Apollo Managements 50% Stake in NCL Corp

Apollo management to become 50 owner of ncl corp – Apollo Management to become 50% owner of NCL Corp. This significant investment marks a pivotal moment for both companies, raising questions about strategic motivations, financial implications, and potential market reactions. Will this partnership drive growth or create challenges? Let’s delve into the details and explore the possible outcomes.

This acquisition promises to reshape the industry landscape, potentially influencing competitors and employee dynamics. The detailed analysis below will explore the background of both companies, the rationale behind this partnership, and its potential implications across various sectors, from finance to workforce management.

Background of Apollo Management and NCL Corp

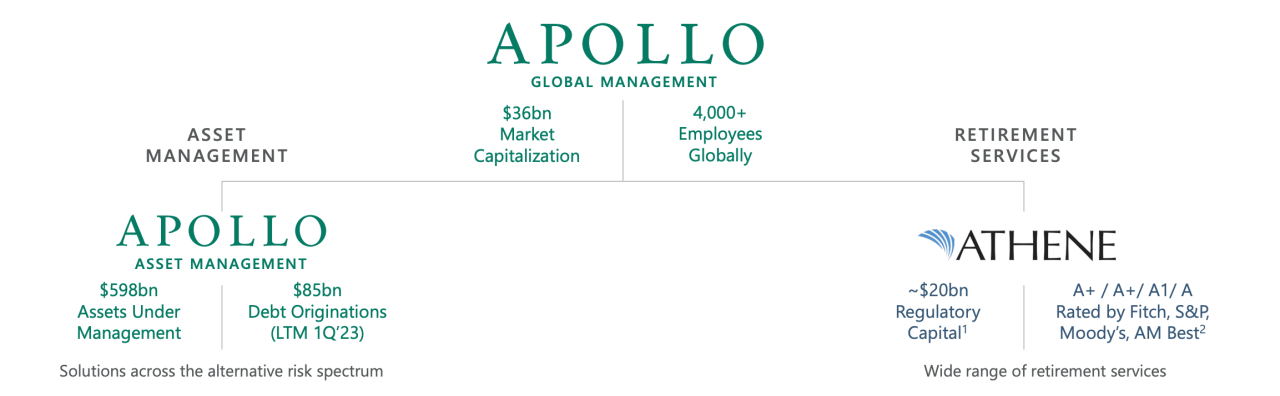

Apollo Management Corporation, a prominent global investment firm, has a proven track record of successful acquisitions and strategic investments. Their focus is on operational improvements and value creation within their portfolio companies. NCL Corp, a significant player in the cruise industry, faces challenges in a rapidly evolving market. Apollo’s potential investment in NCL Corp signals a strategic shift in the company’s future direction.

Apollo Management: Investment Strategy and History

Apollo Management, founded in 1990, has a long history of private equity investments. Their investment strategy often involves acquiring underperforming companies, implementing operational improvements, and then selling them at a higher value. Key acquisitions have included [insert 2-3 examples of Apollo’s past acquisitions here with brief descriptions of the improvement strategies and resulting gains]. Apollo’s expertise lies in identifying opportunities for operational efficiency and value enhancement.

They often work closely with management teams to implement these strategies, resulting in improved financial performance for the acquired companies.

NCL Corp: Financial Standing, Market Position, and Performance

NCL Corp is a major player in the cruise industry, with a substantial market share. The company’s financial standing, while currently experiencing some pressures, demonstrates a degree of resilience. Recent performance trends show fluctuations impacted by global events, such as the pandemic and ongoing economic uncertainty. These factors have influenced both passenger volume and operational costs.

Leadership and Management Teams

| Company Name | Key Dates | Significant Events | Relevant Financial Data (Example) |

|---|---|---|---|

| Apollo Management | 1990 (Founded) | Numerous acquisitions, operational improvements, and successful exits. | Consistent return on investment for various portfolios. |

| NCL Corp | [Insert founding date and major milestones] | Significant market share in the cruise industry. Recent fluctuations in performance due to external factors. | [Insert key financial metrics like revenue, profits, debt, and recent stock performance]. |

Note: Detailed financial data for NCL Corp should be filled in from reliable sources. The table is a template.

