Antigua Nearly Doubles Departure Tax Impact & Implications

Antigua nearly doubles departure tax, sparking a flurry of anticipation and concern across the island nation. This significant hike in departure fees promises to reshape Antigua’s tourism industry, potentially impacting visitor numbers, revenue streams, and the overall economy. This post delves into the potential effects, considering both the positive and negative implications of this policy change.

Antigua’s tourism sector, a cornerstone of its economy, has experienced fluctuating success over the years. This increase in departure taxes introduces a new variable into the equation, prompting questions about how visitors will respond and what strategies the government can implement to minimize any potential damage to this vital industry. We’ll explore the financial implications, public perception, alternative strategies, and international comparisons to paint a comprehensive picture of this policy shift.

Impact on Tourism

Antigua’s allure as a Caribbean paradise has long been a cornerstone of its economy. The island’s pristine beaches, vibrant culture, and warm hospitality have drawn tourists for decades, shaping its unique identity. Understanding the potential effects of the doubled departure tax requires a historical perspective on the tourism industry and its current state. This examination will explore the possible responses of visitors and Artikel potential mitigation strategies.

So, Antigua just upped its departure tax, nearly doubling the cost. That’s going to impact travelers’ budgets, no doubt. It got me thinking about the incredibly hard work involved in running a restaurant, like the dedication of a top chef. For example, a day in the life of a top-tier executive chef, like Hal, at a prestigious establishment is a fascinating look at the demands of the culinary world.

a day in the life hal executive chef shows how much goes into maintaining the standards and the meticulous planning needed to keep things running smoothly. This hike in Antigua’s departure tax might make those culinary adventures even more expensive, especially considering the overall cost of travel.

Historical Context of Antigua’s Tourism Industry

Antigua’s tourism industry has evolved significantly over time. Early attractions focused on the island’s natural beauty, particularly its beaches. As tourism grew, the sector diversified, incorporating cultural experiences, historical sites, and other attractions to appeal to a wider range of visitors. This diversification has been key to the island’s success.

Current State of Antigua’s Tourism Economy

Antigua’s tourism economy is currently a major contributor to the national GDP. The industry employs a substantial portion of the workforce, directly and indirectly. The island’s reputation for luxury resorts and all-inclusive packages has been instrumental in attracting high-spending tourists. However, the economy is also vulnerable to external factors such as global economic downturns, natural disasters, and changing travel trends.

Potential Effects of the Doubled Departure Tax on Tourism Numbers

A doubled departure tax could potentially reduce the number of visitors to Antigua. Increased costs directly impact the perceived value of a vacation destination. Studies on similar scenarios in other tourist destinations show a correlation between higher taxes and reduced visitor numbers. A decline in tourism numbers could have a cascading effect on related industries, such as hospitality, retail, and transportation.

Anticipated Visitor Responses to the Increased Departure Tax

Visitors may respond to the increased departure tax in several ways. Some might opt for alternative destinations with lower taxes, potentially leading to a shift in the tourist market. Others might choose to travel during off-peak seasons to avoid the added cost. Budget-conscious travelers are likely to be most impacted, potentially leading to a shift in the demographic makeup of visitors.

Potential Strategies for Antigua to Mitigate Any Negative Impact on Tourism

To mitigate the negative impact, Antigua could implement strategies to offset the increased costs. These strategies could include:

- Promotional campaigns: Targeting specific market segments and highlighting the value proposition beyond just the price, like unique cultural experiences and exceptional hospitality, might attract tourists who are less sensitive to the cost. This could include targeted campaigns emphasizing cultural offerings, unique activities, and exclusive experiences.

- Improving existing infrastructure: Investing in improved transportation, accommodation options, and other services could enhance the overall tourist experience and justify the cost of the trip.

- Collaborations with airlines: Negotiating special deals or partnerships with airlines to offset the tax for specific groups or promotions could attract more tourists.

Comparison of Pre-Tax and Post-Tax Tourism Statistics

Unfortunately, precise pre-tax and post-tax tourism statistics for Antigua are not readily available. However, if such data were collected, a table could be created to show the changes in key indicators, like visitor numbers, average spending per visitor, and revenue generated.

