Analyst Tells Cruise Lines Cut Agent Pay

Analyst tells cruise lines cut agent pay, sparking debate about the future of travel agent compensation in the industry. Cruise lines are facing pressure to reduce costs, and this strategy could significantly impact the travel agent community. The article delves into the historical trends of agent pay, potential impacts, and possible alternatives, offering a comprehensive overview of this critical issue.

This analysis examines the factors behind the potential cuts, considering market pressures, evolving consumer behavior, and the role of technology. It also explores the potential consequences for agent retention, recruitment, and the overall health of the cruise industry’s sales and marketing efforts.

Background of Agent Pay Cuts

The recent news of cruise lines adjusting agent compensation has sparked considerable discussion within the travel industry. Understanding the historical context of agent pay is crucial to comprehending the current situation. This analysis delves into the evolution of compensation models, examining trends, structures, and factors influencing these decisions.Cruise line agent compensation has been a dynamic aspect of the industry, often reflecting broader economic shifts and competitive pressures.

From commission-based models to more complex structures incorporating base salaries, the landscape has evolved significantly. This examination will provide insights into the historical patterns and the factors that have shaped agent compensation over time.

Historical Overview of Cruise Line Agent Compensation

Cruise line agent compensation has not been static. Early models were primarily commission-based, often tied to the value of the booked cruise. This model incentivized agents to focus on generating sales volume. Over time, however, the industry recognized the need for greater agent retention and stability, leading to the inclusion of base salaries or tiered commission structures.

Typical Compensation Structures

Cruise line agent compensation structures are diverse, with varying models across different companies. A common structure includes a commission percentage on the sale of cruises, supplemented by a base salary, which provides a guaranteed income. Some lines might also incorporate bonuses based on sales targets or agent performance metrics. Incentivized programs and performance-based commissions can also be prevalent.

Comparison of Compensation Models Across Different Cruise Lines

Different cruise lines have adopted varying compensation models. Some lines emphasize a higher commission percentage, while others offer a substantial base salary, along with commission. Comparing these models reveals nuances in agent retention strategies and market positioning.

Factors Influencing Agent Pay Decisions

Several factors have historically influenced cruise line agent pay decisions. These include economic conditions, the competitive landscape within the cruise industry, and the overall performance of the cruise line. Changes in market demand, customer preferences, and agent performance metrics also play a crucial role in adjusting compensation models. In the past, some lines have prioritized sales volume over other factors in determining agent compensation.

Economic Conditions Impacting Agent Pay, Analyst tells cruise lines cut agent pay

Economic downturns and recessions often impact cruise line agent compensation. During periods of economic uncertainty, the demand for luxury vacations, such as cruises, often decreases, potentially leading to lower commission earnings for agents. Cruise lines might adjust compensation to maintain agent engagement and morale while weathering economic storms.

Evolution of Cruise Line Agent Compensation

| Year | Compensation Model | Typical Commission (%) | Base Salary (USD) | Other Incentives |

|---|---|---|---|---|

| 2000 | Commission-based | 10-15% | Variable, usually low | None or minimal |

| 2010 | Commission-based with base salary | 8-12% | $20,000-$30,000 | Performance bonuses |

| 2020 | Commission-based with base salary, tiered commissions | 6-10% | $30,000-$50,000+ | Performance bonuses, sales targets |

| 2023 | Commission-based with base salary, tiered commissions, performance-based incentives | Variable, depending on tier | $40,000-$70,000+ | Performance bonuses, sales targets, incentive programs |

Impact of Agent Pay Cuts

Cruise lines’ recent decisions to reduce agent commissions raise significant concerns about the future of the travel industry. These cuts, while potentially beneficial for the cruise companies in the short term, could have far-reaching consequences for both the travel agents and the cruise industry as a whole. The implications for agent retention, industry sales, and customer service are complex and warrant careful consideration.The cuts to agent commissions, while a seemingly simple financial decision, have a cascade of impacts throughout the travel ecosystem.

Agents are crucial intermediaries in the cruise sales process, and a reduction in their compensation directly impacts their willingness to sell cruise packages. This ripple effect can affect customer satisfaction and the cruise lines’ overall profitability in the long run. The intricate web of relationships between cruise lines, agents, and customers is at risk.