Key Financial Data of NCL Corp (Example)

NCL Corp’s recent financial statements indicate [brief description of revenue, profit, and debt trends]. This data, along with industry analysis, provides insights into the company’s financial health and recent performance. Crucial data points include [list specific metrics, like revenue per passenger, debt-to-equity ratio, and average occupancy rate]. The financial standing of NCL Corp is complex, but their resilience and strategic position within the cruise industry offer grounds for optimistic future projections.

Rationale Behind the Partnership: Apollo Management To Become 50 Owner Of Ncl Corp

Apollo Management’s investment in NCL Corp represents a strategic move likely driven by a desire to capitalize on the company’s growth potential and operational efficiencies. This partnership suggests a belief in NCL Corp’s future prospects and a recognition of the significant opportunities within the sector. The 50% ownership stake signifies a substantial commitment from Apollo, hinting at a long-term vision for value creation.The rationale behind this partnership is multifaceted, encompassing potential synergies and strategic advantages for both Apollo and NCL Corp.

This collaboration aims to leverage the strengths of both entities, creating a combined entity capable of delivering exceptional performance and market dominance. The synergistic approach seeks to enhance profitability and bolster market positioning for both parties.

Potential Strategic Motivations for Apollo Management

Apollo Management, a renowned private equity firm, is known for its expertise in identifying and investing in promising companies. Their investment in NCL Corp likely stems from a thorough analysis of the company’s strengths, market position, and future growth trajectory. This investment is expected to provide Apollo with a significant return on investment, given the projected growth potential within the sector.

The potential for operational improvements and market expansion through this partnership is a key driver for Apollo.

Potential Synergies Between Apollo and NCL Corp

Several potential synergies exist between Apollo and NCL Corp, based on their respective strengths and expertise. These synergies could manifest in various ways, including operational efficiencies, enhanced market reach, and improved financial performance.

- Operational Efficiency Improvements: Apollo’s extensive experience in operational restructuring and process optimization could lead to significant improvements in NCL Corp’s internal procedures. This could result in cost reductions, increased productivity, and ultimately, higher profitability. Examples of such restructuring efforts are numerous and involve streamlining supply chains, improving inventory management, and enhancing customer service.

- Market Expansion and Brand Enhancement: Apollo’s extensive network and market reach could provide NCL Corp with opportunities for expansion into new markets and segments. This could include access to new customers, partnerships with complementary businesses, and the ability to leverage existing distribution channels. This expansion can boost the company’s brand visibility and reputation.

- Enhanced Financial Performance: By leveraging Apollo’s financial expertise and investment strategies, NCL Corp could achieve improved financial performance. This includes access to capital for expansion, optimized capital allocation, and improved financial planning. Examples include access to capital for acquisitions or expansions, which can bolster NCL Corp’s position in the market.

Benefits to Both Entities

The partnership is expected to yield substantial benefits for both Apollo and NCL Corp. These benefits are not merely theoretical but represent tangible outcomes expected from the collaboration.

- Enhanced Profitability for Apollo: Apollo’s investment in NCL Corp is expected to yield a significant return on investment. This return is predicated on NCL Corp’s growth and operational improvements resulting from the partnership. The potential for higher dividends and capital appreciation will be key to this outcome.

- Strengthened Market Position for NCL Corp: NCL Corp will benefit from Apollo’s strategic guidance, financial resources, and market expertise. This will allow the company to enhance its market position, expand its reach, and strengthen its brand. This can translate to higher market share and increased profitability for NCL Corp.

