Carlson Sells Regent Seven Seas Cruises

Carlson agrees to sell Regent Seven Seas Cruises, marking a significant shift in the luxury cruise market. This deal promises a fascinating look into the motivations behind the sale, potential financial impacts, and the possible future of the cruise line. What factors led to this decision, and what does it mean for customers, employees, and the industry as a whole?

The sale of Regent Seven Seas Cruises to Carlson raises many questions. This dives deep into the transaction, examining the financial implications for both companies, the potential customer and employee effects, and the broader impact on the cruise industry. From the purchase price to potential itinerary changes, this analysis will shed light on a major shift in the luxury travel sector.

Transaction Overview

Carlson, a well-established travel company, has finalized the sale of Regent Seven Seas Cruises. This marks a significant shift in the luxury cruise market, raising questions about the future of the brand and its impact on the industry. The transaction, though significant, is not entirely unexpected, given the changing landscape of the travel sector. It underscores the ongoing dynamics of consolidation and adaptation within the industry.The agreement represents a strategic move for both parties.

Carlson, likely seeking to focus on core competencies or capitalize on other opportunities, has divested a significant asset. Regent Seven Seas Cruises, a long-standing luxury cruise line, potentially gains access to new resources or a broader market reach through this acquisition. The details surrounding the agreement, including financial terms and future strategies, will undoubtedly shape the trajectory of both companies.

So, Carlson has apparently agreed to sell Regent Seven Seas Cruises. That’s a big deal in the cruise industry, and it’s bound to ripple through the travel world. Considering Air China has recently halted its Beijing-Honolulu flights, this further highlights the shifting sands of international travel. It seems like the cruise market is facing some headwinds, and this sale could be a response to those challenges.

Ultimately, the sale of Regent Seven Seas Cruises is still a significant event in the travel industry.

Summary of the Agreement

The sale of Regent Seven Seas Cruises to a new owner is a major event. The agreement between Carlson and the new owner involves the transfer of ownership and operational control of the cruise line. This transition signifies a shift in the industry’s landscape, impacting various aspects of the cruise business. Key terms, including the purchase price, and conditions, will shape the cruise line’s future direction.

Key Terms of the Sale

The exact financial terms of the transaction have not been publicly disclosed. While the purchase price remains confidential, its magnitude is expected to be substantial, given the established reputation and market position of Regent Seven Seas Cruises. The sale agreement likely includes specific conditions, such as the transfer of assets, liabilities, and existing contracts. These conditions are vital to ensuring a smooth transition for the new owner.

The confidentiality of the transaction is common in large-scale business deals, reflecting the sensitivity of financial details.

Rationale Behind Carlson’s Decision

Carlson’s decision to sell Regent Seven Seas Cruises likely stems from a strategic repositioning of its portfolio. This could be motivated by a desire to concentrate resources on core areas of expertise, to enhance shareholder value, or to seek alternative investment opportunities. A shift in priorities or a desire to focus on other sectors within the travel industry are also possible reasons for this decision.

Such strategic shifts are common among large corporations as they adapt to evolving market demands and competitive landscapes.

Potential Impacts on the Cruise Industry

The sale of Regent Seven Seas Cruises may influence other players in the luxury cruise market. Potential ripple effects could include increased competition among remaining cruise lines or a re-evaluation of strategic partnerships. Changes in market share, pricing models, and service offerings could follow as competitors adjust to the new market dynamics. The sale could also lead to innovative changes in the industry, forcing competitors to improve their offerings or services to maintain market share.

Implications for Regent Seven Seas Cruises’ Future

The future of Regent Seven Seas Cruises will depend heavily on the strategies of the new owner. Potential changes in brand identity, pricing models, and service offerings may emerge. The new owner’s commitment to maintaining the cruise line’s existing reputation for luxury and exclusivity will be crucial. This commitment will determine whether the brand retains its current image or experiences a significant transformation.