Potential Impact on Agent Retention and Recruitment

Agent retention is paramount to a healthy cruise sales force. Reduced compensation directly impacts agents’ willingness to stay with a particular cruise line. Agents may seek opportunities with companies offering more competitive compensation structures, leading to a loss of valuable experience and industry knowledge. Conversely, new agents may be less inclined to enter the field if the potential earning capacity seems limited.

This will affect the cruise lines’ ability to build and maintain a robust sales network, ultimately impacting their sales figures.

Effects on the Cruise Industry’s Overall Sales and Marketing Efforts

Cruise lines rely heavily on travel agents to generate sales and effectively market their products. Reduced commissions might deter agents from actively promoting cruise packages, leading to a decline in overall sales volume. This decrease in sales might necessitate increased marketing efforts on the cruise lines’ part, potentially increasing their costs and decreasing their profitability margins. Reduced agent enthusiasm could also result in less effective marketing campaigns, impacting customer engagement.

Consequences for Customer Service and Agent Support

Agent compensation plays a crucial role in the quality of customer service provided. Agents who feel undervalued might be less inclined to provide comprehensive support to customers, leading to a decrease in customer satisfaction. This could manifest in slower response times to inquiries, fewer personalized recommendations, and a lack of enthusiasm in handling customer issues. Furthermore, agents who feel devalued might become less likely to offer valuable feedback to cruise lines, leading to missed opportunities for improvement in cruise packages and services.

Potential Consequences for the Travel Agent Community

Reduced agent commissions represent a significant blow to the travel agent community. This decrease in income can negatively impact the financial stability of many agents, potentially forcing them to seek alternative employment or even exit the industry altogether. This will undoubtedly disrupt the existing agent network and create instability in the cruise industry’s sales channel. Moreover, it could have a ripple effect on the wider travel industry, as agents may become less enthusiastic about promoting other travel products and services.

Possible Reactions from Travel Agents and Industry Organizations

Travel agents are likely to react to the pay cuts with a combination of frustration, anger, and perhaps a sense of betrayal. They may seek alternative employment, demand compensation adjustments, or organize collective action against the cruise lines. Industry organizations like the American Society of Travel Agents (ASTA) might intervene by advocating for the rights of their members and potentially negotiating with cruise lines to improve agent compensation.

Protests, boycotts, and negotiations are potential responses from agents and organizations.

Potential Impact of Pay Cuts on Cruise Line Metrics (Illustrative Table)

| Cruise Line Metric | Potential Impact of Pay Cuts |

|---|---|

| Sales Volume | Decreased due to reduced agent motivation and sales efforts. |

| Customer Satisfaction | Potentially decreased due to less attentive agent support and reduced service quality. |

| Agent Turnover | Increased due to reduced compensation and lack of motivation. |

| Marketing Costs | Potentially increased due to the need to compensate for reduced agent efforts. |

| Agent Retention Rate | Decreased due to reduced compensation. |

| Profitability | Potentially decreased due to reduced sales volume and increased marketing costs. |

Reasons for Agent Pay Cuts

Cruise lines are facing unprecedented challenges in the current economic climate, and agent pay cuts are a reflection of these difficulties. Market pressures, evolving consumer behavior, and the need for cost-cutting strategies are all factors contributing to these decisions. Understanding the underlying reasons is crucial for navigating the future of the travel industry.Cruise lines are experiencing a complex web of challenges that necessitate significant adjustments.

From fluctuating fuel prices to heightened competition, these factors directly impact profitability. The impact on agents is often a secondary effect of these broader issues.

Analysts are predicting cruise lines will slash agent commissions, a move that’s likely to impact travel agents significantly. This news comes on the heels of Aker Yards’ name change, a move that’s surely not unrelated to the broader industry shift. While Aker Yards is rebranding, the financial pressures impacting the cruise industry are clearly also leading to cuts in agent pay.

Travel agents need to be aware of these shifts to adapt and stay competitive. aker yards name goes away is certainly part of a larger picture, and these cuts will be a challenge for those in the industry.

Potential Explanations for Reduced Agent Compensation

Several factors contribute to the recent trend of reduced agent compensation. Cruise lines are not operating in a vacuum; they are subject to market forces and industry trends. The need for cost reduction is a primary driver, but there are other influencing factors.