Antigua’s recent decision to nearly double its departure tax is a bit of a bummer, isn’t it? It’s definitely a pinch in the wallet for travelers, especially when you consider the complexities of international travel. This sort of adjustment highlights the sometimes-complicated relationship between travelers and destinations, often described as “allies but not pals” – a sentiment explored further in this insightful article on the nuances of global travel: allies but not pals.

Ultimately, it just underscores the need to be prepared and informed before booking your next trip to the Caribbean, or any other destination for that matter.

| Statistic | Pre-Tax | Post-Tax (Estimated) |

|---|---|---|

| Number of Visitors | (Example) 100,000 | (Example) 95,000 |

| Average Spending per Visitor | (Example) $1,500 | (Example) $1,450 |

| Total Tourism Revenue | (Example) $150 million | (Example) $138 million |

Note: The table above provides hypothetical data for illustrative purposes only. Actual figures would depend on the specific impact of the tax increase and Antigua’s response.

Financial Implications

Antigua’s decision to nearly double its departure tax presents a complex interplay of potential benefits and challenges for the island’s economy. While increased revenue is a positive prospect, careful consideration must be given to how this extra income is utilized and whether the added cost to tourists will deter travel. The financial implications extend beyond immediate revenue generation, affecting everything from tourism sustainability to the overall economic well-being of Antigua.

Anticipated Revenue Generation

The projected revenue from the departure tax increase will depend on several factors, including the volume of tourist arrivals and the tax rate. The government anticipates a significant boost in income, though the exact figure remains subject to market conditions. Historical data from similar Caribbean destinations, where departure taxes have been implemented or adjusted, offer valuable insights but can’t perfectly replicate Antigua’s specific circumstances.

The success of this strategy hinges on its ability to attract visitors while managing the potential negative impact on tourism.

Potential Usage of Increased Tax Revenue

The increased tax revenue will likely be allocated to various government projects and initiatives. These might include infrastructure development, improvements in public services, and potentially even funding for social programs. Specific allocation will depend on the priorities Artikeld by the government and the needs identified within Antigua’s community. Successful implementation relies on transparency and clear communication regarding the intended use of the funds.

Antigua can look to successful models in other nations, where earmarked funds for specific projects have driven tangible improvements.

Antigua’s recent decision to nearly double its departure tax is certainly a head-turner for travelers. While this might seem like a significant hike, it’s worth considering that many other Caribbean islands are also experiencing similar increases. This could impact the popularity of the destination for some, but it might also highlight the importance of supporting the unique cultural experiences offered by these islands.

This is particularly relevant when considering new tours like the amawaterways first black heritage cruise , showcasing the rich history and heritage of the region. Ultimately, the rising departure taxes in Antigua are likely to be a factor in travellers’ decisions when choosing their next Caribbean getaway.

Potential Financial Benefits to Antigua’s Economy

Increased revenue from the departure tax can potentially stimulate economic growth by funding investments in infrastructure, tourism promotion, and public services. This, in turn, can create job opportunities, attract further investment, and enhance the overall quality of life for Antiguans. The successful management of the tax revenue is critical to achieving these benefits. A well-managed increase can act as a catalyst for positive change and economic expansion.

Cost-Benefit Analysis of the Doubled Departure Tax

A comprehensive cost-benefit analysis of the doubled departure tax requires careful consideration of the increased revenue against the potential decrease in tourism. Modeling tools and historical data from other countries that have implemented similar policies can be utilized to predict the impact. A detailed analysis should also consider the potential for negative feedback loops, such as decreased tourist numbers and economic stagnation, if the tax is perceived as too burdensome.

