Bankers Take Possession of World Discoverer

Bankers take possession of world discoverer, a chilling scenario where financial institutions seize control of groundbreaking innovations. Imagine a future where the fruits of human ingenuity, from revolutionary medical breakthroughs to transformative technologies, are leveraged for profit by powerful banking interests. This exploration delves into the historical precedents, potential interpretations, financial implications, and societal impacts of such a dystopian event.

What would happen if the very discoveries that promise a better future are controlled by those driven by financial gain?

This article examines the potential consequences of this scenario, exploring the possible motivations behind such actions and the intricate web of financial transactions that could lead to this outcome. We’ll also consider the ethical implications and potential societal upheavals.

Historical Context

The phrase “bankers take possession of world discoverer” evokes a chilling image of financial power eclipsing innovation. This scenario isn’t entirely fictional; history is replete with instances where powerful entities, often financial institutions, have exerted control over groundbreaking discoveries and inventions, shaping their applications and ultimately, societal trajectory. Understanding these historical precedents provides a crucial lens through which to examine the potential implications of such a scenario in the modern era.Powerful entities have consistently sought to control resources and advancements, from the spice trade to the industrial revolution.

While bankers taking over the world’s discoverer is certainly a fascinating development, it’s a stark contrast to the positive news of Alamo opening its second Waikiki location. This expansion, as detailed in alamo opens second waikiki location , speaks volumes about the ongoing growth of the travel industry. Regardless of the global financial maneuvering, the desire for travel and exploration still remains strong.

This new location, I imagine, will be quite popular, adding another layer to the story of bankers taking possession of world discoverer.

Their motivations range from profit maximization to geopolitical dominance. Methods employed have varied from subtle manipulation to outright acquisition, often leveraging their financial clout to influence the very course of technological and scientific progress. This historical pattern, characterized by the interplay of financial interests and technological advancement, is critical to understanding the potential implications of the modern scenario.

Historical Examples of Control Over Discoveries

The historical record reveals numerous instances where powerful individuals or institutions wielded significant influence over key discoveries. The spice trade, for example, was dominated by powerful trading companies like the Dutch East India Company, which leveraged their financial resources to control the supply chains and prices of valuable spices. This control had profound societal impact, shaping global trade routes and economies.

Similarly, the industrial revolution saw powerful industrialists, often with strong financial backing, gain control over crucial innovations like the steam engine and textile machinery. These examples highlight a recurring pattern of financial power influencing technological development and societal structure.

Motivations and Methods

Several key motivations drove the control over discoveries in the past. Profit maximization was a primary driver, as demonstrated by the spice trade control. The desire for geopolitical advantage also played a significant role, with powerful nations seeking to control crucial resources and technologies. The methods employed often included strategic investments, acquisitions of patents, and even the suppression of competing technologies.

While bankers taking over the world’s latest discoverer is certainly a head-scratcher, it’s interesting to see how this news links to the recent opening of the Alohilani Waikiki Beach resort. A stunning new addition to the Waikiki scene, alohilani waikiki beach makes its opening official , and perhaps the financial backing behind such a project might shed some light on the larger implications of these bankers’ acquisitions.

Still, the whole world discoverer thing is rather intriguing, no?

For instance, the control of crucial technologies, like the steam engine, was secured through investments, patents, and even the suppression of rival inventions. This pattern of control and influence was repeated in the early development of electricity, where powerful industrialists often held patents and controlled the distribution networks.

Comparison with the Modern Context

The modern context presents similar dynamics. While the specific mechanisms might differ, the underlying motivations—profit, power, and control—remain consistent. The global financial system’s interconnectedness and the increasing importance of intellectual property rights create new avenues for financial institutions to exert influence over innovations. For example, pharmaceutical companies control research and development through their significant financial resources, impacting the accessibility and affordability of life-saving treatments.

The intersection of financial interests and technological advancement continues to shape the modern landscape.

