Building the Perfect Compensation Formula Can It Be Done?

Building the perfect compensation formula can it be done? This intricate puzzle involves more than just numbers; it’s about understanding individual needs, market trends, and internal equity. We’ll delve into the multifaceted nature of “perfect,” exploring the components of a robust formula, external market influences, and the crucial balance of internal fairness and performance-based adjustments.

Crafting a compensation system that truly resonates with employees and drives company success requires a delicate balancing act. From base salaries and bonuses to non-monetary benefits, we’ll uncover the key elements that contribute to a winning formula. Ultimately, we’ll evaluate whether a truly “perfect” compensation model is attainable, or if it’s a continuous process of refinement and adaptation.

Defining “Perfect” Compensation

The pursuit of “perfect” compensation is a complex endeavor, far exceeding a simple numerical value. It’s a multifaceted concept encompassing financial rewards, benefits, and the overall employee experience. A truly “perfect” compensation package isn’t a one-size-fits-all solution but rather a tailored blend that resonates with individual needs and aspirations. This often involves a delicate balance between tangible and intangible elements.Compensation extends beyond salary to encompass a wide array of factors that contribute to an employee’s overall well-being and satisfaction.

A comprehensive compensation strategy should consider not only the base pay but also benefits like health insurance, retirement plans, paid time off, and professional development opportunities. Furthermore, a positive work environment, recognition programs, and clear career paths are crucial components that contribute to the overall perception of a “perfect” compensation structure.

Multifaceted Nature of Perfect Compensation

The notion of “perfect” compensation transcends mere financial figures. It encompasses the total package of rewards and benefits that an employee receives, including salary, bonuses, benefits, and other perks. The financial aspects are certainly important, but they are not the sole determinants of a positive employee experience. Factors such as work-life balance, opportunities for growth, and a supportive company culture significantly influence employee satisfaction and loyalty.

Factors Contributing to a Perception of Perfect Compensation

A multitude of factors contribute to an employee’s perception of a “perfect” compensation package. These factors extend beyond just financial considerations and encompass a range of non-monetary elements that impact overall well-being and job satisfaction.

- Financial Aspects: Base salary, bonuses, profit sharing, stock options, and other incentives are crucial components. The value of these elements is relative to the individual’s circumstances, experience level, and market rate. For instance, a higher base salary might be crucial for someone with a family and substantial debt, while stock options might be more appealing to employees seeking long-term growth opportunities.

- Non-Financial Aspects: Benefits like health insurance, paid time off, retirement plans, and flexible work arrangements are vital to employees. The quality of these benefits and their alignment with the individual’s needs and preferences greatly influence the overall perception of compensation. For example, a comprehensive health insurance plan is highly valued by employees with dependents, while a flexible work schedule is crucial for individuals with childcare responsibilities or personal commitments.

- Company Culture and Environment: A positive and supportive work environment significantly influences employee satisfaction. Factors such as opportunities for growth, professional development, recognition programs, and a sense of belonging are crucial elements in a perceived “perfect” compensation package. For example, a company known for its mentorship programs and employee resource groups will likely attract and retain talent more effectively than a company with a less supportive culture.

Individual Needs and Preferences in Compensation

Individual needs and preferences significantly influence the definition of a “perfect” compensation package. A compensation structure that is considered ideal for one employee might be entirely inadequate for another.

- Personal Circumstances: Factors such as family size, financial obligations, and personal values significantly impact an individual’s compensation needs. For example, an employee with young children might prioritize paid parental leave and flexible work arrangements over higher base salary. Conversely, an employee with significant debt may prioritize higher base pay and potential bonuses.

- Career Aspirations: An employee seeking rapid career advancement might value opportunities for professional development and leadership roles over immediate financial gains. Conversely, an employee focused on financial security might prioritize higher base salary and benefits.

- Life Stage: Different life stages require different compensation priorities. For instance, employees entering their careers may prioritize salary growth, while those nearing retirement might focus on retirement benefits and financial security.

Pitfalls of Universal Perfect Compensation

The pursuit of a universally “perfect” compensation structure is fraught with challenges. There is no single formula that satisfies all employees. A one-size-fits-all approach often fails to address the unique needs and preferences of individual employees.

- Difficulty in Meeting Diverse Needs: A universally perfect compensation structure struggles to accommodate the diverse needs and preferences of a diverse workforce. Different employees have different priorities and values, making it challenging to create a single package that appeals to everyone.

