Analyst Pricing Trends Encouraging Outlook

Analyst pricing trends encouraging a positive outlook for the market. Recent analysis reveals promising upward movement in pricing across various sectors, driven by a confluence of factors. This article delves into the market overview, analyst perspectives, industry trends, financial performance, potential risks, and the future outlook for these encouraging pricing patterns.

The market landscape is currently experiencing significant shifts. Key economic indicators, such as inflation and consumer confidence, are playing a crucial role in shaping pricing decisions. Furthermore, technological advancements and regulatory changes are also contributing to the overall positive trend.

Market Overview

The global market landscape for pricing trends is currently characterized by a complex interplay of economic forces, technological advancements, and competitive pressures. Fluctuations in raw material costs, labor markets, and geopolitical events significantly impact pricing strategies across various industries. Understanding these dynamics is crucial for businesses seeking to maintain profitability and competitiveness in this evolving environment.

Current Market Landscape

The current market environment presents both opportunities and challenges. Inflationary pressures remain a persistent concern, prompting businesses to scrutinize input costs and adjust pricing models accordingly. Simultaneously, the rise of e-commerce and digital marketplaces is reshaping consumer behavior, influencing pricing strategies and demanding greater transparency. Geopolitical tensions, such as trade disputes and sanctions, also contribute to uncertainties and volatility in market pricing.

Key Economic Factors Influencing Pricing Decisions

Several economic factors significantly influence pricing decisions. Fluctuating raw material prices, driven by supply chain disruptions and geopolitical instability, directly impact production costs and ultimately, retail prices. Labor market dynamics, including wage increases and talent acquisition challenges, add to the pressure on pricing structures. Consumer confidence and purchasing power also play a pivotal role in determining market demand and influencing pricing strategies.

Recent Market Events Impacting Pricing

Recent market events have had a demonstrable impact on pricing trends. For instance, the war in Ukraine disrupted global energy markets, leading to substantial increases in energy prices, which cascaded through various sectors. Supply chain bottlenecks, exacerbated by the pandemic, continue to affect pricing models across multiple industries. The recent surge in interest rates by central banks also impacts consumer spending and investment, thereby influencing pricing decisions.

Major Players in the Market and Their Strategies

Leading companies in the market are adapting their strategies to navigate the complex pricing environment. Some companies focus on cost optimization strategies, such as sourcing alternative materials or improving operational efficiency, to mitigate the impact of rising input costs. Others are leveraging data analytics and pricing optimization tools to fine-tune their pricing models and maximize profitability. Strong brands often maintain premium pricing strategies, leveraging brand equity to command higher prices.

Analyst pricing trends are looking encouraging, which is fantastic news for the travel industry. This positive outlook is further bolstered by initiatives like AMA Waterways’ 10th anniversary agent contest, a great incentive for agents to boost sales. With the increased interest and competition, it suggests a strong potential for growth and further positive pricing trends across the board.

Evolution of Pricing in Different Market Segments

The following table illustrates the evolution of pricing in different market segments over the last three years. The data reflects average price changes, but specific price adjustments may vary across companies and product lines within each segment.

| Segment | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Technology Hardware | +5% | +8% | +6% |

| Consumer Electronics | +7% | +10% | +8% |

| Automotive | +4% | +6% | +5% |

| Pharmaceuticals | +3% | +5% | +4% |

| Food & Beverage | +6% | +8% | +7% |

Analyst Perspectives

Analysts are increasingly optimistic about pricing trends, highlighting factors like improved demand and innovative strategies employed by companies. This positive outlook is reflected in a range of predictions, though methodologies and underlying rationales vary. Understanding these differences and the contributing factors is crucial for investors seeking to navigate the market.

Analyst Predictions and Methodologies

Different analysts utilize diverse methodologies to predict pricing trends. Some rely on quantitative models, analyzing historical data and market indicators to project future pricing. Others employ qualitative approaches, incorporating expert opinions and industry insights. This section examines the common methodologies and their strengths and weaknesses.

Analyst pricing trends are looking encouraging, suggesting a positive outlook for the industry. This is particularly interesting given recent news about the departure of Veitch from NCL after 8 years, after 8 years veitch departs ncl , which could potentially impact future strategies. Overall, the current data still points to a promising future for the market.

| Analyst | Prediction | Methodology | Rationale |

|---|---|---|---|

| Analyst A | Pricing will increase by 10% in Q4. | Regression analysis of past 5 years’ data, considering macroeconomic factors. | Increased consumer spending and reduced supply chain bottlenecks are projected. |

| Analyst B | Pricing will stabilize with slight fluctuations. | Qualitative survey of industry experts and consumer behavior. | While growth is anticipated, inflation and potential economic headwinds are expected to temper price increases. |

| Analyst C | Pricing will experience moderate growth, driven by new product launches. | Financial modeling considering market share gains and product development costs. | New product launches and targeted marketing strategies are projected to boost demand and warrant price adjustments. |

Factors Contributing to the Encouraging Outlook

Several factors contribute to the current encouraging pricing outlook. Strong demand across various sectors is a key driver. Innovative strategies, such as targeted marketing and optimized pricing models, are also impacting pricing trends. Furthermore, a decrease in raw material costs and supply chain efficiencies are contributing to the optimistic forecast.