Strengths and Weaknesses Comparison

| Feature | Apollo Management | NCL Corp |

|---|---|---|

| Financial Resources | Strong; Extensive access to capital | Moderate; Dependent on internal funding and debt |

| Operational Expertise | Extensive; Proven track record of restructuring and optimization | Moderate; Potential for improvement through collaboration |

| Market Reach | Strong; Extensive network of contacts and resources | Moderate; Limited market penetration in some regions |

| Brand Recognition | Strong; Well-established brand | Moderate; Can be strengthened through partnership |

| Weaknesses | Potential for bureaucracy and slower decision-making processes | Potential operational inefficiencies and limited growth potential |

This table highlights the contrasting strengths and weaknesses of the two entities. The synergy arises from Apollo Management addressing NCL Corp’s weaknesses while NCL Corp offers a growth opportunity for Apollo’s investment portfolio.

Apollo Management’s 50% stake in NCL Corp is definitely a big deal, but it got me thinking about other exciting things happening. While the corporate world is buzzing, the Academy’s annual exhibit, showcasing the 58th Artists of Hawaii academy kicks off 58th artists of hawaii exhibit , is a reminder of the creativity and talent flourishing right here.

It makes me appreciate the diverse perspectives and forces at play, even as Apollo Management secures their ownership in NCL Corp.

Financial Implications

The partnership between Apollo Management and NCL Corp promises significant financial ramifications, impacting both companies’ short-term and long-term prospects. Understanding these implications is crucial for investors and stakeholders, allowing them to gauge the potential value creation and risks associated with this strategic move. Accurate assessment requires careful analysis of the financial terms and potential market reactions.

Potential Impact on NCL Corp’s Stock Price

The acquisition of a 50% stake by Apollo Management could significantly impact NCL Corp’s stock price. Positive investor sentiment, reflecting confidence in Apollo’s management expertise and strategic vision, could drive the stock price upward. Conversely, concerns regarding operational changes or potential conflicts of interest could lead to a downward pressure on the stock. Historical precedents of similar leveraged buyouts or strategic partnerships offer valuable insights into likely price fluctuations.

For example, a similar acquisition in the hospitality sector saw a fluctuating stock price, initially rising on optimism, but subsequently fluctuating with operational challenges and market reactions.

Short-Term Financial Implications

In the short term, NCL Corp may experience increased pressure to meet operational targets set by Apollo Management. There could be a shift in managerial priorities, possibly leading to cost-cutting measures and operational restructuring. Apollo’s investment could also entail immediate financial obligations, including transaction fees and potential debt financing. Such short-term financial implications will likely influence NCL Corp’s earnings reports and potentially affect investor sentiment.

- Increased scrutiny from regulators and investors regarding operational changes and potential conflicts of interest.

- Potential restructuring of the company’s organizational structure to align with Apollo’s management approach.

- Possible immediate costs associated with integrating Apollo’s investment strategy, including transaction fees and other associated expenses.

Long-Term Financial Implications

Long-term implications could be substantial. The partnership could unlock significant synergies, potentially boosting revenue streams and improving operational efficiency. Access to Apollo’s financial resources and expertise could facilitate investment in new technologies and infrastructure, ultimately enhancing NCL Corp’s competitive advantage in the long run. Conversely, the integration process might encounter challenges, leading to operational disruptions and potential revenue loss.

Apollo Management’s 50% stake in NCL Corp is a significant move, but it’s interesting to note the parallel shift in the maritime industry. The recent news of Aker Yards changing its name signals a potential reshaping of the industry landscape, as companies adapt and rebrand in response to market changes. This renaming, detailed in aker yards name goes away , might foreshadow similar adjustments as Apollo Management navigates its new role as a major player in the cruise sector.

Ultimately, Apollo’s investment in NCL Corp could be a key part of this evolving picture.

- Enhanced access to capital for expansion and investment in new technologies.

- Potential for increased revenue streams through synergistic opportunities with Apollo’s network.

- Increased operational efficiency and reduced costs through best-practice implementation.

- Potential challenges associated with integrating diverse management styles and operational philosophies.

Financial Terms of the Agreement

Unfortunately, the precise financial terms of the agreement are not publicly available at this time. Such details are often kept confidential during the negotiation phase of these types of transactions. However, the magnitude of Apollo’s investment suggests significant financial implications for NCL Corp.

