Anatomy of a Deal A Comprehensive Guide

Anatomy of a deal dissects the intricate processes behind successful negotiations and agreements. From initial definition to post-deal activities, this guide explores the key elements, stages, players, and documents involved in various deal types. Understanding the anatomy is crucial for navigating the complexities of any agreement, be it a business venture, an investment, or a real estate transaction.

This exploration delves into the essential components of a deal, from defining its key elements and types to examining the crucial stages involved. We’ll look at the roles of key players, the necessary documents, the negotiation process, potential risks, and the steps to complete a deal successfully.

Defining the Deal

A deal, in its simplest form, is an agreement between two or more parties. It represents a structured exchange of value, whether tangible or intangible. Understanding the “anatomy” of a deal means dissecting its various components, from the initial negotiation to the final execution. This allows us to appreciate the complexities and intricacies involved in successfully navigating these agreements.The anatomy of a deal encompasses more than just the terms and conditions; it also includes the context, the motivations, and the potential consequences.

Analyzing these factors helps in mitigating risks, optimizing outcomes, and building stronger, more sustainable relationships.

Key Elements of a Deal

The fundamental building blocks of any successful deal include mutual agreement, a legally binding contract, and consideration. These elements are essential for ensuring the deal is enforceable and beneficial to all parties involved. Without these core components, the deal risks becoming unenforceable or, worse, a source of conflict.

- Mutual Agreement: This signifies a meeting of the minds, where all parties involved have a shared understanding of the terms and conditions of the agreement. This consensus is crucial for avoiding future disputes and ensuring that everyone is on the same page.

- Legally Binding Contract: A legally binding contract formalizes the agreement, outlining the rights and responsibilities of each party. It provides a framework for resolving disputes and enforcing the terms, safeguarding the interests of all participants.

- Consideration: This represents the value exchanged between the parties. It could be anything from money, goods, services, or promises. Consideration is the price paid for the agreement and is a crucial element in establishing the validity of the deal.

Types of Deals

Deals come in a variety of forms, each with its own unique characteristics and considerations. Understanding these variations is vital for tailoring approaches to specific situations.

- Business Deals: These deals encompass a wide range of transactions, from simple contracts for services to complex mergers and acquisitions. Business deals typically involve the exchange of goods, services, or intellectual property.

- Investment Deals: Investment deals focus on the allocation of capital, often involving the purchase or sale of financial instruments. Key elements include valuation, due diligence, and the specific financial instruments used.

- Real Estate Deals: Real estate deals center on the purchase and sale of property. These transactions involve complexities like financing, legal title transfer, and the closing process.

Common Elements Across Deal Types

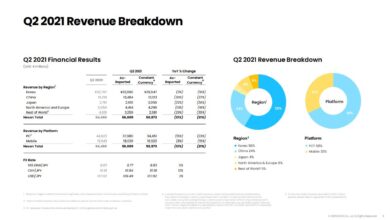

Despite their differences, various deal types share common elements. This table illustrates the key elements present in business, investment, and real estate deals.

| Deal Type | Key Element 1 | Key Element 2 | Key Element 3 |

|---|---|---|---|

| Business Deal | Mutual Agreement | Legally Binding Contract | Consideration |

| Investment Deal | Financial Instrument | Valuation | Due Diligence |

| Real Estate Deal | Property | Financing | Closing |

Stages of a Deal

Navigating a deal successfully requires a clear understanding of its various stages. Each stage presents unique challenges and opportunities, demanding specific actions and strategies. This section delves into the common stages, highlighting the activities involved, and offering insights into how these stages differ across various deal types. Understanding these intricacies is key to optimizing the entire process and achieving favorable outcomes.

Typical Deal Stages

The typical deal progresses through distinct stages, each with its own set of activities and potential pitfalls. These stages are not always linear; they can overlap and sometimes even reverse depending on the complexity of the deal and the circumstances.

- Prospecting and Qualification: This initial stage focuses on identifying potential customers and evaluating their needs and readiness to purchase. Activities include market research, lead generation, initial contact, and preliminary qualification to assess their budget, timeline, and decision-making authority. Understanding the buyer’s journey is crucial here. A company selling enterprise software might spend weeks or even months qualifying a potential client, gathering information on their current systems and processes, before presenting a proposal.

