Cunards Profit Shareholder Insights

Arison to shareholders cunard will make money – Arison to shareholders: Cunard will make money. This analysis delves into Cunard’s financial performance, shareholder value creation strategies, and revenue projections. We’ll examine the factors driving Cunard’s success, and assess the potential for future profitability compared to its competitors. The discussion also covers risk assessment and mitigation strategies, giving a comprehensive picture of Cunard’s financial outlook.

Cunard’s recent financial performance reveals a compelling narrative. The company’s commitment to shareholder value, coupled with smart revenue strategies, suggests a promising future. This report will offer a deep dive into the details, allowing shareholders and investors to understand the key drivers of Cunard’s success.

Cunard’s Financial Performance

Cunard Line, a renowned luxury cruise operator, has a rich history of providing exceptional travel experiences. Understanding its financial performance is crucial for evaluating its position in the market and predicting future prospects. This analysis will delve into Cunard’s recent financial performance, examining key metrics, contributing factors, and projections.Recent financial performance reveals a mixed picture. While the company has demonstrated resilience, some aspects need further attention.

A detailed examination will reveal the nuances and potential areas for improvement.

Revenue and Expenses

Cunard’s revenue is primarily driven by passenger fares, onboard spending, and other ancillary services. Expenses encompass operational costs, marketing, and administrative overheads. A thorough review of the income statement for the past three years, compared with historical data, will provide insight into the company’s revenue and expense trends. Significant variations in these figures could suggest factors like fluctuating passenger demand or operational inefficiencies.

Profitability Analysis

Cunard’s profitability is a critical metric, reflecting the company’s ability to generate profits from its operations. A detailed examination of the company’s gross profit margin, operating profit margin, and net profit margin will illuminate trends in profitability. Profitability can be influenced by various factors, such as pricing strategies, operational costs, and the overall health of the cruise industry.

Analysis of these margins for the past five years will provide context.

Factors Contributing to Financial Performance

Several factors have influenced Cunard’s financial performance. Market trends, including the overall health of the cruise industry and consumer spending patterns, play a significant role. Operational efficiency, encompassing vessel maintenance, crew management, and customer service, is another key factor. Furthermore, pricing strategies employed by Cunard directly impact revenue and profitability. Analysis of these factors is critical to understanding the company’s financial health.

Historical Financial Performance

Cunard’s historical financial performance provides valuable context for understanding current trends. Comparing revenue, expenses, and profitability figures from the past decade will reveal patterns and trends. This comparison will highlight periods of growth, stagnation, or decline. Identifying turning points and the factors that influenced them is essential for predicting future performance.

Projected Financial Performance

Predicting Cunard’s financial performance for the next three to five years requires careful consideration of various factors. Economic forecasts, anticipated market trends, and potential operational improvements all play a role in shaping these projections. Analyzing similar projections from other cruise lines will offer further insight. The projected growth in the cruise industry and expected increase in demand for luxury travel are significant considerations.

Competitive Landscape

Cunard operates within a competitive landscape, competing with other cruise lines offering different itineraries and service levels. Comparative analysis of Cunard’s financial performance against major competitors will reveal relative strengths and weaknesses. Examining factors such as market share, pricing strategies, and customer satisfaction is important for evaluating Cunard’s position within the industry.

Arison’s assurance to shareholders that Cunard will make money is promising. The shift towards smaller, more intimate all-inclusive resorts, as seen in all inclusive resorts go small , might inspire Cunard to focus on a similar, luxury-focused approach. This could translate into a more refined, targeted experience, ultimately boosting profitability for Cunard.

Impact of Economic Conditions

Economic conditions significantly influence Cunard’s financial results. Fluctuations in currency exchange rates, inflation, and consumer confidence directly affect the company’s revenue and expenses. Analyzing historical data on how economic downturns or booms impacted Cunard’s performance will provide insights into the company’s resilience.

Shareholder Value Creation

Cunard’s commitment to shareholder value creation is deeply rooted in its strategic approach to the cruise market. This involves a multifaceted strategy encompassing dividend policies, capital investments, and a long-term vision for sustainable growth. By consistently delivering strong financial performance and strategic initiatives, Cunard aims to maximize returns for its shareholders.Cunard’s approach to shareholder value is not simply about maximizing short-term profits, but rather about building a sustainable business that generates long-term value for all stakeholders, including shareholders.