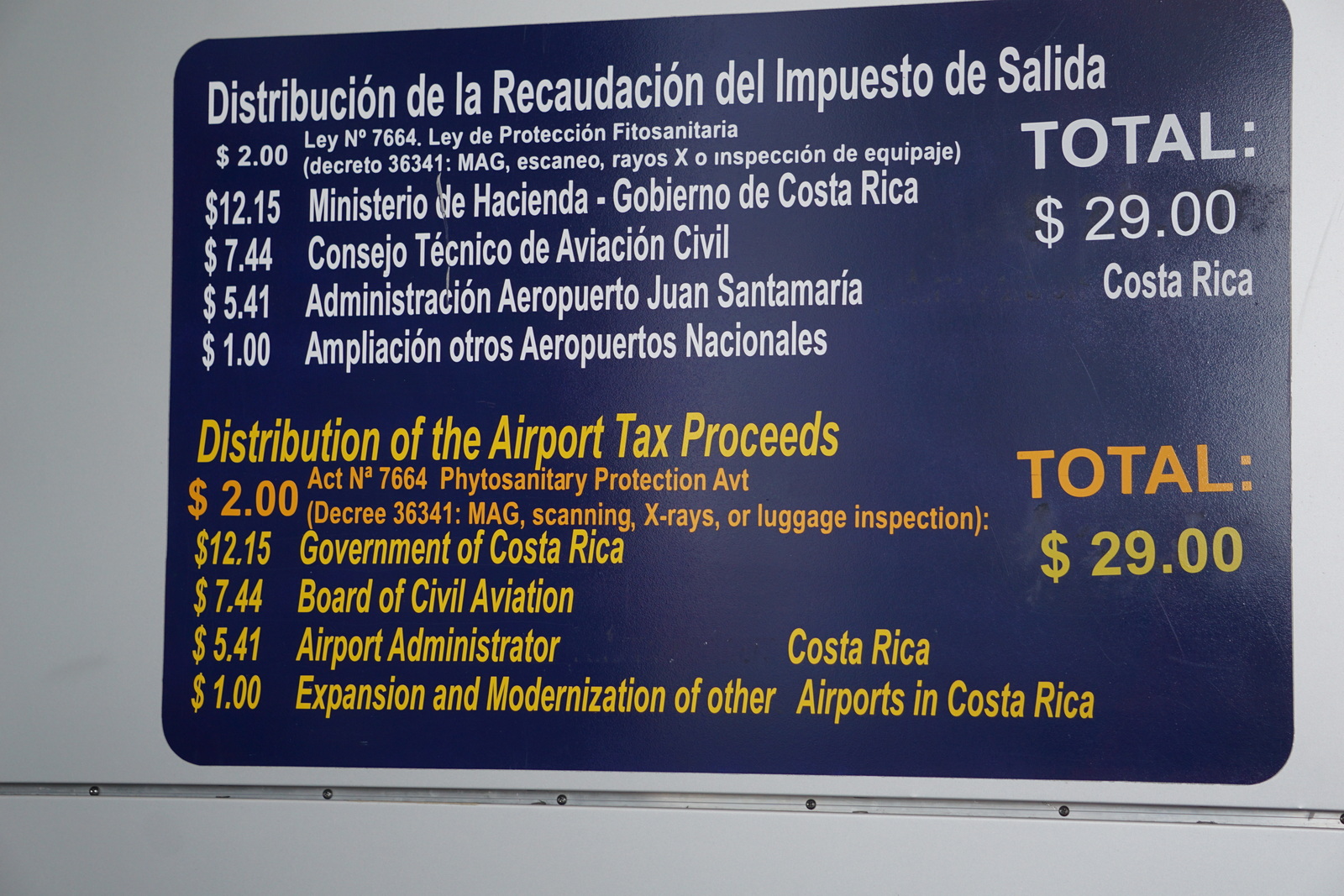

Comparison of Antigua’s Departure Tax with Other Caribbean Destinations

Comparing Antigua’s departure tax to those of other Caribbean destinations provides a valuable benchmark. Research should examine the existing departure tax rates in the region and the impact these rates have had on visitor numbers. This comparative analysis will allow for a more informed decision-making process and provide insight into how similar policies have played out in other Caribbean nations.