This rigorous qualification process ensures the sales team targets their efforts effectively and avoids wasting resources on unqualified leads. Potential roadblocks include difficulty in lead generation, inaccurate lead qualification criteria, or insufficient understanding of the target market.

- Needs Analysis and Proposal Development: Once qualified, the next stage involves a thorough understanding of the client’s specific needs. This includes detailed discussions, gathering information, and evaluating various solutions. This leads to developing a tailored proposal that addresses those needs. For example, a company offering custom software development will conduct a series of meetings with the prospective client, thoroughly analyzing their workflow, business objectives, and existing infrastructure to craft a bespoke solution.

Potential roadblocks include failing to fully grasp the client’s needs, inadequate communication, or difficulties in translating client requirements into a concrete proposal.

- Negotiation and Closing: This stage involves negotiating the terms and conditions of the deal. Activities include discussion of pricing, payment terms, contract clauses, and other critical elements. A successful negotiation hinges on clear communication, strong listening skills, and a well-defined strategy. Consider a deal for a large-scale construction project. The negotiation phase would focus on pricing for materials, labor costs, and project timelines, ensuring all parties are comfortable with the agreed-upon terms.

Potential roadblocks include unrealistic expectations from either party, differing priorities, or a lack of flexibility during negotiations.

- Implementation and Ongoing Support: This crucial stage focuses on executing the agreed-upon terms and providing ongoing support to the client. Activities include contract execution, delivery of services or products, and establishing ongoing support mechanisms. A crucial element is the transition of the deal from sales to customer success. For example, when a company provides a cloud-based platform, implementation involves onboarding the client, integrating the platform into their existing systems, and training their staff on its use.

Understanding the “anatomy of a deal” is crucial, but it’s equally important to remember that successful partnerships aren’t always about becoming best friends. Sometimes, you have allies, but not pals, and navigating those nuanced relationships is key. Think about how those different levels of connection impact the overall structure of a deal, like understanding the specific roles and responsibilities in the process.

This dynamic is often explored in the context of ‘allies but not pals’ which is discussed further here. Ultimately, the anatomy of a deal includes recognizing the various levels of commitment and influence in play.

Potential roadblocks include issues with implementation timelines, technical glitches, or inadequate support structures.

Comparing Deal Types

Different deal types exhibit variations in their stages. A B2B enterprise software sale, for instance, typically has a more protracted qualification and needs analysis phase compared to a B2C sale of a consumer product.

| Deal Type | Key Differences in Stages |

|---|---|

| B2B Enterprise Software | Extensive needs analysis, multi-level decision-making process, longer sales cycle. |

| B2C Consumer Product | Shorter sales cycle, focus on product features, customer acquisition strategies. |

| Government Contracts | Complex legal and regulatory requirements, lengthy approval processes, often multi-stage bidding. |

Step-by-Step Deal Navigation Guide

A structured approach is essential for navigating the various stages effectively. This guide provides a framework:

- Thorough Prospecting: Identify and qualify potential clients based on defined criteria.

- Comprehensive Needs Analysis: Understand the client’s specific requirements and challenges.

- Develop a Compelling Proposal: Craft a proposal that addresses their needs effectively.

- Strategic Negotiation: Negotiate terms and conditions to achieve mutual benefit.

- Efficient Implementation: Execute the deal according to the agreed-upon plan.

- Ongoing Support: Provide ongoing support and maintain strong client relationships.

Key Players and Roles

Understanding the roles and responsibilities of each stakeholder is crucial for a successful deal. Different players have distinct needs and motivations, which, if not understood and managed effectively, can lead to friction and potentially derail the entire process. Effective communication and clear delineation of roles are vital to navigating these complexities. A well-defined hierarchy ensures accountability and streamlines decision-making, ultimately improving the likelihood of a positive outcome.