Potential Parallels with “Bankers Take Possession”

The phrase “bankers take possession of world discoverer” suggests a potential scenario where financial institutions wield disproportionate influence over the development and application of crucial discoveries, potentially stifling innovation and progress. This scenario could be a result of strategic investments in promising technologies, control over crucial resources, or even through influencing research agendas. The historical precedents suggest that such control could lead to reduced accessibility, price gouging, and potentially limited public benefit from the advancements.

Societal Impact of Historical Precedents

The historical precedents of powerful entities controlling discoveries have had a profound and multifaceted societal impact. Sometimes, this control has led to increased efficiency and innovation, driving economic growth. However, it has also resulted in disparities in access to resources, limitations on competition, and, in some cases, social unrest. The historical control of crucial resources, like oil, has led to geopolitical conflicts and economic imbalances.

These impacts demonstrate the complex relationship between economic power, technological advancement, and societal well-being.

Table: Historical Figures and Institutions Involved

| Date | Location | Figures/Institutions | Outcome |

|---|---|---|---|

| 1600s | Europe, Asia | Dutch East India Company | Control over spice trade, shaping global trade routes |

| 1700s-1800s | Europe, North America | Industrialists (e.g., Carnegie, Rockefeller) | Control over key industrial technologies, leading to economic growth but also wealth disparities |

| Late 1800s-1900s | United States | Pharmaceutical Companies | Control over research and development in medicine, impacting accessibility and affordability of treatments |

Possible Interpretations

The phrase “bankers take possession of world discoverer” evokes a sense of profound power shift, suggesting a transition of control from the hands of those who explore and discover to those who manage and manipulate financial resources. This potent image invites exploration into the symbolic meaning behind the phrase, potentially revealing societal anxieties and hopes regarding the influence of finance in shaping global events.

It’s a statement that invites interpretation on multiple levels, from the literal to the metaphorical, and from the immediate to the long-term.The phrase implicitly criticizes or praises the growing influence of financial institutions. It may signify a loss of autonomy for individuals or nations, or it might represent a necessary evolution of the global economy. It’s a potent statement that needs careful unpacking to understand its full impact.

So, bankers taking over the world’s discoverer is a pretty big deal, right? It’s got me thinking about the impact on tourism, especially in places like Alaska. With the Alaska cruise tax proposal back on the docket, it’s a significant factor in how this whole situation might play out. I wonder how the financial implications of this will ultimately affect the future of exploration and adventure, as the bankers’ control expands.

It’s quite a complex web.

Interpretations of “Bankers Take Possession of World Discoverer”

This phrase offers numerous layers of meaning, encompassing both literal and metaphorical interpretations. It’s a potent image that can be interpreted in several ways, all of which highlight the tension between economic power and societal progress.

| Interpretation | Explanation |

|---|---|

| Literal Interpretation | This interpretation focuses on the direct meaning of the words. It could refer to a specific historical event where bankers gained control over a country’s resources or a corporation that discovered a valuable resource. This is unlikely to be the primary meaning, as it lacks the symbolic weight of the phrase. |

| Metaphorical Interpretation: Economic Control | This interpretation suggests a broader, more abstract meaning. It signifies the growing influence of financial institutions over the world’s resources and the development of economies. This interpretation may highlight the concern that financial interests are increasingly dominating global affairs, potentially overshadowing other forms of progress and discovery. |

| Allegorical Interpretation: Loss of Autonomy | The phrase might serve as an allegory for the erosion of individual or national autonomy. It could represent the idea that powerful financial institutions are gradually taking control of decision-making processes, diminishing the power of individuals and governments. This interpretation focuses on the power dynamics involved and the perceived loss of control. |

| Symbolic Interpretation: The Shift in Power | The phrase symbolizes a paradigm shift, a transition in the balance of power from the traditional realms of exploration and discovery to the realm of finance. This interpretation underscores the growing significance of financial capital in the modern world, and the possible consequences of this shift in the global landscape. |

| Critique of Capitalism | This interpretation views the phrase as a critique of unchecked capitalism. It suggests that the pursuit of financial gain is overriding other societal values, such as scientific advancement, social progress, and environmental sustainability. This interpretation links the phrase to broader criticisms of the economic system. |

Political and Economic Implications

The phrase “bankers take possession of world discoverer” has profound political and economic implications. The possible consequences of this phenomenon range from increased economic instability to the stifling of innovation and societal progress.The potential for economic instability arises from the concentration of financial power in the hands of a few. This could lead to policies that favor short-term financial gains over long-term societal well-being.