- Potential for Demotivation: A compensation structure that does not resonate with an employee’s needs and values can lead to demotivation and decreased productivity. A perceived lack of recognition or inadequate benefits can negatively impact employee morale.

- High Administrative Costs: Creating and managing a highly personalized compensation structure can be costly and complex, requiring significant administrative resources.

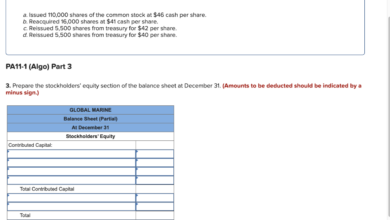

Compensation Models Comparison

Different compensation models cater to varying needs and priorities. The ideal model depends on factors such as the industry, company culture, and employee base.

| Compensation Model | Strengths | Weaknesses |

|---|---|---|

| Salary-Based | Simplicity, predictability, transparency | Limited flexibility, potential for under- or over-compensation |

| Commission-Based | Incentivizes performance, potential for high earnings | Risk of inconsistent income, potential for low earnings if sales are poor |

| Profit-Sharing | Alignment with company success, potential for high earnings | Requires trust and understanding, potential for low earnings if profits are low |

| Performance-Based | Rewards exceptional contributions, aligns compensation with value | Complexity in measuring performance, potential for disputes |

Components of a Compensation Formula

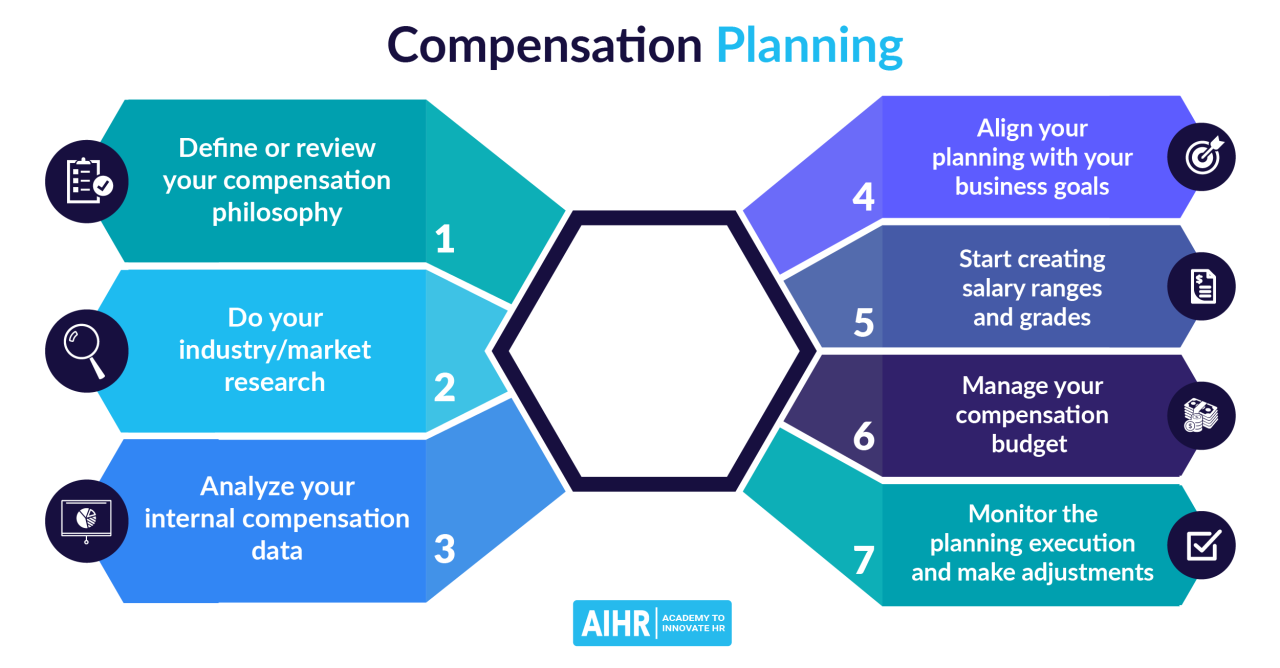

Crafting a fair and effective compensation formula is crucial for attracting and retaining top talent. It’s not just about paying employees; it’s about aligning their incentives with the company’s overall objectives. A well-structured formula ensures equitable pay practices, motivates high performance, and fosters a positive work environment.A robust compensation formula considers a multitude of factors, ranging from base salary and performance-based bonuses to benefits and equity.