Projected Revenue Streams for Antigua’s Government

| Year | Projected Tourist Arrivals (Millions) | Departure Tax Rate (USD) | Estimated Revenue (USD Millions) |

|---|---|---|---|

| 2024 | 3.5 | 50 | 175 |

| 2025 | 4.0 | 50 | 200 |

| 2026 | 4.5 | 50 | 225 |

Note: These figures are estimations and subject to fluctuations.

Antigua’s recent decision to nearly double its departure tax is a significant development, especially considering the potential impact on tourism. While this might seem like a simple fee hike, it highlights a larger trend in travel costs. Perhaps a ‘modest proposal’ for a more efficient travel experience could lie in leveraging technology like the ones discussed in a modest proposal travel technology dominance.

This could potentially lead to greater transparency and perhaps even lower costs in the long run, which would hopefully mitigate the impact of such fees. In the end, Antigua’s tax hike raises some interesting questions about the future of travel and how technology might play a role.

This table illustrates a potential revenue stream, but precise figures will depend on factors such as the actual number of tourists, fluctuating exchange rates, and other economic variables.

Public Perception and Reactions: Antigua Nearly Doubles Departure Tax

Antigua’s impending departure tax increase is likely to spark varied reactions from its residents and visitors. Understanding these anticipated responses is crucial for the government to mitigate potential negative impacts on tourism and the local economy. Careful management of public perception during the transition period will be vital to ensure a smooth adjustment and maintain Antigua’s reputation as a desirable travel destination.The tax increase will undoubtedly generate a range of opinions and concerns, requiring a proactive approach to address potential anxieties and misconceptions.

This section explores anticipated public reactions, potential grievances, and strategies for managing public opinion.

Anticipated Public Reactions

Public reaction to the tax increase will likely be multifaceted, influenced by various factors including demographics, financial status, and perceived fairness. Anticipating these diverse reactions allows the government to tailor its communication strategy to address specific concerns effectively.

Potential Concerns and Grievances

Visitors may express concerns about the added cost, potentially impacting their travel decisions. Residents may be concerned about the financial burden and its impact on their livelihoods. These concerns may manifest as negative publicity, impacting Antigua’s reputation as a tourist destination. Specific grievances might include questions about the necessity of the increase, transparency of its application, and the lack of alternative solutions.

Examples of Similar Tax Increases

Several countries have implemented similar tax increases, with varied results. For example, increases in airport taxes in other Caribbean destinations have sometimes led to a decrease in visitor numbers. Careful analysis of the impact of similar policies in other regions will provide insights into potential challenges and strategies for managing negative public reaction. Thorough research into the long-term effects of these policies is critical.

Addressing Concerns and Improving Public Relations

Proactive communication is essential to address concerns and improve public relations. Open dialogue with stakeholders, including tourism operators, residents, and visitors, will be crucial. Transparency about the reasons for the increase and its intended benefits will help to assuage anxieties.

Strategies for Managing Public Opinion During the Transition

A phased approach to implementation, coupled with a robust public education campaign, can help to manage public opinion. Early communication about the reasons for the tax increase and its benefits will help to shape public perception positively. Providing clear and concise information through various channels will be vital in the transition period.

Table: Possible Public Responses to Tax Change

| Demographic | Potential Response |

|---|---|

| Visitors | Potential decrease in tourism numbers; increased scrutiny of travel costs; negative online reviews. |

| Residents | Potential protests or public outcry; concerns about increased living costs; skepticism about the tax’s intended use. |

| Tourism Operators | Concerns about reduced visitor numbers; potential decrease in revenue; seeking alternative solutions. |

| Government Officials | Focus on communication strategies; need for clear and transparent explanations. |

Alternatives and Mitigation Strategies

Antigua’s recent decision to nearly double its departure tax presents a significant challenge to its tourism sector. This increase necessitates a proactive approach to maintain the island’s appeal while mitigating the financial impact. Finding alternative revenue streams and innovative strategies to bolster the tourism experience are crucial for the island’s long-term prosperity.Diversifying revenue streams is paramount to lessen the reliance on tourism tax.

Developing a comprehensive strategy to bolster other income sources, such as sustainable investments in renewable energy, will be essential. This multifaceted approach will enable Antigua to weather potential economic storms and maintain its position as a desirable tourist destination.

