Anguilla UPS Seaport Embarkation Tax A Deep Dive

Anguilla UPS seaport embarkation tax is a crucial element impacting businesses and tourists in Anguilla. This tax, levied on goods and services entering or leaving the island’s seaport, significantly influences economic activity. Understanding its nuances is key to grasping its potential effects on the island’s economy and trade.

This comprehensive look at the Anguilla UPS seaport embarkation tax will explore its structure, components, impact on businesses and tourists, compliance procedures, and potential future trends. We’ll delve into the historical context, relevant government agencies, and compare it to similar taxes in the Caribbean region.

Overview of Anguilla’s Seaport Embarkation Tax: Anguilla Ups Seaport Embarkation Tax

Anguilla, a picturesque island in the Caribbean, maintains a strategic position as a popular cruise destination. This strategic importance is reflected in the implementation of a seaport embarkation tax, a vital component of the island’s revenue generation and management. This tax, levied on cruise passengers embarking from Anguilla’s seaport, plays a crucial role in supporting local infrastructure and services.The Anguilla seaport embarkation tax is designed to generate revenue for the benefit of the island.

Proceeds from this tax are allocated to improve the island’s facilities, infrastructure, and services. This ensures that the influx of cruise passengers translates into tangible improvements for the local community, benefiting both residents and visitors.