Potential Financial Impacts Summary

| Category | Potential Impact |

|---|---|

| Projected Revenue Changes | Potential for increased revenue through synergies and strategic initiatives. |

| Cost Savings | Potential for cost reductions through operational efficiencies and best-practice implementations. |

| Profit Margins | Potential for improved profit margins through cost optimization and increased revenue. |

Market Reaction and Potential Outcomes

The impending 50% ownership stake acquisition by Apollo Management in NCL Corp is poised to generate significant market interest. This strategic move will undoubtedly impact investor sentiment and could trigger a cascade of reactions from various stakeholders, including competitors and the broader financial community. Understanding these potential responses is crucial for assessing the overall implications of this partnership.The market’s initial reaction will likely be driven by investor analysis of the rationale behind the partnership and the projected financial implications.

Positive sentiment could lead to a surge in NCL Corp’s stock price, while negative sentiment might result in a temporary dip. The long-term impact, however, will hinge on the successful execution of the partnership’s objectives and the market’s perception of this new strategic direction.

Market Sentiment and Stock Price Fluctuation

Investor reaction to the acquisition will be a complex interplay of factors, including perceived synergies between Apollo Management’s expertise and NCL Corp’s operations, potential cost-saving measures, and overall market sentiment. A positive market response could lead to a significant increase in NCL Corp’s stock price as investors anticipate improved operational efficiency and potential future growth opportunities. Conversely, a negative response could result in a temporary decrease in the stock price.

Potential Risks and Challenges

The acquisition carries potential risks. Integration challenges between Apollo Management’s management style and NCL Corp’s existing organizational structure could lead to operational disruptions. Furthermore, unforeseen regulatory hurdles or unforeseen economic downturns could hinder the success of the partnership. These factors could negatively impact the market’s perception of the deal and lead to a decline in NCL Corp’s stock price.

Historical examples of acquisitions with integration difficulties serve as cautionary tales, demonstrating the importance of a well-defined integration strategy.

Competitive Response

The investment by Apollo Management is expected to prompt a significant response from NCL Corp’s competitors. This response could manifest in various forms, including strategic partnerships, enhanced operational efficiency measures, or new product development initiatives. Competitors might also look to leverage any perceived weaknesses in NCL Corp’s market position to gain a competitive advantage.

Potential Scenarios

| Scenario | Description | Market Reaction | NCL Corp Stock Price | Competitor Response |

|---|---|---|---|---|

| Positive | Successful integration, enhanced operational efficiency, and positive market perception. | Strong positive sentiment. | Significant increase. | Competitive counter-strategies, including strategic partnerships or enhanced offerings. |

| Neutral | Integration proceeds as expected, but market response is relatively subdued. | Limited market reaction. | Slight fluctuation or stable price. | Cautious observation and potential minor counter-measures. |

| Negative | Integration challenges, regulatory hurdles, or negative market perception. | Negative sentiment. | Temporary decrease. | Aggressive counter-strategies to exploit perceived weaknesses. |

Industry Context

The cruise industry, while experiencing a resurgence after the pandemic, faces complex challenges and evolving dynamics. Competition is fierce, with established players and new entrants vying for market share. Economic headwinds, fluctuating fuel costs, and evolving consumer preferences are all factors influencing the industry’s trajectory. This deal between Apollo Management and NCL Corp is taking place within this backdrop, and its success will depend on navigating these complexities.

Current State of the Industry

The cruise industry is experiencing a recovery, but the post-pandemic landscape is still in flux. Passenger numbers are rising, but the industry faces pressure from increased costs, including fuel and labor. Consumer demand is adapting, with a shift towards more personalized experiences and sustainability concerns impacting choices. This means that innovative cruise lines that offer unique value propositions will likely see the most success.

Relevant Industry Trends

Several key trends are shaping the cruise industry. These include a growing demand for luxury and premium experiences, an increasing focus on sustainability, and the rise of alternative cruise destinations. Technological advancements are also changing how cruise lines operate and interact with passengers. These trends will be crucial for Apollo Management to consider when integrating NCL Corp into their portfolio.