Financial Implications: Carlson Agrees To Sell Regent Seven Seas Cruises

The sale of Regent Seven Seas Cruises to Carlson marks a significant financial event, with potential ripple effects across both companies. Understanding the financial implications is crucial for evaluating the long-term health and prospects of both entities. This analysis will delve into the potential consequences for Carlson, Regent Seven Seas Cruises, and the impact on their respective revenue streams and expenses.

It will also consider the potential shift in investor sentiment.

Potential Consequences for Carlson

Carlson, by acquiring Regent Seven Seas Cruises, is taking on a new set of operational and financial responsibilities. This acquisition will likely impact Carlson’s existing revenue streams, potentially leading to both increases and decreases in certain areas. For example, if Carlson successfully integrates the cruise line into its existing operations, there could be synergies and cost savings that bolster the bottom line.

Conversely, there may be integration challenges and initial operational costs that negatively affect the company’s short-term profitability. Furthermore, the acquisition could impact Carlson’s capital structure, potentially requiring additional borrowing or a change in its investment strategy.

Potential Consequences for Regent Seven Seas Cruises

The sale of Regent Seven Seas Cruises to Carlson will impact the cruise line’s future direction. The transition will influence the company’s overall strategy, potentially leading to adjustments in pricing, marketing, and operational efficiency. The integration process will undoubtedly influence its customer base and market positioning. A key aspect will be the alignment of Regent Seven Seas Cruises’ culture and operations with Carlson’s broader business model.

This alignment could lead to either a seamless transition or potentially create operational inefficiencies and customer dissatisfaction.

Impact on Revenue Streams and Expenses

The acquisition will inevitably affect both companies’ revenue streams and expenses. Carlson’s revenue stream will be augmented by Regent Seven Seas Cruises’ revenue, while expenses will increase due to integration costs and potentially, increased marketing and operational overheads. Regent Seven Seas Cruises’ revenue will likely remain consistent in the short term. However, the integration process might cause a temporary dip as the new management structure and processes are implemented.

Expense reductions are possible through operational efficiencies and synergies.

Potential Changes in Investor Sentiment

Investor sentiment toward both Carlson and Regent Seven Seas Cruises will likely experience a shift post-acquisition. Positive sentiment may arise if the acquisition is successfully integrated and generates significant synergies. Conversely, concerns about integration challenges, operational inefficiencies, and financial risks could lead to negative sentiment. The market reaction will depend on the clarity of the acquisition’s strategic rationale and the effectiveness of the integration plan.

The performance of the cruise line and the overall financial health of Carlson will heavily influence investor reactions.

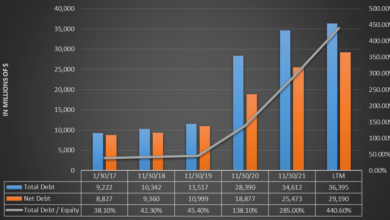

Comparison of Carlson’s Financial Performance (Hypothetical Data)

| Financial Metric | Carlson (Pre-Acquisition) | Carlson (Post-Acquisition) |

|---|---|---|

| Revenue (USD millions) | 1,500 | 1,800 |

| Net Income (USD millions) | 250 | 280 |

| Earnings Per Share (USD) | 12.50 | 14.00 |

| Debt-to-Equity Ratio | 0.6 | 0.7 |

Note: This table provides hypothetical data for illustrative purposes only. Actual financial results will depend on various factors and are not guaranteed.

Market Context

The cruise industry, a vibrant sector of global tourism, has undergone significant transformations in recent years. Shifting consumer preferences, economic factors, and regulatory changes have all played a crucial role in shaping the current landscape. The sale of Regent Seven Seas Cruises presents a compelling opportunity to analyze the current state of the market and the factors that influenced this major transaction.