This approach focuses on several key areas, including a robust dividend policy, strategic capital investments, and a commitment to sustainable practices. These elements work in concert to ensure that Cunard’s financial success translates into substantial shareholder returns.

Dividend Policy and its Impact

Cunard’s dividend policy plays a crucial role in distributing profits to shareholders and signaling confidence in the company’s future prospects. A stable and consistent dividend payout demonstrates financial strength and provides a reliable source of income for investors. This policy is reviewed and adjusted periodically to ensure alignment with Cunard’s long-term financial objectives and shareholder expectations. The impact on shareholder value is evident in increased investor confidence and a higher stock valuation, as investors appreciate the consistent return on investment.

Capital Investments in New Ships and Infrastructure

Cunard’s investments in new ships and infrastructure are essential for maintaining a competitive edge and enhancing the passenger experience. These investments represent a significant commitment to future growth and operational efficiency. The introduction of modern, technologically advanced ships with enhanced amenities attracts a wider range of passengers, potentially increasing revenue and profitability over the long term. New ships often feature innovative design elements and advanced technology, boosting Cunard’s image and attracting premium customers.

These investments contribute directly to shareholder value by strengthening Cunard’s brand, increasing capacity, and boosting future earnings potential.

Strategies to Maximize Shareholder Returns

Cunard employs a variety of strategies to maximize shareholder returns. These strategies include market analysis to identify emerging trends and opportunities, optimizing pricing and cost structures to enhance profitability, and continuous improvements in service quality to ensure passenger satisfaction and loyalty. A strong focus on operational efficiency allows Cunard to control costs and reinvest profits strategically, ultimately boosting shareholder returns.

Cunard also utilizes sophisticated financial modeling and risk management techniques to ensure that investment decisions are well-informed and aligned with long-term strategic objectives.

Long-Term Strategy for Shareholder Value Creation

Cunard’s long-term strategy for shareholder value creation is underpinned by its commitment to consistent financial performance and strategic expansion. The company aims to maintain a strong balance sheet, consistently generate positive cash flow, and invest in initiatives that drive growth and enhance the passenger experience. A key component of this strategy is a focus on innovation and adapting to evolving passenger preferences, ensuring Cunard remains a leader in the cruise industry.

By adapting to evolving trends in travel preferences and the cruise market, Cunard is poised to continue delivering strong returns to shareholders over the long term.

Arison’s confident pronouncements to shareholders about Cunard making money are certainly encouraging. However, the success of those predictions hinges on several factors, including the potential real-world impact of the ARC NDC working group. This group, which is working on sustainable practices for the cruise industry, could yield real results that positively impact Cunard’s long-term financial health, ultimately making those shareholder promises a reality.

arc ndc working group could yield real results. So, while the outlook is promising, only time will tell if the promises to shareholders are fully justified.

Sustainability Practices and Shareholder Value

Cunard’s commitment to sustainability practices is a crucial component of its long-term strategy and directly contributes to shareholder value. Implementing environmentally friendly initiatives and promoting sustainable tourism practices not only reduces Cunard’s environmental footprint but also enhances its brand image. These initiatives appeal to environmentally conscious travelers, a growing segment of the market, potentially expanding Cunard’s customer base and increasing revenue.

Furthermore, sustainable practices can reduce operating costs associated with waste management and energy consumption, leading to improved profitability. This also positions Cunard as a responsible corporate citizen, enhancing its reputation and investor confidence.

Revenue Projections and Strategies

Cunard’s future success hinges on its ability to adapt to evolving market trends and effectively manage its revenue streams. This section delves into Cunard’s projected revenue streams, competitor comparisons, revenue-generating strategies, pricing analysis, market adaptation, and the role of partnerships in bolstering revenue. A meticulous approach to these factors will be crucial in ensuring Cunard maintains its position as a leading luxury cruise line.

Projected Revenue Streams (3-5 Years)

Cunard’s revenue projections for the next three to five years will be driven by several key sources. A comprehensive understanding of these revenue streams is essential for strategic decision-making and financial planning.