Stakeholder Roles and Responsibilities

Stakeholders in a deal encompass a wide range of individuals and entities, each with their own unique role and responsibilities. These roles can vary significantly depending on the specific deal type, ranging from simple transactions to complex mergers and acquisitions. Understanding the diverse roles, their interactions, and potential conflicts is paramount for a successful negotiation.

Categorizing Stakeholders

A typical deal involves several key stakeholder groups, each with specific responsibilities and levels of influence. This hierarchy often reflects the structure of the organizations involved.

- Executive Leadership: This group, typically composed of CEOs, CFOs, and other senior executives, sets the overall strategic direction for the deal and makes critical decisions. Their responsibilities often include high-level approvals, financial analysis, and risk assessment. For example, the CEO’s involvement in a merger decision is essential to ensure alignment with the overall company strategy. Similarly, the CFO plays a vital role in analyzing the financial implications of the deal and ensuring its feasibility.

Understanding the “anatomy of a deal” often involves careful consideration of various factors. For example, a recent, noteworthy deal is AmaWaterways’ first Black Heritage cruise, a journey exploring significant historical sites. This cruise, detailed in the AmaWaterways first black heritage cruise , highlights the importance of historical context within the broader structure of a travel deal. Ultimately, the “anatomy of a deal” is about recognizing and analyzing the interwoven elements that contribute to its success.

- Legal Teams: Legal professionals are integral to ensuring compliance with regulations and safeguarding the interests of their respective organizations. They review contracts, assess legal risks, and negotiate terms. Their work is essential to preventing future legal issues and mitigating potential liabilities, such as due diligence investigations and intellectual property reviews.

- Financial Professionals: These professionals, including financial analysts and investment bankers, evaluate the financial aspects of the deal. Their responsibilities include valuation, due diligence, and financial modeling. For example, in an acquisition, financial professionals assess the target company’s financial health and determine the appropriate purchase price. This often involves extensive research, data analysis, and complex calculations.

- Operational Teams: These teams are responsible for the day-to-day execution of the deal. Their responsibilities often include integrating operations, managing employees, and ensuring smooth transitions. In a merger, operational teams play a key role in coordinating activities between the two merging entities, managing employee integration, and ensuring minimal disruption to business operations.

Variations Across Deal Types

The roles and responsibilities of stakeholders can differ significantly based on the type of deal. A simple sales transaction, for example, involves fewer stakeholders and simpler roles compared to a complex merger or acquisition.

Understanding the “anatomy of a deal” is key, whether it’s a business transaction or a meticulously planned vacation. For instance, the recent Louis Cristal Aegean sailing offered ample diversions, like exploring hidden coves and indulging in delicious meals. A good example of this is detailed in ample diversions on Louis Cristal Aegean sailing. Ultimately, knowing the components of any deal, from initial negotiation to final execution, is crucial for a successful outcome.

- Mergers and Acquisitions (M&A): In M&A deals, the involvement of investment bankers, legal teams, and financial analysts is significant, due to the complexity and high value of such transactions. These teams handle extensive due diligence, valuation, and negotiation processes.

- Private Equity Investments: Private equity investments often involve complex negotiations, including valuation assessments, legal due diligence, and financial modeling. The roles of private equity firms, investment bankers, and legal teams are crucial in these deals.

Importance of Communication

Clear and consistent communication between stakeholders is essential to ensure everyone is on the same page. This includes regular updates, open dialogue, and proactive problem-solving. Effective communication facilitates a smooth and efficient deal process, reduces misunderstandings, and fosters trust among stakeholders. It can be facilitated through regular meetings, shared documents, and dedicated communication channels.

Essential Documents and Processes

The successful navigation of any deal hinges on meticulously crafted documents and a well-defined process. Thorough documentation ensures clarity, accountability, and mitigates potential disputes. A robust process, mirroring the deal’s specifics, streamlines communication and decision-making throughout the stages. This section dives into the key documents and procedures, highlighting their legal implications and negotiation strategies.Understanding the specific documents and processes used in a deal allows participants to better anticipate potential challenges and develop strategies to navigate them.

This detailed knowledge enables effective negotiation and mitigates risks. By carefully considering the legal implications of each document, parties can minimize the likelihood of unforeseen issues and ensure that the agreement is legally sound.

