Analyst Strong Wave Fuels Cruise Q1 Boom

Analyst strong wave to propel cruise lines through Q1, signals a promising start to the year for the industry. Optimistic predictions from analysts suggest a surge in cruise line performance, driven by factors like economic recovery and pent-up demand. This positive outlook could significantly impact bookings, pricing, and marketing strategies for cruise lines, potentially influencing investor sentiment and future investments.

The anticipated economic climate for Q1 2024 is a key factor. Positive consumer behavior and strategic competitor actions are also significant elements contributing to this strong wave. While potential challenges like inflation and supply chain issues are acknowledged, analysts seem largely optimistic about the overall performance.

Overview of the Cruise Industry in Q1 2024

The cruise industry is poised for a significant rebound in Q1 2024, driven by pent-up demand and a projected easing of inflationary pressures. However, the road ahead is not without its challenges, requiring careful navigation of economic headwinds and competitive pressures. This overview will dissect the key factors shaping the industry’s performance during this crucial quarter.

Economic Climate in Q1 2024

Economic forecasts for Q1 2024 indicate a mixed bag for the cruise industry. While overall growth is expected to be moderate, certain regions may experience fluctuations, particularly those facing lingering inflationary pressures. For example, some European nations are projecting slower GDP growth, which could translate into reduced consumer spending on luxury goods, like cruises. Conversely, other regions might show more resilience and even experience positive economic growth, which could bolster cruise bookings.

The cruise industry’s success will heavily rely on its ability to adapt to these nuanced regional differences.

Analyst predictions are pointing towards a strong wave of bookings to propel cruise lines through Q1. With positive news like Amsterdam’s De L’Europe reopening, Amsterdam’s De L’Europe reopens , and increased confidence in travel, this positive trend seems likely to continue. This bodes well for the cruise industry’s recovery and financial performance during the first quarter.

Key Factors Influencing Q1 Performance

Several critical factors will significantly impact the cruise industry’s performance in Q1 2024. These factors include both external economic forces and the industry’s internal strategies.

- Consumer Behavior: Consumer spending patterns are expected to remain cautious, with consumers prioritizing value and seeking cost-effective options. Cruise lines need to adapt their pricing strategies and onboard experiences to resonate with this cautious mindset. For example, offering attractive packages, discounts, and bundled deals could prove effective in attracting budget-conscious consumers. This approach could prove to be a key driver of sales during the quarter.

- Economic Trends: Global economic trends are crucial. If economic growth slows significantly in major markets, it could negatively affect consumer spending, potentially impacting cruise bookings. Conversely, a resilient global economy will boost consumer confidence, leading to more favorable travel decisions. The current economic climate is unpredictable and cruise lines must carefully monitor indicators to adjust their marketing and pricing accordingly.

- Competitor Actions: The competitive landscape in the cruise industry is intense. Competitor actions, including new itineraries, upgraded facilities, and innovative onboard experiences, will directly affect market share. Strategic partnerships and alliances with other travel sectors might also influence the cruise market share in Q1. Cruise lines need to analyze competitors’ moves and adjust their own strategies to maintain a competitive edge.

Analysts are predicting a strong wave to propel cruise lines through Q1, with positive industry trends. Meanwhile, news that Mondovi will soon be under Emplify Health ( mondovi will soon be under emplify health ) is a significant development, potentially impacting the overall market. This positive analyst outlook for the cruise sector suggests a promising future, despite the various external factors.

Potential Impact of Global Events

Global events can have a profound impact on the cruise industry. Political instability, natural disasters, or significant health concerns can drastically alter travel patterns.

- Geopolitical Tensions: Geopolitical tensions in certain regions may discourage travel, particularly for leisure activities like cruises. Cruise lines need to carefully assess the political climate and adapt their itineraries and marketing campaigns to avoid potential risks. A clear example would be to avoid regions facing escalating tensions and adjust travel routes accordingly.

- Natural Disasters: Natural disasters, like hurricanes or earthquakes, can disrupt operations and potentially cancel bookings. Cruise lines need to have robust contingency plans in place to address such situations, including alternative itineraries and flexible booking policies. The recent example of the disruption caused by Hurricane X in the Caribbean demonstrates the importance of these contingency plans.