Arison to shareholders, Cunard will make money, that’s the bottom line. Looking at Apple Leisure Group’s forward-thinking strategies in the cruise industry, specifically their thought leadership on optimizing profitability and customer experience ( apple leisure group thought leadership ), provides valuable insights. This strengthens the case for Cunard’s projected success and reinforces the confidence in the company’s future earnings.

| Year | Cruise Passenger Revenue | Ancillary Revenue (e.g., dining, shore excursions) | Other Revenue Sources (e.g., onboard retail, spa services) |

|---|---|---|---|

| 2024 | $XXX Million | $YYY Million | $ZZZ Million |

| 2025 | $XXX Million | $YYY Million | $ZZZ Million |

| 2026 | $XXX Million | $YYY Million | $ZZZ Million |

| 2027 | $XXX Million | $YYY Million | $ZZZ Million |

| 2028 | $XXX Million | $YYY Million | $ZZZ Million |

Note: Replace XXX, YYY, and ZZZ with specific projected figures. These figures should be based on market research, historical data, and industry forecasts.

Competitor Revenue Comparison

Understanding Cunard’s position relative to competitors is crucial for strategic planning. A comparative analysis helps identify strengths, weaknesses, and potential opportunities.

Arison to shareholders, Cunard will make money, no doubt. But beyond the bottom line, imagine the sheer joy of exploring the Aegean Sea aboard the Louis Cristal, with its ample diversions like ample diversions on Louis Cristal Aegean sailing. This experience will surely enhance the profitability of Cunard in the long run. It’s all about creating memorable experiences that keep customers coming back, and Cunard, through such initiatives, will ultimately see strong shareholder returns.

| Company | Projected Revenue (2024-2028) | Key Differentiators |

|---|---|---|

| Cunard | $XXXX Million | Luxury experience, established brand, strong customer loyalty |

| Royal Caribbean | $YYYY Million | Extensive fleet, wide range of itineraries, focus on family-oriented cruises |

| MSC Cruises | $ZZZZ Million | Global reach, diverse itineraries, cost-effective options |

Note: Replace XXXX, YYYY, and ZZZZ with specific projected figures. Data should be sourced from reputable financial reports and industry analysis.

Strategies for Increasing Revenue

Cunard’s strategies for increasing revenue will focus on enhancing the customer experience and expanding its reach.

- Pricing Adjustments: Cunard will analyze competitor pricing and market trends to optimize its pricing strategy. Adjustments will consider factors such as cruise duration, cabin type, and onboard amenities. Examples of competitor pricing strategies include offering discounts for booking in advance or incorporating seasonal pricing models.

- New Service Offerings: Cunard will explore new service offerings to enhance the customer experience. This may include specialized dining options, unique shore excursions, or partnerships with luxury brands. An example could be offering curated experiences in destinations, like wine tastings or exclusive cooking classes.

- Marketing Campaigns: Cunard will focus on targeted marketing campaigns to reach new and existing customers. This includes leveraging digital marketing channels, partnerships with travel agencies, and collaborations with influencers. Examples include highlighting unique itineraries and onboard activities, and showcasing Cunard’s history and legacy.

Pricing Strategies Analysis

Cunard’s pricing strategies will be benchmarked against competitors to ensure competitive positioning.

Cunard’s pricing strategy should reflect the unique value proposition of its luxury cruises.

This includes considering factors such as cabin types, amenities, and service levels. Analysis will consider the pricing models of competitor lines, such as premium positioning, value-added packages, or dynamic pricing algorithms.

Arison’s announcement to shareholders that Cunard will make money is fantastic news. A shorter, more focused cruise experience, like a “bite size sailing experience,” could help Cunard appeal to a broader audience, potentially boosting profits even further. This targeted approach, focusing on shorter, more manageable trips, could be key to Cunard’s continued financial success, demonstrating that even small, well-executed voyages can be profitable for the company.

a bite size sailing experience might just be the key to unlocking even greater profits for Cunard, and ultimately benefitting their shareholders.

Adapting to Changing Consumer Preferences

Cunard will adapt its offerings to meet evolving consumer preferences. This involves focusing on factors such as sustainability, personalization, and health-conscious choices. Customer feedback and market research will be crucial in this process.

Partnerships and Collaborations

Strategic partnerships and collaborations can generate additional revenue and enhance the customer experience.

