Beware the Tax Collectors A Historical Look

Beware the tax collectors – a phrase that resonates through history, reflecting the complex relationship between governments and their citizens. This exploration delves into the historical context, religious and moral implications, cultural interpretations, and modern significance of this often-fraught relationship. From ancient Egypt to modern democracies, we’ll examine how societies have viewed and interacted with tax collectors throughout time.

The historical perspective reveals the evolution of tax collection methods and the shifting societal attitudes toward those tasked with collecting taxes. We’ll examine how religious beliefs and cultural norms shaped these attitudes, and how these perceptions continue to influence our understanding of taxation today.

Historical Context: Beware The Tax Collectors

From the earliest civilizations to the modern world, the concept of taxation has been a fundamental aspect of governance. It’s a complex interplay between the state’s need for resources and the citizen’s obligation, often fraught with tension and evolving practices. This historical overview delves into the fascinating evolution of taxation, exploring its various forms, societal perceptions, and the roles of tax collectors across different eras.Understanding the historical context of taxation provides crucial insight into the development of modern fiscal systems.

It reveals how societal attitudes towards taxation have shifted over time, influenced by economic realities, political structures, and philosophical viewpoints. The evolution of tax collection methods, from rudimentary systems to sophisticated bureaucracies, offers valuable lessons for policymakers and citizens alike.

While we should always be mindful of tax collectors, sometimes it’s good to appreciate the sheer scale of investments, like the recent 40m investment that’s given a whole new lease on life to the Ritz-Carlton St Thomas. a 40m investment buys a rebirth at ritz carlton st thomas It’s a reminder that huge sums can create something truly special, though it’s still crucial to keep a watchful eye on those tax implications, no matter the size of the project.

Ancient Egypt

Taxation in ancient Egypt was intricately tied to the Nile’s flooding cycle and agricultural yields. The pharaoh, as the supreme ruler, levied taxes on various aspects of life, including agricultural produce, livestock, and crafts. These taxes were essential for funding public works, maintaining the infrastructure, and supporting the elaborate religious ceremonies that underpinned Egyptian society. Collection methods were often tied to local officials who had direct oversight of the population and their resources.

Medieval Europe

The medieval European system of taxation was far less centralized compared to ancient Egypt. Feudal structures meant that taxes were often collected by local lords and rulers, who frequently kept a significant portion for themselves. These levies were primarily on agricultural output and trade, with variations depending on the region and the ruling power. The methods of collection varied widely, from direct payment to mandated labor services, often reflecting the complex and decentralized political landscape.

Table: Societal Attitudes Towards Tax Collectors

| Era | Societal Attitudes | Methods of Collection |

|---|---|---|

| Ancient Egypt | Generally viewed as necessary for the functioning of society, though potentially subject to abuse by corrupt officials. | Often tied to local officials overseeing agricultural production. Records and assessments were likely kept. |

| Medieval Europe | Mixed attitudes. Tax collectors were sometimes seen as agents of the ruling class, and potentially viewed with suspicion or hostility, especially when seen as overly demanding or corrupt. | Varied widely. Direct payment, labor services, and various forms of trade levies were common. There was likely less centralized record keeping compared to later eras. |

| Colonial America | Resistance to taxation without representation became a rallying cry, particularly in the lead-up to the American Revolution. The perception of fairness and the right to consent to taxation was paramount. | Taxes were levied by the British Crown and collected through appointed colonial officials. Methods included duties on imported goods and land taxes. |

| 20th Century | Modern tax systems are generally viewed as necessary for public services, though debates around fairness, transparency, and efficiency persist. | Highly developed and sophisticated systems with centralized record-keeping and various tax forms. Tax collectors work for government agencies and follow established procedures. |

Colonial America

Taxation in colonial America was a significant point of contention. The colonists, largely accustomed to self-governance, viewed the taxes imposed by the British Crown as unjust, particularly those levied without direct representation in Parliament. The Stamp Act, for example, sparked widespread protests and resistance. The concept of “taxation without representation” became a rallying cry for the colonists and contributed to the growing tensions that ultimately led to the American Revolution.

