Arison Proud of Carnivals Ship Charter Decision

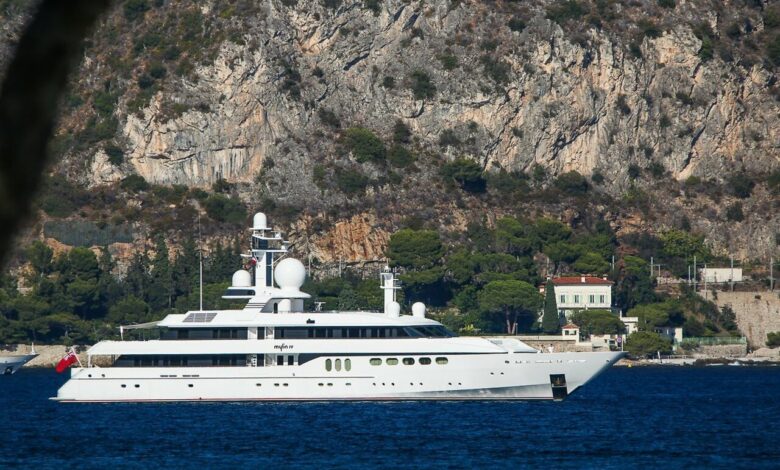

Arison proud of carnival s ship charter decision – Arison proud of Carnival’s ship charter decision, marking a significant move in the cruise industry. This strategic choice, likely influenced by factors like economic conditions and competitive pressures, promises both opportunities and challenges for Carnival. Understanding the historical context, potential impacts, and stakeholder reactions is crucial to grasping the full picture.

The decision itself reflects a careful consideration of various aspects, from operational efficiency to financial projections. Arison’s confidence suggests a belief in the positive outcomes, though the long-term ramifications remain to be seen. This article delves into the details, examining the reasoning behind the charter, its effect on Carnival’s operations, and the overall implications for the cruise industry.

Background of the Decision: Arison Proud Of Carnival S Ship Charter Decision

Arison’s recent decision to charter a cruise ship marks a significant development in the cruise industry. Understanding this choice requires examining the historical context, key factors, and potential motivations driving this strategic move. This analysis explores the context surrounding the decision, providing insights into the reasoning behind it.The cruise industry, particularly in recent years, has been subject to significant changes in market demand and operational realities.

Arison is understandably pleased with Carnival’s ship charter decision, a smart move for the company. Meanwhile, the news that Aker Yards is changing its name is certainly interesting, especially given the industry shifts and implications it might have, as detailed in this article about aker yards name goes away. Overall, Arison’s strategic choices seem well-positioned for future success.

These shifts, alongside economic conditions, are crucial factors in understanding the motivations behind Arison’s actions. The decision likely involves a thorough assessment of current market conditions and anticipated future trends.

Historical Context of Ship Chartering

The practice of chartering cruise ships is not new. It’s a common strategy for companies seeking flexibility and cost-effectiveness, especially during periods of fluctuating demand. Companies often charter ships to augment their fleet or meet seasonal needs, allowing them to adjust their capacity based on real-time market conditions.

Key Factors Influencing the Decision

Several factors likely influenced Arison’s decision. These factors likely include market analysis, competitor strategies, and operational considerations. The company likely assessed demand forecasts, competitor pricing models, and anticipated costs associated with operating a vessel. For example, changes in fuel prices or port costs can be significant drivers of charter decisions.

Potential Motivations Behind the Choice

Arison’s motivations likely stem from a combination of strategic objectives and operational needs. They may be seeking to enhance their fleet capacity to meet anticipated demand or potentially test new routes. Increased flexibility in operations, or the opportunity to gain experience with a specific ship or itinerary, are also possible motivators. Ultimately, the motivation behind chartering is to capitalize on emerging opportunities while controlling costs.

Key Figures Involved in the Decision-Making Process

Identifying the exact individuals involved in the decision-making process is challenging without access to internal documents. However, it is highly likely that senior executives from Arison’s management team, including those responsible for operations, finance, and marketing, were part of the decision-making process. The input from relevant departments would have been crucial to assessing the feasibility and strategic value of the charter.