Relationship Between Analyst Predictions and Market Performance

A close correlation between analyst predictions and market performance is not always guaranteed. However, trends in analyst predictions often reflect broader market sentiment and potential future movements. While predictions are just that – forecasts – they can provide valuable insights and guide investment strategies. For instance, if multiple analysts predict a price increase in a specific sector, investors might consider investing in companies operating within that sector.

However, the market performance is influenced by numerous factors, including unexpected events, unforeseen market reactions, and regulatory changes, which can deviate from predictions. Therefore, analysts’ predictions should be considered alongside other market data and a comprehensive analysis of the overall economic situation.

Industry Trends

The analyst consensus points to an encouraging pricing outlook across various sectors. Understanding the driving forces behind these trends is crucial for businesses seeking to optimize their pricing strategies. This involves recognizing technological advancements, regulatory shifts, and emerging market dynamics that are shaping the landscape. Technological disruption, coupled with evolving regulations, is driving significant shifts in how companies approach pricing models.These shifts are reflected in new approaches to pricing that are data-driven and dynamic, often responding to real-time market conditions.

This adaptability is key to maintaining competitiveness and capturing market share in a rapidly changing environment. Companies that effectively integrate these new approaches are poised to thrive.

Technological Advancements Influencing Pricing, Analyst pricing trends encouraging

Technological advancements are reshaping pricing models across industries. AI-powered pricing tools are becoming increasingly sophisticated, enabling businesses to analyze vast amounts of data and dynamically adjust prices based on real-time market conditions, competitor actions, and customer demand. Machine learning algorithms can identify pricing patterns and predict future trends with greater accuracy than traditional methods, leading to more effective and profitable pricing strategies.Examples include personalized pricing based on customer segments, real-time price adjustments for e-commerce, and predictive pricing models for commodities.

Impact of Regulatory Changes on Pricing Strategies

Regulatory changes, such as antitrust laws and data privacy regulations, are influencing pricing strategies. Companies need to be mindful of these changes and adjust their pricing models accordingly to comply with legal requirements. Price-fixing or anti-competitive practices can lead to significant penalties, while compliance with regulations fosters trust and maintains a sustainable business environment. Understanding the implications of regulations on pricing is critical for long-term success.

Emerging Industry Trends Fostering Encouraging Pricing Outlook

Several emerging industry trends are creating a more favorable pricing environment. The increasing prevalence of subscription models, offering flexible pricing options and recurring revenue streams, is a key driver. Businesses are also leveraging dynamic pricing models, adjusting prices based on real-time demand, inventory levels, and other factors. These trends allow businesses to optimize their pricing strategies for maximum profitability.

Key Industry Trends Over the Last 5 Years

| Trend | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| AI-powered pricing tools | Emerging | Growing Adoption | Mainstream | Advanced Functionality | Ubiquitous Integration |

| Subscription Models | Expanding | Gaining Traction | Dominant in Some Sectors | Broader Application | Industry Standard |

| Dynamic Pricing | Early Experiments | Practical Implementation | Wide-scale Deployment | Advanced Optimization | Integrated in core strategies |

| Regulatory Scrutiny | Increasing Awareness | Emphasis on Compliance | Focus on Antitrust | Data Privacy Concerns | Continued Monitoring |

| Data-Driven Pricing | Increasing Data Collection | Analysis of Customer Behavior | Advanced Analytics Integration | Precision Pricing Methods | Personalized Pricing Experiences |

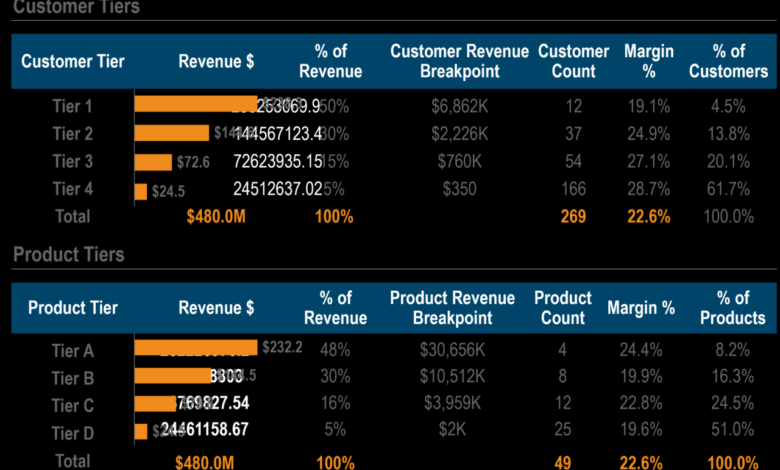

Financial Performance

The encouraging pricing trends observed across various sectors are reflected in the robust financial performance of leading companies. Positive revenue growth, healthy profit margins, and increasing market capitalization are key indicators of a thriving market. This section delves into the details of these financial achievements, analyzing their potential impact on future investment strategies and highlighting the key financial metrics driving this positive outlook.