Description of the Anguilla Seaport Embarkation Tax

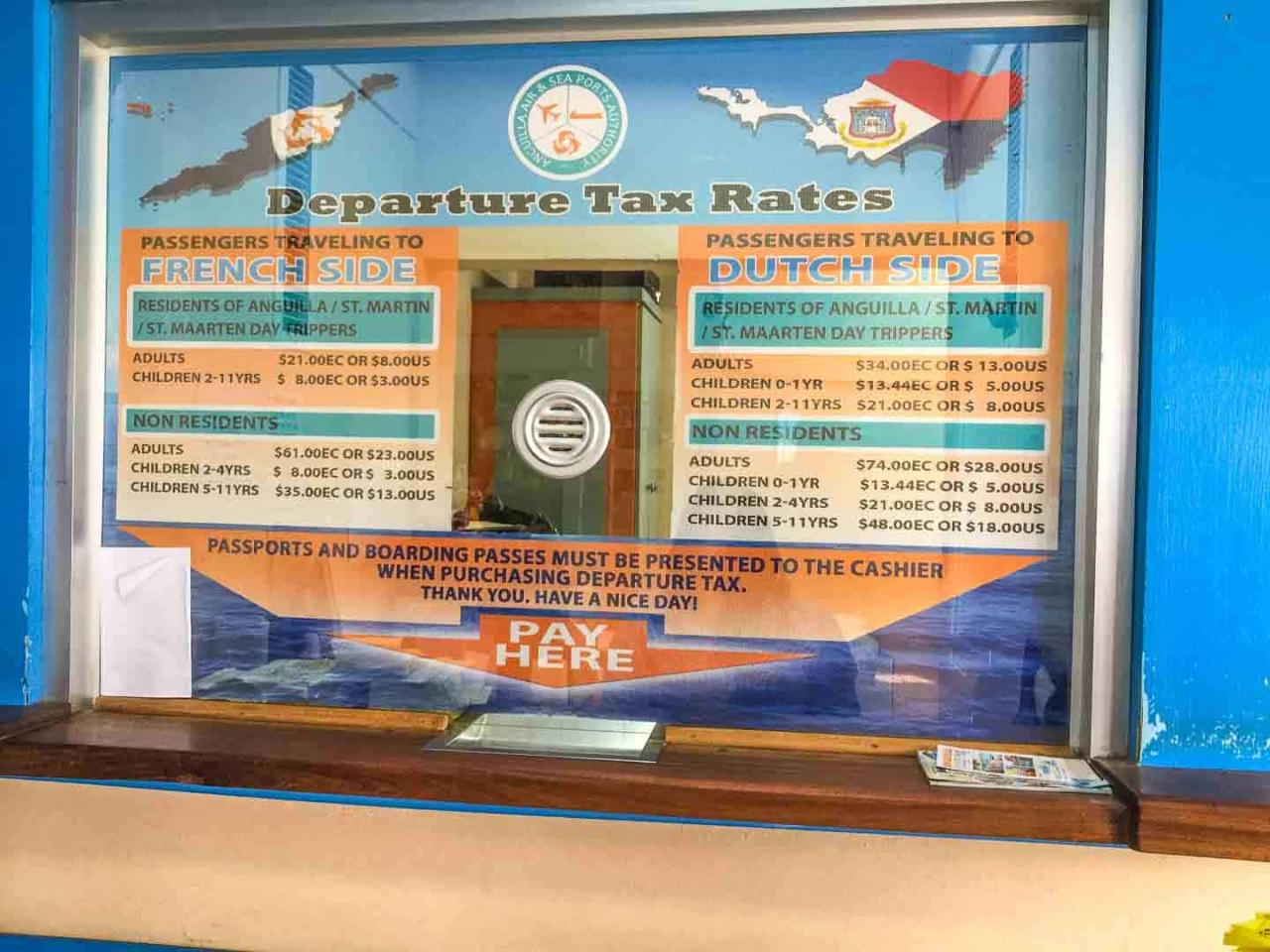

The Anguilla seaport embarkation tax is a levy imposed on individuals embarking from the island’s seaport. It is a percentage-based fee applied to each passenger. The exact rate and the specifics of its application are determined by the relevant Anguilla government agencies.

Purpose and Objectives of the Tax

The primary purpose of the Anguilla seaport embarkation tax is to provide funding for essential infrastructure and services. This includes improving and maintaining the island’s seaport facilities, as well as funding other projects that enhance the overall experience for both residents and visitors. This tax is a crucial element in the financial ecosystem of Anguilla, ensuring that the economic benefits of tourism are translated into tangible improvements for the island’s well-being.

Historical Context of the Tax

The implementation of the Anguilla seaport embarkation tax can be traced back to [Insert Year] when the Anguilla government recognized the need to create a sustainable funding mechanism to support tourism-related developments. The historical context of this tax is closely intertwined with the island’s evolving tourism industry and its associated infrastructure needs. The exact details of the tax’s evolution, including any modifications or adjustments, can be found in relevant government publications and records.

Anguilla Government Agencies Responsible for the Tax

The Anguilla government agencies responsible for the seaport embarkation tax are [Insert Agency Names]. These agencies play a critical role in the collection, management, and allocation of funds generated by the tax. Their roles and responsibilities are defined by the laws and regulations governing the tax, ensuring transparency and accountability in its administration. These agencies are responsible for implementing the policies and regulations associated with the tax.

Tax Structure and Components

The Anguilla seaport embarkation tax, a vital revenue source for the island, is structured to manage the flow of goods and services through its ports. Understanding its components is crucial for businesses and individuals involved in import and export activities. This section delves into the tax’s detailed structure, calculation methods, and the categories of goods and services subject to the tax.The tax’s structure is designed to be transparent and fair, with specific components and rates applied based on various factors.

This allows the government to collect revenue efficiently while maintaining a balance between attracting trade and controlling costs for importers and exporters.

Tax Components

The Anguilla seaport embarkation tax comprises several components, each with its own rate and applicability. These components are Artikeld in the table below.

Calculation Methods, Anguilla ups seaport embarkation tax

Calculation methods for the Anguilla seaport embarkation tax are meticulously detailed and vary depending on the component. For example, the cargo handling fee is determined by calculating the weight of the cargo multiplied by a predetermined rate per unit of weight, which differs based on the type of cargo. Similarly, the passenger embarkation fee is a fixed amount per passenger.

Categories of Goods/Services

The tax applies to a broad range of goods and services, including:

- Passenger transport: This encompasses all passengers embarking from Anguilla’s seaports, whether traveling for tourism or business.

- Cargo transport: This applies to all goods being exported or imported via Anguilla’s seaports, encompassing various types of cargo such as perishable goods, raw materials, and manufactured products.

- Cruise ships: This applies to cruise ships visiting Anguilla’s ports, covering the entire ship and each passenger embarking.

Exemptions and Deductions

Certain goods and services may be exempt from or receive deductions in the Anguilla seaport embarkation tax. For example, humanitarian aid and certain types of raw materials may be exempt. Specific details and the conditions for exemptions are available from the relevant government agencies.

