Arrivals Surge, Air Tax Battle Heats Up

Arrivals increase air tax battle among cto conference topics is dominating the discussion at the upcoming conference. The rising number of travelers is creating a complex web of economic and political considerations. Airlines, governments, and passengers are all affected by potential changes in air tax policies. This article explores the historical context of air taxes, the factors driving increased arrivals, and the potential outcomes of the debate, all within the framework of the CTO conference.

The conference is expected to delve into the nuances of air tax policies, examining their impact on various stakeholders. From the historical evolution of air taxes to the potential economic benefits of increased tourism, this article will provide a comprehensive overview of the issues at hand.

Background on Air Tax

Air taxes, levied on air travel, have a rich history, evolving alongside the growth of air travel itself. From modest beginnings, they have become a significant source of revenue for governments worldwide, while also influencing travel patterns and airline business models. This evolution has been marked by varied implementations across different regions, each responding to specific economic and social contexts.

Understanding the nuances of air tax policies is crucial to grasping the complex interplay between government, industry, and consumers.Air taxes are a multifaceted tool used by governments to fund infrastructure projects, mitigate environmental impacts, and manage the economic impact of air travel. They manifest in various forms, each with distinct purposes and implications. The current landscape of air tax policies is a dynamic mix of national and regional initiatives, reflecting the globalized nature of air travel.

This discussion will explore the history, types, current state, and economic effects of air taxes on various stakeholders.

Historical Overview of Air Taxes

Air taxes emerged in the early days of commercial aviation, often as a simple surcharge on air travel tickets. Initially, they were relatively modest in amount and focused primarily on funding airport infrastructure development. Over time, however, air taxes have evolved to encompass a wider range of purposes, including environmental considerations and economic management. Different regions have adopted various approaches, reflecting differing economic structures, social priorities, and the specific challenges of air travel within their contexts.

For instance, developing nations might use air taxes to fund national infrastructure projects, while developed nations might prioritize environmental protection.

Types of Air Taxes

Different types of air taxes exist, each serving a unique purpose. These include:

- Airport taxes: These are levied by airports to cover their operational costs, including maintenance, security, and staff. This revenue is directly linked to airport operations and infrastructure development.

- Passenger taxes: These are charges levied on passengers based on the distance of the flight or the class of travel. They may contribute to national coffers or specific airport funds.

- Fuel taxes: These taxes are levied on the fuel used by aircraft, often linked to environmental regulations and fuel efficiency initiatives.

- Security taxes: These taxes are often imposed in response to security concerns to help fund airport security measures and related programs.

Current State of Air Tax Policies Worldwide

The current state of air tax policies globally is diverse. Some countries have comprehensive systems of air taxes, while others have relatively simple or limited policies. Factors influencing the complexity and design of these policies include economic conditions, environmental concerns, and the level of air travel activity within a region.

Economic Impact of Air Taxes

Air taxes have a significant economic impact on various stakeholders, including airlines, passengers, and governments. Airlines must factor air taxes into their pricing strategies, which can influence their profitability and competitiveness. Passengers may perceive air taxes as an additional cost, impacting their travel choices. Governments, on the other hand, gain revenue that can be used for various purposes, such as infrastructure development and environmental protection.

The overall economic effect of air taxes is a complex balance among these factors, with the specific impact varying based on the specific tax structure, level of taxation, and regional context.

Table: Air Tax Policies Across Regions

| Region | Tax Type | Purpose | Impact |

|---|---|---|---|

| North America | Airport taxes | Funding airport operations | Airlines factor costs into pricing, potentially affecting competitiveness. Passengers bear additional costs. |

| Europe | Passenger taxes | Revenue generation and environmental initiatives | Diverse impacts depending on specific policies, potentially affecting passenger choices. |

| Asia | Fuel taxes | Environmental protection and fuel efficiency | Airlines adjust fuel costs, influencing ticket prices. |

| South America | Airport and passenger taxes | Infrastructure development and general revenue | Varying impacts on airlines and passengers based on the structure of the tax. |

Arrivals Increase Context

The escalating number of tourist arrivals globally is a significant phenomenon, driving economic activity and reshaping travel patterns. This influx of visitors presents both opportunities and challenges, particularly regarding the management of infrastructure and the potential for conflicts over taxation. Understanding the factors behind these increases and their regional variations is crucial for policymakers and stakeholders alike.