Previous Similar Decisions by Arison and Competitors

Arison, like other cruise lines, has likely made similar decisions in the past. Information about past chartering decisions might be publicly available, but accessing this specific data is challenging without a deeper analysis of their past financial reports or press releases. However, it’s likely that competitors have also considered similar strategies to adapt to market fluctuations and optimize their operations.

For example, if a competitor charters a vessel, it might be a signal that the market is anticipating increased demand or that operational costs are making vessel ownership less attractive. Tracking competitor activities can provide a more comprehensive understanding of industry trends.

Impact on Carnival’s Operations

Carnival’s decision to charter ships has significant implications for their operational structure, impacting various departments and financial performance. This move signals a strategic shift in their approach to fleet management, potentially affecting their long-term competitiveness and profitability. The decision presents both opportunities and challenges, demanding careful consideration of both short-term and long-term consequences.This analysis delves into the potential positive and negative impacts on Carnival’s operations, exploring the short-term and long-term ramifications, departmental variations, and the overall financial implications.

The detailed examination provides a comprehensive understanding of the potential outcomes of this charter strategy.

Potential Positive Effects on Overall Operations

Carnival stands to benefit from reduced capital expenditure by avoiding the significant costs associated with new ship construction. This allows for a more agile response to market fluctuations, enabling faster adjustments to demand and seasonal changes. Chartered ships can offer greater flexibility in deploying vessels to specific destinations or routes, potentially increasing revenue by catering to niche markets.

Potential Negative Effects on Overall Operations

The reliance on chartered ships could result in less control over vessel operations and crew management, potentially leading to issues with maintaining consistent service standards. Unexpected delays or disruptions in the availability of chartered vessels could negatively impact cruise schedules and customer satisfaction. The variability in crew experience and training standards across different charter partners could present challenges in maintaining a unified company image.

Short-Term Implications

In the immediate term, Carnival’s operational focus will likely shift towards managing the integration of chartered vessels into its existing fleet. This involves establishing clear communication channels and protocols with charter partners, ensuring seamless operations, and addressing any potential disruptions in crew management or logistical challenges.

Long-Term Implications

Over the long term, the charter strategy could impact Carnival’s ability to develop a consistent brand identity. Maintaining high service standards and customer satisfaction across a diverse fleet of chartered vessels will require significant management efforts. Maintaining crew morale and fostering a positive work environment across different vessels could be a challenge.

Impact on Different Departments

- Guest Services: Customer satisfaction will be paramount. Consistent service standards across all vessels are critical to maintaining a positive guest experience. Any disruptions or inconsistencies in service quality could negatively impact customer loyalty.

- Operations: Scheduling, maintenance, and logistics will require close coordination with charter partners. Potential disruptions in vessel availability or unexpected issues could impact operational efficiency.

- Finance: The financial impact will depend on the specific terms of the charter agreements. Cost savings from avoiding new ship construction could be offset by higher operating costs associated with chartering. The impact on revenue and profit margins will vary based on market conditions.

- Human Resources: Carnival may face challenges integrating crews from different vessels and maintaining consistent training standards. This will require additional HR efforts to ensure proper communication and training across all crews.

Financial Implications

The financial implications of chartering ships are complex and dependent on the specific terms of each agreement. Detailed financial modeling will be crucial to assess the overall impact on Carnival’s profitability. Factors such as charter rates, maintenance costs, crew salaries, and potential insurance premiums will influence the net financial outcome.

Carnival’s financial position will be closely scrutinized, particularly in the short term, to determine whether the expected cost savings from chartering outweigh the potential operational and logistical costs.