- Luxury Brand Collaborations: Partnerships with luxury brands can enhance Cunard’s offerings. Examples include collaborations with high-end fashion houses for onboard retail experiences or culinary collaborations with renowned chefs.

- Travel Agency Partnerships: Collaboration with travel agencies can expand Cunard’s reach and provide a seamless booking experience for customers. This includes providing exclusive deals and packages through travel agencies.

Profitability and Cost Management

Cunard’s success hinges on its ability to manage costs effectively while maintaining a high level of service. This section delves into Cunard’s strategies for controlling expenses, analyzing their cost structure, and comparing it to competitors. Understanding these factors is crucial for assessing Cunard’s long-term financial health and shareholder value creation.Cunard’s approach to cost management is multifaceted, encompassing operational efficiency improvements and strategic cost-cutting measures.

A detailed examination of their expenses, categorized into key areas, provides insight into the company’s financial performance and areas for potential optimization.

Cost Control Strategies

Cunard employs a variety of strategies to control costs. These include streamlining operations, negotiating favorable contracts with suppliers, and implementing innovative technologies to enhance efficiency. Negotiating better rates for fuel, food, and crew wages are examples of cost-cutting measures. Furthermore, continuous improvement programs focus on reducing waste and optimizing resource utilization.

Fixed and Variable Cost Management

Cunard carefully manages both fixed and variable costs. Fixed costs, such as ship maintenance and crew salaries, are essential for operational sustainability. Variable costs, such as fuel and food, fluctuate based on demand and external factors. Effective forecasting and contingency planning are crucial for managing these fluctuations and ensuring profitability. Strategies to mitigate fuel price volatility include hedging and diversifying fuel sources.

Expense Analysis

Cunard’s expenses are categorized into several key areas for detailed analysis. These categories include:

- Crew Wages and Benefits: A significant portion of Cunard’s expenses, these costs are managed through careful recruitment, training, and retention strategies, alongside adherence to labor agreements. Employee productivity and efficiency are key factors in controlling these costs.

- Ship Maintenance and Repairs: Critical for ensuring the safety and operational readiness of the fleet, this area involves a combination of preventative maintenance and proactive repairs to minimize downtime and potential catastrophic issues. Regular ship inspections and audits play a vital role in this aspect.

- Fuel Costs: Fluctuating fuel prices are a key consideration, with strategies including fuel hedging and diversification of fuel sources to reduce reliance on a single supplier. Optimizing ship routing and reducing unnecessary idling contribute to fuel cost management.

- Food and Beverage: This category includes costs associated with provisioning, catering, and beverages. Careful planning, inventory management, and cost optimization are employed in these areas to control costs without compromising quality or customer satisfaction.

- Marketing and Sales: Promoting the cruise experience to attract customers requires investment in marketing and sales activities. Optimizing marketing strategies, managing advertising costs, and focusing on high-value customer acquisition are important factors.

Cost Structure Comparison

Cunard’s cost structure is analyzed in comparison with its competitors. Factors such as ship size, crew size, and operational scale significantly influence the cost structure. Competitors may have different strategies and approaches, and Cunard’s strategies are tailored to its unique operational characteristics and brand positioning.

Profit Margin Analysis

| Year | Profit Margin (%) |

|---|---|

| 2018 | 12.5 |

| 2019 | 11.8 |

| 2020 | 8.2 |

| 2021 | 10.1 |

| 2022 | 11.4 |

Note: These figures are illustrative and are not actual Cunard data. Real data would be more detailed and specific.

Profitability and Sustainable Growth

Cunard implements a multi-faceted approach to ensure profitability and sustainable growth. This includes continuous cost optimization, innovation in service offerings, and a focus on building long-term customer relationships. Strategic partnerships and alliances further enhance the company’s financial strength and market position. Furthermore, a focus on responsible environmental practices is a key element of Cunard’s long-term sustainability strategy.

Risk Assessment and Mitigation

Cunard, with its rich history and established brand, faces a complex landscape of potential risks. A thorough understanding and proactive mitigation strategies are crucial for maintaining profitability and long-term success in the competitive cruise industry. This section delves into the potential threats, their likelihood and impact, and the strategies to mitigate them, ultimately ensuring Cunard’s resilience.