Factors Contributing to Increased Arrivals

Several interconnected factors contribute to the rise in tourist arrivals. Improved global connectivity, including advancements in air travel and increased accessibility to destinations, plays a pivotal role. Relaxed travel restrictions and visa policies in many regions also encourage tourism. Furthermore, the increasing purchasing power in emerging economies and the rise of affordable travel options are significant drivers.

The allure of unique cultural experiences, historical sites, and natural wonders further fuels this global travel trend.

Regional Variations in Arrival Increases

The growth in tourist arrivals is not uniform across all regions. Some areas, like Southeast Asia and certain parts of South America, are experiencing rapid increases due to a combination of factors, including improved infrastructure, vibrant cultural offerings, and targeted marketing campaigns. Other regions, such as parts of Europe, are seeing more stable, though still considerable, growth. Analyzing the specific factors driving these regional differences is vital for developing effective strategies to accommodate the rising tourist numbers.

Economic Benefits of Increased Arrivals

Increased tourism significantly impacts local economies. It creates jobs in the hospitality sector, boosts revenue for businesses, and stimulates economic growth through spending on transportation, entertainment, and other services. This increased economic activity can lead to improved infrastructure, better living standards, and the development of new industries. For example, the Maldives’ rapid growth in tourism has led to significant job creation and economic prosperity.

Impact on Infrastructure and Local Communities

The influx of tourists can place a strain on existing infrastructure, particularly in areas experiencing rapid growth. Increased traffic congestion, water shortages, and strain on sanitation systems are potential consequences. Furthermore, cultural sensitivities and the preservation of local traditions are crucial concerns. Sustainable tourism practices are essential to minimize negative impacts and ensure that the benefits of tourism are shared equitably among local communities.

Chain of Events Leading to Air Tax Battles

This flowchart illustrates the chain of events leading to potential air tax battles. The escalating demand for air travel, driven by increasing arrivals, can lead to congestion at airports and on flights. Increased competition among airlines and the need to offset rising costs often translate into pressure to increase air taxes. The revenue generated from these taxes can be used to fund infrastructure improvements or provide subsidies to airlines.

However, public opposition, particularly from travelers and tourism stakeholders, may emerge, leading to a contentious debate about the fairness and necessity of such taxes.

The CTO conference is buzzing with discussions about rising air taxes, fueled by increased arrivals. This debate highlights the crucial role of advertising, especially for pioneer online travel agencies (OTAs) like those discussed in advertising and the pioneer otas. Ultimately, the rising cost of air travel, potentially due to increased taxes, will influence consumer choices and, in turn, shape the future of air travel and OTA strategies.

This is shaping up to be a fascinating discussion point for the entire industry.

CTO Conference Focus

The upcoming CTO conference promises to be a crucial platform for discussing the complex interplay between rising passenger numbers and the potential introduction of air taxes. This gathering of industry leaders and policymakers will explore the multifaceted impact of these changes on the aviation sector, encompassing economic ramifications, environmental considerations, and passenger experience. The conference’s focus on the air tax debate is particularly timely given the current global economic climate and the push for sustainable aviation practices.

Conference Goals and Objectives

The conference aims to foster a productive dialogue between stakeholders, including airlines, airports, government agencies, and environmental groups. Key objectives include analyzing the economic feasibility of air taxes, evaluating their potential environmental benefits, and exploring alternative revenue models. This comprehensive approach seeks to balance the needs of various parties involved in the aviation industry, promoting sustainable and equitable solutions.

Conference Agenda: Air Taxes

The conference agenda will dedicate significant time to the debate surrounding air taxes. Presentations and panel discussions will delve into the various aspects of air tax implementation, including potential revenue generation, its impact on ticket prices, and the resulting effect on passenger numbers. Experts will discuss the current landscape of air tax policies across different regions, examining both successes and challenges.

The discussions will also explore the correlation between rising passenger numbers and the feasibility of implementing various air tax models.

Significance for the Aviation Industry

The conference holds immense significance for the aviation industry. By providing a platform for diverse stakeholders to engage in constructive discourse, it can lead to the development of more informed and equitable policies regarding air taxes. This dialogue is crucial for shaping the future of the aviation industry, fostering sustainability, and ensuring continued growth while mitigating potential negative consequences.

A well-managed debate can help steer the industry toward a future where environmental responsibility and economic viability coexist.

Participating Figures and Organizations

The conference is expected to attract a wide range of prominent figures from the aviation sector, including representatives from major airlines, airport authorities, government agencies, and leading environmental organizations. The presence of these key players ensures a comprehensive and balanced discussion, fostering a collaborative approach to tackling the challenges and opportunities presented by rising passenger numbers and the air tax debate.