Understanding the interplay of these components is vital for creating a system that’s both just and motivating.

Base Salary, Building the perfect compensation formula can it be done

Base salary forms the foundation of the compensation structure. It represents the guaranteed compensation an employee receives for their role and responsibilities. It’s typically determined by factors like job level, experience, skills, and market rates. A competitive base salary attracts qualified candidates and sets the stage for additional compensation components.

Figuring out the perfect compensation formula feels like a never-ending quest, right? It’s tough to balance attracting top talent with staying profitable. But while you’re wrestling with spreadsheets, consider this: escaping to attentive elegance at secluded recreo resort in Costa Rica attentive elegance at secluded recreo resort in costa rica might just offer a fresh perspective.

Maybe the key to a perfect formula lies not in the numbers, but in recharging your own creativity and focus. Then, when you return, tackling the compensation conundrum will feel much less daunting.

Bonuses

Performance-based bonuses are a crucial element for motivating employees to exceed expectations and contribute to the company’s success. These rewards can be tied to individual performance metrics, team achievements, or overall company goals. They incentivize employees to strive for higher levels of productivity and efficiency.

Benefits

Employee benefits encompass a wide range of non-monetary perks that enhance employee well-being and satisfaction. These can include health insurance, retirement plans, paid time off, and other perks. Benefits demonstrate a company’s commitment to its employees and contribute significantly to overall job satisfaction.

Equity

Equity compensation, such as stock options or restricted stock units, provides employees with ownership in the company. This alignment of interests incentivizes employees to work towards the company’s long-term success. Equity compensation is particularly valuable for attracting and retaining high-potential employees.

Performance Metrics

Performance metrics are essential for evaluating employee contributions and adjusting compensation accordingly. These metrics should be clearly defined, measurable, and aligned with company objectives. Examples include sales targets, project completion rates, customer satisfaction scores, or innovation metrics.

Company Goals and Objectives

Incorporating company goals and objectives into the compensation formula ensures that employee incentives are aligned with the overall strategic direction of the company. This integration motivates employees to contribute to the achievement of company-wide goals, creating a cohesive and productive work environment.

Compensation Formula Table

| Component | Description | Factors Considered |

|---|---|---|

| Base Salary | Guaranteed compensation | Job level, experience, skills, market rates |

| Bonuses | Performance-based rewards | Individual/team performance, company goals |

| Benefits | Non-monetary perks | Health insurance, retirement plans, paid time off |

| Equity | Ownership in the company | Stock options, restricted stock units |

Compensation Calculation and Adjustment Examples

Consider an employee whose base salary is $60,000. Their performance targets for the year include exceeding sales quotas by 15% and successfully completing 3 key projects. If they meet or exceed these targets, a bonus of 10% of their base salary (or $6,000) could be awarded. Furthermore, if company performance metrics are exceeded, an additional bonus of 5% of base salary (or $3,000) can be awarded.

These adjustments ensure that compensation is directly tied to performance and company success.

External Market Factors: Building The Perfect Compensation Formula Can It Be Done

Crafting the perfect compensation formula isn’t just about internal equity; it’s a dance with the external market. Understanding prevailing compensation practices across industries and regions is crucial. This allows you to position your company’s offers competitively and attract top talent. External factors, such as economic conditions, play a significant role in salary trends, making a dynamic approach essential.External market analysis is an ongoing process.

Figuring out the perfect compensation formula feels like searching for the mythical unicorn – can it truly be achieved? While the details of building a competitive compensation structure are complex, the recent news of Alamo opening a second Waikiki location ( alamo opens second waikiki location ) highlights the importance of understanding market dynamics. Ultimately, crafting a compensation plan that attracts and retains top talent requires a nuanced approach, blending internal factors with external market pressures.

So, can the perfect formula exist? Maybe not, but we can certainly strive for one that works!

Compensation benchmarks shift as industries evolve and economic climates change. Regularly monitoring these trends enables companies to adapt their compensation strategies for continued success in attracting and retaining skilled employees.

Comparing Compensation Practices Across Industries and Geographic Locations

Understanding how compensation varies across industries and geographies is vital for building a competitive compensation structure. The technology sector, for instance, often pays higher salaries than the retail sector, reflecting the unique skills and demands of the respective fields. Similarly, cost of living significantly influences salary expectations in different regions. A software engineer in Silicon Valley will likely command a higher salary than an equivalent role in a less expensive metro area.

This disparity underscores the importance of regional cost of living adjustments.