- Increased Competition: The cruise industry is becoming more competitive, with new entrants and existing players vying for market share. This heightened competition necessitates a more aggressive approach to pricing and operational costs, sometimes leading to reduced commissions or agent incentives to maintain profitability and competitiveness. For example, the rise of budget airlines in the aviation industry has pressured traditional carriers to adopt similar cost-cutting measures.

Analysts are reporting cruise lines are cutting agent commissions, a move that’s likely to further strain the travel industry. This echoes a broader trend, where technology is increasingly taking center stage in travel booking. A recent proposal, like a modest proposal travel technology dominance , suggests a potential shift towards more streamlined and perhaps less agent-dependent booking platforms.

Ultimately, these cuts could impact the livelihoods of travel agents, particularly as the industry navigates this changing landscape.

- Rising Operational Costs: Fuel costs, port fees, and staffing expenses have risen significantly in recent years. These increased operational costs directly translate into reduced profit margins for cruise lines. To mitigate these rising expenses, cruise lines may implement strategies to contain costs.

- Changing Consumer Behavior: Consumer preferences and travel habits are evolving. This shift in demand necessitates a more adaptable approach to marketing and service offerings. Cruise lines may be adapting their strategies to remain relevant and competitive, which can include adjustments to agent compensation models.

- Technological Advancements: The cruise industry is embracing technological advancements, including online booking platforms and direct-to-consumer sales channels. These changes may impact the role of travel agents, and cruise lines may adjust compensation models to reflect the changing landscape.

Market Pressures Influencing Cruise Line Profitability

The cruise industry faces numerous market pressures that affect profitability. These pressures influence the decisions made by cruise lines regarding agent compensation.

- Economic Downturns: Economic downturns often lead to decreased consumer spending and reduced travel budgets. This impact on overall travel demand directly affects cruise lines, necessitating cost-cutting measures to maintain viability.

- Fuel Price Volatility: Fluctuations in fuel prices significantly impact cruise line operating costs. Higher fuel costs translate to higher ticket prices or reduced profit margins, leading to adjustments in pricing strategies and potentially agent compensation.

- Inflationary Pressures: Inflationary pressures across various sectors increase the cost of goods and services for cruise lines. This directly affects their profitability and can influence their approach to agent compensation.

Potential Strategies for Cost Reduction

Cruise lines are constantly seeking ways to reduce costs and increase efficiency. Strategies employed may affect agent compensation.

- Reducing Agent Commissions: Cruise lines may reduce the commission rates paid to agents to offset rising operational costs and maintain profitability.

- Improving Direct Bookings: Encouraging direct bookings through online platforms can reduce reliance on agents, lowering the overall commission expenses.

- Negotiating with Suppliers: Cruise lines might negotiate lower prices with suppliers for various services and products to contain expenses.

Potential Alternative Revenue Streams

Cruise lines are exploring diverse revenue streams to offset decreasing profitability. These alternatives can potentially affect agent compensation models.

- Expansion into New Markets: Expanding into new markets can increase revenue and offset some of the challenges faced in established markets. This can involve adjustments to agent training and compensation models to cover new markets.

- Diversification of Products and Services: Adding ancillary services or products, such as shore excursions or onboard amenities, can diversify revenue streams.

- Partnerships and Collaborations: Collaborating with other businesses or organizations can create new revenue opportunities. These partnerships can also affect the role of agents and their compensation models.

Impact of Changing Consumer Behavior

Changing consumer behavior necessitates adaptations by cruise lines, which can impact agent compensation.

- Increased Focus on Experiences: Consumers are increasingly seeking unique experiences and personalized services. Cruise lines are responding by enhancing onboard experiences and marketing their offerings.

- Emphasis on Sustainability: Consumers are more aware of environmental issues and are choosing sustainable options. Cruise lines are adapting their strategies to align with consumer preferences and expectations.

- Preference for Flexibility and Customization: Consumers prefer more flexible booking options and customized experiences. Cruise lines are adjusting their services and offerings to cater to these preferences.

Technological Advancements in Agent Compensation Models

Technology plays a significant role in the cruise industry. New technologies can affect how agents are compensated.