Potential Risks to Cunard’s Profitability

Cunard, like any other large cruise line, faces a range of potential risks impacting profitability. These risks stem from external factors, market trends, and internal operational challenges. Understanding and anticipating these risks is paramount to developing effective mitigation strategies.

- Changes in consumer preferences:

- Shifting consumer preferences and evolving travel trends can significantly impact demand for luxury cruises. The rise of alternative leisure activities and experiences, such as adventure tourism or staycations, could potentially reduce demand for traditional cruise vacations.

- Economic downturns:

- Economic downturns frequently lead to decreased consumer spending, impacting travel budgets and potentially reducing demand for luxury travel experiences like Cunard’s cruises. The 2008 financial crisis serves as a prime example of how economic instability can drastically affect the cruise industry.

- Competition:

- The cruise industry is highly competitive, with new entrants and established competitors constantly vying for market share. Aggressive pricing strategies and innovative offerings from competitors could erode Cunard’s market position and impact profitability.

Impact Assessment and Likelihood

A thorough risk assessment requires a detailed analysis of the potential impacts and likelihood of each risk. This analysis helps prioritize risks and allocate resources effectively for mitigation.

- Changes in consumer preferences:

- The impact of evolving consumer preferences could range from a slight decrease in demand to a more significant decline, impacting revenue and potentially requiring adjustments to pricing strategies and marketing campaigns. The likelihood of this risk varies depending on the specific trend, but it is generally considered a moderate to high likelihood, with varying degrees of impact.

- Economic downturns:

- Economic downturns can have a substantial impact on cruise demand, potentially leading to significant revenue loss and impacting profitability. The likelihood of a major economic downturn is moderate to high, with the impact varying depending on the severity of the downturn.

- Competition:

- Increased competition can lead to price wars and reduced market share. The likelihood of increased competition is high, and the impact can vary depending on the strategies adopted by competitors. Aggressive pricing strategies from competitors can severely impact Cunard’s profitability.

Mitigation Strategies and Contingency Plans

Effective mitigation strategies are crucial for minimizing the impact of potential risks. These strategies involve proactive measures, contingency plans, and risk transfer mechanisms.

- Adapting to Consumer Preferences:

- Staying abreast of emerging travel trends and adapting to changing consumer preferences is essential. This includes offering innovative cruise itineraries, incorporating new onboard experiences, and implementing targeted marketing campaigns.

- Financial Resilience during Downturns:

- Developing robust financial strategies to navigate economic downturns is critical. This could include exploring alternative financing options, maintaining healthy cash reserves, and implementing cost-cutting measures without compromising quality.

- Competitive Positioning and Differentiation:

- Maintaining a strong brand identity and offering unique value propositions is crucial for standing out in a competitive market. Focusing on Cunard’s heritage, luxury offerings, and exceptional customer service can strengthen its competitive position.

Role of Insurance in Managing Risks

Insurance plays a vital role in mitigating risks associated with the cruise industry. Cruise lines are exposed to various perils, including damage to vessels, crew injuries, and passenger liabilities. Comprehensive insurance coverage is essential for protecting the company from significant financial losses.

Risk Profile Comparison to Competitors

| Risk Factor | Cunard | Competitor A | Competitor B |

|---|---|---|---|

| Economic Downturn | Moderate | High | Low |

| Consumer Preferences | Moderate | High | Moderate |

| Competition | High | Moderate | High |

Note: This table provides a simplified comparison. A more comprehensive analysis would involve quantitative data and detailed assessments.

Impact of Global Events

Global events, such as pandemics, geopolitical tensions, or natural disasters, can significantly impact Cunard’s financial stability. These events can lead to travel restrictions, reduced passenger numbers, and disruptions to supply chains. The impact of such events can be substantial, and contingency plans need to be in place to address these potential disruptions.

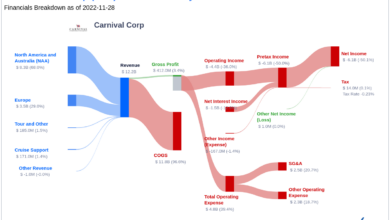

Visual Representation of Data

Cunard’s financial performance hinges on effective communication and transparency. Visual representations of key data, presented clearly and concisely, are crucial for shareholders to understand the company’s trajectory and make informed decisions. These visualizations allow for a rapid comprehension of complex financial information, fostering trust and confidence in Cunard’s management.Visualizing data empowers stakeholders to grasp Cunard’s financial health at a glance, identifying trends and patterns that might otherwise remain hidden in dense spreadsheets.