Expect prominent CEOs, government ministers, and aviation experts to participate.

Proposed Resolutions on Air Taxes

- Fairness and Equity: Resolutions should address the potential for air taxes to disproportionately affect low-income travelers and necessitate exploring tiered pricing or exemptions for specific demographics. This will ensure the tax’s fairness and minimize negative impacts on vulnerable populations.

- Sustainable Aviation Fuel Incentives: Resolutions should strongly advocate for policies that incentivize the use of sustainable aviation fuel (SAF). This will encourage the development and adoption of environmentally friendly alternatives, aligning with broader sustainability goals. Examples of incentives could include tax breaks for SAF production and usage.

- Revenue Allocation and Transparency: The conference should emphasize the need for transparent revenue allocation strategies for air taxes. Discussions should focus on ensuring the funds generated are used specifically for aviation infrastructure improvements, environmental initiatives, or research related to sustainable aviation practices.

- Impact Assessment and Feedback Mechanisms: Resolutions should address the need for rigorous impact assessments before implementing air taxes. These assessments should consider the potential impact on ticket prices, passenger numbers, and overall economic viability of the industry. Further, resolutions should propose mechanisms for gathering feedback from various stakeholders and adjusting policies as needed.

Air Tax Battle Dynamics

The escalating debate surrounding air taxes, a recurring theme at CTO conferences, reflects the complex interplay of economic, political, and social forces. Air travel’s increasing popularity, coupled with environmental concerns and varying stakeholder interests, has intensified the discussion about the fairness and effectiveness of such levies. This section delves into the nuanced arguments for and against air taxes, exploring the perspectives of diverse groups and examining the potential ramifications of this ongoing battle.The air tax debate is not simply about revenue generation.

It touches upon crucial issues like environmental sustainability, economic competitiveness, and the equitable distribution of costs associated with air travel. Understanding the multifaceted arguments is vital for comprehending the political and social implications of this contentious issue.

Arguments for Air Taxes

Air taxes are often advocated for their potential to generate revenue for infrastructure improvements, funding environmental initiatives, and addressing social inequities. Proponents highlight the potential for dedicated funding sources to enhance airports, improve public transportation, and mitigate the environmental impact of air travel. This revenue can also be channeled toward specific social programs.

- Improved Infrastructure: Air taxes can provide a dedicated funding stream for upgrading and expanding airport facilities, enhancing passenger experience, and improving safety standards. This, in turn, can stimulate economic activity in surrounding areas.

- Environmental Sustainability: A significant portion of the arguments for air taxes emphasizes the environmental impact of air travel. The revenue generated could be used to support research into sustainable aviation fuels, offset carbon emissions, or fund alternative transportation options.

- Funding Social Programs: Proponents also argue that air taxes can be used to support social programs, such as affordable housing, education, or healthcare initiatives. This can potentially address social inequalities and improve the overall quality of life.

Arguments Against Air Taxes

Conversely, opponents of air taxes often highlight the potential negative economic consequences, such as reduced air travel demand and increased ticket prices. The burden on consumers and the impact on tourism are frequently cited concerns.

- Reduced Air Travel Demand: A major concern is the potential for air taxes to deter air travel, reducing the number of passengers and impacting the profitability of airlines. This can lead to job losses in the aviation industry and related sectors.

- Increased Ticket Prices: Opponents argue that air taxes will inevitably translate into higher ticket prices, making air travel less affordable for individuals and families, potentially impacting tourism and international trade.

- Impact on Tourism: Tourism is often a major economic driver in many regions. Higher air fares due to taxes could decrease tourism numbers, impacting local businesses and employment.

Stakeholder Perspectives

The air tax debate involves a diverse range of stakeholders, each with unique perspectives and priorities. Airlines, passengers, governments, and environmental groups hold distinct views regarding the feasibility and desirability of air taxes.

- Airlines: Airlines generally oppose air taxes, citing the potential for reduced profitability and passenger demand. They often advocate for alternative revenue streams or argue for the inclusion of alternative fuels as part of the environmental solution.

- Passengers: Passengers, especially those who frequently travel, may see air taxes as an additional cost that can impact their budget. They often weigh the environmental and social benefits against the personal cost of the tax.

- Governments: Governments face the challenge of balancing economic considerations, environmental concerns, and social priorities. The decision to implement an air tax often involves navigating these complex issues.