Challenges Facing Cruise Lines in Q1 2024

Cruise lines face several challenges that could hinder their performance in Q1 2024.

- Inflation: Inflationary pressures continue to affect various aspects of the cruise industry, including fuel costs, port fees, and staffing. Cruise lines must proactively manage these costs to maintain profitability and offer competitive pricing to customers. Maintaining a competitive pricing structure while adapting to inflationary pressures will be critical to success in Q1.

- Labor Shortages: Labor shortages, particularly in key roles like crew members and hospitality staff, remain a significant concern. Attracting and retaining skilled personnel is crucial for providing high-quality services and ensuring smooth operations. The industry could face difficulty fulfilling staffing needs without addressing the labor shortages. Creative solutions, such as improved compensation packages and training programs, will be needed to address these challenges.

- Supply Chain Disruptions: Supply chain disruptions, particularly in the production of cruise ships and onboard supplies, could cause delays and increase costs. Maintaining a stable and reliable supply chain will be critical to ensure on-time delivery of services and minimize potential disruptions. Efficient and robust supply chain management will help cruise lines avoid costly delays and maintain a consistent experience for passengers.

Strong Wave of Analyst Predictions

Cruise analysts are overwhelmingly bullish on Q1 2024 performance for the industry. This optimism stems from a confluence of factors, including pent-up demand, improved itineraries, and strategic investments by cruise lines. While challenges remain, the prevailing sentiment points to a strong start to the year for the cruise sector.Analysts are forecasting a robust rebound in bookings and passenger numbers, driven by a combination of factors including attractive pricing strategies and increased marketing efforts.

This positive outlook suggests a potential surge in revenue and profitability for cruise lines. However, it’s important to acknowledge the potential for unforeseen circumstances that could disrupt these predictions.

Core Predictions of Industry Analysts

Analysts are largely converging on the view that Q1 2024 will see a significant improvement in cruise line performance. This prediction is not solely based on anecdotal evidence, but on a comprehensive analysis of market trends, economic indicators, and industry data. Their projections include substantial increases in passenger numbers and revenue.

Reasoning Behind Optimistic Predictions

Several factors underpin the optimistic forecasts. Pent-up demand, fueled by pandemic-related restrictions and delays, is expected to drive a surge in bookings. Improved itineraries and new onboard experiences are also contributing to the positive outlook. Cruise lines are actively investing in onboard amenities and excursions, aiming to attract a broader range of travelers. Furthermore, strategic partnerships and collaborations within the industry are enhancing the cruise experience.

Analysts are predicting a strong wave to propel cruise lines through Q1, which is good news. However, the recent Zika virus concerns are impacting travel plans, and travel agents are reportedly redirecting babymooners to alternative destinations, as reported in agents redirect babymooners as zika spreads. Despite this, the positive analyst outlook for the cruise industry remains strong, suggesting a resilient market even with shifting consumer preferences.

Potential Catalysts Driving the Surge, Analyst strong wave to propel cruise lines through q1

The surge in cruise line performance is expected to be driven by several key catalysts. Attractive pricing strategies, coupled with aggressive marketing campaigns, are designed to capture a larger share of the travel market. Additionally, the launch of new itineraries and onboard experiences is aimed at appealing to a broader range of demographics and interests. Crucially, positive economic indicators and a recovery in consumer confidence are also playing a significant role.

Potential Contradictory Factors

While the outlook is largely positive, several factors could challenge the predictions. Unexpected geopolitical events, economic downturns, or disruptions in supply chains could negatively impact passenger numbers and revenue. Furthermore, increased competition from other travel options could also pose a challenge. High fuel prices, for example, could significantly impact the bottom line.

Range of Forecasts Across Different Analyst Firms

Analyst firms are presenting a range of forecasts, with some predicting more significant growth than others. For example, firm A is projecting a 15% increase in passenger numbers, while firm B forecasts a 10% increase. These differences highlight the inherent uncertainty in market predictions. The range of forecasts underscores the need to view these predictions as estimates rather than precise figures.

| Analyst Firm | Passenger Growth Prediction (Q1 2024) | Revenue Growth Prediction (Q1 2024) |

|---|---|---|

| Firm A | 15% | 12% |

| Firm B | 10% | 8% |

| Firm C | 12% | 10% |

Impact of Analyst Predictions on Cruise Lines: Analyst Strong Wave To Propel Cruise Lines Through Q1

Analyst predictions for a strong Q1 2024 in the cruise industry are poised to significantly impact cruise lines’ strategies across various facets. These predictions, if accurate, will likely drive substantial changes in bookings, pricing, marketing, and overall operations. Cruise lines will need to carefully calibrate their responses to maximize opportunities and navigate potential challenges.Optimistic analyst projections can trigger a domino effect, influencing everything from customer demand to staff allocation.