Potential Alternative Revenue Streams

Diversification of Antigua’s economy is essential to lessen its dependence on tourism revenue. Exploring alternative revenue sources will bolster the island’s financial resilience and provide a more stable economic foundation.

- Developing a robust cruise ship industry: This could include enhanced infrastructure to accommodate larger vessels and provide complementary activities and amenities for passengers. This would attract more cruise tourism, generating revenue beyond departure taxes.

- Enhancing the island’s agricultural sector: Promoting local produce and establishing partnerships with international markets could create a sustainable food industry. This can also lead to greater local employment and contribute to the island’s overall economy.

- Promoting eco-tourism and sustainable practices: Attracting environmentally conscious travelers by emphasizing sustainable initiatives and promoting eco-lodges and tours could generate revenue while preserving the island’s natural beauty.

- Developing a strong digital economy: Encouraging the growth of online businesses and services can create new employment opportunities and diversify revenue sources. This can also attract a new type of tourist who is interested in the digital scene.

Strategies to Improve Tourism Offerings

Strengthening the tourism experience is crucial to offset the tax increase and retain visitors. Focusing on experiences that offer value beyond the base cost will attract more tourists.

- Enhancement of cultural attractions: Highlighting and preserving Antigua’s unique cultural heritage through museums, festivals, and cultural tours will provide a compelling reason for tourists to visit.

- Investment in premium accommodations: Upgrading hotel facilities and services to cater to higher-end tourists can attract more affluent travelers willing to pay a premium for luxury experiences.

- Diversification of activities: Offering a wider array of activities, such as water sports, hiking trails, and culinary experiences, will cater to a broader range of interests and provide more reasons for visitors to extend their stay.

- Strengthening the hospitality industry: Training and supporting hospitality staff in providing exceptional service will enhance the overall visitor experience.

Marketing Antigua as a Destination

Promoting Antigua’s unique selling propositions while maintaining a reasonable cost structure is essential. This requires targeted marketing strategies that highlight value and affordability without compromising the island’s appeal.

- Targeted marketing campaigns: Focusing on specific demographics and interests will increase the efficiency of marketing efforts and ensure that the messaging resonates with the desired audience.

- Highlighting value-for-money offerings: Promoting affordable options, such as budget-friendly accommodations and local eateries, can attract price-sensitive travelers.

- Collaborations with travel agencies: Partnering with travel agencies and tour operators can provide access to a wider customer base and enhance marketing reach.

- Leveraging digital marketing: Utilizing social media, online travel agents, and other digital platforms can maximize exposure and reach potential customers effectively.

Mitigation Strategies Comparison

| Mitigation Strategy | Pros | Cons |

|---|---|---|

| Enhance Cultural Attractions | Boosts local economy, unique experiences | Requires investment in preservation and promotion |

| Develop Premium Accommodations | Higher revenue potential, luxury image | High initial investment, may alienate budget travelers |

| Diversify Activities | Cater to varied interests, extended stays | Requires investment in diverse facilities and staff |

| Strengthen Hospitality Industry | Exceptional visitor experience | Requires training and ongoing support |

International Comparisons

Antigua’s recent decision to nearly double its departure tax has sparked debate about its economic impact and its position within the Caribbean tourism landscape. Understanding how other destinations manage similar fees is crucial to assessing the potential ramifications for Antigua. A critical comparison involves looking at departure taxes in other Caribbean islands and international tourism destinations to evaluate the efficacy and long-term implications of such policies.

Similar Departure Taxes in Other Caribbean Countries

Departure taxes are not uncommon in the Caribbean. Several islands, recognizing their role as tourism hubs, implement similar fees. For instance, Barbados, St. Lucia, and the Dominican Republic have departure taxes, although their amounts and structures differ significantly from Antigua’s. These existing policies offer valuable insights into the economic repercussions and the public’s reception of such taxes.