Salary Trends and Benchmarks

Salary data provides critical insights into competitive compensation. Salary survey data from reputable sources like Salary.com, Glassdoor, and Payscale offer detailed compensation ranges for various roles and locations. These benchmarks help in establishing fair and competitive salary structures. For example, a 2023 salary survey might show a median salary of $85,000 for a data scientist in the San Francisco Bay Area.

This figure can be used as a crucial data point in your compensation strategy.

Impact of Economic Conditions on Compensation Decisions

Economic downturns and recessions often impact compensation decisions. Companies might freeze salaries or implement hiring freezes to manage costs. Conversely, periods of economic growth often lead to increased salary demands and a higher emphasis on compensation as a recruitment tool. During recessions, companies may prioritize retaining existing talent and reducing costs through measures like salary freezes or reduced benefits packages.

Conversely, economic booms can fuel a rise in demand for specific skills, pushing salaries upward in those sectors.

Researching and Analyzing Competitive Compensation Data

Thorough research is key to understanding competitive compensation practices. Start by identifying your target roles and corresponding job titles. Then, research industry-specific salary surveys. Consider geographical factors like cost of living adjustments. A good starting point is to collect data from multiple reputable sources, compare results, and identify any patterns or discrepancies.

Use a combination of online resources and direct interactions with industry experts.

Incorporating External Market Data into the Compensation Formula

Once you’ve gathered the data, you can integrate it into your compensation formula. A common approach is to use a combination of job evaluation, market data, and internal equity considerations. For instance, if the external market benchmark for a software engineer position is $90,000, your formula should reflect this, considering internal equity to ensure fairness within your organization.

The exact weighting of each component depends on your organization’s specific goals and circumstances. A possible formula would be:

Base Salary = (Market Benchmark

Internal Equity Factor) / 100

This illustrates a fundamental principle: external market data provides a crucial foundation for setting competitive salaries.

Internal Equity and Fairness

Building a compensation formula that truly works requires more than just market analysis. A crucial element often overlooked is internal equity – ensuring that compensation fairly reflects the value of different roles within the company. This isn’t just about being fair; it’s about fostering a motivated and engaged workforce. Employees who feel their contributions are undervalued are less likely to be productive and loyal.Internal equity goes beyond simply paying similar roles the same amount.

It considers the complexity of responsibilities, skill requirements, and the overall value a role brings to the organization. By establishing a clear and transparent framework for internal equity, companies can create a positive work environment where employees feel valued and motivated.

Importance of Internal Equity

Internal equity is paramount for maintaining a healthy and productive work environment. Employees who perceive their compensation as fair compared to their colleagues in similar or different roles are more likely to be engaged, motivated, and committed to their work. Conversely, perceived inequities can lead to resentment, decreased morale, and even higher turnover rates. A strong sense of internal equity fosters a culture of trust and respect within the organization.

Methods for Ensuring Fairness

Ensuring fairness in compensation across different roles requires a systematic approach. A key aspect is job evaluation, which assesses the relative worth of various positions based on factors like skill requirements, responsibility levels, and working conditions. This process should be transparent and well-documented, providing clear criteria for comparisons.Another essential method is regular review of compensation structures. The external market and internal roles evolve over time.

Regular assessments of compensation levels and adjustments based on market data and internal value ensure that the system remains fair and competitive.

Avoiding Internal Equity Discrepancies

Internal equity discrepancies often stem from a lack of consistent evaluation criteria. Without a well-defined framework for assessing roles, disparities can emerge, leading to employee dissatisfaction and potential legal challenges. Companies should implement clear job descriptions that Artikel the responsibilities and required skills for each position. Regular reviews of job descriptions and corresponding compensation structures are crucial for maintaining fairness.

Compensation Structures Promoting Internal Equity

Various compensation structures can be designed to promote internal equity. One approach is a tiered structure based on performance levels within a given role. Another is a system that incorporates merit increases and bonuses tied to specific contributions. Compensation should be tied to the value the role brings to the organization. Consideration should be given to factors such as the level of impact the employee has on the organization’s success.A bonus structure tied to company performance, where everyone shares in the success, can also foster a sense of collective equity.

Implementing these structures ensures that employees feel valued for their contributions.