20th Century

The 20th century witnessed the development of increasingly complex tax systems, often designed to fund large-scale public projects and social programs. The role of the tax collector evolved into a specialized profession, with greater emphasis on efficiency, transparency, and accountability. The methods of tax collection became more sophisticated, incorporating technology and data analysis to streamline processes and reduce potential fraud.

Religious and Moral Implications

Religion has profoundly shaped human societies, including their attitudes toward taxation. From ancient times to the present, religious doctrines have offered frameworks for understanding the ethical dimensions of collecting and paying taxes. These frameworks often intertwine with societal values and power structures, influencing not only individual actions but also the very concept of governance.Religious beliefs frequently prescribe moral obligations regarding wealth and its distribution, which naturally impact the perception of taxation.

The notion of a just society, often a central tenet of religious thought, influences how individuals and communities view the role of government and the legitimacy of its financial demands. This complex relationship is critical to understanding the historical and ongoing tensions surrounding taxation.

Religious Perspectives on Taxation

Religious traditions offer diverse perspectives on taxation, often reflecting their unique understanding of societal roles, individual responsibility, and the relationship between the divine and the earthly realm. These perspectives frequently address not only the legitimacy of taxation but also the ethical responsibilities of both the tax collector and the taxpayer.

Moral Arguments for Taxation

Proponents of taxation, from a religious perspective, often frame it as a moral imperative. Taxation can be seen as a means of supporting the common good, ensuring social welfare, and promoting the well-being of the community. This argument is frequently linked to concepts of charity, communal responsibility, and the obligation to contribute to the greater good, a cornerstone of many faiths.

For instance, the concept of “tithes” in many religions embodies this principle of contributing a portion of one’s wealth for communal purposes.

Moral Arguments Against Taxation

Conversely, arguments against taxation from a religious standpoint often center on individual rights, property ownership, and the potential for government abuse. Some religious traditions emphasize individual autonomy and the sanctity of private property, viewing taxation as a potential infringement on these fundamental rights. Concerns about the potential for corruption and misallocation of funds by governing bodies also play a role in such opposition.

These arguments often highlight the importance of responsible governance and accountability in the use of collected funds.

Examples of Religious Texts and Figures on Taxation

Various religious texts and figures have addressed the issue of taxation. The Bible, for example, contains passages discussing the obligation to pay taxes to the governing authorities. Different interpretations of these passages exist, with some emphasizing the duty to obey legitimate authority and others emphasizing the need for just and equitable governance. Similarly, Islamic jurisprudence (Sharia) has detailed rules regarding taxation and the use of public funds, emphasizing the importance of fairness and accountability in the financial dealings of the state.

Always be mindful of potential tax implications, especially when big travel deals like the American Queen Voyages’ partnership with the Rocky Mountaineer are involved. This exciting collaboration offers incredible adventure opportunities, but understanding the tax implications of such trips is crucial. Don’t get caught off guard; thoroughly research the potential tax deductions and responsibilities associated with your travel plans, as tax collectors are always watching! american queen voyages rocky mountaineer partnership is worth checking out for those seeking a luxurious journey.

The Quran contains verses that touch upon the importance of Zakat, a form of obligatory charity, which could be seen as an aspect of taxation in some interpretations.

Theological Perspectives on the Responsibilities of the Tax Collector

Theological perspectives on the role of the tax collector vary significantly. Some religious traditions view tax collectors as essential members of society, responsible for collecting revenue for public works and services. Others may view them with suspicion or condemnation, particularly if their actions are perceived as exploitative or unjust. This difference in perspective highlights the complexities of interpreting religious teachings in a practical context.

Emergence of “Beware the Tax Collector”

The phrase “beware the tax collector” likely emerged from a combination of social and religious factors. Public perception of tax collectors could vary greatly, depending on the fairness and efficiency of the tax system in place. In some contexts, tax collectors might be seen as corrupt, oppressive, or exploitative. In contrast, in other societies, they could be seen as neutral or even benevolent agents of the state.

Religious perspectives certainly influenced these varying perceptions, adding moral dimensions to the image of the tax collector.