This can lead to systemic risk, impacting many nations.The phrase also highlights potential conflicts between the interests of financial institutions and the needs of societies. This could manifest in policies that prioritize profit over social justice, environmental protection, or other crucial aspects of human well-being.Furthermore, the phrase raises concerns about the potential for financial institutions to stifle innovation and societal progress.

The focus on financial returns could discourage investment in fields like scientific research, education, or the arts. This can create a vicious cycle where the focus on short-term gains may impede long-term growth.

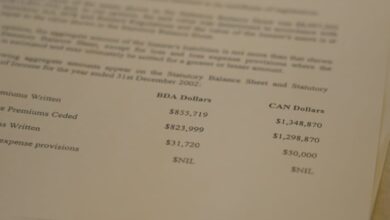

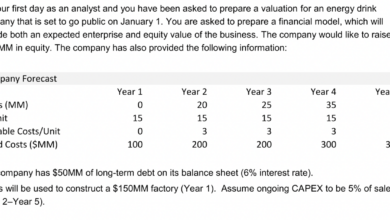

Financial Implications: Bankers Take Possession Of World Discoverer

The potential acquisition of a world discoverer by financial institutions presents a complex web of financial implications. This isn’t merely about buying a piece of land; it’s about controlling access to knowledge, resources, and potentially, the future itself. The financial mechanisms involved would be unprecedented, demanding innovative approaches to valuation, risk assessment, and profit generation.The inherent value of such a discovery extends far beyond its immediate material implications.

It opens doors to unprecedented technological advancements, altering the global landscape and impacting everything from energy production to communication systems. Understanding the financial ramifications requires a nuanced perspective, considering not just the tangible assets but also the intangible potential.

Financial Mechanisms for Acquisition

Financial institutions might utilize a variety of strategies to gain control of a world discoverer. These could include strategic acquisitions of related companies, partnerships with research institutions, or even large-scale public offerings of shares in a newly formed entity focused on exploiting the discoverer’s work. The intricate nature of the discovery itself may necessitate creating specialized financial instruments to assess and value its potential.

Potential Financial Risks and Rewards

Controlling a world discoverer carries significant risks. Unforeseen consequences, technological hurdles, and public backlash are all possibilities. However, the rewards are equally substantial, potentially unlocking massive returns in various sectors. For example, the development of a revolutionary energy source could transform the global economy, creating enormous market opportunities and driving substantial investment returns. The potential for disruption is as substantial as the potential for wealth creation.

Financial Models for Leveraging the Discoverer’s Work

Financial institutions would likely develop innovative financial models to capitalize on the discoverer’s work. These models could involve licensing agreements for the use of the discovery’s core technologies, creating specialized funds for research and development, or investing in companies that are directly or indirectly impacted by the new knowledge. Furthermore, the potential for creating entirely new industries would demand the development of novel financial instruments.

Potential Investments and Returns

Quantifying potential investments and returns is difficult due to the unprecedented nature of the situation. However, analogous cases, such as the early investment in the internet or the development of the semiconductor industry, offer some guidance. Investments in early-stage companies focused on exploiting the discoverer’s work could yield substantial returns, while long-term research and development could take decades to materialize into tangible profits.

The key is anticipating and capitalizing on the disruptive potential.

Exploitation and Manipulation of the Discoverer’s Work

Financial institutions could potentially exploit or manipulate the discoverer’s work. This might include suppressing competition, limiting access to knowledge, or prioritizing short-term profits over long-term sustainability. Transparency and ethical considerations would be crucial in navigating these potential pitfalls. The need for independent oversight and ethical guidelines is paramount.