Figuring out Anguilla’s ups seaport embarkation tax can be tricky, right? It’s all about those little details, like knowing how much to budget. You might find yourself wondering about the daily grind of a high-profile executive chef, like Hal, whose experiences are detailed in a day in the life hal executive chef. But in the end, understanding these taxes is key to planning a smooth trip to Anguilla.

So, keep researching those fees!

Impact on Businesses and Tourists

The Anguilla seaport embarkation tax, a new revenue stream for the island, promises to generate funds for infrastructure improvements. However, its impact on businesses and tourists is a critical factor to consider. Understanding how this tax affects various sectors is essential for a balanced assessment of its long-term effects on Anguilla’s economy.The implementation of the embarkation tax will likely have varying consequences on different types of businesses operating in Anguilla’s seaport.

Some businesses, like those directly involved in cruise ship passenger handling and services, may experience increased costs, potentially impacting their profitability. Others, such as those providing support services to cruise ship operations, may see a reduction in revenue if cruise lines shift their operations to destinations without similar taxes.

Impact on Different Business Types

The tax’s effect will vary depending on the specific business. Cruise ship tour operators, for instance, will likely see an increase in their operational costs, which they might pass on to customers through higher tour prices. Retail businesses reliant on cruise ship visitors might experience a decrease in sales if the tax deters tourists from shopping. However, businesses offering alternative experiences, such as eco-tourism or local cultural tours, may see an increase in demand from tourists seeking a more authentic Anguillian experience.

Impact on Tourism

The tax could influence tourism patterns in Anguilla. Tourists may adjust their travel plans, opting for destinations without such levies or those offering competitive pricing. A comparative analysis of similar taxes in other Caribbean jurisdictions is important for predicting the Anguilla tax’s impact on tourism.

Potential Effects on International Trade

The tax’s potential impact on international trade activities in the region is complex. If the tax is perceived as burdensome, cruise lines might reroute their ships to other islands, potentially reducing the flow of international visitors and impacting related businesses. Conversely, if the tax is managed effectively and used to improve the seaport and tourism infrastructure, it could attract more tourists and potentially stimulate further international trade activities.

Comparative Analysis with Other Caribbean Jurisdictions

A comparative analysis of similar taxes in other Caribbean jurisdictions will help assess the Anguilla embarkation tax’s competitiveness.

Anguilla’s seaport embarkation tax is a bit of a head-scratcher, isn’t it? While planning my next trip, I was researching different cruise options, and that got me thinking about how these fees impact the overall cost. I came across some fascinating details about Amawaterways’ first Black Heritage cruise , which really made me consider the bigger picture.

Ultimately, the Anguilla ups seaport embarkation tax still needs more clarity for travelers like me.

| Feature | Anguilla Tax | Jurisdiction 1 Tax (e.g., Barbados) | Jurisdiction 2 Tax (e.g., St. Kitts) |

|---|---|---|---|

| Tax Rate | To be determined | $10 per passenger | $5 per passenger |

| Exemptions | Potentially for local residents | Students, residents | Cruises under 24 hours |

| Usage of Funds | Infrastructure development | Port modernization | Environmental programs |

The table above presents a hypothetical comparison. Actual figures and details would depend on the specific tax structure implemented in Anguilla and the chosen comparative jurisdictions. Further research into the specific tax structures and implementations in these jurisdictions will provide a more accurate comparison.

Anguilla’s ups seaport embarkation tax is definitely something to consider when planning a trip. While it’s a bit of a head-scratcher, it’s a small price to pay for the stunning beauty of the island. It’s all about balancing that tax with the overall experience, which reminds me of a similar luxury upgrade. A recent $40 million investment in the Ritz-Carlton St.

Thomas ( a 40m investment buys a rebirth at Ritz Carlton St Thomas ) showcases the commitment to upscale tourism. Ultimately, the Anguilla tax, while noteworthy, is just one piece of the island’s allure. It’s a nice reminder of the overall investment in the tourism sector.

Compliance and Enforcement Procedures

Navigating Anguilla’s new seaport embarkation tax requires a clear understanding of the compliance and enforcement procedures. This section details the steps involved in adhering to the tax, ensuring smooth operations for businesses and tourists alike. Accurate record-keeping and timely filings are crucial for avoiding penalties and maintaining a positive relationship with the Anguilla authorities.