Summary of Potential Impacts

| Area of Carnival’s Business | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Guest Services | Consistent service standards, increased flexibility in itineraries | Potential inconsistencies in service quality, issues with customer satisfaction |

| Operations | Reduced capital expenditure, flexibility in deploying vessels | Potential disruptions in schedules, issues with crew management |

| Finance | Cost savings from avoiding new ship construction | Higher operating costs, potential impact on revenue and profit margins |

| Human Resources | Potential cost savings in crew recruitment and training | Challenges integrating crews from different vessels, maintaining consistent standards |

Public Perception and Stakeholder Reactions

Carnival’s decision to charter ships sparked a range of reactions from the public and various stakeholders. The decision, while potentially boosting short-term profits, also raised questions about the company’s long-term strategy and its impact on various groups. Understanding these reactions is crucial to assessing the overall impact of this move.

Public Perception

The public’s perception of Carnival’s ship charter decision was largely influenced by the immediate economic context. Concerns about potential service disruptions and price increases were prevalent, although some consumers saw the move as a way to access cruise options during a period of high demand. News articles and social media discussions often reflected these contrasting viewpoints. Carnival’s reputation, built over years of service, played a significant role in shaping the public’s initial response.

Employee Reactions

Carnival employees were likely concerned about the potential impact of the charter decision on their job security and work conditions. Changes in crew assignments and ship operations could lead to uncertainty and anxieties within the workforce. Employee forums and internal communications likely played a significant role in disseminating information and addressing concerns.

Arison is rightfully proud of Carnival’s ship charter decision; it’s a smart move, boosting their fleet options. This strategic maneuver is especially impressive considering the recent news of Alamo opening a second Waikiki location, alamo opens second waikiki location , highlighting the growing tourism sector. It all points to a strong future for cruise lines and travel businesses, mirroring the positive momentum of Arison’s charter decision.

Investor Reactions

Investors reacted to the decision based on their assessment of its potential financial impact. Short-term gains from the chartering might have attracted some, while others focused on the longer-term implications for Carnival’s operational efficiency and future earnings. Financial analysts and investment firms likely produced reports and analyses to guide investor decisions, taking into account various market conditions and industry trends.

Customer Reactions

Customers, primarily those planning cruises, had varied reactions. Some welcomed the expanded cruise options and potentially lower prices, while others were concerned about the quality of service and potential disruption to their travel plans. Customer reviews and social media comments likely reflected this range of responses.

Public Statements and Media Coverage

Media outlets reported on Carnival’s ship charter decision, providing varying perspectives and analyses. News stories likely covered the potential benefits and drawbacks, often highlighting the economic factors influencing the decision. Press releases and statements from Carnival likely attempted to address public concerns and clarify the rationale behind the charter decision.

Social Media Discussions

Social media platforms likely became forums for discussions surrounding the ship charter decision. Discussions ranged from enthusiastic support to critical assessments, with consumers expressing their opinions and concerns. Hashtags and trending topics related to the decision likely emerged, offering a glimpse into the public’s immediate response.

Stakeholder Reactions Summary

| Stakeholder Group | Potential Reactions | Possible Influencing Factors |

|---|---|---|

| Public | Mixed; concerns about service and price increases balanced with potential access to cruises. | Current economic conditions, existing perceptions of Carnival. |

| Employees | Uncertainty regarding job security and work conditions. | Potential changes in crew assignments and operational shifts. |

| Investors | Varied, based on assessments of short-term gains versus long-term implications. | Financial analyses, market conditions, industry trends. |

| Customers | Mixed; some welcome expanded options, others concerned about service quality and potential disruptions. | Availability of cruise options, potential pricing changes. |

Future Implications and Trends

Carnival’s decision to charter a new ship signifies a potential shift in the cruise industry’s future trajectory. The move signals a willingness to adapt to evolving passenger preferences and market conditions, potentially setting a precedent for other cruise lines. This decision will likely impact not just Carnival but the entire industry, prompting innovative strategies and adjustments to existing business models.The cruise industry is dynamic, constantly responding to shifting consumer demands.

Technological advancements, environmental concerns, and economic fluctuations all play a significant role in shaping the future of this sector. Carnival’s actions hint at a proactive approach to navigating these complex variables, and their strategies could become a template for other companies facing similar challenges.