Job Role Categorization for Fair Compensation Comparisons

A well-structured table helps visualize the different job roles and their corresponding compensation comparisons. The table below categorizes job roles within a hypothetical company, demonstrating a method for consistent evaluation. Each category reflects the skill level, responsibility, and value to the company.

| Job Role Category | Examples | Key Responsibilities | Compensation Band |

|---|---|---|---|

| Entry-Level | Junior Analyst, Customer Service Representative | Basic tasks, limited responsibility | $30,000 – $45,000 |

| Mid-Level | Senior Analyst, Team Lead | Increased responsibility, supervision | $45,000 – $70,000 |

| Senior-Level | Director, Manager | High level of responsibility, leadership | $70,000+ |

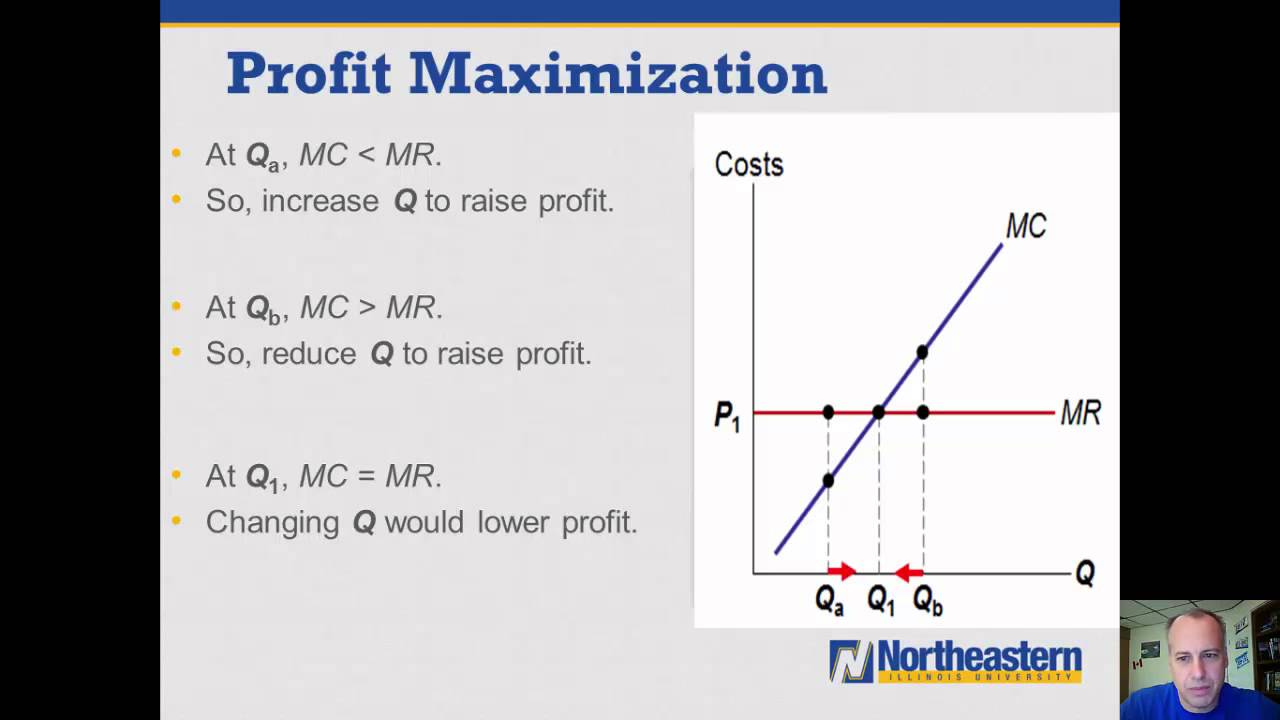

Performance-Based Adjustments

Linking compensation directly to performance is crucial for a fair and effective compensation system. It fosters a culture of accountability and rewards employees for exceeding expectations. This approach not only motivates individuals but also aligns their efforts with the company’s overall goals. A well-designed performance-based compensation system can drive significant improvements in productivity and efficiency.Performance evaluation methods and metrics should be carefully chosen to ensure they accurately reflect an employee’s contributions.

This necessitates a clear understanding of the desired outcomes and the specific roles within the organization. A transparent and consistent evaluation process builds trust and allows for constructive feedback, ultimately leading to improved performance over time.

Figuring out the perfect compensation formula—can it truly be achieved? It’s a constant balancing act, isn’t it? Luxury resorts like the Amanyara Turks and Caicos, with their recent renovations, amanyara turks and caicos renovations , demonstrate how meticulous planning and attention to detail can lead to something truly special. But translating that level of precision into a compensation structure is another beast entirely.