Contrasting Religious Perspectives on Taxation

| Religion | Perspective on Taxation | Role of Tax Collector |

|---|---|---|

| Christianity | Generally supports taxation as a necessary function of government, but emphasizes just and equitable governance. Various interpretations exist, some emphasizing obedience to authority, others advocating for social justice and the use of tax revenue for the common good. | Tax collectors’ roles are viewed with varying degrees of suspicion or acceptance depending on their conduct and the perceived fairness of the tax system. Some religious figures and texts critique the exploitative aspects of taxation, while others emphasize the importance of responsible governance and the legitimate function of tax collection. |

| Islam | Islamic jurisprudence (Sharia) provides detailed rules on taxation, emphasizing fairness and accountability in the collection and use of public funds. Zakat, a form of obligatory charity, is often discussed in the context of taxation. | Tax collectors are expected to be just and accountable, upholding the principles of fairness and equity. Their role is considered crucial in supporting the public good and ensuring the proper distribution of wealth. |

| Hinduism | Hinduism emphasizes dharma (righteousness) in all aspects of life, including taxation. Taxation can be viewed as a means to support societal needs and maintain order. The concept of ‘yajna’ (sacrifice) and ‘daan’ (charity) are also relevant. | Tax collectors are expected to uphold dharma in their duties, ensuring fairness and transparency in the collection and distribution of taxes. Their actions should align with the principles of righteousness and societal well-being. |

Cultural Interpretations

Taxation, a fundamental aspect of societal organization, has been viewed through diverse cultural lenses. Across history and geography, attitudes towards taxation and the figures tasked with collecting it have varied significantly. These variations reflect deep-seated beliefs, economic realities, and power dynamics within different societies. This exploration delves into the rich tapestry of cultural perceptions surrounding tax collectors, examining how these perceptions shaped the concept of “beware the tax collector.”Cultural interpretations of taxation and tax collectors are deeply intertwined with the specific historical, economic, and social structures of a given society.

The perception of a tax collector as a necessary evil, a corrupt official, or a symbol of state power is often a reflection of the broader social and political landscape. This complex interplay of factors will be examined through the lens of specific cultural contexts.

Cultural Variations in Attitudes Towards Taxation

Different cultures have developed distinct attitudes towards taxation. In some societies, taxation is viewed as a crucial component of maintaining public infrastructure and providing social services, while in others, it is seen as an infringement on individual liberties or a tool for oppression. These contrasting views stem from differing philosophies about the role of the state and the distribution of resources.

For instance, some cultures emphasize communal responsibility and collective well-being, leading to a more accepting view of taxation as a necessary contribution to the common good.

Cultural Perceptions of Tax Collectors

Tax collectors, as intermediaries between the state and its citizens, often hold a complex position in various cultures. In some, they are seen as neutral agents of the state, responsible for collecting taxes according to established rules. In others, they are viewed with suspicion and distrust, perceived as corrupt, exploitative, or even agents of oppression. These contrasting perceptions are often rooted in the historical relationship between the state and its citizens.

Examples of Cultural Expressions Reflecting Views on Tax Collectors

Cultural expressions, such as literature, art, and folklore, often reflect the prevailing attitudes towards tax collectors. For example, in some ancient Greek tragedies, tax collectors might be portrayed as greedy and unscrupulous figures, highlighting the anxieties surrounding taxation. Similarly, in some African proverbs, tax collectors might be depicted as oppressive figures, emphasizing the struggle against unjust taxation. This suggests that cultural narratives often serve as a form of social commentary, reflecting and shaping perceptions of tax collectors.

How Cultural Narratives Shape the Concept of ‘Beware the Tax Collector’

Cultural narratives play a crucial role in shaping the concept of “beware the tax collector.” By portraying tax collectors in negative light, these narratives warn citizens about the potential for exploitation and abuse. This cautionary tale often reinforces social anxieties about power imbalances and the potential for corruption. Stories, myths, and legends can perpetuate negative stereotypes, influencing the way individuals perceive tax collectors for generations.