- Automation of Tasks: Automation of tasks can improve efficiency and potentially reduce the need for certain agent roles. This may lead to adjustments in agent compensation models.

- Data-Driven Insights: Data analysis provides insights into consumer behavior and market trends. This data can be used to optimize pricing strategies and agent compensation models.

- Improved Booking Platforms: Enhanced booking platforms provide greater transparency and efficiency for both cruise lines and agents. This can potentially affect the structure and value of agent compensation.

Potential Reasons for Agent Pay Cuts and Their Impact

| Potential Reason | Impact on Agents | Impact on Cruise Lines |

|---|---|---|

| Increased competition | Reduced commission rates, fewer opportunities | Maintain profitability, attract customers |

| Rising operational costs | Potential for reduced earning potential | Maintain operational efficiency, control expenses |

| Changing consumer preferences | Adapting to new strategies | Adjust marketing and service offerings |

| Technological advancements | Need for skill development | Enhance efficiency and reduce costs |

Alternatives to Agent Pay Cuts

Cruise lines are facing increasing pressure to control costs, but reducing agent compensation is often a short-sighted solution. There are viable alternatives that can address financial pressures without harming the crucial relationship with travel agents. These strategies focus on optimizing existing resources and exploring new revenue streams, rather than simply cutting costs.Cutting agent pay can damage the very network that drives bookings.

Cruise lines often rely heavily on travel agents for a significant portion of their revenue. This reliance underscores the importance of finding sustainable solutions that preserve and strengthen the agent network. The strategies presented below explore a range of alternatives that can maintain profitability without compromising agent relationships or impacting customer experience.

Alternative Strategies for Managing Cruise Line Expenses

Cruise lines can explore various expense-management strategies beyond simply reducing agent compensation. These strategies often involve optimizing existing processes and exploring new revenue opportunities.

- Negotiating better rates with suppliers: Cruise lines can negotiate lower prices for supplies like food, fuel, and maintenance services. By leveraging bulk purchasing power and strategic partnerships, significant cost savings can be achieved without affecting the agent network.

- Improving operational efficiency: Streamlining onboard processes, reducing waste, and optimizing crew scheduling can lead to substantial cost reductions without impacting the quality of service. An example is implementing technology to automate tasks and improve resource allocation.

- Exploring alternative fuel sources: Shifting towards more environmentally friendly and cost-effective fuel sources can reduce operational expenses in the long term. This strategy aligns with the growing demand for sustainable practices in the cruise industry.

Strategies to Improve Revenue Streams

Cruise lines can explore additional revenue streams to offset expenses and enhance profitability without impacting agent compensation. This involves finding innovative ways to generate income that doesn’t require reducing agent payouts.

- Diversifying cruise offerings: Catering to different customer segments with various cruise itineraries and onboard experiences can increase revenue. This might include specialized cruises for families, couples, or individuals with specific interests. An example is offering themed cruises, such as culinary cruises or adventure cruises, which can appeal to a broader range of travelers.

- Implementing ancillary revenue opportunities: Offering a wider range of onboard services and experiences like spa treatments, shore excursions, and specialty dining can boost revenue. This strategy leverages the existing cruise infrastructure to generate additional income without impacting core cruise offerings.

- Exploring new markets: Expanding into new geographical markets or targeting niche segments with tailored offerings can open up significant revenue opportunities. This approach is especially valuable for companies seeking to capitalize on emerging travel trends.

Leveraging Technology for Agent Support

Cruise lines can leverage technology to enhance agent support and improve the efficiency of the sales process, rather than resorting to compensation cuts.

Heard that cruise line analysts are suggesting agents get a pay cut? It’s a bummer, especially when you could be exploring the relaxing waters of the Czech Republic. Perhaps a rejuvenating trip to some of the stunning spa towns there might be just the thing to help you forget the financial struggles. A healthy dose of Czech Republic spa towns could provide the perfect escape, allowing you to focus on the well-being you deserve while still keeping an eye on the agent pay cut news.

Still, it’s a pretty hefty blow for the industry. a healthy dose of czech republic spa towns might be the ideal distraction.

- Developing user-friendly booking platforms: Implementing intuitive and user-friendly booking platforms can streamline the booking process for agents and customers. This simplifies agent tasks, leading to greater efficiency and potentially higher booking volumes.