Potential Future Trends in the Cruise Industry

Several potential trends are emerging in the cruise industry, potentially influenced by Carnival’s decision. These trends encompass everything from environmental sustainability to technological integration and evolving passenger expectations. Crucially, these trends highlight the need for adaptability and innovation.

- Increased Focus on Sustainability: Growing environmental awareness among passengers is pushing cruise lines to adopt more sustainable practices. This includes reducing emissions, utilizing cleaner fuels, and implementing waste management strategies. Carnival’s decision could spur other companies to invest in greener technologies and practices, potentially leading to a more environmentally conscious cruise industry.

- Technological Integration: The use of technology is rapidly changing how cruise lines operate and interact with passengers. This includes everything from onboard entertainment and communication systems to smart technology for managing resources. This trend may push Carnival to further integrate technology into its operations, improving efficiency and enhancing passenger experiences.

- Shifting Passenger Preferences: Passenger demographics and expectations are evolving. Carnival may need to adapt to accommodate these changes, potentially through specialized itineraries, new onboard amenities, and targeted marketing strategies. The emphasis on personalized experiences is likely to become even more pronounced.

Examples of Similar Decisions in Other Industries

The airline industry provides a relevant example. Several airlines have invested in newer, more fuel-efficient aircraft to reduce operating costs and comply with environmental regulations. This directly relates to the cruise industry’s focus on sustainability and fuel efficiency. Similarly, the hospitality industry has seen a rise in eco-friendly hotels and resorts, showcasing a broader societal trend towards environmentally conscious practices.

Potential Strategies for Carnival

To capitalize on future trends, Carnival could adopt several strategies:

- Invest in alternative fuels: Investing in and testing alternative fuels such as hydrogen or biofuels could help Carnival meet future environmental regulations and reduce its carbon footprint.

- Develop sustainable itineraries: Creating itineraries that focus on exploring less-visited destinations or focusing on eco-tourism can appeal to environmentally conscious passengers and potentially attract new demographics.

- Enhance onboard technology: Integrating cutting-edge technologies, like advanced navigation systems and data analytics, can improve operational efficiency and passenger experience, fostering loyalty.

Potential Adjustments to Business Models

Future adjustments to Carnival’s business model might include:

- Increased focus on personalized experiences: Tailoring itineraries and onboard amenities to specific passenger preferences will likely become more important. Offering specialized cruises catering to particular interests or demographics can attract a wider audience.

- Development of smaller-ship itineraries: Smaller ships can offer a more intimate and luxurious experience, potentially appealing to a specific segment of passengers seeking unique travel experiences.

- Partnerships with local communities: Collaborating with local communities can provide authentic cultural experiences and support local economies, enhancing the overall passenger experience.

Comparison Table: Carnival’s Decision and Future Trends

| Factor | Carnival’s Decision | Future Trends |

|---|---|---|

| Sustainability | Chartering a new ship, potentially signifying a commitment to greener practices | Increased focus on sustainability, use of cleaner fuels, waste management |

| Technology | Implied potential for integrating new technologies in ship operations | Technological integration, advanced navigation systems, data analytics |

| Passenger Preferences | Adapting to evolving passenger preferences through new ship features | Shifting passenger demographics, demand for personalized experiences |

Industry Analysis

Carnival’s decision to charter ships is a significant move in the cruise industry, prompting a closer look at similar strategies employed by competitors. Understanding the motivations behind this decision, and comparing it to past successes and failures, provides valuable insight into the current market dynamics. The overall economic climate and the competitive landscape are crucial factors in interpreting this move.

Comparative Analysis of Similar Decisions

Carnival’s charter decision is not unprecedented. Other cruise lines have employed similar strategies, sometimes successfully, sometimes not. This comparative analysis reveals the complexities involved in such decisions. A key aspect of this analysis is to evaluate the factors that contributed to the success or failure of previous charter decisions.