Comparison and Contrast of Cultural Interpretations of Tax Collectors

| Culture | Perception of Tax Collector | Motivations |

|---|---|---|

| Ancient Greece | Often depicted as greedy and unscrupulous, potentially exploiting the populace. Sometimes seen as agents of a powerful state. | Personal gain, maintaining the state’s resources, or potentially fulfilling an obligation to the state. |

| Medieval Japan | Likely viewed through a more nuanced lens, potentially influenced by the feudal system and the role of the shogunate. Might have been seen as part of a complex system of governance. | Collecting taxes for the shogunate, potentially seen as upholding social order, or fulfilling an obligation within the feudal hierarchy. |

| Modern Africa | Varying perceptions depending on the specific country and region. Might be seen as corrupt, exploitative, or as essential for maintaining state functions. | Personal gain, maintaining state functions, or potentially fulfilling an obligation to the state. The context of corruption and varying levels of government efficiency influence perceptions. |

Modern Significance

The ancient adage “beware the tax collector” transcends its historical context and retains potent relevance in the modern world. While the methods of taxation have evolved significantly, the underlying principle—the potential for exploitation and abuse of power in the collection of taxes—remains a crucial concern. The relationship between citizens and their governments, especially concerning financial obligations, is a dynamic interplay of trust, accountability, and scrutiny.The contemporary relevance of this cautionary tale extends far beyond simple financial matters.

While the saying “beware the tax collectors” might seem ancient, it’s a timeless truth. Planning a trip like the Avalon Alegria’s first call, avalon alegria first call , can easily get expensive, so make sure you factor in potential travel fees and understand all the fine print before booking. Always double-check those details and be prepared to handle any unexpected charges; beware the tax collectors, even in the world of travel.

It encompasses the broader ethical considerations of power, transparency, and the responsible management of public resources. Modern governments, despite their complexity, still face the challenge of balancing the needs of the populace with the necessity of collecting revenue. This dynamic is often fraught with complexities and potential for abuse.

Contemporary Relevance in Business

Businesses, too, encounter the modern equivalent of tax collectors. Regulatory bodies, compliance officers, and internal audit departments often act as gatekeepers of financial integrity. The pressure to minimize tax liabilities and maximize profits creates a tension that requires ethical navigation. Maintaining a strong ethical foundation, while pursuing financial goals, is crucial for long-term sustainability. Failing to comply with regulations, or engaging in aggressive tax avoidance, can have severe consequences for a company’s reputation and its bottom line.

Modern Implications in Economic Systems

The concept of “beware the tax collector” has modern implications across diverse economic systems. In free market economies, the fairness and efficiency of tax policies are critical to economic stability. Excessive or poorly designed taxation can stifle investment, discourage innovation, and ultimately hamper economic growth. Conversely, well-structured tax systems can fund vital public services, improve infrastructure, and promote a more equitable distribution of wealth.

Modern examples range from the complexities of international tax laws to the ongoing debate surrounding corporate tax rates.

Role of Tax Collectors in Modern Democracy

Tax collectors in modern democracies are crucial to the functioning of government. They are responsible for collecting revenue that supports essential public services, from education and healthcare to infrastructure and defense. Their actions directly impact the quality of life for citizens. Transparency, accountability, and adherence to legal frameworks are paramount to ensure that tax collection serves the public good.

Beware the tax collectors, they’re always lurking! But hey, sometimes a thrilling adventure like trying out the skydiving simulator at Anthem ( anthem a good sport with skydiving simulator ) can make you forget about those pesky tax forms. Still, remember, taxes are a necessary evil, so be prepared to pay your dues!

This necessitates a system of checks and balances to prevent abuses of power and ensure equitable distribution of the tax burden.

While enjoying the amazing sights of a new country, it’s always wise to be mindful of the local regulations, especially when it comes to taxes. Navigating the tax system in China can be tricky, but luckily, after my recent China sojourn, I’ve been enjoying a relaxing cruise on the Norwegian Joy, now updated for an Alaskan adventure. after china sojourn norwegian joy updated for alaska Of course, even on this beautiful cruise, you should always double-check to avoid any unexpected tax surprises back home.