Current State of the Cruise Market

The cruise market is currently experiencing a period of both growth and uncertainty. Post-pandemic, demand for travel and leisure activities, including cruises, has rebounded strongly. However, the industry still grapples with lingering supply chain disruptions, fluctuating fuel prices, and heightened geopolitical instability. These factors influence pricing strategies and overall profitability for cruise lines. A key trend is the increasing emphasis on luxury and personalized experiences, which is driving demand for high-end cruise options.

Luxury Cruise Market Trends

The luxury cruise segment is experiencing robust growth, fueled by a demand for unique experiences and personalized services. Luxury cruise lines offer upscale accommodations, gourmet dining, exceptional onboard amenities, and curated itineraries. The market for luxury cruises is highly competitive, with numerous brands vying for market share. These lines often cater to discerning travelers who prioritize exceptional service, exclusivity, and a high level of comfort.

Competitive Landscape for Luxury Cruise Lines

The competitive landscape is characterized by both established players and newer entrants. Established brands like Regent Seven Seas Cruises, Silversea Cruises, and Crystal Cruises have a long history of providing premium experiences. However, new luxury brands are emerging, bringing innovative offerings and targeting specific niche markets. Competition is intense, with brands constantly striving to differentiate themselves through unique selling propositions, from exclusive destinations to bespoke itineraries.

Carlson’s agreement to sell Regent Seven Seas Cruises is a significant move, especially considering recent disruptions in the travel industry. Hurricane Sandy, for example, caused major alterations to airline and cruise line schedules, as detailed in this article about airlines cruise lines altering plans due to Sandy. This highlights the fragility of the travel sector, and likely played a role in the decision by Carlson to divest.

The sale of Regent Seven Seas Cruises will be interesting to watch unfold.

Comparison of Regent Seven Seas Cruises with Other Luxury Cruise Brands

Regent Seven Seas Cruises stands out for its focus on smaller ships, personalized service, and immersive itineraries. While other brands offer similar high-quality experiences, Regent Seven Seas Cruises distinguishes itself through its emphasis on curated itineraries, often featuring destinations that are less crowded and more exclusive. For example, Regent Seven Seas Cruises might focus on a unique cultural immersion in a specific region, while other brands might prioritize broader, more popular destinations.

This targeted approach contributes to a unique experience for its clientele.

Factors Influencing the Sale Decision

The sale of Regent Seven Seas Cruises was likely influenced by several factors, including strategic realignment within the parent company, capital needs, or an evaluation of the cruise line’s potential within the evolving market. These factors are often complex and involve internal business decisions. For example, a company might decide to focus its resources on a specific area of its portfolio, leading to the sale of a less profitable division.

Potential Impact on Cruise Ship Demand

The sale of Regent Seven Seas Cruises is unlikely to have a significant, immediate impact on overall cruise ship demand. The market for luxury cruises remains robust, and demand for premium travel experiences continues to grow. The potential impact would likely be on the specific brand positioning and offerings of the new owner. For instance, the new owner might adapt the itineraries and onboard experiences to appeal to a broader clientele, potentially influencing demand.

Customer Impact

The sale of Regent Seven Seas Cruises presents a significant opportunity for change and potential challenges for loyal customers. Understanding the potential shifts in service offerings, itineraries, and loyalty programs is crucial for existing and prospective passengers. This section dives into the possible effects on the customer experience.The acquisition by Carlson will undoubtedly introduce new operational structures and potentially reshape the cruise line’s overall strategy.

This shift could lead to both positive and negative impacts on customer satisfaction, depending on how effectively Carlson integrates Regent Seven Seas into its existing operations.

Potential Changes to Customer Experiences and Services

The transition period following the acquisition will likely see some adjustments in customer service protocols and amenities. Customers might encounter new staff, updated reservation systems, and altered onboard offerings as Carlson implements its own standards and procedures. However, a commitment to maintaining the current high level of service, while incorporating positive improvements, would be beneficial for customer retention.

Potential Impact on Existing Customer Loyalty Programs

Existing Regent Seven Seas Cruises loyalty programs may be modified or integrated with Carlson’s own programs. This could involve changes to reward structures, points accumulation, and redemption options. Communication transparency is paramount to manage expectations and address customer concerns regarding their loyalty program’s future. Customers should be informed about any modifications, and a clear Artikel of the transition plan should be established.