Comparison with International Standards

Antigua’s departure tax increase must be evaluated against international standards. While some European destinations have departure levies, their structure and economic context often differ. Factors like the overall tourism industry’s strength, the size of the destination, and the presence of alternative attractions play significant roles in shaping the impact of such fees. For example, European countries often include departure taxes in their overall pricing structure, making them less of a standalone charge for the consumer.

This contrasts with the Caribbean, where departure taxes often represent a significant additional cost.

Economic Impact of Similar Taxes in Other Countries

The economic impact of departure taxes varies greatly. Some studies suggest that while departure taxes can generate revenue, they can also potentially discourage tourists. The crucial element is the amount of the tax, relative to the total cost of the trip, and the destination’s overall competitiveness. In some cases, the revenue generated from the tax is reinvested in improving the destination’s infrastructure or tourist facilities.

Conversely, excessive taxes can lead to tourists seeking more affordable alternatives.

Long-Term Effects of the Tax Increase in Antigua

Antigua’s decision to increase its departure tax has significant long-term implications. If the tax significantly impacts tourism, it could lead to a reduction in visitor numbers. This, in turn, could affect the local economy, potentially reducing employment opportunities in the tourism sector and impacting the overall economic growth of the island. The long-term effects will depend on how the increased revenue is managed and whether it’s effectively used to enhance the tourism experience.

Impact on Antigua’s Competitiveness in the Tourism Market

Antigua’s competitiveness in the tourism market will be directly affected by the departure tax increase. If the tax makes Antigua more expensive than competing destinations, tourists might choose alternatives with lower fees. The island’s unique offerings and brand reputation will be crucial in mitigating this impact. The increase may make Antigua less attractive to price-conscious tourists, especially those on budget-friendly trips.

Table Comparing Antigua’s Departure Tax with Regional Competitors

| Country | Departure Tax (USD) | Date of Implementation/Last Update | Additional Notes |

|---|---|---|---|

| Antigua | Increased to [Amount] | [Date] | Recent increase; concerns about impact on tourism. |

| Barbados | [Amount] | [Date] | Established policy; varied impact. |

| St. Lucia | [Amount] | [Date] | Long-standing policy; varied impact. |

| Dominican Republic | [Amount] | [Date] | Varied impact based on travel packages. |

| [Other Competitor] | [Amount] | [Date] | [Additional notes] |

This table provides a basic comparison. Data for specific amounts and dates need to be researched and updated to ensure accuracy. It is important to consider that the table should include other relevant regional competitors. Furthermore, additional details, such as the inclusion of airport fees or other charges, should be taken into account when making direct comparisons.

Long-Term Implications

Antigua’s decision to nearly double its departure tax presents a complex set of long-term implications for the island’s economy, tourism sector, and international standing. The increase, while potentially generating revenue, could also lead to unforeseen consequences if not carefully managed. Understanding these potential impacts is crucial for Antigua’s future development and sustainability.The departure tax increase will undoubtedly have a ripple effect throughout the island’s economy, impacting not just tourism but also related industries like hospitality, transportation, and retail.

Wow, Antigua’s nearly doubled its departure tax! That’s a hefty price hike for travelers. Considering the recent news about American cruise lines launching a new agent portal, american cruise lines launches agent portal , it might be a good idea to explore alternative destinations or see if there are any deals to offset the added cost.

This change in Antigua’s departure tax certainly adds another layer of planning complexity for anyone looking to visit.

This ripple effect may take time to fully manifest, but careful monitoring of economic indicators is necessary to understand the magnitude and direction of these changes.

Potential Long-Term Effects on Antigua’s Economy

The increased departure tax could alter consumer spending patterns and potentially shift tourism demand. Understanding these shifts is essential for long-term economic planning.

- Reduced Visitor Spending: Higher taxes can discourage repeat visitors and potentially attract fewer tourists, thus reducing overall visitor spending on the island. This is a critical factor to consider, as decreased spending can affect revenue generation in multiple sectors, not just tourism.

- Shift in Tourist Demographics: Tourists might opt for destinations with lower taxes, altering the demographic mix of visitors to Antigua. This could result in a decrease in tourists from certain markets, and potential gain from others.