Always be prepared and do your homework before any trip, as they say, “beware the tax collectors.”

Ethical Considerations Surrounding Tax Collection

Ethical considerations in modern tax collection are multifaceted. The pursuit of fairness and equity requires governments to consider the diverse economic situations of their citizens. Tax policies should aim to balance the need for revenue with the need to minimize the financial burden on individuals and businesses. Tax collection practices should prioritize transparency and accountability to build public trust.

Issues of corruption, fraud, and inequitable tax burdens remain persistent challenges that require vigilant monitoring and robust legal frameworks.

Table: Modern Application of “Beware the Tax Collector”

| Modern Issue | Relevance to ‘Beware’ | Explanation |

|---|---|---|

| Tax Evasion | High | Tax evasion undermines the integrity of the tax system, leading to a loss of public revenue and a perception of unfairness. It can also erode public trust in the government. |

| Tax Reform | Moderate | Tax reform necessitates careful consideration of the potential impact on various segments of society. Reform efforts must strive to create a system that is both efficient and equitable. |

| Tax Compliance | High | Maintaining robust tax compliance systems is vital for ensuring transparency and accountability in government operations. These systems must be clear, accessible, and effectively enforced to deter non-compliance. |

Literary and Artistic Representations

Tax collectors, figures often viewed with suspicion and disdain throughout history, have been consistently portrayed in literature and art. Their roles, responsibilities, and perceived morality have shaped how these characters are depicted, offering insights into societal values and economic structures of different eras. From the biting satire of ancient texts to the nuanced portrayals in modern works, the image of the tax collector reflects the complexities of human nature and the enduring tension between the state and its citizens.The portrayal of tax collectors in literature and art often serves as a reflection of prevailing societal views.

These depictions reveal not only the practical functions of tax collection but also the moral and social implications associated with the role. Works often highlight the collectors’ interactions with the community, illustrating the power dynamics, social hierarchies, and economic conditions of the time.

Portrayal in Literature

Literary works frequently use tax collectors as a vehicle to explore various themes. The characters often embody the struggles of the common people under oppressive tax systems, and sometimes, they are presented as corrupt individuals. This portrayal can range from outright condemnation to more nuanced perspectives, reflecting the changing attitudes towards taxation and governance throughout history.

- Ancient Greek and Roman literature frequently depicts tax collectors as greedy and exploitative figures. Plays and poems often use these characters to satirize the abuses of power and the harsh realities of taxation.