Key Documents in a Typical Deal, Anatomy of a deal

A comprehensive deal often involves several critical documents, each playing a specific role in defining the agreement and outlining responsibilities. These documents range from simple letters of intent to complex contracts.

- Letter of Intent (LOI): A non-binding agreement outlining the key terms of a potential deal. It serves as a preliminary framework for negotiations, allowing parties to explore potential synergies and assess the viability of the transaction. The LOI often includes confidentiality clauses, outlining the terms for handling sensitive information. This preliminary document helps to identify deal-breakers early in the process.

The lack of legal enforceability allows parties to walk away without significant legal repercussions if the negotiations don’t progress to a binding agreement.

- Memorandum of Understanding (MOU): A more detailed document than an LOI, typically outlining the terms of a potential agreement in greater detail. It is still non-binding and is often used in more complex deals to explore collaborative projects or joint ventures. An MOU can be more legally specific than an LOI, laying out the framework for future negotiations. This document aids in setting expectations and establishing shared goals, which is crucial for the success of a collaborative project.

- Term Sheet: A binding agreement defining the key financial and operational terms of a deal. This document Artikels the structure of the transaction, including the purchase price, payment terms, and other important conditions. The term sheet often acts as a blueprint for the final contract. Its binding nature means that parties are obligated to fulfill the terms Artikeld in the sheet, and it serves as a crucial reference point for the final contract.

- Purchase Agreement (or Sale Agreement): The legally binding contract that formalizes the terms of the deal. It spells out all aspects of the transaction, including the purchase price, payment schedule, representations and warranties, and other critical provisions. This document, often the most complex, defines the legal obligations of each party and sets the stage for the completion of the transaction. Negotiations around this document often involve significant legal review and refinement.

- Financing Documents: If financing is involved, these documents detail the terms of the financing arrangements. These documents are crucial to ensure that the deal can be completed successfully. The financing documents often involve agreements with lenders or investors and need to be carefully reviewed to ensure that they align with the deal’s overall structure.

Legal Implications of Documents

Each document carries specific legal implications, which need careful consideration during negotiation. Understanding the legal implications of each document helps ensure the deal’s legal soundness and minimizes future disputes.

- Confidentiality Clauses: These clauses protect sensitive information shared during negotiations. Breach of these clauses can result in legal action and significant financial penalties.

- Representations and Warranties: These clauses Artikel the representations made by each party regarding the assets or liabilities being transferred. Misrepresentations can lead to significant legal liabilities and claims for damages.

- Due Diligence Procedures: Due diligence processes are often Artikeld in the documents. Failure to conduct due diligence or to properly disclose information can have significant legal consequences.

Negotiation Tactics for Specific Documents

Strategic negotiation is crucial for securing favorable terms in each document.

- LOI and MOU: Negotiating the scope of confidentiality and the timeframe for subsequent negotiations are key considerations. Thorough due diligence can identify potential risks early in the process. Use the LOI and MOU to solidify your position and set expectations for the subsequent negotiations.

- Term Sheet: Focus on key financial terms, payment structures, and potential contingencies. Ensure that the term sheet accurately reflects the overall deal structure and aligns with the final contract. Use clear and precise language to avoid ambiguity and misunderstandings.

- Purchase Agreement: Careful consideration of representations and warranties is crucial. Negotiate reasonable indemnification clauses to protect against potential liabilities. Thorough review of all clauses, including termination clauses, is essential to understand the exit strategies for the deal.

Common Deal Procedures

Several procedures are common across many deal types, ensuring smooth and efficient execution.

- Due Diligence: This crucial process involves thorough investigation of the target company’s financial records, legal standing, and operational performance. Due diligence is a critical step in mitigating risk and ensuring that the deal is conducted on a sound basis.

- Contract Negotiation: This phase involves careful review, discussion, and modification of the contractual terms. Effective communication and clear understanding are vital for successful contract negotiation.

- Closing: The closing involves finalizing all the contractual obligations and transferring ownership. The legal and financial processes involved in the closing need to be meticulously documented and executed.