Perhaps the perfect formula isn’t one single equation, but a series of thoughtfully considered factors?

Performance Metrics and Their Corresponding Compensation Adjustments

Selecting appropriate performance metrics is essential to ensuring that compensation accurately reflects employee contributions. Metrics should be measurable, relevant to the job, and aligned with company objectives. These metrics should be clearly communicated to employees, enabling them to understand how their performance directly impacts their compensation.

- Sales Performance: For sales roles, metrics like revenue generated, number of deals closed, and customer acquisition rate are common. A commission structure tied to these metrics is a typical approach. For instance, a salesperson achieving 120% of their quota might receive a 10% bonus on their base salary. This incentivizes high performance and directly links compensation to sales targets.

- Project Completion: In project-based roles, metrics such as project completion on time and within budget, quality of deliverables, and positive client feedback are crucial. A bonus system tied to successful project completion and exceeding expectations can be implemented. For example, a project manager delivering a project ahead of schedule and under budget might receive a 5% bonus on their base salary.

- Customer Satisfaction: For roles involving customer interaction, metrics such as customer satisfaction scores, number of positive reviews, and reduction in customer complaints are important. A tiered bonus system based on customer satisfaction scores can be designed, where high scores translate to higher bonuses. For example, a customer service representative achieving a consistently high customer satisfaction rating might receive a 2% bonus for each rating point above the company average.

Trying to build the perfect compensation formula? It’s a tricky business, isn’t it? While the intricacies of compensation models are always evolving, the recent reopening of Amsterdam’s De l’Europe amsterdam s de l europe reopens reminds me that even in seemingly complex situations, there are often unexpected factors at play. Perhaps, like a well-curated museum reopening, a successful compensation strategy needs careful consideration of all aspects to truly resonate with its audience.

So, is the perfect compensation formula achievable? Maybe not, but it’s certainly worth striving for.

Types of Performance Evaluation Methods

Various performance evaluation methods exist, each with its own strengths and weaknesses. Understanding these methods helps organizations select the most appropriate one for their needs.

- 360-degree feedback: This method gathers feedback from multiple sources, including supervisors, peers, subordinates, and even clients. It provides a holistic view of an employee’s performance and allows for a more comprehensive understanding of their strengths and weaknesses. This feedback can then be used to design specific training programs or development opportunities to enhance performance.

- Management by Objectives (MBO): This method focuses on setting clear, measurable, achievable, relevant, and time-bound (SMART) objectives for employees. Performance is then evaluated based on the achievement of these objectives. This method promotes alignment between individual and organizational goals, leading to increased productivity.

- Competency-Based Assessments: This method evaluates employees based on specific competencies or skills required for their role. This approach focuses on the behaviors and skills necessary for success, rather than just output. It allows for a more comprehensive evaluation of an employee’s abilities and potential for growth.

Designing a System for Rewarding Exceptional Performance

Exceptional performance should be recognized and rewarded appropriately. A well-designed system encourages employees to strive for excellence. This can include not only monetary rewards but also non-monetary incentives like opportunities for professional development or recognition.

- Tiered Bonus Structure: Implementing a tiered bonus structure that progressively increases the reward for exceeding performance targets can motivate employees to consistently perform at a high level. This creates clear expectations and provides incentives for achieving exceptional results.

- Performance-Based Promotions: Linking promotions to demonstrably high performance creates a strong incentive for employees to develop their skills and take on greater responsibilities. This recognition for achievements creates a positive work environment.

- Recognition Programs: Creating a culture of recognition through formal and informal programs, like employee of the month awards or public acknowledgments, can foster a sense of appreciation and motivate employees to achieve excellence. This strengthens company culture and motivates exceptional performance.

Performance-Based Compensation Models

Different performance-based compensation models exist, each with its own characteristics. Choosing the right model depends on the specific needs and context of the organization.

| Model | Description |

|---|---|

| Commission | Compensation is directly tied to sales performance. |

| Piece-rate | Compensation is based on the number of units produced. |

| Profit Sharing | Compensation is tied to the company’s overall profitability. |

| Bonus | A one-time payment for exceeding performance targets. |

Non-Monetary Benefits

Crafting a truly effective compensation strategy requires looking beyond the paycheck. Non-monetary benefits, often overlooked, can significantly impact employee satisfaction, engagement, and retention. They offer a powerful tool for attracting and keeping top talent, contributing substantially to a positive work environment. These benefits are frequently as valuable as, or even more valuable than, monetary compensation, particularly in today’s competitive job market.Non-monetary benefits are increasingly recognized as crucial elements of a comprehensive compensation package.