- Environmental Groups: Environmental groups strongly advocate for air taxes, viewing them as a crucial tool for reducing the environmental impact of air travel. They argue that the cost of inaction is far greater than the cost of implementing such measures.

Timeline of Air Tax Debates

A historical overview of air tax debates reveals a recurring pattern of discussion, implementation, and subsequent revisions. Past debates often involved heated arguments over the most effective and equitable approach.

- 2010-2015: Initial discussions on potential air taxes, particularly in Europe, centered on carbon emissions and airport infrastructure funding.

- 2015-2020: A significant increase in air travel and the rise of environmental concerns prompted renewed debate, leading to the introduction of pilot programs in several regions.

- 2020-Present: The COVID-19 pandemic and its economic repercussions have added new layers to the discussion, with debates on the long-term sustainability of air travel and the need for new funding models.

Comparative Analysis of Arguments

| Argument | Supporting Evidence | Counterarguments |

|---|---|---|

| Air taxes generate revenue for infrastructure improvements. | Increased funding for airport upgrades and maintenance, potentially leading to enhanced safety and passenger experience. | Potential for reduced air travel demand, leading to decreased revenue for airlines and related businesses. |

| Air taxes can support environmental initiatives. | Funding for research into sustainable aviation fuels and offsetting carbon emissions. | Potential for increased ticket prices, making air travel less accessible for some individuals. |

| Air taxes can address social inequities. | Dedicated funding for social programs like affordable housing and healthcare. | Potential for regressive taxation, disproportionately impacting lower-income travelers. |

Potential Solutions and Outcomes

The air tax battle, a contentious issue at the CTO conference, highlights the complex interplay between government revenue, consumer costs, and aviation growth. Finding common ground on air taxes requires careful consideration of diverse stakeholder interests, from airline companies and travel agencies to passengers and environmental advocates. Understanding potential solutions and outcomes is crucial for navigating this dynamic landscape.This section explores potential compromises and solutions to the air tax battle, examining possible outcomes and their implications for future travel policies.

It also considers the impact on aviation growth and how different resolutions might affect air travel costs for various demographics.

The CTO conference is buzzing with talk about rising arrivals and the ensuing air tax battle. While that’s a major point of contention, the potential for real progress from the ARC NDC working group could actually impact these discussions significantly. arc ndc working group could yield real results by streamlining processes and potentially lowering costs, which could ultimately influence the air tax debate and the future of air travel.

This all boils down to the need for a more efficient and cost-effective system for managing increasing passenger numbers.

Potential Compromises and Solutions, Arrivals increase air tax battle among cto conference topics

Various compromises can be explored to address the air tax dispute. A phased implementation of the tax, starting with a lower rate and gradual increases, could mitigate initial public backlash. Alternatively, targeted exemptions for specific demographics, such as low-income travelers or students, could ease the burden on vulnerable groups. Revenue generated from the tax could be channeled into improving airport infrastructure or funding sustainable aviation initiatives, potentially creating a more compelling argument for its adoption.

Potential Outcomes of the Air Tax Battle

The air tax battle could result in several outcomes. A complete rejection of the tax could lead to the status quo, leaving revenue generation for airports and government bodies unchanged. Acceptance of the tax, with modifications, would likely create a new framework for air travel financing, potentially impacting ticket prices and future policies. The negotiation process could also reveal unforeseen synergies between stakeholders, potentially leading to new solutions or policies in the future.

The CTO conference is buzzing with discussions about rising arrivals and the ensuing air tax battle. It’s a complex issue, but interestingly, Alaska is also making headlines with the unveiling of their renovated Sanctuary Sun IV. This impressive update to the facility is sure to boost tourism, which ultimately could influence the air tax debate. So, while the conference wrestles with the rising air tax debate, it’s clear that the travel industry is always evolving.

ak unveils renovated sanctuary sun iv is a great example of that evolution.

Impact on Future Travel Policies

The resolution of the air tax battle will undoubtedly influence future travel policies. If the tax is implemented, it could set a precedent for other forms of transportation taxation. Conversely, if the tax is rejected, it might discourage future attempts at similar revenue-generating measures for aviation. Furthermore, the outcome could shape public perception of government involvement in the aviation sector and influence future policy discussions.

Impact on Aviation Growth

Lack of consensus on air taxes might hinder future aviation growth. Uncertainty surrounding potential cost increases could deter potential travelers and investors. This could manifest in reduced air travel demand and a slowdown in airport expansions, ultimately impacting the overall economic vitality of the aviation industry. A clearer and more predictable regulatory environment is crucial for sustained aviation growth.