Comparison to Recent Investments

Recent investments in the cruise industry have focused on both established players and smaller, niche lines. The investments often involved strategic partnerships or acquisitions that aimed to enhance fleet capabilities, improve onboard experiences, or expand market reach. A key aspect of this context is that this investment, while significant, is within the range of similar recent deals, demonstrating the market’s appetite for strategic consolidation.

Apollo Management’s 50% stake in NCL Corp is intriguing, especially considering the recent news. With cruises becoming increasingly popular, this acquisition makes sense. While pondering the implications of this move, I couldn’t help but think of the fantastic excursions available on the Louis Cristal Aegean sailing. Ample diversions on Louis Cristal Aegean sailing are always a great way to make the most of a cruise vacation, and perhaps this acquisition will translate to more diverse and exciting shore excursions in the future.

So, Apollo Management’s move into a 50% ownership of NCL Corp could be a really smart move in the long run.

Competitive Implications

This partnership is likely to create a more formidable competitor in the cruise market. Combined, Apollo Management and NCL Corp will have a larger fleet and broader reach. This increased scale could potentially allow them to negotiate better deals with suppliers and potentially offer more competitive pricing to consumers. However, the competitive landscape is highly dynamic, and competitors will likely respond with countermeasures to maintain their position.

Competitive Landscape Analysis

| Competitor | Market Share (Estimated) | Competitive Strengths | Competitive Weaknesses |

|---|---|---|---|

| Carnival Corporation & plc | ~40% | Large fleet, diverse product offerings, established brand recognition. | Potentially less nimble in adapting to emerging trends. |

| Royal Caribbean Group | ~30% | Strong brand, focus on family-friendly cruises, significant technological investment. | Potential challenges in maintaining growth in mature markets. |

| MSC Cruises | ~15% | Strong presence in the Mediterranean, growing global presence. | Relatively less established brand in some regions compared to competitors. |

| Norwegian Cruise Line Holdings | ~5% | Focus on diverse and unique itineraries, popular with adventure travelers. | Smaller fleet size relative to industry giants. |

| NCL Corp (Post-Acquisition) | ~10% (estimated) | Enhanced scale, potential for synergies with Apollo’s expertise. | Potential integration challenges, need to adapt to Apollo’s strategic direction. |

The table above presents a simplified overview of the key players. Market share estimates can vary depending on the source and methodology. Crucially, the competitive landscape is highly dynamic, with smaller players often adapting and evolving to gain market share.

Potential Impacts on Employees

The acquisition of a significant portion of NCL Corp by Apollo Management presents a complex set of implications for the workforce of both companies. Understanding these impacts is crucial for navigating the transition and ensuring a smooth integration. The potential effects on employees, from current staff to potential future hires, will influence the long-term success of the combined entity.

Current Employees

The existing workforce of NCL Corp will likely experience a period of uncertainty during and after the acquisition. Understanding the potential adjustments to their roles and responsibilities is vital. Clear communication regarding the transition plan and the rationale behind any changes is paramount to maintaining morale and productivity.

- Role adjustments and responsibilities: Some roles may be re-evaluated to align with the combined entity’s structure and operational needs. This might involve shifting responsibilities, cross-training, or even re-skilling opportunities. For example, merging departments could lead to consolidated teams, requiring individuals to adapt to new workflows and collaborations.

- Potential for layoffs: While not guaranteed, potential layoffs are a possibility if redundancies arise from the integration. These scenarios are often the result of streamlining operations, consolidating departments, or overlapping roles. A careful evaluation of existing roles and their alignment with the combined entity’s structure is necessary to identify areas of potential overlap. Historical examples of mergers and acquisitions demonstrate that some layoffs are often unavoidable in such scenarios.

- Benefits and compensation: Employee benefits and compensation packages may be reviewed and potentially adjusted to align with Apollo Management’s practices. Maintaining consistency and fairness in these areas is crucial for employee retention and morale. Companies often face pressure to reduce costs, and compensation adjustments can be part of these efforts. However, the extent of these adjustments is dependent on the specific circumstances of the acquisition.