Negotiation and Agreement

The final stages of a deal often hinge on effective negotiation and the meticulous creation of a legally sound agreement. This phase requires a delicate balance of compromise, legal acumen, and adherence to regulations. A well-structured agreement safeguards all parties’ interests and sets the stage for a successful and lasting partnership.Successful negotiation is not simply about achieving your desired outcome; it’s about understanding the other party’s perspective and finding mutually beneficial solutions.

This requires active listening, clear communication, and a willingness to explore various options. Ultimately, a well-negotiated agreement fosters a collaborative environment and minimizes potential conflicts down the road.

Strategies for Effective Negotiation

Negotiation strategies vary based on the specific context of the deal. A structured approach, however, can significantly enhance the chances of a positive outcome. Understanding the principles of distributive and integrative bargaining is crucial. Distributive bargaining focuses on a fixed pie, where one party’s gain is another party’s loss. Integrative bargaining, conversely, seeks to create a win-win scenario by exploring various options and identifying common interests.

Preparation is key; researching the other party, understanding their needs and motivations, and defining your own objectives are essential steps.

Importance of Compromise in a Deal

Compromise is a fundamental aspect of successful negotiation. It demonstrates a willingness to meet the other party halfway and find a solution that benefits both sides. Without compromise, the deal may become stalled or collapse altogether. A good example is the negotiation of salaries in a merger; each party may need to adjust their expectations slightly to reach a point of mutual satisfaction.

Key Components of a Legally Sound Agreement

A legally sound agreement must include several key components. These elements ensure clarity, enforceability, and protection for all parties involved. The agreement must clearly define the terms and conditions of the deal, outlining the responsibilities, obligations, and rights of each party. Specific performance standards, timelines, and payment schedules must be meticulously documented. A comprehensive description of the goods or services exchanged, along with their associated specifications and quality standards, is also critical.

All of this is best achieved with the guidance of legal counsel.

Importance of Confidentiality and Legal Counsel

Confidentiality is paramount throughout the negotiation and agreement phases. Sensitive information must be protected to avoid breaches of trust and potential legal complications. Consulting with legal counsel from the outset is crucial. They provide guidance on contract drafting, ensuring the agreement aligns with applicable laws and regulations. They also help identify potential risks and liabilities.

Legal counsel’s expertise ensures the agreement is legally sound, minimizes future disputes, and protects all parties’ interests.

Importance of Adhering to Regulations and Industry Standards

Compliance with regulations and industry standards is essential for a legitimate and ethical deal. Understanding and adhering to these rules ensures the deal operates within the boundaries of the law. Violation of these rules can lead to substantial penalties and legal repercussions. It’s crucial to conduct thorough due diligence to identify and address potential regulatory issues. A comprehensive review of relevant industry standards and regulations is vital to ensure compliance and maintain the integrity of the deal.

For instance, in the financial industry, adhering to anti-money laundering (AML) regulations is crucial to maintain a legitimate and ethical deal.

Risks and Mitigation Strategies

Navigating a deal successfully hinges on anticipating and mitigating potential risks. A thorough understanding of potential pitfalls and the proactive development of mitigation strategies are critical to ensuring a smooth and profitable transaction. This section delves into the crucial aspects of risk assessment, contingency planning, and due diligence, equipping you with the tools to navigate the complexities of any deal.Effective deal management involves recognizing that unforeseen circumstances can arise.

From market fluctuations to legal challenges, a proactive approach to risk assessment and mitigation is essential to safeguard the interests of all parties involved. This involves not only identifying potential risks but also developing robust strategies to address them.

Identifying Potential Risks

Understanding the potential risks inherent in any deal is the first step in mitigating them. These risks can stem from various sources, including market conditions, financial uncertainties, legal ambiguities, and operational complexities. A comprehensive risk assessment should meticulously examine each aspect of the deal to identify potential vulnerabilities.

- Market Risks: Changes in market demand, economic downturns, or competitor actions can negatively impact the value or viability of the deal. For example, a sudden shift in consumer preference could significantly affect the sales projections of an acquisition target, rendering the deal less lucrative than initially anticipated.