Impact on Air Travel Costs

| Resolution | Predicted Cost Changes | Impacted Demographics |

|---|---|---|

| Complete Rejection | No change in air travel costs. | All demographics. |

| Acceptance with Modifications (Phased Implementation) | Initial slight increase, followed by gradual price adjustments based on the phase. | All demographics, with potential mitigation for low-income travelers. |

| Acceptance with Modifications (Targeted Exemptions) | Increased costs for some demographics, offset by potential cost savings for others. | Specific demographics benefitting from exemptions will experience lower costs, while others will see increased costs. |

Note: Predicted cost changes are estimations based on various factors, including the tax rate, implementation timeline, and economic conditions.

Visual Representation

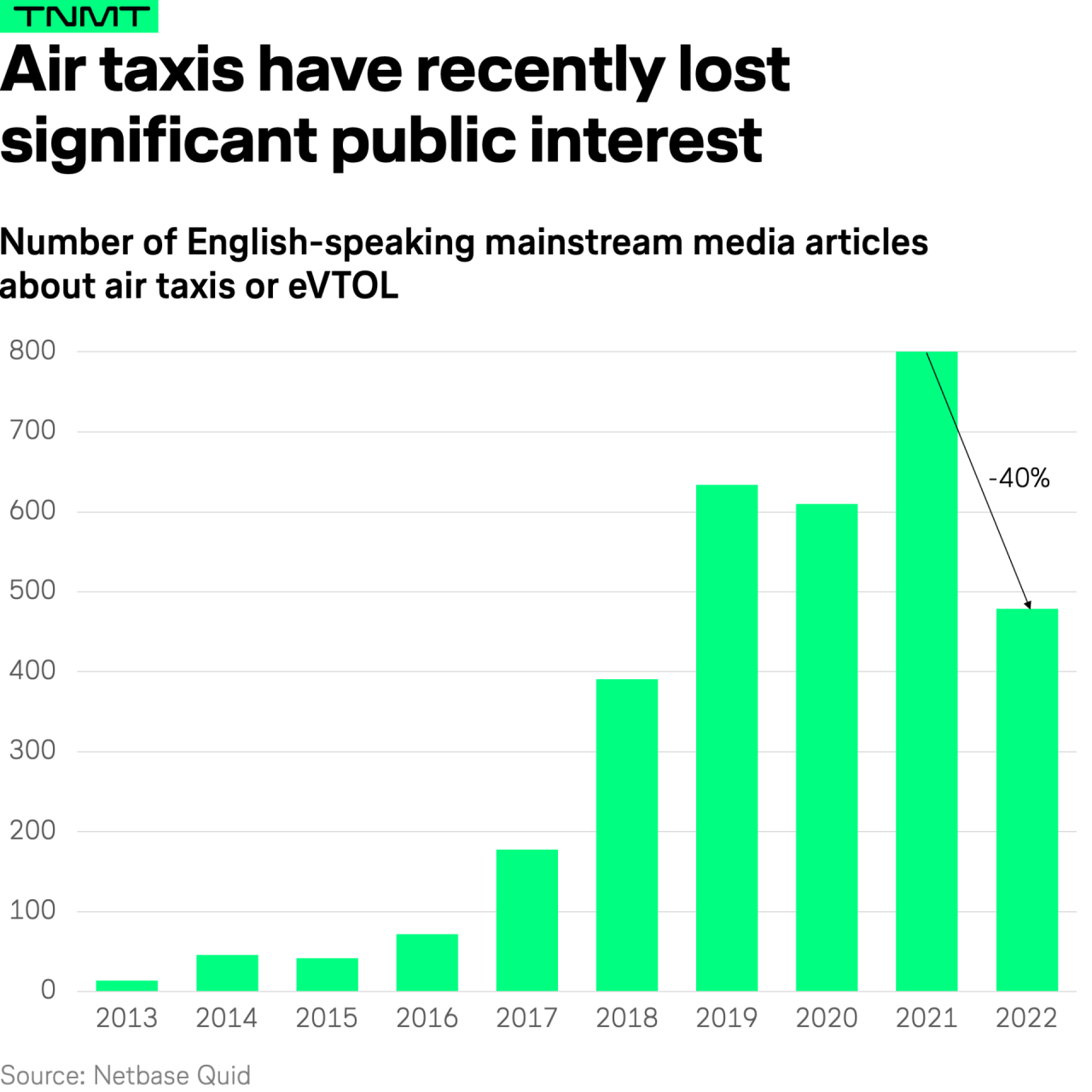

Visualizations are crucial for understanding complex issues like the air tax debate. Clear and compelling visuals can simplify intricate relationships, helping stakeholders and the public grasp the potential impacts and perspectives. This section explores various visual representations to illustrate the intricacies of the air tax debate.