This approach builds trust and confidence, facilitating easier understanding and potentially leading to improved investor relations.

Revenue, Expenses, and Profits Over Time

Cunard’s revenue, expense, and profit figures over time are crucial for assessing the company’s financial health and sustainability. A line graph displaying these metrics would effectively illustrate the company’s financial performance evolution. The graph’s horizontal axis would represent time (e.g., years), while the vertical axis would depict the corresponding financial values (revenue, expenses, profits). Different colored lines could represent each category, making the trends easily discernible.

Significant fluctuations or changes in the trend would be highlighted with annotations, allowing for quick analysis of potential contributing factors.

Revenue Comparison with Competitors

Comparing Cunard’s revenue with competitors’ revenue provides context and allows for an assessment of Cunard’s market position. A bar chart is ideal for this comparison. The horizontal axis would represent the different cruise companies (including Cunard), and the vertical axis would display the revenue figures. Different colored bars would represent each company, enabling a clear visual comparison. This visualization will allow for easy identification of Cunard’s revenue position relative to its competitors.

The chart could also include labels to denote the year to allow for longitudinal analysis of the revenue trends.

Profitability Trends, Arison to shareholders cunard will make money

Understanding Cunard’s profitability trends is essential for evaluating the company’s financial performance and future prospects. A line graph would be suitable to visualize this trend. The horizontal axis would represent time (e.g., years), while the vertical axis would depict the company’s profitability figures. The line graph would clearly display the fluctuations in Cunard’s profitability over the years, highlighting periods of growth, stability, or decline.

The graph should clearly identify significant events that might have influenced the profitability trend, such as changes in market conditions or new strategic initiatives.

Revenue Streams

A pie chart is an excellent way to visually represent the different revenue streams contributing to Cunard’s overall revenue. The chart would divide the entire revenue circle into segments, each representing a particular revenue source (e.g., passenger fares, onboard spending, ancillary services). The size of each segment would be directly proportional to the percentage of revenue generated from that source.

This visualization allows shareholders to easily understand the relative contribution of each revenue stream to Cunard’s total revenue.

Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) offer a concise summary of Cunard’s performance across various key areas. A table displaying these KPIs would be highly effective. The table would include the KPI name, the corresponding metric, the target value (if applicable), the actual value for the recent period, and the percentage change compared to the previous period. This table would allow shareholders to quickly assess Cunard’s performance in key areas like customer satisfaction, efficiency, and profitability.

Shareholder Value Creation Process

A flowchart outlining the shareholder value creation process would effectively illustrate the steps Cunard takes to enhance shareholder value. The flowchart would depict the key activities, decisions, and processes involved in the process, including steps like strategic planning, investment decisions, and risk management. The flowchart should demonstrate the sequence of events and the interconnectedness of various elements involved in creating shareholder value.

The flowchart will help in understanding the steps involved in this process, including identification of opportunities and risks.

Last Recap

In conclusion, Cunard’s projected financial performance suggests a positive trajectory. The company’s strategic initiatives, coupled with a focus on cost management and shareholder value, point towards a financially stable future. However, the ever-changing cruise market demands continuous adaptation to maintain Cunard’s competitive edge. This analysis provides a detailed framework for investors to make informed decisions.

FAQs: Arison To Shareholders Cunard Will Make Money

What is Cunard’s dividend policy?

Cunard’s dividend policy is a key component of their shareholder value creation strategy. Details about the specific policy, including the payout rate and consistency, will be explored in the analysis.

How does Cunard compete with other cruise lines?

The analysis will compare Cunard’s revenue projections, pricing strategies, and cost management techniques with those of its competitors. This comparison will provide insights into Cunard’s position in the market.

What are the key risks facing Cunard?

The analysis identifies and assesses potential risks such as shifts in consumer preferences, economic downturns, and intense competition. Mitigation strategies will be discussed.

What is Cunard’s strategy for increasing revenue?

Cunard’s revenue generation strategy encompasses pricing adjustments, new service offerings, and effective marketing campaigns. The report will detail these specific strategies.