- Financial Risks: Unexpected financial difficulties of either party, unforeseen increases in interest rates, or fluctuations in currency exchange rates can impact the deal’s financial feasibility. A thorough financial analysis of the target company is crucial in assessing the risk of default or inability to meet financial obligations.

- Legal Risks: Potential legal disputes, breaches of contract, or regulatory issues can jeopardize the entire transaction. A review of relevant legal documents and consultations with legal experts can significantly mitigate the likelihood of legal issues arising.

- Operational Risks: Difficulties integrating operations, logistical challenges, or unforeseen technological disruptions can impede the success of the deal. A detailed analysis of operational processes and potential integration challenges is essential.

Mitigation Strategies

Once potential risks are identified, strategies must be implemented to mitigate their impact. These strategies may include diversification, hedging, insurance, and contingency planning.

Understanding the “anatomy of a deal” is key, whether it’s a business transaction or a travel plan. For instance, after a fascinating China sojourn, the Norwegian Joy cruise ship has been updated for Alaskan adventures, as detailed in this recent article after china sojourn norwegian joy updated for alaska. This demonstrates how careful consideration of various factors – like the ship’s upgrades and the destination’s appeal – is crucial to a successful deal, just like any successful business deal involves meticulous planning and evaluation.

- Diversification: Reducing reliance on a single source or market can lessen the impact of adverse events. For example, expanding into new markets or securing multiple supply chains can mitigate risks associated with a single supplier.

- Hedging: Using financial instruments to offset potential losses is an effective risk mitigation strategy. Hedging against currency fluctuations or interest rate changes can protect the deal’s financial stability.

- Insurance: Purchasing appropriate insurance policies can provide financial protection against various risks, such as property damage or liability claims. Consider specific insurance needs related to the deal’s nature.

- Contingency Planning: Developing a comprehensive plan to address potential issues is critical. This plan should Artikel specific actions to take if a particular risk materializes. Detailed contingency plans for potential legal disputes, operational problems, or market fluctuations are essential for a successful deal.

Due Diligence and Risk Assessment

Due diligence is a crucial component of risk assessment. Thorough due diligence involves a comprehensive investigation of the target company or asset to identify potential risks and vulnerabilities. This process should include financial reviews, legal assessments, and operational evaluations.

- Financial Due Diligence: Scrutinizing financial statements, evaluating historical performance, and assessing the target company’s ability to meet financial obligations is critical.

- Legal Due Diligence: Examining legal documents, assessing potential liabilities, and verifying compliance with regulations is essential to identify potential legal issues.

- Operational Due Diligence: Assessing the target company’s operational efficiency, evaluating key personnel, and identifying potential integration challenges are vital.

Avoiding Legal Issues

Proactive measures to prevent legal issues are vital. Consulting with legal experts, carefully reviewing all contracts and documents, and ensuring compliance with all applicable regulations are essential.

- Thorough Contract Review: A meticulous review of all contracts and agreements by legal professionals is critical. This ensures all terms are clear, enforceable, and protect the interests of all parties.

- Compliance with Regulations: Ensuring compliance with all relevant laws and regulations is essential to avoid legal issues. Consulting with legal experts to understand applicable regulations is crucial.

- Seeking Legal Counsel: Seeking legal counsel from experienced professionals is crucial to prevent and resolve potential legal disputes.

Post-Deal Activities

The successful conclusion of a deal marks a significant milestone, but the journey doesn’t end there. Post-deal activities are crucial for ensuring the agreement’s smooth execution and maximizing its benefits. These activities encompass everything from finalizing paperwork to maintaining a positive relationship with stakeholders. A well-managed post-deal phase fosters trust, minimizes disputes, and ultimately drives the deal’s long-term success.Post-deal activities are vital for ensuring the deal’s seamless implementation and long-term profitability.

These activities cover all facets of the transaction, from meticulous record-keeping to fostering positive relationships with stakeholders. Effective post-deal management directly impacts the success of the deal.