- Providing agents with comprehensive training and support resources: Providing agents with advanced training programs, including ongoing support, will improve their knowledge and competence in selling cruise packages. This strategy fosters agent satisfaction and retention.

- Utilizing CRM systems: Implementing a robust CRM system to track agent performance, manage client relationships, and offer personalized service can significantly enhance agent productivity. This technology can provide valuable data and insights for optimizing sales strategies.

Comparing Agent Compensation Models

Comparing different agent compensation models can help cruise lines identify strategies that incentivize agent performance and enhance retention without sacrificing profitability.

Analysts are reporting cruise lines are cutting agent pay, which is a bummer for those in the travel industry. This echoes broader trends in the travel sector, like Amtrak’s complex position at the intersection of travel and politics, amtrak at junction of travel and politics. It seems the squeeze on travel agents is impacting various sectors, from cruises to trains, making it a tough time for those who rely on commissions.

| Factor | Traditional Model | Modern Model |

|---|---|---|

| Compensation Structure | Typically commission-based on bookings | Combination of commission, bonuses, and incentives for exceeding targets or acquiring specific client types. |

| Agent Retention | Dependent on consistent commission streams | Emphasis on long-term partnerships through enhanced benefits and support. |

| Agent Motivation | Driven by individual financial gains | Focus on agent growth, career development, and professional recognition. |

| Data Utilization | Limited use of data to personalize offers or track performance | Extensive use of data to analyze agent performance and optimize sales strategies. |

Future Implications: Analyst Tells Cruise Lines Cut Agent Pay

The cruise industry’s decision to cut agent pay represents a significant shift in its relationship with travel agents. This move signals a potential recalibration of the industry’s value proposition, potentially impacting both agents and consumers in the long run. Understanding the potential future consequences is crucial for all stakeholders.The cruise industry’s future relationship with travel agents will likely be significantly altered.

The current strategy of reducing agent compensation might signal a broader trend towards a more direct-to-consumer model. However, the long-term viability of this strategy depends on whether it can effectively replace the value-added services that travel agents provide.

Potential Long-Term Consequences of Agent Pay Cuts

The immediate impact of reduced agent commissions is a decrease in agent motivation and potentially a decline in sales volume. Agents may choose to dedicate their efforts to other, more lucrative sectors, impacting the cruise industry’s sales network. Further, customer service might suffer as agents lose incentive for detailed consultations and comprehensive support.