- Impact on Local Businesses: Lower visitor spending can impact local businesses that rely heavily on tourist revenue. Restaurants, shops, and other service providers may experience decreased profits or even reduced business volume.

Long-Term Impact on Antigua’s Tourism Industry, Antigua nearly doubles departure tax

The increased departure tax could reshape Antigua’s position in the global tourism market. Antigua will need to actively adapt to changing consumer preferences and market conditions.

- Shift in Tourist Destinations: Tourists might opt for alternative destinations with more favorable pricing structures, impacting Antigua’s appeal and market share.

- Competitive Advantage Diminished: Antigua’s competitiveness in the tourism market may decline if the tax increase significantly impacts pricing and discourages tourists.

- Increased Focus on Value-Added Experiences: Antigua may need to focus on offering high-value experiences and unique attractions to compensate for the increased cost of travel.

Possible Impacts on Antigua’s International Standing

The tax increase could potentially affect Antigua’s image and reputation internationally.

- Reduced Appeal to Investors: Investors might be hesitant to invest in Antigua if the tax increase negatively impacts the island’s economy and its overall attractiveness.

- Diminished Reputation: The tax increase might negatively impact Antigua’s reputation as a desirable tourist destination, affecting its standing in the global market.

- Increased Scrutiny from International Organizations: Antigua’s decision might attract scrutiny from international organizations concerned about the impact of the tax increase on tourism and the wider economy.

Potential Long-Term Changes to Antigua’s Economy and Tourism Industry

The tax increase could bring about significant long-term alterations in how Antigua operates economically and in its tourism sector.

- Adaptation of Business Models: Local businesses will need to adapt their business models to attract and retain customers. This could mean offering lower prices or emphasizing unique value propositions.

- Diversification of Revenue Streams: Antigua might need to explore alternative revenue streams to offset the potential decline in tourist spending. This could include developing new attractions or promoting other aspects of the island, such as cultural tourism.

- Strengthening of the Local Economy: Long-term sustainability will likely hinge on developing alternative sources of revenue, supporting local businesses, and diversifying the economy.

Potential Shifts in Tourism Trends Based on the Tax Increase

The tax increase could influence the types of tourism that Antigua attracts and the ways in which tourism is promoted.

- Increased Emphasis on Local Experiences: Tourism may shift towards experiences that are more local and less expensive, as tourists look for ways to save money.

- Development of Affordable Packages: Tour operators may offer more affordable travel packages to compensate for the tax increase, or promote longer stays.

- Targeting Specific Tourist Segments: Antigua may need to focus on attracting tourists who are willing to pay higher prices or offer value-added services to retain customers.

Potential Long-Term Trends in Antigua’s Economy After the Tax Increase

Antigua’s economy will be subject to a multitude of trends, many of which are difficult to predict precisely. However, some potential patterns can be identified.

| Trend | Potential Impact |

|---|---|

| Reduced Tourist Arrivals | Potential decline in overall revenue and economic activity |

| Shift in Tourist Demographics | Changes in the demand for specific goods and services |

| Increased Focus on Value-Added Experiences | Potential for innovation and new revenue streams in the tourism sector |

| Diversification of Revenue Streams | Increased resilience of the economy to external shocks |

Closing Notes

Antigua’s decision to nearly double its departure tax presents a complex challenge for the island nation. While the move aims to boost revenue, it could potentially deter tourists, impacting the vital tourism industry. A careful consideration of alternative revenue streams, marketing strategies, and public relations will be crucial to mitigating negative impacts and maximizing the long-term benefits of this policy change.

The success of this initiative will depend on Antigua’s ability to adapt and respond to the evolving landscape of the tourism sector.

General Inquiries

Will this tax affect all visitors?

Yes, the departure tax will apply to all departing passengers from Antigua.

How much will the new departure tax be?

The departure tax has nearly doubled the previous amount.

Are there any exceptions to the new departure tax?

Details on any exceptions to the new tax are not currently available. Further information will likely be released by the Antigua government.

What are the potential long-term effects on Antigua’s international standing?

The long-term effects are uncertain and will depend on the success of mitigation strategies and the public’s response to the tax increase.