They go beyond the immediate financial reward and address employee needs related to personal and professional growth, work-life balance, and overall well-being. Their inclusion can foster a stronger sense of appreciation and loyalty among employees, making them feel valued and supported.

Importance of Non-Monetary Benefits

Non-monetary benefits play a vital role in creating a positive and productive work environment. They can boost employee morale, reduce stress, and increase job satisfaction. Beyond these intangible benefits, well-designed non-monetary programs can enhance productivity and reduce employee turnover, resulting in long-term cost savings for the organization.

Examples of Valuable Non-Monetary Benefits

A diverse range of non-monetary benefits can enhance employee well-being. These benefits can be categorized into several key areas:

- Professional Development Opportunities: Offering training programs, mentorship opportunities, and conferences empowers employees to advance their skills and knowledge. This demonstrates a commitment to career growth, which is highly valued by many employees. Companies like Google and Amazon are known for extensive internal training programs, fostering a culture of continuous learning and development.

- Work-Life Balance Initiatives: Flexible work arrangements, generous vacation time, and wellness programs address the importance of personal time. These benefits directly impact employee stress levels and overall satisfaction. For example, many tech companies now offer remote work options or compressed workweeks to accommodate employee needs.

- Recognition and Appreciation Programs: Public acknowledgment of achievements, employee-of-the-month programs, and personalized thank-you notes foster a sense of accomplishment and belonging. This is a cost-effective way to demonstrate appreciation and boost employee morale.

- Health and Wellness Programs: On-site gym facilities, subsidized health insurance premiums, and stress management workshops promote physical and mental well-being. These benefits can significantly impact an employee’s quality of life and productivity.

- Company Culture and Social Activities: Team-building events, social gatherings, and opportunities for collaboration foster a positive and supportive work environment. These activities can strengthen relationships, enhance communication, and build a strong sense of community among employees.

Incorporating Non-Monetary Benefits into Compensation Strategy

Integrating non-monetary benefits into the overall compensation strategy requires careful planning and alignment with company values and employee needs. This involves conducting surveys to understand employee preferences, identifying suitable programs, and allocating resources effectively. Companies should prioritize benefits that align with their culture and employee base, ensuring they are perceived as valuable and meaningful.

Assessing the Value of Non-Monetary Benefits

Quantifying the value of non-monetary benefits is complex, but crucial for effective compensation planning. It often involves assessing the cost of the benefit against the potential return in terms of employee satisfaction, retention, and productivity. One approach is to compare the cost of the benefit to the cost of replacing an employee who leaves the company. The potential savings from reduced turnover can be a significant factor in evaluating the value of a non-monetary benefit.

Cost and Value Comparison of Non-Monetary Benefits

A table outlining the costs and perceived value of various non-monetary benefits can provide a practical framework for decision-making:

| Benefit | Estimated Cost (per employee/year) | Estimated Value (per employee/year) | Justification |

|---|---|---|---|

| Flexible Work Arrangements | $0 – $500 | $1000 – $3000 | Reduced stress, improved work-life balance, increased productivity |

| Professional Development Courses | $500 – $2000 | $1500 – $5000 | Enhanced skills, increased employee knowledge, improved job performance |

| Wellness Program (Gym Membership) | $200 – $500 | $500 – $1500 | Improved physical and mental health, reduced health care costs |

| Employee Recognition Program | $50 – $200 | $200 – $1000 | Increased morale, sense of appreciation, improved team cohesion |

| Company Social Events | $100 – $500 | $200 – $1000 | Improved team spirit, stronger relationships, increased employee engagement |

Note: Costs and values are estimates and can vary significantly based on specific program details and employee demographics.

Flexibility and Adaptability

Crafting a truly effective compensation formula requires more than just a static set of rules. A modern approach must embrace flexibility and adaptability, acknowledging the ever-shifting landscape of the job market and the diverse needs of today’s workforce. Compensation strategies must be agile enough to respond to changing economic conditions, employee preferences, and performance fluctuations.A well-designed compensation structure is not a one-time creation but a living document that requires ongoing refinement.

Figuring out the perfect compensation formula—can it truly be achieved? It’s a complex puzzle, isn’t it? Perhaps the answer lies in inspiration, like the talent on display at the academy kicks off 58th artists of hawaii exhibit. Observing how artists find their unique value propositions might offer clues to crafting a compensation structure that truly resonates with employees.