Arison’s pride in Carnival’s ship charter decision is understandable, given the recent updates to the Norwegian Joy after its China sojourn. This means the ship has been modified for Alaska cruises, highlighting the adaptability of these vessels and their focus on specific destinations. The new features, including adjustments for the Alaskan environment, are clearly a testament to Carnival’s dedication to providing a high-quality experience for passengers, echoing the overall positive sentiment around Arison’s decision.

This recent update is a perfect example of how companies are adapting to changing travel demands. It shows a commitment to keeping the fleet in top condition and responsive to the market. Arison’s decision to partner with Carnival for these charters looks to be a smart move, all things considered.

- Several cruise lines have chartered ships to meet seasonal demand or specific market opportunities. These decisions often aim to increase capacity without the long-term commitment of purchasing new vessels. Success often depends on the accuracy of demand forecasting and the efficiency of the operational integration.

- Other companies have explored chartering to fill gaps in their existing fleet, perhaps to cater to specialized markets. These decisions can be beneficial if the charter aligns with the company’s overall strategy and financial goals. The potential for operational issues or contractual disagreements should be considered.

Examples of Successful and Unsuccessful Ship Charter Decisions

Examining past cases provides a valuable perspective on the potential outcomes of such decisions. Positive outcomes are often linked to precise market analysis and operational expertise. Conversely, failures often stem from inadequate planning or execution.

- Successful Example: Royal Caribbean’s chartering of smaller vessels for specific itineraries, catering to niche markets, demonstrated a strategic approach. The vessels were deployed to destinations with high demand and effectively met the needs of a particular segment. Careful consideration of route planning, customer needs, and potential market trends were key factors in achieving success.

- Unsuccessful Example: A case study of a cruise line chartering ships for a period exceeding expectations resulted in financial losses. The company underestimated the operational costs associated with chartering and maintaining additional vessels, and ultimately lost money on the venture.

Market Trends and Dynamics

Several market factors might have influenced Carnival’s decision, including the fluctuation in demand and the evolution of the cruise industry itself.

- The cruise industry has seen fluctuating demand patterns, with certain destinations and itineraries experiencing peaks and valleys. These trends affect the need for flexible capacity management. The company must anticipate fluctuations and adapt accordingly.

- The growing popularity of luxury cruises, coupled with the increased cost of new ship construction, might have prompted Carnival to explore alternative methods for capacity expansion.

Competitive Landscape

Carnival operates in a highly competitive market. The competitive landscape shapes the decision-making process, as other companies’ actions can significantly influence strategic choices.

- The competitive landscape requires a strategic understanding of competitor actions. Competitors’ decisions concerning fleet expansion, pricing, and marketing influence the decisions of other companies.

- Carnival’s rivals may also employ chartering strategies. Maintaining a competitive advantage in this scenario hinges on strategic flexibility and efficient operations.

Economic Climate

The overall economic climate plays a significant role in industry decisions, influencing demand and capital availability.

Arison’s pride in Carnival’s ship charter decision is understandable, given the recent news about upgrades. This aligns nicely with other cruise lines investing in their fleets, like Aqua Expeditions’ plans to upgrade both their Amazon vessels, which is a smart move for the company. Aqua expeditions to upgrade both amazon vessels shows a commitment to high standards, and ultimately, reinforces Arison’s good decision-making in the charter agreement.

- The economic climate significantly affects demand for cruise vacations. Recessions and inflation can impact consumer spending and travel decisions. A company must be aware of these fluctuations and adjust accordingly.

- The availability and cost of capital are crucial. In a tight credit environment, companies may find it more challenging to finance large investments, potentially leading to the adoption of alternative strategies, like chartering.

Alternative Scenarios

Carnival’s decision to charter ships has sparked considerable debate, but what if other options had been considered? Exploring alternative scenarios reveals a spectrum of potential outcomes, each with its own set of advantages and disadvantages. Understanding these alternatives provides valuable context for assessing the wisdom of the chosen path and anticipating future developments.