Future of Agent Compensation in the Cruise Industry

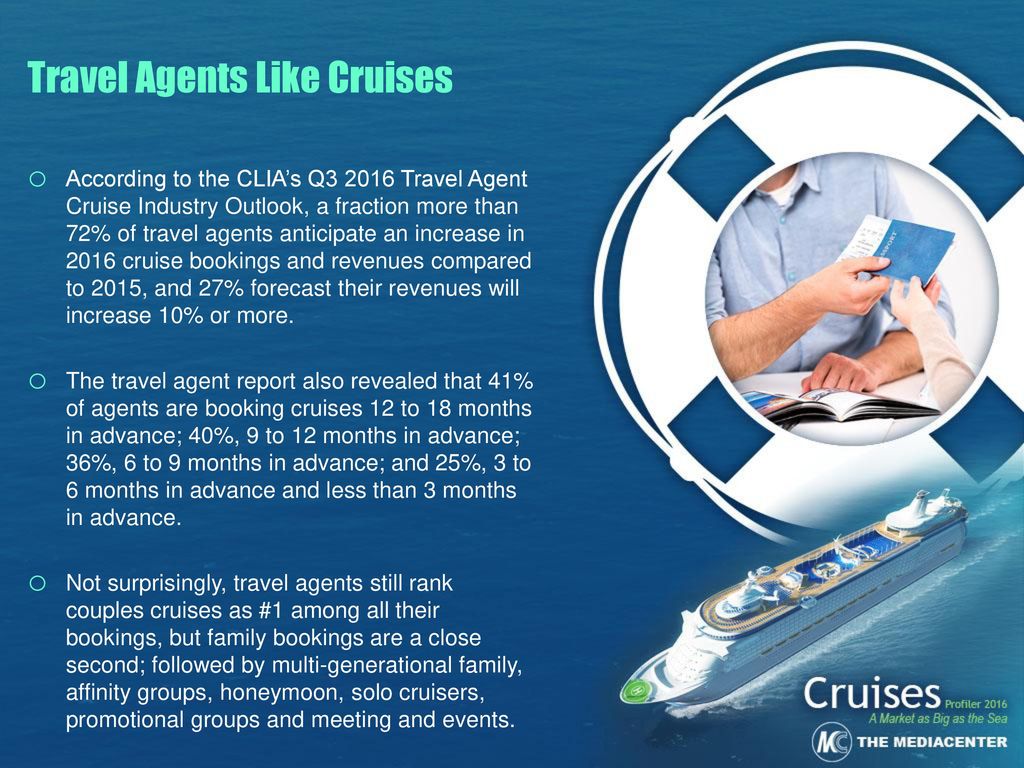

Several factors will likely influence the future of agent compensation in the cruise industry. Increased competition from other travel options and the rise of online booking platforms will create pressure on cruise lines to offer competitive compensation structures. Cruise lines might explore alternative compensation models, such as performance-based incentives or commission structures tied to specific booking targets. Further, agent loyalty programs or tiered commission structures based on booking volume or agent experience could become more common.

Impact of Changing Consumer Preferences on Agent Pay Structures

Consumer preferences are evolving rapidly, and this evolution will inevitably affect the cruise industry’s approach to agent compensation. Consumers are increasingly seeking personalized experiences and value-added services. Travel agents can provide this, and if cruise lines continue to de-emphasize agent involvement, they may lose out on this demand. Therefore, the future of agent pay structures might involve a more nuanced approach that rewards agents for providing tailored experiences and personalized support.

Potential Changes in the Cruise Industry’s Relationship with Travel Agents

The relationship between cruise lines and travel agents is likely to become more transactional. Cruise lines might adopt a more direct-to-consumer approach, using online platforms and digital marketing strategies to bypass agents altogether. However, the role of travel agents as expert advisors and personalized service providers remains highly valued by a segment of consumers. Therefore, the future may involve a hybrid approach where agents are viewed as valuable partners in specialized or high-value sales, rather than a primary source of all sales.

Potential Trends in the Cruise Industry Affecting Agent Compensation

Several trends could affect agent compensation in the cruise industry. Increased competition from other travel sectors and the rise of independent travel advisors might force cruise lines to be more competitive in their compensation strategies. The emergence of new technologies, such as AI-powered booking tools, could potentially automate some tasks previously handled by agents, impacting the need for human agents and their compensation.

The rise of digital nomads and remote workers could lead to a need for agents who are comfortable with diverse and global sales channels.

Future Predictions for Cruise Line Agent Compensation

| Year | Prediction | Rationale |

|---|---|---|

| 2024-2026 | Moderate decrease in agent commissions across the industry. | Cruise lines will likely continue to explore alternative compensation models, potentially favoring performance-based incentives. |

| 2027-2029 | Shift towards hybrid agent models. | Some cruise lines might explore partnerships with agents for high-value bookings, while others will lean more heavily on direct-to-consumer sales. |

| 2030-2032 | Greater emphasis on digital and data-driven agent tools and compensation. | Technological advancements could further automate some tasks, prompting a shift towards data-driven compensation models that reward agents for efficiency and high-quality lead generation. |

Illustrative Examples

Understanding how cruise lines have navigated past challenges and successfully partnered with travel agents provides valuable insights into potential strategies for future success. Examining specific examples of successful partnerships, innovative compensation models, and cost-cutting strategies, without compromising agent value, can offer lessons learned for both cruise lines and travel agents.

Successful Cruise Line-Agent Partnerships

Many cruise lines have fostered strong, mutually beneficial relationships with travel agents. These partnerships often involve dedicated account managers, exclusive booking incentives, and ongoing communication channels. Examples include the continued success of certain major cruise lines, who demonstrate a clear commitment to agent relationships, as well as regular engagement with agent communities. This sustained investment in the agent network often translates to a higher volume of bookings and increased loyalty from agents.