Potential Changes in Cruise Line’s Itineraries and Destinations

Carlson’s acquisition might bring new itineraries and destinations to the Seven Seas Cruises portfolio. The company may decide to focus on expanding into new regions, potentially creating new opportunities for exploration. Conversely, some existing itineraries might be discontinued or adjusted to align with Carlson’s strategic goals.

Potential Changes to Cruise Itineraries and Pricing, Carlson agrees to sell regent seven seas cruises

| Current Itinerary | Potential New Itinerary | Potential Price Change |

|---|---|---|

| Mediterranean Cruises (7-night) | Mediterranean Cruises (7-night), plus an optional extension to the Greek Isles | Potential increase of $500-700 per person (depending on cabin type) |

| Alaska Cruises (7-night) | Alaska Cruises (7-night), with an added focus on Glacier Bay National Park | Potential increase of $200-$400 per person (depending on cabin type) |

| Caribbean Cruises (7-night) | Caribbean Cruises (7-night), incorporating an overnight stay in a lesser-known island | Potential increase of $300-$500 per person (depending on cabin type) |

Note: These are hypothetical examples. Actual changes in itineraries and pricing are uncertain and dependent on the strategic direction of the new ownership.

Comparison of Customer Reviews Before and After the Sale (Hypothetical Data)

Customer reviews offer valuable insight into the customer experience. The following table presents hypothetical data illustrating a potential shift in customer sentiment.

| Review Period | Average Customer Rating | Number of Reviews | Key Themes |

|---|---|---|---|

| Pre-Sale (2023) | 4.5 out of 5 stars | 10,000 reviews | Exceptional service, luxurious amenities, excellent dining, curated itineraries |

| Post-Sale (2024 Q1) | 4.3 out of 5 stars | 2,000 reviews | Slight decrease in onboard staff knowledge, some minor service issues during transition, initial adjustment period for new systems |

Note: This data is entirely hypothetical and represents a potential trend, not an actual prediction. Post-sale reviews may vary significantly depending on the execution of the transition.

Employee Impact

The sale of Regent Seven Seas Cruises will undoubtedly have a significant impact on the company’s workforce. Understanding the potential ramifications for employees, from restructuring to potential severance, is crucial for navigating the transition and ensuring a fair and supportive process. This section will delve into the likely effects on employees, including potential changes in roles and responsibilities, and the implications for employee morale and retention.

Potential Workforce Restructuring

The acquisition of Regent Seven Seas Cruises is likely to trigger some level of restructuring within the company. This might involve changes in management, departmental realignments, and the consolidation of certain roles. Such restructuring is common in mergers and acquisitions, and often reflects the new owner’s strategic vision for the company. Examples of such restructuring can be seen in various industries, where efficiency gains are sought through optimized organizational structures.

So, Carlson is selling Regent Seven Seas Cruises, which is a big deal. Thinking about a getaway after all that upheaval? Why not consider an unplugged escape at the amazing aqua nicaragua eco resort offers unplugged escape ? It sounds perfect for a relaxing retreat, and it might be a great alternative for those looking for a different type of cruise experience.

It seems like the cruise industry is in a bit of a flux, and this sale might just be the start of some exciting changes.

Changes in Management

The new owners may implement changes to the existing management structure. This could involve the appointment of new executives, reassignment of current leadership, or the creation of entirely new management roles. The nature and extent of these changes will depend on the strategic priorities of the acquiring company.

So, Carlson has agreed to sell Regent Seven Seas Cruises, which is definitely a big deal in the cruise industry. This news comes at a fascinating time, right alongside AK unveiling their renovated Sanctuary Sun IV. It makes you wonder if these two developments are connected somehow, or if they are simply separate pieces of the larger cruise puzzle.