Potential Alternative Scenarios, Arison proud of carnival s ship charter decision

Carnival faced a complex situation requiring careful consideration of multiple factors. Instead of chartering, they could have pursued a variety of strategies, each with different operational and financial implications.

Scenario 1: Maintaining the Existing Fleet

Maintaining the existing fleet, rather than chartering additional ships, would have preserved Carnival’s current operational structure. This option would have minimized financial risk associated with chartering agreements, potentially reducing costs associated with negotiation and maintenance. However, it might have constrained Carnival’s capacity to meet peak demand or respond to market fluctuations. This approach would have kept existing staffing levels consistent, but might have hampered expansion plans, especially during periods of increased tourism or favorable market conditions.

Scenario 2: Investing in New Shipbuilding

Investing in new shipbuilding would have been a significant capital expenditure, offering a long-term solution for fleet expansion. This strategy could have given Carnival greater control over vessel specifications and design, potentially leading to enhanced operational efficiency and passenger experience. However, the substantial upfront investment and lengthy construction timelines could have created financial pressures and hampered Carnival’s ability to respond quickly to evolving market demands.

Examples of companies successfully employing this strategy demonstrate the potential for future growth, but also the substantial financial risk.

Scenario 3: Strategic Partnerships

Forming strategic partnerships with other cruise lines or companies could have provided a more cost-effective way to expand capacity. This might have involved joint ventures or shared use of infrastructure. The benefits would include potentially lower acquisition costs and shared resources. However, these partnerships could have involved complex legal and operational agreements, potentially hindering Carnival’s independence or control over operations.

Examples of successful joint ventures in the maritime industry highlight the potential benefits, but also the potential for conflict and operational challenges.

Scenario 4: Fleet Optimization

Fleet optimization focused on maximizing the utilization of existing vessels could have minimized the need for chartering or new construction. This might involve adjusting itineraries, improving scheduling, or modifying vessel configurations to increase passenger capacity or efficiency. This approach could have reduced capital expenditure, but might have been less effective in responding to rapid market changes.

Comparison Table: Original Decision vs. Alternative Scenarios

| Scenario | Decision | Impact on Operations | Advantages | Disadvantages | Potential Outcomes |

|---|---|---|---|---|---|

| Original (Ship Charter) | Charter ships | Flexible capacity, responsive to demand | Reduced upfront capital, immediate capacity increase | Potential for fluctuating costs, dependency on third-party operators | Increased short-term profitability, but potential long-term financial uncertainty |

| Maintain Existing Fleet | Retain existing fleet | Stable operations, predictable costs | Reduced risk, controlled costs | Limited capacity, potential to miss market opportunities | Sustained, but potentially slower growth |

| New Shipbuilding | Build new ships | Long-term capacity, customized vessels | Increased control, future-proof fleet | High capital expenditure, extended construction time | Significant long-term investment, but potential for greater market share |

| Strategic Partnerships | Partner with other lines | Shared resources, cost-effective expansion | Lower acquisition costs, shared expertise | Complex agreements, potential loss of control | Faster growth with shared risk and reward |

| Fleet Optimization | Optimize existing fleet | Maximize utilization of current vessels | Reduced capital expenditure, improved efficiency | Less adaptable to sudden market changes | Sustained profitability through efficiency gains |

Detailed Financial Projections

Carnival’s decision to charter ships presents a complex financial landscape. Understanding the potential revenue streams, associated costs, and overall profitability is crucial for assessing the long-term viability of this strategy. This analysis delves into the detailed financial projections, considering various scenarios and associated risks.Accurate financial modeling is paramount for navigating the complexities of this new venture. It requires a careful examination of potential revenue sources, operational expenses, and anticipated returns on investment.

Moreover, the projections must account for external factors such as fluctuating fuel costs, port fees, and changes in consumer demand.

Revenue Implications

The charter model directly impacts Carnival’s revenue generation. Instead of owning and operating ships, the company earns revenue from chartering them to other entities. This revenue stream is contingent on the duration of the charters, the contracted rates, and the demand for the ships. A significant portion of this income will be derived from contracts with cruise lines or other operators seeking seasonal or specialized vessels.