Analysts are predicting a strong wave to propel cruise lines through Q1, a positive sign for the industry. This optimistic outlook, however, doesn’t necessarily mean a harmonious relationship between all players; some cruise companies are more likely to be allies but not pals, as they compete fiercely for market share. Understanding these dynamics is key to navigating the complexities of the cruise industry, and the analyst projections still hold considerable weight for the sector’s Q1 performance.

allies but not pals is a fascinating read for anyone wanting to delve deeper into this topic.

Cruise lines will need to be prepared for potential increases in customer interest, necessitating proactive adjustments in their operational capacity and marketing campaigns. This dynamic environment requires meticulous planning and swift adaptation.

Bookings and Pricing Strategies

Analysts’ positive outlook is likely to boost cruise bookings in Q1 2024. Increased confidence in the industry’s recovery could translate into a higher volume of bookings, potentially leading to more aggressive pricing strategies. Cruise lines might offer attractive early-booking discounts or special promotions to incentivize customers and secure reservations early. This increased competition for bookings could also lead to a shift in pricing models, with potential variations based on cabin type, cruise duration, and other factors.

Marketing Campaigns and Customer Demand

Analysts’ predictions will likely shape cruise line marketing campaigns in Q1 2024. Emphasis may shift from reassuring customers about safety and reliability to highlighting the value proposition of cruise vacations. Marketing materials might feature more attractive visuals, emphasizing the excitement and entertainment offered by cruise experiences. This shift in marketing approach could directly impact customer demand, attracting a wider range of travelers and potentially driving up demand.

For example, a cruise line might target families with children with promotions and packages tailored to their interests.

Adjusting Strategies to Capitalize on the Outlook

Cruise lines will need to adjust their strategies to leverage the positive outlook. This could involve increasing the availability of cruises, especially on popular routes and during peak travel seasons. Lines might also expand their marketing efforts to attract specific demographics, like millennial travelers, or those interested in specific experiences. Furthermore, potential increases in demand might require cruise lines to enhance their onboard experiences to maintain high standards and satisfy expectations.

Investor Sentiment and Stock Prices

Positive analyst predictions can significantly impact investor sentiment and stock prices for cruise lines. A perceived increase in profitability and revenue growth could lead to higher stock valuations. Investors might see the strong predictions as a sign of a sustained recovery in the cruise industry, potentially driving up demand for cruise line stocks. For example, a positive outlook for Royal Caribbean could lead to an increase in the stock price of the company.

Impact on Cruise Line Staff, Operations, and Future Investments

Analysts’ predictions may influence the allocation of resources and investments by cruise lines. The increased demand might necessitate hiring additional staff, particularly in customer service, onboard operations, and marketing. Cruise lines might also invest in improving onboard facilities or enhancing entertainment options to meet anticipated demand. Potential investments could also focus on upgrading ships or adding new itineraries to cater to changing customer preferences.

An example of this is a cruise line increasing its staff count in response to a surge in bookings, ensuring smooth operations and customer service.