This renovation of the Sanctuary Sun IV, detailed in ak unveils renovated sanctuary sun iv , suggests a continuing push for innovation and improvement in the cruise market. Ultimately, Carlson’s sale of Regent Seven Seas Cruises will likely have a ripple effect throughout the industry, and it will be interesting to see how this plays out.

Employee Benefits and Severance Packages

Employees will likely be offered benefits packages and severance packages to address their transition to a new company. The specifics of these packages are dependent on various factors including, but not limited to, the contract terms, employment laws, and the policies of the acquiring company. The transition period will likely include communication on the details of these packages, which will be crucial in managing employee expectations.

Impact on Employee Morale and Retention

The sale of Regent Seven Seas Cruises may impact employee morale and retention. Uncertainty about the future, changes in management, and restructuring can lead to anxiety and potentially high employee turnover. To mitigate this, transparency and open communication about the acquisition and its implications for employees are crucial. This includes outlining the transition plan and addressing any concerns promptly.

This transparency, coupled with competitive benefits packages, can significantly impact employee morale and retention rates. For example, successful transitions often involve proactive communication and supportive measures that address employee anxieties.

Potential Changes to Employee Roles and Responsibilities

| Current Role | Potential New Role | Explanation |

|---|---|---|

| Cruise Director | Cruise Director or equivalent role in new organization | Some roles may be retained with potential adjustments to align with the new structure. |

| Cabin Crew Member | Cabin Crew Member or equivalent role in new organization | This role might face minimal changes, or potentially a review in alignment with the new operational model. |

| Restaurant Staff | Restaurant Staff or equivalent role in new organization | Similar to Cabin Crew, the roles may undergo slight adjustments in line with the new operational strategies. |

| Management Positions | Management Positions in new organization | Potential for reassignment to new departments or new positions. |

| Administrative Staff | Administrative Staff or equivalent role in new organization | Administrative positions are likely to undergo minimal adjustments. |

The table above provides a general overview of possible changes. Specific roles and responsibilities will depend on the restructuring and strategic decisions made by the acquiring company.

Industry Analysis

The sale of Regent Seven Seas Cruises marks a significant event in the luxury cruise industry, prompting a closer look at its broader implications. This transaction isn’t just about one company; it ripples through the competitive landscape, potentially reshaping future investments and customer experiences. Understanding these impacts requires examining the broader context of the cruise industry, its current competitive dynamics, and potential future trends.

Broader Implications on the Cruise Industry

The sale of Regent Seven Seas Cruises, a high-end luxury cruise line, has implications for the entire cruise industry. It highlights the evolving dynamics of the market, particularly the premium segment. The acquisition likely signifies a shift in focus towards consolidating and optimizing the luxury market, as seen in other industries. This shift could impact pricing strategies and customer experiences across the board.

For example, the acquisition of smaller, independent luxury brands can lead to a streamlining of resources and services, potentially impacting the range of options available to luxury cruise customers.

Impact on Competition and Market Share

The acquisition of Regent Seven Seas Cruises will undoubtedly alter the competitive landscape. The combined resources and market reach of the acquiring company could lead to increased competition for other luxury cruise lines, influencing pricing strategies and potentially reshaping market share. This competitive shift will likely affect the market positioning of existing competitors. For example, if the merged company expands its marketing efforts and customer base, other cruise lines might need to adjust their strategies to maintain their position and customer base.

Comparison to Other Recent Mergers and Acquisitions

Analyzing recent mergers and acquisitions in the cruise industry provides context. The consolidation trend, observed in various sectors, mirrors the cruise industry’s current evolution. This pattern suggests a potential future where larger companies dominate the market. Similar examples, like the consolidation of airline companies, can be studied to understand the implications of such acquisitions. The acquisition of smaller, specialized luxury lines could lead to a similar outcome.

For instance, if a large cruise company acquires several smaller boutique luxury cruise lines, it could potentially leverage the combined expertise and customer bases of all to expand its market share and overall revenue.