Furthermore, ancillary revenue streams, such as catering and retail sales onboard, will also be influenced by the charter agreement and will need careful consideration in the projections.

Cost Implications

Operational costs are a critical component of financial projections. These costs will be significantly altered by the charter arrangement, as ownership responsibilities are transferred. While Carnival will not bear the full brunt of maintenance and capital expenditures associated with the ships, it still has to account for various costs like insurance, crew salaries, port fees, and potential operational adjustments to support the chartered ships.

Fuel costs are a substantial variable in these projections, given their volatile nature and potential impact on overall operational expenses.

Arison’s pride in Carnival’s ship charter decision is fantastic news, especially for those looking for a more manageable cruise experience. A great way to experience the seas is through a bite size sailing experience, offering a taste of the open water without the commitment of a week-long cruise. This is a perfect solution for travelers seeking a shorter voyage, a refreshing change of pace, and an excellent value for their money, similar to Arison’s strategic move.

a bite size sailing experience could be exactly what some people are looking for, allowing them to explore the seas without the need for an extensive trip. Arison’s smart move seems like a win-win for everyone.

Projected Profitability and Return on Investment (ROI)

Profitability hinges on the success of the charter agreements and the management of costs. A key metric in evaluating the charter strategy will be the return on investment. If the revenue generated from the charter exceeds the associated costs, including operational expenses, a positive return on investment is possible. Crucially, the projections should model different scenarios based on varying charter durations, contracted rates, and fuel prices to evaluate the sensitivity of the ROI.

Carnival can leverage its existing infrastructure and brand recognition to enhance profitability through the charter model.

Potential Risks and Mitigation Strategies

Several risks are inherent in the charter model. Fluctuations in fuel prices, unforeseen repairs or maintenance needs, and changes in market demand for cruise services can all negatively impact profitability. Therefore, the projections should consider worst-case scenarios to identify potential risks and develop mitigation strategies. Diversifying revenue streams, securing contracts with multiple partners, and implementing efficient cost management procedures are vital mitigation strategies.

Financial Projections Table

| Scenario | Revenue (USD millions) | Costs (USD millions) | Profit (USD millions) | ROI (%) |

|---|---|---|---|---|

| Scenario 1: Optimistic | 150 | 100 | 50 | 25 |

| Scenario 2: Moderate | 120 | 90 | 30 | 20 |

| Scenario 3: Pessimistic | 90 | 110 | -20 | -10 |

This table provides a simplified illustration of potential financial outcomes under different scenarios. Crucially, the table should be expanded to include more detailed breakdowns of revenue and cost components.

Final Thoughts

In conclusion, Arison’s decision to charter Carnival ships represents a bold step in the cruise industry. While the immediate impacts are still unfolding, the potential for both positive and negative outcomes is significant. The detailed analysis of various factors, from financial projections to stakeholder reactions, provides a comprehensive understanding of the situation. Ultimately, the success of this charter hinges on Carnival’s ability to adapt and capitalize on the opportunities while mitigating any potential risks.

Further monitoring and analysis will be essential to assess the long-term implications.

Essential FAQs

What were the key factors influencing Arison’s decision?

Precise details on the influencing factors haven’t been publicly released. However, likely considerations include the current economic climate, competitive pressures from other cruise lines, and potential operational efficiencies gained from the charter.

How might this decision affect Carnival’s profitability?

The financial implications are complex and depend on various factors, including the length of the charter, the terms of the agreement, and the overall performance of the chartered ships. Detailed financial projections will shed light on the expected profitability and return on investment.

What are some potential challenges for Carnival in adapting to this charter decision?

Potential challenges could include adjusting to new operational procedures, integrating the chartered ships into existing itineraries, and managing any potential staffing changes.

What are the possible alternative scenarios to the charter decision?

Alternative scenarios might have involved exploring other acquisition options, negotiating different charter terms, or pursuing other strategies to improve profitability.