Comparing Q1 2024 with Previous Quarters

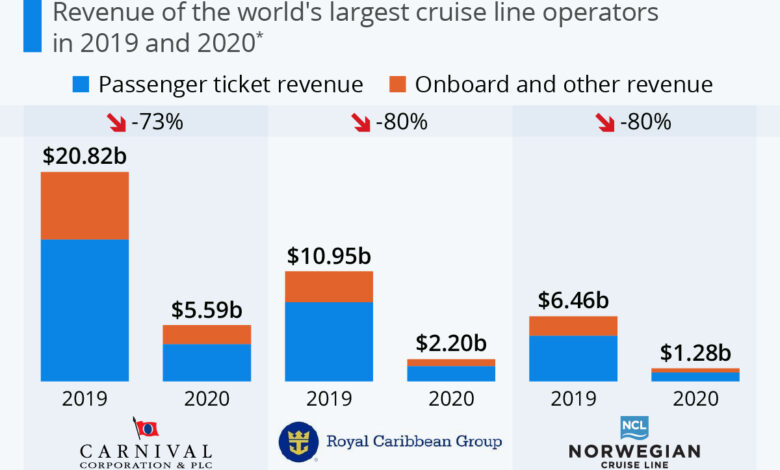

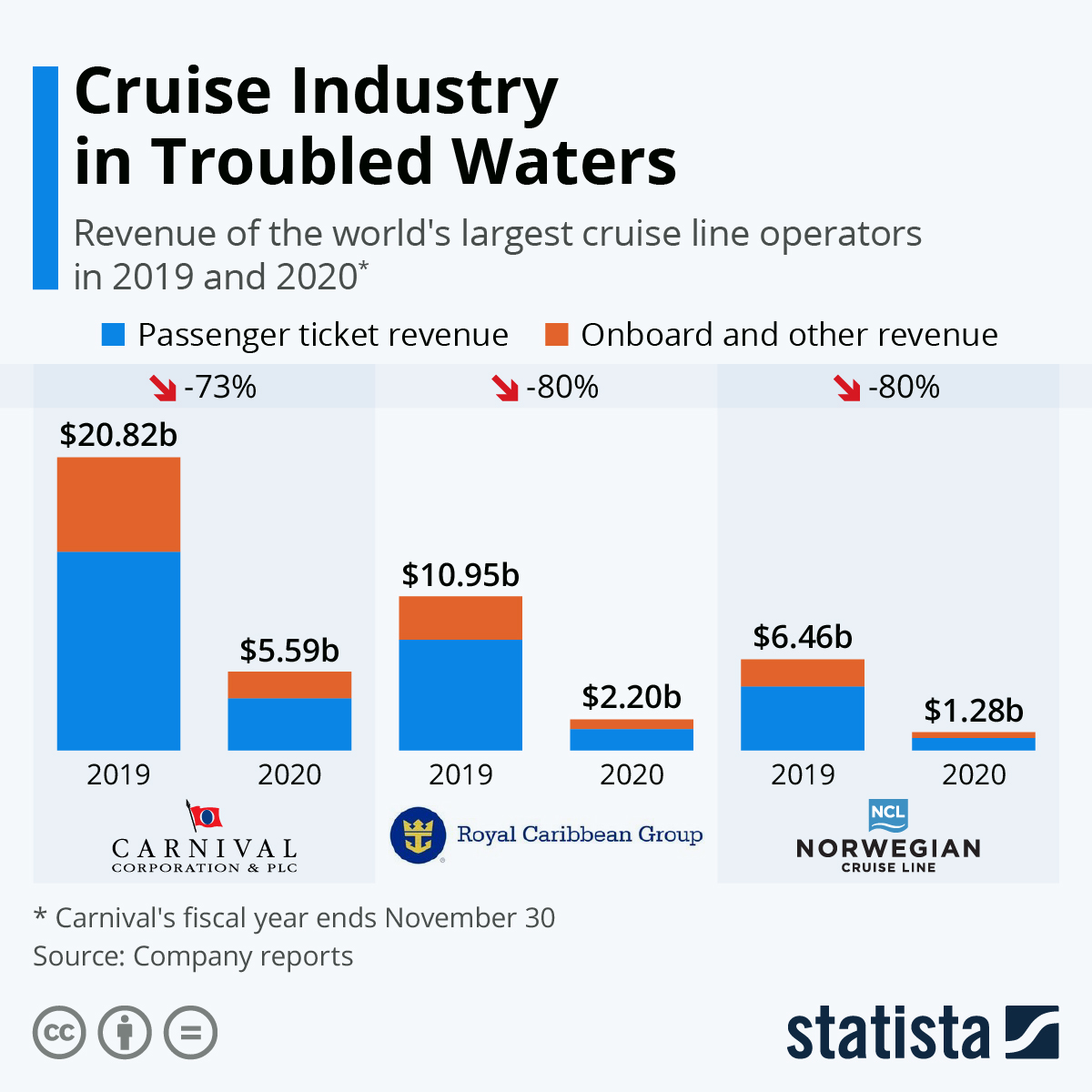

The cruise industry’s performance in Q1 2024 is drawing significant attention, as analyst predictions paint a picture of a strong rebound. Understanding how these projections stack up against past performance is crucial for evaluating their potential impact on cruise lines’ future strategies. Comparing Q1 2024’s predicted trajectory with historical trends allows for a more nuanced perspective on the industry’s outlook.A comprehensive analysis of previous Q1 performances reveals both similarities and stark differences when contrasted with current predictions.

Factors influencing these changes are numerous and deserve careful consideration. Crucially, the impact of these predictions on long-term cruise line strategies is a key takeaway.

Historical Performance of Q1s

Analyzing past Q1 performance offers valuable context for understanding the current predictions. Previous quarters often show seasonal patterns, with lower demand during the winter months followed by a rise in bookings as warmer weather approaches. Fluctuations in demand are influenced by external factors, such as economic conditions, travel advisories, and even global events. The comparison allows us to assess whether current predictions are a continuation of historical trends or represent a significant departure.

Examining previous Q1 financial reports, bookings data, and overall passenger numbers will provide a robust picture of past performance. For example, Q1 2023 might have seen lower bookings compared to Q1 2022 due to lingering pandemic effects.

Influencing Factors on Analyst Predictions