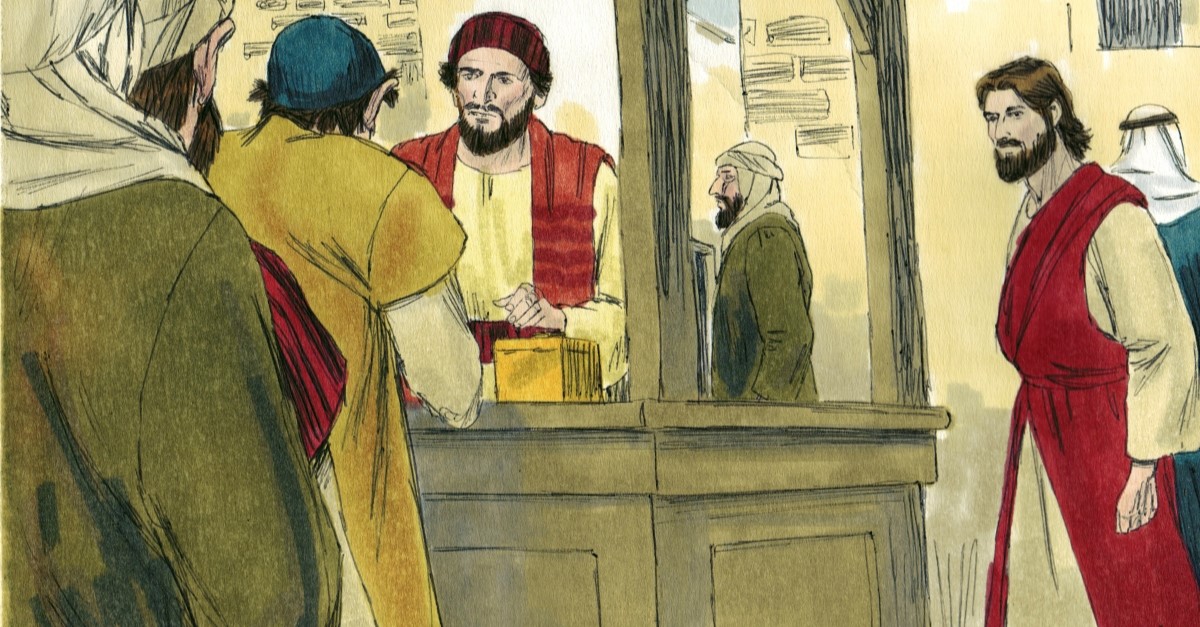

- In the Bible, tax collectors are often portrayed as morally compromised, highlighting the social stigma associated with their profession. The parable of the publican and the Pharisee, for example, contrasts the humble repentance of the tax collector with the self-righteousness of the Pharisee.

- During the Renaissance and Baroque periods, literature often explored the conflict between individual greed and the demands of the state. Tax collectors were frequently portrayed as figures who exploited their position for personal gain, reflecting the societal concerns about corruption and inequality.

- In modern literature, tax collectors are sometimes presented as sympathetic characters grappling with the moral dilemmas of their profession. Their motivations and experiences are explored in a more nuanced way, often reflecting the evolving understanding of the tax system and its impact on society.

Recurring Themes

The recurring themes in literary depictions of tax collectors include greed, corruption, exploitation, and social inequality. However, depictions have also reflected evolving societal views on taxation, illustrating the tension between the state’s need for revenue and the citizen’s desire for fair treatment. These themes are often interwoven with broader political and economic contexts.

Examples of Literary Works, Beware the tax collectors

Examples of literary works featuring tax collectors include:

- Plays by Aristophanes and Plautus in ancient Greece and Rome.

- The Bible (Parables of the Publican and the Pharisee).

- Shakespeare’s plays (e.g., characters representing tax officials or collectors).

- Works by Charles Dickens (e.g., depicting the impact of taxes on the poor in Victorian England).

Artistic Representations

Artistic representations of tax collectors, particularly in paintings and sculptures, often reflect the social and political climate of the time. They frequently portray the collectors in a way that conveys their perceived role in society, from corrupt and oppressive figures to more neutral or even sympathetic individuals. Symbolic meanings associated with tax collectors can range from greed and exploitation to the necessity of state revenue.

Examples of Artistic Representations

- Many Renaissance paintings depict tax collectors in a somewhat negative light, often emphasizing their wealth or greed.

- Sculptures, particularly from historical periods, might depict tax collectors as part of a larger group or scene related to government or commerce.

Table of Common Themes

Epilogue

Ultimately, the phrase “beware the tax collectors” serves as a potent reminder of the power dynamics inherent in taxation. From ancient societies to modern times, the collection of taxes has always been a complex issue, influencing societal structures and individual perceptions. This discussion highlights the enduring importance of this relationship and the ongoing need for ethical and effective tax systems.

Essential FAQs

What are some common methods of tax collection throughout history?

Tax collection methods have varied greatly across different eras and cultures. In ancient times, methods could include direct levies, tithes, and even labor services. Later, more formalized systems emerged, involving records, assessments, and various forms of payment.

How has religion influenced views on taxation?

Religious perspectives on taxation have often shaped societal attitudes. Some religions have viewed taxes as a necessary contribution to the common good, while others have viewed them with suspicion or even opposition, particularly when the collection methods were seen as unfair or exploitative.

How does the concept of “beware the tax collector” apply to modern tax evasion?

In modern times, the phrase highlights the potential for abuse of power and the importance of transparency and accountability in tax collection. Tax evasion, for example, illustrates a distrust of the system and the potential for corruption, directly reflecting the historical concerns.