Ultimately, it’s a balancing act, not a formula, but it’s a fascinating journey to explore.

The formula needs to adapt to changing market realities and employee needs, and a regular review process is essential to maintain its effectiveness and relevance. This ensures the compensation strategy remains competitive and fair, preventing it from becoming outdated or misaligned with the company’s goals.

Designing a Responsive Compensation Formula

A compensation formula that can adapt to changing conditions must be built with flexibility in mind. This involves incorporating mechanisms that allow for adjustments based on various factors, such as performance reviews, market fluctuations, and employee development needs.

Adapting to Market Fluctuations

Regular market research is crucial for maintaining competitiveness. The formula should include a mechanism for periodic review and adjustment. For example, if a particular skill set becomes more valuable in the market, the formula should allow for a corresponding increase in compensation for employees possessing that skill. Similarly, during economic downturns, adjustments could be made to reduce costs without compromising employee morale or impacting long-term value.

Integrating Employee Needs

Flexibility extends to the employee’s needs as well. A compensation structure should offer various options, including flexible work arrangements. This allows employees to tailor their compensation packages to their unique situations. This could involve options like compressed workweeks, remote work allowances, or flexible benefits packages.

Example of Flexible Compensation Options

- Performance-based bonuses: These allow for a direct link between performance and compensation, rewarding employees for exceeding expectations. The formula can be adjusted to reflect different performance metrics, allowing for customization.

- Skill-based pay: This system recognizes the value of employees’ specific skills. As employees acquire new skills, their compensation can increase accordingly. The formula can be designed to track skill development and reflect the market value of those skills.

- Flexible benefits packages: These packages offer employees a choice of benefits that best suit their needs. The compensation formula can include a pre-determined budget for flexible benefits, allowing employees to customize their package.

Regular Review and Adjustment

A static compensation formula will quickly become outdated and ineffective. Regular reviews are essential for maintaining alignment with the company’s strategic goals, the needs of its employees, and the overall market. The frequency of reviews will vary depending on the specific industry and company dynamics. But the key is to have a schedule for review and modification that ensures the formula’s ongoing relevance.

Examples of Review Criteria

- Market analysis: Periodic reviews of the current market rates for similar roles and skills are essential for ensuring the formula remains competitive. Regular surveys and analysis will help identify trends and adjustments.

- Employee feedback: Gathering feedback from employees regarding their satisfaction with the compensation structure provides valuable insights into potential areas for improvement. Employee surveys, focus groups, and informal discussions can reveal areas where the formula needs modification.

- Company performance: The compensation formula should align with the company’s overall financial health and performance. If the company is experiencing a downturn, adjustments might be necessary to ensure the formula is sustainable.

Implementing Flexible Work Arrangements

Flexible work arrangements are increasingly important for attracting and retaining talent. Compensation structures should be designed to accommodate these arrangements. This might involve adjustments to base salary or the inclusion of allowances for remote work equipment, internet access, or other expenses related to a flexible work environment. For example, a company might offer a remote work stipend for employees who choose to work from home, while adjusting the base salary to reflect this benefit.

Final Wrap-Up

In conclusion, while achieving a truly “perfect” compensation formula might be an elusive ideal, creating a system that fosters employee satisfaction, motivation, and performance is achievable. By considering the intricate interplay of individual needs, market factors, internal equity, and performance-based adjustments, companies can build a compensation strategy that effectively attracts, retains, and motivates their workforce. The key lies in continuous evaluation, adaptation, and a commitment to fairness and transparency.

FAQ

What are some common pitfalls in creating a compensation structure?

Ignoring external market data, failing to maintain internal equity across roles, and not incorporating performance-based adjustments can lead to employee dissatisfaction and decreased motivation.

How can I ensure fairness in compensation across different roles?

Thoroughly analyzing job responsibilities, skills, and experience levels for each role, and comparing them against market benchmarks, is essential for creating a fair compensation structure. Using a standardized evaluation method for all positions can help.

What is the role of non-monetary benefits in a compensation package?

Non-monetary benefits, like flexible work arrangements, professional development opportunities, and company culture, contribute significantly to employee well-being and overall job satisfaction. They often have a high value beyond their direct financial cost.

How can I adjust compensation based on performance fluctuations?

Implementing a transparent performance evaluation system that links specific performance metrics to compensation adjustments is crucial. This approach should be clearly communicated to employees, and adjusted periodically.