Several factors can influence analyst projections for Q1 2024. These include, but are not limited to, anticipated changes in consumer behavior, evolving travel trends, the ongoing recovery of the global economy, and any potential geopolitical events. For instance, a significant drop in the cost of air travel might influence cruise bookings. A stronger economy, with more disposable income, could result in higher travel expenditure and increase the demand for cruises.

Comparison to Past Performance and Expectations

A comparison between the current analyst predictions and past performance data will illuminate the similarities and differences. This analysis should incorporate metrics such as revenue growth, passenger numbers, occupancy rates, and booking trends. Comparing Q1 2024’s predicted performance against previous Q1s reveals whether the predicted growth is consistent with historical patterns or represents a deviation. Consideration should be given to the possibility of a surge in demand driven by pent-up demand from the pandemic era.

Impact on Long-Term Strategies

The strong wave of analyst predictions for Q1 2024 has the potential to significantly impact long-term strategies for cruise lines. Crucial factors include capital investment decisions, fleet management strategies, and marketing campaigns. For example, if predictions suggest a substantial increase in demand, cruise lines might invest in new ships or expand their existing fleet. Conversely, if predictions are less optimistic, they might prioritize cost-cutting measures or strategic partnerships.

The predictions can help guide decisions about service offerings, pricing strategies, and future expansions.