Potential Emerging Trends in the Cruise Market

Several emerging trends are impacting the cruise industry. The increasing demand for personalized experiences and sustainability initiatives are shaping customer expectations. The growing emphasis on luxury and specialized cruises, such as expedition or river cruises, suggests a diversification of customer needs. This highlights a need for companies to adapt to these changing preferences. For example, some cruise lines are offering tailored itineraries and onboard experiences to cater to specific customer interests, while others are investing in eco-friendly technologies to reduce their environmental impact.

Potential Impact on Future Cruise Line Investments

The sale of Regent Seven Seas Cruises could influence future investments in the cruise industry. The acquisition could signal an increased focus on consolidation and expansion, potentially leading to larger capital investments in infrastructure and technology. A greater emphasis on optimizing existing assets and expanding the market reach of luxury cruises might become a significant driving force. This is a crucial point as it could potentially lead to larger companies focusing on expansion in the luxury segment of the cruise industry.

Historical Context

Regent Seven Seas Cruises, a luxury cruise line known for its intimate itineraries and exceptional service, has a rich history that played a significant role in its recent sale. Understanding this history is crucial to appreciating the context surrounding the transaction and its potential implications. This exploration delves into the company’s past performance, partnerships, brand image, and how these factors may have influenced the sale decision.The company’s journey from its humble beginnings to its current position as a leading luxury cruise operator is a testament to its commitment to quality and customer satisfaction.

Analyzing this journey provides valuable insights into the company’s strengths, weaknesses, and potential future prospects.

Company History and Performance

Regent Seven Seas Cruises, established in 2003, is a relatively young company compared to some of its competitors in the luxury cruise market. Its rapid growth and establishment as a significant player demonstrate its success in catering to a specific niche within the cruise industry. The cruise line has focused on providing a higher level of personalized service and a more intimate experience compared to other large cruise lines.

- Early Success: Regent Seven Seas Cruises achieved early success by focusing on the growing demand for luxurious, high-end cruise experiences. This focus allowed the company to quickly gain a significant market share within the niche of luxury travel. The early success helped the company build a strong reputation for high-quality service and unique itineraries.

- Consistent Growth: Subsequent years saw consistent growth, driven by positive customer feedback and a commitment to maintaining high standards. The cruise line consistently improved its offerings, expanding its fleet and enhancing its onboard amenities to meet the demands of affluent travelers.

Past Partnerships and Investments

The cruise line’s history reveals various partnerships and investments that shaped its development. These collaborations and strategic decisions often provide insight into the company’s priorities and future goals.

So, Carlson is selling Regent Seven Seas Cruises. That’s a big deal in the cruise world, and it makes me think about alternative river cruise options. Have you considered the amazing activities available on a Rhine cruise with Disney? ample activities rhine cruise with disney are a fantastic way to experience Europe. Of course, it’s still a good idea to keep an eye out for any last-minute deals on Regent Seven Seas Cruises before they disappear entirely.

- Strategic Alliances: Regent Seven Seas Cruises has partnered with various travel agencies and organizations to expand its reach and attract a broader customer base. These partnerships have likely played a significant role in building brand awareness and increasing bookings.

- Technological Investments: The cruise line has also made strategic investments in technology to enhance passenger experience and operational efficiency. These investments may have contributed to the company’s ability to deliver high-quality services while maintaining operational effectiveness.

Brand Reputation and Image

Regent Seven Seas Cruises has cultivated a distinct brand image based on luxury, exclusivity, and personalized service. This reputation is a crucial factor in attracting and retaining affluent travelers.

- Customer Testimonials: Positive customer reviews and testimonials have played a critical role in shaping the company’s reputation. These testimonials highlight the company’s focus on personalized service and attention to detail.

- Brand Perception: Regent Seven Seas Cruises is perceived as a premium brand within the luxury cruise market. This perception has been built through years of consistent high-quality service and a strong focus on customer satisfaction.