Closing and Execution Procedures

The closing and execution phases represent the culmination of the deal process. These critical steps ensure that all parties fulfill their contractual obligations. Proper documentation and timely completion are essential to avoid delays and potential conflicts.

- Review and Finalization of Documents: Thorough verification of all documents, including contracts, agreements, and supporting materials, is crucial to ensure accuracy and compliance. This involves a meticulous review to confirm that all terms are clearly understood and legally sound by both parties. Discrepancies or ambiguities must be addressed before the closing process.

- Fulfillment of Obligations: This encompasses the delivery of agreed-upon goods, services, or assets. Clear timelines and responsibilities are crucial to avoid delays and maintain a smooth execution. Effective communication between parties is vital to ensure that obligations are fulfilled efficiently and effectively.

- Transfer of Assets and Liabilities: In cases involving asset transfers, legal documentation and regulatory approvals are essential. A smooth transfer of ownership ensures the continuity of operations. The transfer of liabilities and associated responsibilities needs careful consideration to avoid future conflicts.

Dispute Resolution Procedures

While every effort is made to prevent disputes, having a clear dispute resolution process in place is vital. This process should be Artikeld in the initial agreement to guide parties through potential conflicts.

- Establishing Dispute Resolution Mechanisms: Agreements should clearly define mechanisms for resolving disagreements, such as mediation, arbitration, or litigation. This clarifies the process for both parties and can prevent escalation.

- Prompt and Effective Communication: Maintaining open communication channels is essential to address concerns proactively. This includes responding to inquiries and addressing issues promptly to prevent small problems from escalating.

- Documentation of Efforts: Detailed records of all communications, negotiations, and attempts at resolution are critical in case of future disputes. This documentation provides a clear historical context and can support claims.

Maintaining Stakeholder Relationships

Building and maintaining positive relationships with all stakeholders is critical for the long-term success of the deal. This includes internal teams, external partners, and regulatory bodies.

- Open Communication and Transparency: Maintain open lines of communication and provide updates on the deal’s progress. Transparency fosters trust and reduces concerns.

- Proactive Problem Solving: Anticipate potential issues and address them proactively to avoid escalations. Address concerns and feedback promptly to mitigate negative impact.

- Recognition and Appreciation: Recognize the contributions of all stakeholders involved. Acknowledging their efforts reinforces positive relationships.

Follow-up and Monitoring

Follow-up and monitoring are critical for ensuring that the deal’s objectives are met and that any unforeseen issues are addressed promptly. Regular reviews help to maintain momentum and prevent potential problems from becoming major issues.

- Regular Check-ins: Scheduling regular check-ins with stakeholders to monitor progress, identify potential roadblocks, and ensure alignment with objectives.

- Performance Measurement: Establish key performance indicators (KPIs) to measure the success of the deal against pre-defined goals. Tracking performance allows for timely adjustments and prevents deviations from expectations.

- Feedback Mechanisms: Implementing feedback mechanisms to gather input from stakeholders about the deal’s execution and identify areas for improvement is vital.

Illustrative Examples: Anatomy Of A Deal

Analyzing successful and challenging deals provides valuable insights into the intricacies of negotiation and execution. Understanding the factors that contribute to success or failure allows for informed decision-making and enhanced strategic planning. This section delves into case studies to illustrate the anatomy of a deal, highlighting key components and their impact.

Understanding the “anatomy of a deal” is crucial, especially when considering major projects like the recent refurbishment of the Allure of the Seas cruise ship. Allure of the Seas refurbishment showcases how meticulous planning and negotiation are essential for a successful outcome. From initial concept to final execution, each stage reveals the complex interplay of factors within the deal.

This highlights the importance of thorough due diligence in any significant business undertaking.

A Successful Acquisition

The acquisition of Acme Corp by Beta Industries serves as a prime example of a successful deal. Acme Corp, a leading provider of innovative software solutions, was a strategically important acquisition for Beta Industries, expanding their market reach and product portfolio. The deal was meticulously structured, with a clear definition of the target company’s value, a comprehensive due diligence process, and a robust negotiation strategy.