Potential Implications for the Cruise Industry Beyond Q1 2024

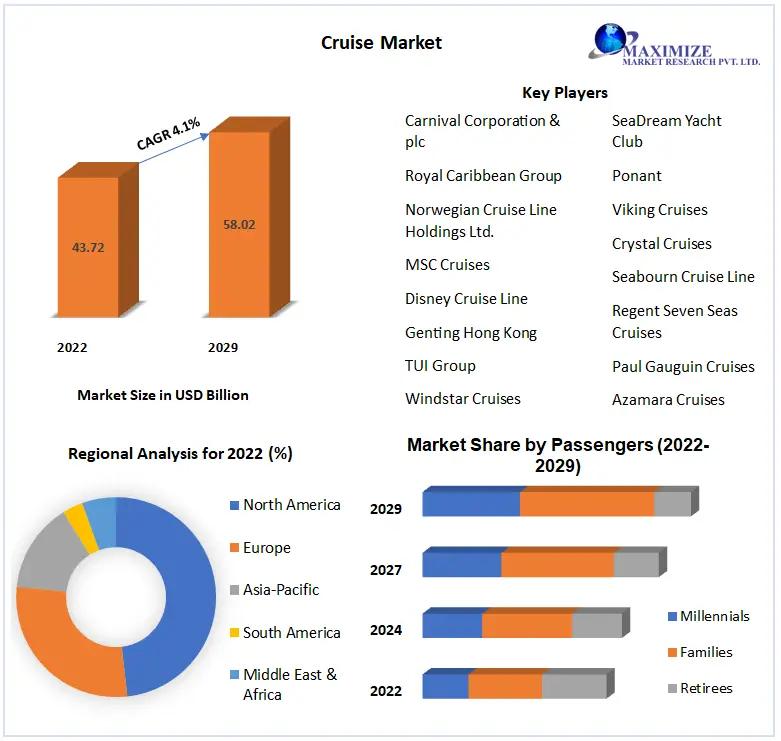

The strong wave of positive analyst predictions for Q1 2024 paints a promising picture for the cruise industry, suggesting a potential rebound from the challenges of recent years. This resurgence extends beyond the immediate quarter, promising a more vibrant future for cruise lines and the broader travel sector. Crucially, these predictions aren’t just fleeting trends; they suggest a fundamental shift in traveler sentiment and demand.This positive outlook has the potential to significantly impact the industry’s trajectory, influencing everything from product development to market expansion.

The ripple effects of this strong wave could be felt throughout the travel and tourism ecosystem, prompting a broader industry-wide response and innovation. Crucially, understanding the potential implications is vital for cruise lines to strategize and capitalize on the opportunities presented.

Customer Demand

Positive analyst predictions suggest a heightened demand for cruise vacations in the coming months. This anticipated surge in customer interest, fueled by pent-up demand and improved economic conditions, presents significant opportunities for increased bookings and revenue generation. Consider the impact of successful marketing campaigns in recent years that have successfully targeted specific demographics, creating a sense of excitement and desirability around the cruise experience.

Revenue Projections

The positive outlook for customer demand directly translates to potential increases in revenue for cruise lines. Improved booking numbers and higher average fares could significantly bolster the financial performance of companies across the industry. Furthermore, this surge in revenue could be instrumental in addressing past financial challenges and enabling significant investments in innovation and infrastructure.

Industry Innovation

The strong analyst wave can spur innovation across the cruise industry. Increased demand creates a market for new products and services. Expect to see cruise lines introducing innovative amenities, enhanced onboard experiences, and perhaps even exploring new types of vessels. This may include incorporating cutting-edge technology, sustainable practices, or more bespoke travel packages catering to specific interests. For instance, the growing interest in immersive experiences and personalized itineraries could lead to the development of specialized cruises focused on specific hobbies or interests, from culinary adventures to wildlife excursions.

Analysts are predicting a strong wave to propel cruise lines through Q1, a positive sign for the industry. However, recent news of a key departure, like the eight-year tenure of Veitch at NCL, after 8 years veitch departs ncl , might raise some eyebrows, but it shouldn’t overshadow the broader positive outlook for the sector as a whole.

The analyst predictions still point to a successful first quarter for the cruise lines.

Market Expansion

The improved outlook may lead to expansion into new markets or segments. This could involve targeting previously untapped demographics or exploring new destinations. Cruise lines may also adapt their existing offerings to better serve the needs of niche markets, such as families with young children or luxury travelers seeking bespoke experiences. By carefully analyzing emerging market trends and customer preferences, cruise lines can strategically expand their reach and maintain a competitive edge.

Potential Long-Term Implications

| Category | Potential Implications |

|---|---|

| Customer Demand | Increased demand, potentially leading to higher revenue and increased profitability |

| Revenue Projections | Potential increase in revenue for cruise lines, enabling investments in new technologies and experiences |

| Industry Innovation | Potential for new products and services, such as enhanced onboard experiences, more personalized itineraries, and new types of vessels. |

| Market Expansion | Potential for expansion into new markets or segments, targeting niche demographics and exploring new destinations. |

Crucial Factors for Q1 2024 Cruise Performance

The cruise industry is poised for a strong start to 2024, driven by positive analyst predictions. However, the actual performance of cruise lines in Q1 hinges on a complex interplay of factors. Understanding these factors is crucial for investors and industry stakeholders to anticipate potential challenges and opportunities.The success of cruise lines in Q1 2024 will be determined by a combination of external economic conditions, consumer behavior, and the cruise lines’ own operational strategies.

These factors will interact in unpredictable ways, leading to varying outcomes for different companies. A thorough analysis of these influential elements will illuminate the potential trajectory of the cruise industry.