Procedures for Business Compliance

Businesses operating within Anguilla’s seaport embarkation tax framework must meticulously adhere to established procedures. This involves maintaining comprehensive records of all embarkation activities, including passenger details, vessel information, and any associated fees. Accurate record-keeping forms the bedrock of compliance. These records will serve as crucial evidence in the event of audits or inquiries.

Filing Tax Returns

The tax return filing process is a critical aspect of compliance. Businesses are expected to file their returns on a predetermined schedule, typically quarterly or annually. The filing process involves submitting the necessary documentation, including supporting invoices and receipts, to the designated tax authority. Accurate and timely submission is essential to avoid penalties. Delays in filing can lead to financial repercussions.

Payment Process Flowchart

The following flowchart illustrates the steps involved in the payment process for the Anguilla seaport embarkation tax:

Start | V 1. Calculate Tax Liability based on embarkation data. | V 2. Obtain payment reference number from the official Anguilla tax portal. | V 3. Access the Anguilla government online portal or designated bank account. | V 4. Make Payment using approved payment method. | V 5.Verify payment receipt on portal. | V 6. Record payment details in accounting records. | V 7. Complete.

Penalties for Non-Compliance

Non-compliance with the Anguilla seaport embarkation tax can lead to penalties. These penalties may vary in severity, depending on the nature and extent of the non-compliance.

Late filings, inaccurate reports, and failure to pay taxes on time will incur financial penalties. In some instances, legal actions may be pursued for serious or repeated violations. Businesses should promptly address any compliance issues to avoid escalating penalties.

Future Trends and Projections

The Anguilla seaport embarkation tax, while currently generating revenue, faces potential future adjustments. Understanding these potential changes and their impact on economic development is crucial for maintaining a sustainable and attractive tourism sector. Analyzing likely modifications and potential challenges will aid in proactive planning and policy adjustments.

Potential Modifications to the Tax

Anticipating future changes to the tax is essential for long-term planning. Potential modifications could include adjustments to the tax rate, the scope of activities covered, or the application of exemptions. For instance, the tax rate might be reviewed to ensure its competitiveness in the region or to reflect changing economic realities. Similarly, the scope of the tax could be expanded to cover additional services or reduced to focus on core activities, impacting the breadth of activities subject to the levy.

Furthermore, adjustments to exemptions for specific businesses or tourist activities could be introduced to maintain Anguilla’s appeal to various markets.

Impact on Economic Development

Changes to the embarkation tax can significantly impact Anguilla’s economic development. A well-structured tax can encourage investment and tourism, while a poorly designed or overly burdensome tax can deter businesses and visitors. For example, a reduced tax rate might attract more cruise ships, increasing visitor numbers and generating more revenue from other sectors. Conversely, a substantial increase could deter tourists, potentially impacting related industries like restaurants, shops, and water sports activities.

Careful consideration of the tax’s effect on different economic sectors is vital to ensure its overall benefit for Anguilla.

Anguilla’s ups seaport embarkation tax is definitely something to consider, but did you know that there’s an exciting new contest happening? AMA Waterways is celebrating their 10th anniversary with a fantastic agent contest, perfect for travel agents looking to boost their skills and knowledge! ama waterways launches 10th anniversary agent contest It’s a great opportunity to learn more about river cruising, and ultimately, might even influence the way you approach Anguilla’s port charges.

Keep an eye out for potential perks and deals related to river cruises when planning Anguilla trips.

Possible Solutions to Challenges

Potential challenges related to the tax, such as revenue fluctuations or reduced visitor numbers, require proactive solutions. Regular reviews and adjustments to the tax structure based on market trends and economic data are necessary. Implementing robust data collection systems to track the impact of the tax on various sectors is essential. Consulting with industry stakeholders, including tourism operators and businesses, during tax review processes can provide valuable insights and ensure the tax remains beneficial for all parties involved.

Summary of Overall Impact

The Anguilla seaport embarkation tax’s overall impact depends on its design, implementation, and adaptation to changing circumstances. A well-managed tax, adaptable to economic trends, can contribute positively to economic development by encouraging tourism and investment. However, an inflexible or poorly designed tax can have negative consequences for both businesses and visitors, potentially impacting the island’s overall economic health.