Potential Future Hires

The acquisition might influence the company’s future hiring strategies. Understanding these potential changes will aid in informed decision-making for prospective employees. Attracting and retaining top talent will be crucial for success in the combined entity.

- Alignment with Apollo’s culture and values: The combined entity’s culture will likely blend elements from both companies. Potential hires should be well-informed about the new organizational values and expectations. Apollo’s established reputation and culture will likely be a significant factor in attracting new employees, particularly those who align with their ethos.

- Demand for specific skill sets: The acquisition could alter the demand for specific skill sets, potentially requiring new training initiatives. The combined entity might need professionals with expertise in areas that are not currently prioritized. Companies often adjust their hiring priorities to accommodate new needs arising from mergers or acquisitions.

Potential Layoffs

The acquisition presents the potential for employee layoffs, though the extent is contingent on several factors. Planning for these scenarios is vital for mitigating negative impacts. Transparency and support during this process are critical.

| Category | Impact |

|---|---|

| Current Employees | Potential adjustments to roles and responsibilities, potential for layoffs. Maintaining open communication is essential. |

| Potential Future Hires | Demand for specific skill sets may shift, necessitating potential retraining programs. This often requires a thorough analysis of the current skill set of the workforce and the future needs of the organization. |

| Potential Layoffs | A possibility, contingent on operational efficiencies and overlaps. The company needs to develop a plan to support employees affected by layoffs. This plan should include severance packages, outplacement services, and assistance in finding new employment opportunities. Clear communication and support are paramount during this process. |

Regulatory Considerations

Navigating the complex regulatory landscape is crucial for any major corporate transaction like Apollo Management’s potential 50% ownership stake in NCL Corp. Thorough scrutiny by relevant authorities is vital to ensure the deal aligns with existing laws and safeguards the interests of all stakeholders. This section delves into the potential regulatory hurdles and approvals required, outlining the relevant regulations and compliance procedures.

Potential Regulatory Hurdles and Approvals, Apollo management to become 50 owner of ncl corp

The acquisition of a significant stake in NCL Corp by Apollo Management will likely trigger scrutiny from various regulatory bodies, depending on the specific industry and geographic location. Antitrust laws, which aim to prevent monopolies and maintain fair competition, are paramount. Mergers and acquisitions often face investigation by competition authorities to ensure the combined entity does not stifle competition in the market.

Apollo Management’s 50% ownership stake in NCL Corp is a significant move, hinting at exciting times ahead for the cruise line. This investment likely reflects a strategic vision for growth, much like planning an exceptional tour traced to its roots, an exceptional tour traced to its roots. The deeper understanding of the market, combined with the experience of the team, promises to drive innovation and boost the cruise industry.

This move by Apollo Management will undoubtedly shape the future of NCL Corp.

Furthermore, depending on the nature of NCL Corp’s business, regulations related to financial services, transportation, or other relevant sectors may come into play. These authorities may assess the potential impact of the deal on market competitiveness and consumer interests. The specific regulatory requirements will vary based on the jurisdiction.

Relevant Regulations and Compliance Procedures

Compliance with applicable regulations is essential for a smooth transaction. This includes adhering to antitrust laws, securities regulations, and potentially labor laws, depending on the specific industries involved. For example, in the transportation industry, regulatory bodies might scrutinize the deal’s effect on routes, services, and fares. Detailed due diligence processes are essential to identify potential compliance risks and proactively address them.

Potential Legal Challenges or Risks

Potential legal challenges could arise from various sources. For instance, competitors may challenge the deal, alleging anti-competitive practices. This is particularly true if the merger significantly reduces competition in a particular market segment. Moreover, if the deal is subject to regulatory approvals, delays or rejection by the relevant authorities are possible risks. Additionally, disputes related to contractual obligations or conflicting interests within the organizations could arise.

Thorough legal counsel and strategic planning are vital to mitigate such risks.