Hypothetical Infographic

A hypothetical infographic could visually represent the relationship between arrivals, air taxes, and the CTO conference. It could feature a stacked bar chart showing the increasing number of arrivals over time. A second chart could display the corresponding rise in air tax revenue generated. A third element would highlight the trend in CTO conference attendance, potentially linked to both arrival numbers and tax revenue.

This infographic would effectively demonstrate the interconnectedness of these factors.

The CTO conference is buzzing with the rising air tax debate, fueled by increasing passenger arrivals. This points to a need for innovative solutions, like a modest proposal for travel technology dominance a modest proposal travel technology dominance , to streamline the process and potentially mitigate the financial burden. Ultimately, however, these discussions need to find practical solutions to address the complexities of rising arrivals and air tax debates.

Venn Diagram of Perspectives

A Venn diagram can effectively illustrate the differing perspectives on air taxes. Three overlapping circles represent different stakeholder groups: airlines, passengers, and the government. Areas of overlap indicate shared interests, while non-overlapping areas highlight specific concerns. For instance, the airline circle might emphasize revenue generation, the passenger circle could focus on affordability, and the government circle might highlight revenue collection for infrastructure.

This visualization would help demonstrate common ground and areas of contention.

Economic Impact Visualization

Visualizing the potential economic impact of different air tax scenarios requires a combination of charts. A line graph could show projected tax revenue under various tax rates. A pie chart could depict how the revenue is allocated amongst different government sectors (e.g., airport infrastructure, environmental initiatives, etc.). Bar charts could illustrate the potential impact on airline profits, passenger spending, and overall economic activity in different regions.

The CTO conference is buzzing with talk of rising arrivals and the ensuing air tax battle. It’s all about the logistics of travel, isn’t it? Meanwhile, Adventuresmith has announced a fantastic new Hawaii cruise offering, perfect for anyone looking to escape the hustle and bustle, and it’s a nice change of pace from the conference discussions about airfare costs adventuresmith announces hawaii cruise offering.

Ultimately, the increasing passenger numbers are likely to fuel the debate over air taxes at the conference.

For example, a scenario of a 10% increase in air taxes might show a 5% decrease in passenger spending, and a 2% reduction in airline profit margins. Color-coding and clear labels would be essential for clarity.

Stakeholder Interrelationships

Illustrating the complex interrelationships among stakeholders requires a network diagram. Nodes could represent airlines, airports, passengers, government agencies, environmental groups, and other stakeholders. Lines connecting the nodes would indicate the nature of their relationship (e.g., financial transactions, regulatory oversight, advocacy). This type of diagram would visually showcase the complex web of interactions and influence within the air tax debate.

Color-coding could differentiate the types of relationships (e.g., positive, negative, neutral).

Best Visual Medium

The best visual medium for portraying the data on air tax impact and its effect on stakeholders depends on the specific message. For illustrating the relationship between arrivals and tax revenue, a line graph or a stacked bar chart would be most effective. A network diagram would best represent the interdependencies between various stakeholders. A Venn diagram is best for depicting differing perspectives.

Using interactive elements in the visualization could provide further insight and allow users to explore different scenarios and variables. For example, an interactive line graph might allow users to adjust tax rates and see the projected revenue changes in real-time.

Final Conclusion

The CTO conference promises to be a pivotal moment in the ongoing air tax debate. The potential solutions and outcomes will shape future travel policies, impacting not only the aviation industry but also local communities and economies. The complexities of this issue are multifaceted, and the conference is poised to bring these competing interests together for a crucial discussion.

The potential for compromise and agreement, or further division, will be critical in the coming months.

FAQ Resource: Arrivals Increase Air Tax Battle Among Cto Conference Topics

What are some common types of air taxes?

Air taxes can include departure taxes, landing fees, and passenger taxes. Their purposes vary, from funding airport infrastructure to generating revenue for the government.

How do increased arrivals affect infrastructure?

Increased arrivals often strain existing infrastructure, leading to potential overcrowding at airports and increased demands on public transportation and local amenities.

What are some potential compromises in the air tax debate?

Potential compromises might involve tiered tax structures, focusing on specific types of travel or destinations, or exploring revenue-neutral options to support infrastructure improvements without impacting travel costs directly.