The acquisition was completed within the projected timeframe and budget. Key factors contributing to the success included:

- Clear Objectives: Beta Industries clearly defined the strategic goals of the acquisition, aligning the acquisition with their overall business strategy. This clarity guided the entire process.

- Thorough Due Diligence: A thorough investigation of Acme Corp’s financial records, legal obligations, and operational efficiency identified potential risks and ensured the acquisition was sound.

- Effective Negotiation: Negotiations focused on mutual benefit, resulting in a fair and equitable agreement that addressed the needs of both parties.

- Strong Communication: Transparent communication among all stakeholders (Beta Industries, Acme Corp, legal teams, etc.) facilitated a smooth and efficient transaction.

A Deal with Unforeseen Challenges

The merger of Gamma Solutions and Delta Technologies presented significant challenges. While the strategic rationale for the merger seemed sound, unforeseen operational issues arose post-merger integration. A key problem was the incompatibility of the two companies’ IT systems. This issue, not fully anticipated during due diligence, caused significant delays and increased costs. Further, cultural clashes between the two teams hindered collaboration and productivity.

- Integration Issues: The merger integration plan lacked sufficient detail on crucial operational aspects, like IT systems integration, and underestimated the cultural differences between the two teams. This led to unexpected complexities.

- Lack of Contingency Planning: The deal’s structure did not incorporate contingency plans to address potential operational challenges, such as IT system incompatibility or cultural integration difficulties.

- Communication Breakdown: The communication between the leadership teams of both organizations was insufficient during the integration phase, exacerbating the challenges.

Deep Analysis of Deal Anatomy

A comprehensive analysis of the Acme Corp acquisition reveals a well-defined deal structure. The agreement included clear purchase price terms, financing arrangements, and a detailed timeline for closing. The deal structure was well-documented and compliant with relevant regulations.

| Deal Component | Description |

|---|---|

| Purchase Price | Fixed price based on a valuation of Acme Corp’s assets and revenue streams. |

| Financing | Secured through a combination of debt financing and equity investment. |

| Timeline | Phased approach with specific milestones for due diligence, negotiation, and closing. |

Comprehensive Deal Structure Example

A well-structured deal involves detailed documentation, clear roles and responsibilities, and a robust risk management plan. For example, a joint venture agreement between Alpha Innovations and Omega Resources might include provisions for:

- Equity Distribution: Defines the percentage of ownership for each partner in the joint venture.

- Profit Sharing: Artikels the terms for sharing profits and losses generated by the joint venture.

- Decision-Making Process: Specifies how decisions will be made regarding the joint venture.

- Dispute Resolution: Establishes procedures for resolving disagreements or disputes.

The success of a deal hinges on a robust understanding of the target company, careful planning, and a proactive approach to potential risks.

Ending Remarks

In conclusion, navigating the “anatomy of a deal” requires a deep understanding of its various components. From meticulous planning and strategic negotiation to risk mitigation and post-deal follow-up, every aspect plays a critical role in achieving a successful outcome. This comprehensive guide provides a roadmap for understanding and mastering the complexities of deals, enabling informed decision-making and maximizing potential benefits.

Expert Answers

What are some common roadblocks in the deal stages?

Common roadblocks in deal stages can include disagreements on key terms, unexpected changes in market conditions, issues with due diligence, and difficulties in securing financing. Each stage presents unique challenges that require careful consideration and proactive strategies to overcome.

How important is confidentiality in a deal?

Confidentiality is paramount in any deal, particularly those involving sensitive financial or business information. Maintaining confidentiality safeguards the interests of all parties and protects against potential leaks or breaches that could damage reputations or jeopardize the deal’s success.

What are some examples of effective negotiation tactics?

Effective negotiation tactics include active listening, understanding the other party’s needs, proposing solutions that address mutual interests, and maintaining a professional demeanor. Adapting your approach to different personalities and situations can significantly improve the outcome of any negotiation.

What is the role of due diligence in risk assessment?

Due diligence plays a critical role in risk assessment by providing a comprehensive understanding of the deal’s potential risks. Thorough investigation into financial statements, legal documents, and market conditions helps identify potential problems and develop mitigation strategies.