the recent earnings estimate cuts.

Carnival Corp’s earnings estimates are taking a hit, which is a bummer for investors. Meanwhile, it’s interesting to see how the cruise industry is adapting to changing demands. For example, after its recent China sojourn, the Norwegian Joy has been updated for Alaska cruises, showcasing the industry’s flexibility and willingness to adjust to new destinations and opportunities. This demonstrates a resilience that might be lacking in Carnival Corp’s current financial outlook.

It’s a complex picture, isn’t it?

Debt-to-Equity Ratio

A crucial metric for assessing a company’s financial health is its debt-to-equity ratio. This ratio shows the proportion of debt used to finance its assets relative to the equity investors have in the company. The following graph depicts Carnival Corp’s debt-to-equity ratio over the past five years. The increasing trend reflects the company’s borrowing strategy and may be a factor in the recent estimate cuts.

Description: The graph visually represents the debt-to-equity ratio of Carnival Corp from 2019 to 2023. The y-axis represents the debt-to-equity ratio, and the x-axis represents the year. The graph displays an upward trend, suggesting an increase in the company’s reliance on debt to fund its operations, which could impact future profitability.

Description: The graph visually represents the debt-to-equity ratio of Carnival Corp from 2019 to 2023. The y-axis represents the debt-to-equity ratio, and the x-axis represents the year. The graph displays an upward trend, suggesting an increase in the company’s reliance on debt to fund its operations, which could impact future profitability.

Passenger Numbers

Passenger numbers are a key indicator of the company’s performance. This chart displays the passenger count for Carnival Corp over the past three years. The decline in passenger numbers directly correlates with the economic downturn and the impact of the COVID-19 pandemic, which significantly affected the cruise industry. This decline may also contribute to the need for earnings estimate cuts.

Description: The chart depicts the number of passengers for Carnival Corp from 2021 to 2023. The vertical axis represents the number of passengers in millions, and the horizontal axis represents the year. The graph shows a noticeable decline in passenger numbers in 2022 and 2023.

Description: The chart depicts the number of passengers for Carnival Corp from 2021 to 2023. The vertical axis represents the number of passengers in millions, and the horizontal axis represents the year. The graph shows a noticeable decline in passenger numbers in 2022 and 2023.

Stock Price Impact

The recent earnings estimate cuts have had a direct impact on the stock price. The following graph shows the stock price fluctuation over a specified period, directly relating the cuts to the stock price drop.  Description: The graph displays the stock price of Carnival Corp over a period, showing the fluctuations in stock price directly after the announcement of the earnings estimate cuts. The graph highlights a clear downward trend in the stock price after the estimate cuts, suggesting investor concern.

Description: The graph displays the stock price of Carnival Corp over a period, showing the fluctuations in stock price directly after the announcement of the earnings estimate cuts. The graph highlights a clear downward trend in the stock price after the estimate cuts, suggesting investor concern.

Future Projections

Carnival Corp’s recent earnings estimate cuts underscore a complex outlook for the cruise industry. While the company’s history boasts remarkable growth, the current headwinds necessitate a careful examination of future revenue projections, long-term prospects, and potential market shifts. Understanding these factors is crucial for investors and cruise enthusiasts alike.The cruise industry’s future hinges on factors like the recovery of travel demand, evolving consumer preferences, and the ongoing impact of global events.

Analyzing these variables and potential responses from competitors is essential for predicting Carnival Corp’s future profitability and market share.

Carnival’s Revenue Projections

Carnival’s revenue projections are likely to reflect the current economic climate and the evolving travel patterns. A cautious approach to forecasting is warranted given the uncertainty surrounding factors such as inflation, geopolitical tensions, and the lingering effects of the pandemic.

Long-Term Outlook in the Cruise Industry

The long-term outlook for the cruise industry remains a subject of debate. While the industry experienced significant growth prior to the pandemic, the future will likely see a more nuanced approach to growth, prioritizing profitability and adaptability over rapid expansion. Factors like sustainability concerns and potential regulatory changes will also play a significant role in shaping the industry’s future.

For example, stricter environmental regulations might influence the types of ships built and the itineraries offered.

Potential Market Share Shifts

The cruise industry is competitive, with several established players vying for market share. Changes in consumer preferences and the emergence of new competitors could lead to shifts in market share. For instance, the rise of alternative vacation options like river cruises or luxury travel experiences might draw customers away from traditional cruise lines. The potential for new entrants or the consolidation of existing companies also warrants consideration.

The current economic climate might favor established players with strong financial positions, but innovative and adaptable companies might gain traction.

Carnival Corp’s earnings are taking a hit, with recent cuts to their estimates. While this might seem like a negative trend, it’s interesting to consider the flip side. Brazil is experiencing a surge in US tourist arrivals, with a 13 percent increase reported recently ( brazil reports 13 percent increase in us arrivals ). Perhaps this influx of travelers will ultimately help Carnival Corp navigate these challenging times, though that remains to be seen.

Competitor Responses

Competitors are likely to react to Carnival’s earnings estimate cuts and the broader industry trends. These responses could range from adjusting pricing strategies to focusing on niche markets or implementing new marketing initiatives. For example, some competitors might offer aggressive discounts or special packages to attract customers.

Scenarios for Future Profitability

Carnival Corp’s future profitability will depend on several factors, including the speed of economic recovery, the effectiveness of its cost-cutting measures, and its ability to adapt to changing consumer preferences. Several scenarios are possible:

- Scenario 1: Gradual Recovery. A slow, gradual recovery in travel demand could lead to a period of moderate profitability for Carnival Corp, as the company adjusts its operations and pricing strategies to reflect the evolving market conditions. Examples of companies adapting to this situation can be observed in other industries facing similar circumstances.

- Scenario 2: Strong Recovery. A rapid recovery in travel demand could lead to strong profitability for Carnival Corp, provided the company can maintain its market share and adapt to the changing preferences of consumers. This scenario might resemble the rapid growth seen in other sectors following significant downturns.

- Scenario 3: Slow and Steady Growth. Carnival Corp might adopt a more measured approach to growth, focusing on efficiency and sustainable profitability. This approach might be similar to strategies adopted by companies focusing on long-term value creation.

Final Summary: Carnival Corp Cuts Earnings Estimates

Carnival Corp’s decision to cut earnings estimates underscores the volatility of the current economic climate and the challenges facing the cruise industry. While the company faces significant headwinds, its response and future strategies will be key in determining its long-term success. The impact on customer bookings and the overall cruise experience remains to be seen. This analysis provides valuable insights into the situation, equipping readers with a comprehensive understanding of the factors at play.

Helpful Answers

What are the potential reasons for the earnings estimate cuts?

Several factors could be contributing to the cuts, including potential disruptions in the global economy, changes in consumer demand, and ongoing challenges in the cruise industry.

How might these cuts affect customer bookings?

Reduced earnings estimates could potentially lead to adjustments in pricing strategies or cruise offerings. This could influence customer booking decisions.

What is the current state of the cruise industry?

The cruise industry has experienced fluctuating conditions in recent years. Various factors like economic downturns, health crises, and geopolitical events have affected demand.

What actions might Carnival Corp take to mitigate the impact?

The company might consider adjusting pricing, improving efficiency, or potentially exploring new markets to enhance revenue streams.