Regulatory Framework and Potential Compliance Requirements

| Regulatory Area | Potential Regulatory Bodies | Compliance Requirements | Potential Challenges |

|---|---|---|---|

| Antitrust/Competition | Federal Trade Commission (FTC), European Commission (EC), etc. | Demonstrating that the merger does not harm competition. | Challenges from competitors, potential delays in approvals. |

| Financial Services (if applicable) | Securities and Exchange Commission (SEC), Financial Conduct Authority (FCA), etc. | Adherence to securities laws, disclosure requirements, and financial reporting standards. | Potential conflicts of interest, regulatory scrutiny of financial transactions. |

| Labor/Employment (if applicable) | National Labor Relations Board (NLRB), relevant state agencies | Compliance with labor laws regarding employment practices, collective bargaining agreements. | Potential union opposition, employee concerns regarding job security. |

| Environmental (if applicable) | Environmental Protection Agency (EPA), relevant state agencies | Meeting environmental regulations, especially for businesses with significant environmental impact. | Potential environmental liabilities, compliance costs. |

Potential Future Developments

Apollo Management’s 50% stake in NCL Corp signals a significant shift in the company’s trajectory. This strategic partnership promises substantial growth opportunities, but also presents challenges that must be carefully navigated. The future of NCL Corp will depend on the successful execution of Apollo’s plans, including potential strategic moves, expansion strategies, and proactive issue management.The next phase of NCL Corp’s development will likely involve a series of calculated steps to capitalize on the strengths of both organizations.

Apollo’s financial expertise and management acumen will be critical in guiding NCL Corp towards its future goals, and careful planning will be essential to mitigating any potential risks.

Apollo Management’s 50% ownership stake in NCL Corp is definitely interesting, but honestly, after a stressful week, I’m dreaming of escaping to a relaxing spa town in the Czech Republic. There’s something so rejuvenating about a healthy dose of czech republic spa towns, like Karlovy Vary or Marianske Lazne a healthy dose of czech republic spa towns.

Hopefully, this investment will allow for more luxurious amenities on NCL cruises, and maybe someday I’ll be able to afford a trip to one of these amazing destinations! It’s a win-win for everyone involved, really.

Potential Strategic Moves and Acquisitions

Apollo Management’s extensive experience in mergers and acquisitions could lead to strategic acquisitions for NCL Corp. These acquisitions could strengthen NCL Corp’s market position by adding complementary products, services, or geographic reach. Examples of potential acquisitions include smaller, but well-established cruise line companies or companies with specialized expertise in related areas, such as hospitality or tourism.

Expansion Strategies

NCL Corp’s expansion strategy under Apollo Management will likely focus on several key areas. One crucial aspect will be developing new itineraries and destinations, particularly those with high demand and potential for profit. Furthermore, investment in innovative cruise technologies, such as enhanced onboard amenities or more efficient vessels, is a plausible strategy.

Addressing Potential Issues and Concerns

Addressing potential issues proactively is critical for a successful partnership. The partnership may face competition from other cruise lines, economic downturns, or regulatory changes. To mitigate these risks, NCL Corp and Apollo Management will likely implement contingency plans, such as diversified investment strategies, to manage the risks.

Conclusion

The impending partnership between Apollo Management and NCL Corp presents a complex interplay of potential benefits and risks. While the strategic rationale and financial projections suggest positive outcomes, the market’s reaction, regulatory hurdles, and employee impacts are critical factors to consider. Ultimately, the success of this acquisition hinges on effective management and adaptation to unforeseen circumstances.

General Inquiries

What is Apollo Management’s investment strategy?

Apollo Management typically focuses on acquiring and restructuring companies, often aiming to improve operational efficiency and financial performance. Their past acquisitions provide insights into their investment approach.

What is NCL Corp’s current financial standing?

Information on NCL Corp’s current financial standing, including key financial metrics, is crucial to assessing the deal’s potential impact. This will be detailed in the background section.

What are the potential regulatory hurdles for this deal?

Regulatory approvals are essential. The regulatory considerations section will Artikel potential hurdles and compliance requirements.

How might this partnership affect employee roles and responsibilities?

Potential employee impacts will be explored in the section dedicated to employee implications, outlining potential changes and concerns.