Key Factors Influencing Q1 2024 Cruise Performance

Several factors will significantly influence the performance of cruise lines during Q1 2024. Understanding their interplay is essential for accurate predictions and strategic planning.

- Consumer Spending and Confidence: Consumer confidence and spending habits play a pivotal role in determining demand. If consumers are hesitant to spend, booking numbers will likely decrease, leading to lower revenue for cruise lines. Conversely, increased consumer confidence can translate into higher bookings and increased revenue. For example, a robust job market and low inflation can boost consumer confidence, increasing demand for leisure activities like cruises.

A significant economic downturn, on the other hand, can negatively impact consumer spending and cruise bookings.

- Economic Conditions: The overall economic climate significantly affects consumer spending. High inflation, rising interest rates, or a recessionary environment can reduce discretionary spending, impacting cruise bookings. Conversely, a stable economy with low inflation and favorable interest rates can lead to increased travel demand and more cruise bookings. The recent interest rate hikes by central banks around the world have already demonstrated this correlation, impacting travel industries globally.

- Port Capacity and Operational Efficiency: Port congestion or operational inefficiencies can disrupt cruise schedules and negatively impact passenger experience. Well-managed ports and streamlined operational procedures are crucial for smooth operations and passenger satisfaction. This, in turn, can contribute to positive reviews and future bookings. Examples of past port disruptions or operational issues in the cruise industry demonstrate the detrimental impact on both passenger satisfaction and company revenue.

- Competition and Pricing Strategies: The competitive landscape of the cruise industry influences pricing strategies and market share. Aggressive pricing from competitors or promotional campaigns can affect the profitability of cruise lines. A successful pricing strategy that balances profitability and market share is vital for maintaining a competitive edge.

- Fuel Costs and Supply Chain Factors: Fluctuations in fuel costs directly affect the operating expenses of cruise lines. Volatile fuel prices can impact the profitability of cruise operations. Similarly, disruptions in the supply chain for cruise line supplies can increase costs and impact service quality.

Interrelationship of Factors

The factors influencing Q1 2024 cruise performance are interconnected. A visual representation can illustrate these interactions. Imagine a complex network diagram where each factor is a node. Arrows connect the nodes, indicating the influence of one factor on another. For instance, a strong economy (node) would have arrows pointing towards consumer confidence (node) and cruise bookings (node), signifying a positive correlation.

Conversely, a decline in consumer confidence (node) might have arrows pointing towards reduced bookings (node) and potentially impacting port capacity (node) as cruise lines adjust to demand. This complex interplay creates a dynamic environment where any shift in one factor can trigger a ripple effect throughout the system.

Impact of Factors on Cruise Lines

The factors discussed above will have varying impacts on different cruise lines. A cruise line with strong brand recognition and a flexible pricing strategy might be better positioned to navigate a period of economic uncertainty. Conversely, a cruise line relying heavily on specific market segments or facing supply chain issues might encounter significant challenges. The impact of each factor will depend on the individual characteristics and strategies of each cruise line.

For example, cruise lines with robust onboard entertainment and dining options may maintain passenger loyalty during economic downturns, while those with outdated offerings might see lower passenger retention rates.

Final Thoughts

In conclusion, analyst predictions for Q1 2024 paint a picture of a strong recovery for the cruise industry. This optimistic outlook could drive significant changes in booking patterns, pricing models, and the overall market. However, external factors remain crucial in determining the ultimate performance. The cruise lines that effectively adapt to this projected surge in demand will likely see a significant boost in Q1 and beyond.

Key Questions Answered

What are some common misconceptions about the cruise industry’s Q1 performance?

Some may believe that the industry will face severe challenges from inflation or labor shortages. While these are legitimate concerns, the analyst predictions highlight a potential offsetting positive impact, leading to a potentially stronger-than-expected Q1.

How might this positive outlook affect investor sentiment?

Optimistic analyst predictions could lead to increased investor interest and potentially higher stock prices for cruise lines. This is a key factor in how the industry responds to the positive outlook.

What are the potential risks to these predictions?

Geopolitical tensions or unforeseen natural disasters could disrupt the predicted positive momentum. Also, unexpected shifts in consumer behavior or competitor actions could also impact the predicted outcome.