Careful consideration of all factors and ongoing monitoring are critical to ensure the tax’s long-term success in supporting Anguilla’s economic growth.

Relevant Legal Frameworks

The Anguilla seaport embarkation tax, a relatively new addition to the island’s revenue streams, rests firmly on a foundation of existing legal frameworks. Understanding these frameworks is crucial for navigating the tax’s implementation and potential impacts. Navigating this complex area requires careful scrutiny of the relevant laws and precedents to anticipate and address potential challenges.

The legal framework underpinning the tax is multifaceted, drawing from various Anguillian statutes and international agreements. It’s vital to dissect these legal documents to comprehend the tax’s scope and limitations, as well as its potential implications for both businesses and tourists. This analysis will shed light on the legal precedents that shape the tax’s application and enforcement.

Summary of Legal Documents and Acts

Anguilla’s legal system draws from a blend of common law traditions and specific legislation. The specific statutes governing the embarkation tax, including provisions on collection, reporting, and penalties, need to be meticulously examined. This examination must also consider the relevant provisions of the Anguilla Constitution and any international treaties that might influence the tax’s application.

Relevant Court Decisions and Legal Precedents

Reviewing existing court decisions and legal precedents related to similar taxes in other jurisdictions provides valuable insights into potential interpretations and challenges. Examining how courts have interpreted comparable provisions in other jurisdictions, especially those with established legal systems, offers a comparative lens. This analysis is essential for understanding the potential for legal challenges and the potential for interpretations that might diverge from the intended purpose of the tax.

Comparison with Other Jurisdictions

Comparing Anguilla’s legal framework with those of other Caribbean islands or similar destinations reveals potential similarities and differences. Analyzing the legal approaches of comparable jurisdictions in terms of tax structures, enforcement mechanisms, and dispute resolution processes is a crucial step. This analysis helps illuminate potential areas of strength and weakness in Anguilla’s approach and highlights potential opportunities for improvement or alignment with international best practices.

Potential Legal Challenges

The introduction of a new tax inevitably raises potential legal challenges. Potential challenges include disputes over the tax’s constitutionality, challenges to the tax’s application in specific cases, and issues related to the tax’s impact on specific industries or businesses. Furthermore, challenges related to compliance and enforcement procedures, such as the clarity of regulations and the effectiveness of administrative mechanisms, could emerge.

Heard about the Anguilla UPS seaport embarkation tax? It’s definitely a factor to consider when planning a trip. Meanwhile, the grand opening of the new Alohilani Waikiki beach resort is a big deal, offering a fantastic alternative for travelers looking for luxury accommodations, check out alohilani waikiki beach makes its opening official for more details.

Ultimately, understanding these kinds of fees is crucial when budgeting for your Anguilla getaway.

Understanding and addressing these potential legal hurdles is essential for ensuring the smooth and equitable implementation of the tax.

Final Review

In conclusion, the Anguilla UPS seaport embarkation tax presents a complex interplay of economic factors, legal frameworks, and potential impacts. Understanding its intricacies is essential for businesses, tourists, and policymakers alike. Navigating the intricacies of this tax will require careful consideration of its structure, impact, and future projections. This exploration provides a solid foundation for further analysis and informed decision-making.

Question Bank

What are the different categories of goods/services subject to the tax?

The specific categories of goods and services subject to the Anguilla UPS seaport embarkation tax need to be detailed in the body of the Artikel, and will likely include imported and exported goods, services provided by port operators, and specific types of transportation services.

What are the potential exemptions or deductions for this tax?

Exemptions and deductions, if any, will need to be clearly defined and documented in the body of the Artikel. This may include exemptions for essential goods, certain types of businesses, or specific circumstances.

How does this tax compare to similar taxes in other Caribbean jurisdictions?

A detailed comparison table is needed to illustrate the similarities and differences between Anguilla’s UPS seaport embarkation tax and those of other Caribbean countries, showcasing the unique aspects of Anguilla’s system.

What are the penalties for non-compliance with the tax?

The Artikel should detail the specific penalties for non-compliance, including late payment fees, interest charges, and potential legal repercussions. This information is crucial for businesses to understand the financial consequences of not adhering to the tax regulations.