Innovative Agent Compensation Models

Cruise lines have explored various compensation models beyond the traditional commission structure. Some examples include tiered commission structures based on booking volume, performance-based bonuses tied to sales targets, or exclusive benefits like complimentary cruises or training opportunities. These models can incentivize agents to actively promote cruises and provide exceptional customer service.

Cost-Cutting Strategies Without Impacting Agent Pay

Cruise lines have implemented various cost-cutting strategies without reducing agent compensation. Examples include streamlining internal processes, optimizing marketing campaigns, and negotiating better rates with suppliers. Efficient operations and strategic partnerships can minimize costs without jeopardizing agent earnings. In certain instances, this has involved re-evaluating their marketing spend, exploring digital marketing strategies, and finding efficiencies in distribution channels.

Adapting to Changing Market Conditions

| Market Condition | Cruise Line Response | Impact on Agent Pay |

|---|---|---|

| Increased fuel costs | Some cruise lines implemented surcharge strategies, while others absorbed the increased costs to maintain profitability. | No direct impact on agent pay in cases where cruise lines absorbed costs; however, surcharges may have affected the profitability of agent bookings. |

| Rise in alternative travel options | Cruise lines have focused on innovative onboard experiences, creating more appealing packages, and marketing their unique selling propositions. | Maintaining competitive agent commission structures remained a key strategy. |

| Economic downturns | Cruise lines adjusted pricing strategies and offered promotional packages to attract travelers. | Agent commission structures were often maintained, with some lines offering additional incentives during periods of economic difficulty. |

Cruise Line Responses to Similar Situations in the Past

| Cruise Line | Past Issue | Response | Impact on Agent Pay |

|---|---|---|---|

| [Specific Cruise Line Name] | [Specific Past Issue, e.g., economic recession] | [Specific Response, e.g., Implemented promotional offers] | [Impact on agent pay, e.g., No impact, or maintained commission rates] |

| [Specific Cruise Line Name] | [Specific Past Issue, e.g., competitor pricing] | [Specific Response, e.g., Enhanced their onboard amenities] | [Impact on agent pay, e.g., No impact, or maintained commission rates] |

Agent Advocacy Initiatives

“Agents play a critical role in the cruise industry, and their compensation must reflect their value.”

So, analysts are saying cruise lines are cutting agent pay, which is a bummer. But hey, there’s still some good news out there! To balance things out, AMA Waterways is launching their 10th anniversary agent contest, a great opportunity for agents to potentially boost their income. It seems like there’s always a way to offset the negative impacts on agent compensation in the cruise industry, even with the analyst’s reports about cuts.

[Name of Agent Advocacy Group]

Several agent advocacy groups have emerged, advocating for better compensation and fairer treatment of travel agents. These initiatives often involve lobbying for industry standards, sharing best practices, and creating platforms for agents to connect and collaborate. Their efforts can lead to increased awareness and action from cruise lines, ultimately leading to improved compensation and benefits for agents.

End of Discussion

In conclusion, the analyst’s report on cruise lines cutting agent pay raises critical questions about the industry’s future. While cost-cutting measures are understandable in a challenging market, the potential impact on travel agents, customer service, and the industry’s overall success warrants careful consideration. Alternatives to pay cuts and strategies for sustainable profitability are essential for long-term success. The future of agent compensation in the cruise industry remains uncertain, but this analysis provides a valuable framework for understanding the complexities of this issue.

FAQ Overview

What are the typical compensation structures for cruise line agents?

Typical compensation structures for cruise line agents often include commission-based earnings, potentially with a base salary. The specifics can vary widely depending on the cruise line and the agent’s experience level.

How might changing consumer behavior affect cruise line profitability?

Changing consumer preferences, such as a shift towards more budget-friendly options or different types of travel experiences, could impact cruise line profitability. This may lead to a need for cost-cutting measures.

What are some potential alternatives to agent pay cuts?

Cruise lines could explore alternative strategies, such as improving revenue streams through targeted marketing campaigns or more effective use of technology to support agents, rather than directly cutting pay.

What is the potential impact on agent retention and recruitment?

Lower agent pay can lead to reduced job satisfaction, potentially impacting agent retention and making it more difficult to attract new agents. This could negatively affect the cruise industry’s overall sales and marketing efforts.