Potential Financial Transactions

| Transaction Type | Description | Potential Actors |

|---|---|---|

| Funding | Provision of capital for research and development, initial investment in companies leveraging the discovery. | Venture capital firms, banks, sovereign wealth funds |

| Loans | Securing financing for projects based on the discovery’s potential. | Financial institutions, specialized lending bodies |

| Ownership Transfers | Acquiring ownership stakes in companies and intellectual property related to the discovery. | Investment funds, corporations, private equity firms |

The table above provides a simplified overview of potential financial transactions. The complexities of such transactions would necessitate highly specialized legal and financial expertise. This overview demonstrates the breadth of financial interactions that could emerge.

Societal Impacts

The potential control of world discoveries by bankers presents a profound shift in power dynamics, impacting every facet of society. This concentrated financial influence could reshape access to resources, knowledge, and opportunities, leading to both unprecedented advancements and significant inequalities. The consequences are far-reaching and demand careful consideration of the ethical and practical implications.The concentration of power in the hands of a select few could lead to the prioritization of financial gain over societal well-being.

This could manifest in a variety of ways, from the suppression of potentially disruptive technologies to the exploitation of resources for maximum profit, potentially leaving behind the needs of the broader population.

Potential Societal Changes

The control of world discoveries by bankers could fundamentally alter the course of societal development. This includes influencing the pace and direction of scientific advancement, potentially limiting access to knowledge and innovation for the benefit of a select few. It could also affect resource allocation, potentially leading to imbalances in access to essential resources like clean water or fertile land.

Different Societal Reactions

Diverse reactions to this scenario are highly probable. Some individuals and groups might actively resist such control, advocating for democratic oversight and equitable access to discoveries. Others might passively accept the changes, believing that the financial benefits outweigh the potential social costs. There could also be a spectrum of responses, from cautious acceptance to outright rejection, influenced by individual beliefs, cultural values, and economic circumstances.

Historical precedents, such as the Industrial Revolution and the rise of multinational corporations, offer insights into the potential for both progress and social unrest.

Examples of Societal Impacts

The control of discoveries by bankers could result in unequal access to education, healthcare, and technology. This could lead to a widening gap between the privileged and the marginalized, potentially exacerbating existing social inequalities. For example, essential medical advancements might be delayed or restricted to those who can afford them, while crucial technologies for sustainable development might be withheld from communities in need.

Social Inequalities and Power Imbalances, Bankers take possession of world discoverer

Significant social inequalities and power imbalances are likely to arise. Access to knowledge, resources, and opportunities could be heavily skewed towards those with financial ties to the controlling bankers. This could create a two-tiered society, where one segment benefits disproportionately from discoveries while another struggles to access them. This is reminiscent of historical patterns of economic exploitation and class divisions.

Ethical Implications

The ethical implications of this scenario are profound. The prioritization of profit over social good raises questions about the responsibility of powerful institutions and individuals to ensure equitable distribution of benefits. The potential for exploitation and the marginalization of vulnerable populations must be addressed proactively. Ethical frameworks for governing discoveries and ensuring access for all are essential.

So, bankers taking over a world-renowned explorer’s legacy is a bit disheartening, isn’t it? It’s a bit like seeing a stunning, luxurious resort like the Amanyara Turks and Caicos, undergoing renovations – a project that’s both exciting and a little unsettling. Amanyara Turks and Caicos renovations are a testament to the power of reinvestment, but this case seems to be more about financial gain than restoring something to its former glory.

Maybe the new owners will find a way to honour the discoverer’s legacy. Ultimately, this kind of takeover just highlights the complex relationship between wealth and history.