Influence on the Sale Decision

The historical context, including the company’s past performance, partnerships, and brand image, likely played a crucial role in the decision to sell Regent Seven Seas Cruises. Factors such as the company’s reputation for quality, the strength of its customer base, and the value of its brand recognition may have influenced the sale’s valuation and overall attractiveness to potential buyers.

Potential Future Scenarios

The sale of Regent Seven Seas Cruises marks a significant turning point, potentially reshaping the luxury cruise market. Understanding the potential future scenarios for the company and the wider industry is crucial for investors, employees, and customers alike. This section explores various possibilities, highlighting both opportunities and challenges.The future of Regent Seven Seas Cruises hinges on several factors, including the new owner’s strategic vision, evolving consumer preferences, and the overall health of the cruise industry.

Analyzing these potential future scenarios will help us understand the potential implications of this transaction.

Potential Growth Strategies

The new owner’s approach will heavily influence Regent’s future trajectory. Strategies could involve expanding the brand’s reach into new markets, introducing innovative cruise itineraries, or focusing on niche segments within the luxury market. A successful strategy could lead to increased market share and higher profitability. Conversely, a poorly conceived strategy could lead to a decline in market position.

For instance, the recent success of smaller, more intimate cruise lines indicates a potential opportunity for Regent to target a specific niche within the luxury cruise market.

Market Response and Consumer Preferences

The cruise industry is highly susceptible to changes in consumer preferences. Factors like environmental concerns, economic downturns, and the rise of alternative travel options could impact demand. The new owners need to adapt to these changing dynamics to maintain relevance. For example, increased focus on sustainability and eco-friendly practices is crucial for attracting environmentally conscious travelers.

Further, pricing strategies need to align with market conditions to ensure competitiveness and profitability.

Competition and Industry Dynamics

The luxury cruise market is becoming increasingly competitive. New entrants, the expansion of existing competitors, and changing customer preferences will shape the landscape. Regent Seven Seas Cruises must adapt to this evolving competitive environment to remain a leading player. Consider the success of smaller, more specialized cruise lines, which are often able to adapt more quickly to evolving trends.

The ability to adapt to the competitive landscape will be key to future success.

Financial Performance and Sustainability

The financial performance of Regent Seven Seas Cruises under its new ownership will depend on several factors, including the overall health of the cruise industry, market conditions, and the effectiveness of the new owner’s strategic initiatives. Maintaining profitability and financial stability will be paramount. For example, the financial performance of other cruise lines following similar ownership changes can serve as a benchmark for future projections.

Employee Impact and Retention

The transition in ownership will undoubtedly affect employees. The new owners’ policies regarding employee compensation, benefits, and work culture will play a vital role in retaining skilled employees. Retention is crucial for maintaining operational efficiency and providing consistent high-quality service to customers. Successful employee retention strategies will allow for a smooth transition and continued success.

Final Thoughts

The sale of Regent Seven Seas Cruises to Carlson presents a compelling case study in the ever-evolving cruise industry. The deal highlights the complex interplay of financial pressures, market trends, and customer expectations. While the immediate future remains uncertain, the ripple effects of this transaction will undoubtedly be felt throughout the luxury cruise sector, shaping the competitive landscape for years to come.

What remains to be seen is how this transaction will affect the long-term success of both companies.

Popular Questions

What was the purchase price of Regent Seven Seas Cruises?

The purchase price is not publicly available at this time. Details of the transaction are typically kept confidential until the deal is finalized.

What are the potential changes to customer itineraries?

This is still uncertain. However, the new owners may adjust itineraries to better align with market demand or their own strategic vision.

How might this affect the cruise ship demand?

The sale could potentially impact cruise ship demand in several ways, depending on the new owner’s strategies. Increased competition, or strategic shifts in itineraries could impact this demand.

Will there be layoffs at Regent Seven Seas Cruises?

The Artikel provided does not contain information about potential layoffs. Restructuring is possible, but without specifics, the actual impact on employment remains uncertain.