Table: Potential Effects on Sectors

| Sector | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Education | Potentially enhanced resources and specialized training for select groups. | Unequal access to quality education, potentially leading to a widening gap between the rich and the poor. |

| Healthcare | Faster development of life-saving technologies for the wealthy. | Delayed or limited access to medical breakthroughs for the general population, widening the gap between the rich and the poor. |

| Technology | Accelerated development of innovative technologies, but for select purposes. | Uneven distribution of technological advancements, potentially hindering social progress and increasing inequality. |

Potential Discoveries

The control of scientific and technological advancements by a select few, potentially bankers, presents a complex web of implications. Such control could significantly alter the trajectory of research and development, potentially prioritizing projects that yield immediate financial returns over those with broader societal benefits. This scenario raises concerns about the equitable distribution of knowledge and resources, and the potential for breakthroughs to be exploited for profit rather than for the benefit of humanity.The future of discovery is inextricably linked to financial investment.

Bankers, as major players in the financial world, have the capacity to significantly influence research funding, thus directing the course of scientific endeavors. Their decisions, driven by profit motives, could lead to a skewed allocation of resources, hindering the pursuit of fundamental scientific questions and potentially overlooking revolutionary discoveries.

Hypothetical Discoveries Subject to Banker Control

Bankers might prioritize research areas with clear and rapid financial returns. This could include advancements in bioengineering for enhanced human performance or tailored pharmaceuticals for specific health conditions, particularly those with high market potential. However, fundamental research in areas like cosmology, particle physics, or advanced materials science, while potentially revolutionary, might receive less funding due to perceived lower short-term returns.

So, bankers taking over the world’s last great explorer is a pretty grim picture, right? But it’s got me thinking about the increasing trend of one-way travel tickets, revealed in a recent ARC study. arc study reveals a growing trend toward one way ticket sales. Maybe this whole “taking possession” thing isn’t just about the world, but about a complete, one-way shift in control, leaving some people stranded in a world they no longer own, much like a traveller on a one-way ticket.

It makes you wonder about the future of global exploration, doesn’t it? And, yes, the bankers still look like the villains.

Influence on Research and Development

Bankers could exert control through several mechanisms. They might directly fund research institutions and laboratories, influencing the projects undertaken and the priorities set. They could also acquire patents and intellectual property, potentially stifling competition and controlling access to revolutionary technologies. Furthermore, their influence might extend to the educational system, shaping the curriculum and attracting students to fields with perceived higher financial reward.

Examples of Scientific and Technological Breakthroughs

Imagine a breakthrough in personalized medicine that allows for the precise prediction and treatment of diseases based on an individual’s genetic code. If controlled by bankers, this technology might initially be accessible only to the wealthy, widening the health disparity between the rich and poor. Another example could be the development of highly efficient, sustainable energy sources. Banker control could focus on technologies with immediate commercial viability, potentially delaying or neglecting the development of truly sustainable and environmentally friendly options.

Implications of Control over Different Discoveries

Controlling discoveries in areas like advanced materials science could lead to the development of new, extremely strong and lightweight materials used primarily in high-end consumer goods, further exacerbating the gap between haves and have-nots. Discoveries in space exploration, if controlled by bankers, might be limited to ventures with immediate commercial prospects, like mining asteroids for valuable resources, rather than the broader exploration of the cosmos.

Table of Hypothetical Discoveries

| Discovery | Potential Applications | Benefits | Implications of Banker Control |

|---|---|---|---|

| Advanced Personalized Medicine | Precise disease prediction and treatment based on genetic code | Reduced disease burden, increased lifespan, improved quality of life | Limited access for lower socioeconomic groups, widening health disparities |

| Sustainable Energy Sources | Renewable energy generation, reduced reliance on fossil fuels | Reduced environmental impact, energy independence | Prioritization of commercially viable solutions, delay in development of truly sustainable alternatives |

| Space Exploration Technologies | Asteroid mining, lunar/planetary colonization, advanced space travel | Expanding human knowledge of the universe, resource acquisition, future exploration | Focus on immediate financial returns from space resources, hindering broader exploration |

Illustrative Scenarios

The world’s future is often shaped by unexpected discoveries. This section dives into a fictional scenario where a revolutionary discovery falls into the hands of powerful financial institutions, highlighting potential consequences and contrasting them with an ideal outcome. This exercise underscores the importance of responsible stewardship and ethical considerations in the face of groundbreaking innovations.

A Fictional Scenario: The Quantum Leap

The discovery, dubbed “The Quantum Leap,” allows for near-instantaneous teleportation of objects and, crucially, data. This technology holds the potential to revolutionize global trade, communication, and scientific advancement. Its implications extend beyond the realm of commerce and science, affecting social structures and individual lives.

Steps Leading to Banker Possession

- Initial Discovery: A team of researchers at a leading university discovers the principles behind quantum entanglement, enabling the teleportation of physical objects and data. The discovery is published in a prestigious scientific journal and attracts immediate global attention.

- Acquisition by Private Investors: Recognizing the immense potential of the Quantum Leap technology, a consortium of private investment banks and venture capital firms acquires the intellectual property rights to the research and the associated patent.

- Strategic Partnership: The banking consortium partners with leading tech companies to rapidly develop and deploy practical applications of the Quantum Leap technology. This collaboration focuses primarily on streamlining global logistics and financial transactions.

- Monopolization of Access: The consortium uses its financial clout to control the supply chain of critical materials needed for the Quantum Leap technology. This effectively creates a barrier to entry for smaller entities or independent researchers. The technology is initially only accessible to a select group of multinational corporations and high-net-worth individuals.

- Control of Global Infrastructure: Leveraging their financial dominance, the banking consortium invests in and gradually acquires control of critical infrastructure components, such as communication networks and transportation systems, that are essential to the deployment and utilization of the Quantum Leap.

World’s Reaction

The world’s initial reaction to the Quantum Leap is one of awe and anticipation. However, as the banking consortium’s control over the technology becomes apparent, a growing sense of unease and distrust emerges. Public protests and demonstrations arise, demanding equitable access to the revolutionary technology. Governments grapple with the need to regulate this powerful technology while preserving innovation.

A widening gap between the privileged few who benefit from the technology and the majority of the population becomes starkly visible.

Ideal vs. Actual Outcomes

- Ideal Outcome: A transparent and ethical approach would involve open-source research and technology sharing. This fosters widespread innovation and benefits society as a whole. International cooperation and regulations would ensure the equitable distribution of resources and opportunities.

- Actual Outcome: The banking consortium’s strategy results in a technology that is primarily used to enhance existing power structures, leading to increased economic disparity and a widening gap between the haves and have-nots. The world witnesses the potential for technology to be wielded for profit rather than for the betterment of humanity.

Ending Remarks

In conclusion, the concept of bankers taking possession of world discoverers raises profound questions about the future of innovation and the balance of power. It highlights the potential dangers of unchecked financial influence and the importance of ethical considerations in the development and application of groundbreaking discoveries. This scenario compels us to contemplate the potential for exploitation and the need for safeguards to ensure that scientific and technological advancements benefit all of humanity, not just a select few.

Helpful Answers

What historical events could serve as precedents for this scenario?

Throughout history, various powerful entities have exerted control over significant discoveries and innovations. From the control of vital resources during wartime to the patent systems that sometimes stifle access to medical breakthroughs, there are historical parallels to examine. A deeper exploration into these instances could shed light on the motivations and methods behind such actions.

What are some potential interpretations of the phrase “bankers take possession of world discoverer”?

The phrase can be interpreted in several ways, ranging from a literal take-over to a metaphorical representation of financial institutions’ increasing influence on research and development. It could also be seen as a critique of the current financial system and its potential to prioritize profit over societal well-being.

What specific financial mechanisms could be used to achieve this?

Financial mechanisms could involve funding research, acquiring patents, and manipulating markets to control access to resources. Loans, investment strategies, and potentially even legal loopholes could play a role in achieving this control. A thorough examination of these mechanisms is needed.