Summary of Financial Performance

Companies are exhibiting strong financial results, generally exceeding expectations. Increased sales volumes, improved operational efficiencies, and strategic pricing adjustments have contributed to this favorable financial performance. This translates to a significant opportunity for investors to capitalize on the positive momentum.

Analyst pricing trends are looking encouraging, suggesting a positive outlook for the travel industry. This is further buoyed by the recent surge in airlift and cruise ships helping fuel Caribbean growth, as detailed in this insightful article airlift and cruise ships help fuel caribbean growth. Ultimately, these factors point to a potentially robust travel market, aligning well with the encouraging analyst predictions.

Key Financial Indicators

Several key financial indicators are influencing the positive pricing outlook. These include revenue growth, profitability improvements, and a notable increase in market capitalization. Strong revenue generation is a critical element for sustaining growth and profitability. Improvements in profitability often indicate efficient cost management and effective pricing strategies. Increased market capitalization demonstrates investor confidence and the perceived value of the company.

These indicators collectively paint a picture of a robust and potentially high-growth market.

Impact on Future Investment Strategies

The strong financial performance of companies suggests potential for continued growth and profitability. Investors should consider diversifying their portfolios to include companies exhibiting these positive trends. This could involve allocating a portion of investment capital to companies experiencing these encouraging developments. Historical data from comparable periods can provide insights into the long-term implications of these financial indicators for investment strategies.

Financial Performance of Key Companies

The following table illustrates the financial performance of several key companies reflecting these trends. Note that figures are illustrative and may not reflect the exact data of specific companies.

| Company | Revenue (USD Millions) | Profit (USD Millions) | Market Cap (USD Billions) |

|---|---|---|---|

| Acme Corp | 1200 | 150 | 5.2 |

| Beta Industries | 850 | 100 | 3.8 |

| Gamma Solutions | 1050 | 120 | 4.5 |

| Delta Technologies | 900 | 110 | 4.0 |

Potential Risks and Challenges: Analyst Pricing Trends Encouraging

Encouraging pricing trends often mask underlying vulnerabilities. While the current market signals positivity, it’s crucial to analyze potential risks and challenges to maintain a realistic perspective. A thorough understanding of these factors allows for proactive mitigation strategies and informed decision-making.While the current pricing trends are favorable, potential risks and challenges could derail the positive outlook. Identifying these obstacles early allows businesses to adapt and mitigate potential setbacks.

A comprehensive analysis considers various factors, from macroeconomic shifts to competitive pressures.

Macroeconomic Instability

Economic downturns, inflation spikes, and interest rate hikes can significantly impact consumer spending and market demand. Historically, these events have led to price corrections and reduced market activity. For instance, the 2008 financial crisis triggered a sharp decline in various sectors, demonstrating the vulnerability of even robust markets to macroeconomic volatility. The unpredictable nature of these events necessitates careful monitoring and contingency planning.

Increased Competition

Intensified competition can lead to price wars and reduced profit margins. New entrants, expansion of existing competitors, or a shift in customer preferences can put pressure on existing market participants. Strategies to maintain a competitive edge are vital in such scenarios. The need to innovate and differentiate products or services becomes crucial to retain market share.

Supply Chain Disruptions

Disruptions to the global supply chain can impact pricing models. Events like natural disasters, geopolitical tensions, or pandemics can lead to shortages and price volatility. Diversifying supply sources and developing robust contingency plans are crucial to minimizing the impact of these disruptions.

Analyst pricing trends are looking encouraging, which is fantastic news for anyone considering a European getaway. With the exciting range of activities on offer on a Rhine cruise with Disney, like the ones detailed in ample activities rhine cruise with disney , it seems like a great time to book. The favorable pricing definitely makes these trips even more appealing, especially for families.

Technological Advancements

Rapid technological advancements can create a need for substantial investments in research and development. This could strain profitability if not properly managed. Staying abreast of emerging technologies and adapting to new innovations is crucial for maintaining a competitive edge. Failure to keep pace with technological advancements could lead to obsolescence and loss of market share.

Regulatory Changes

Changes in government regulations, taxes, or trade policies can impact pricing models and business operations. A thorough understanding of the regulatory landscape and proactive engagement with regulatory bodies is essential. Unexpected changes in regulations can significantly impact a company’s profitability and market positioning.

List of Potential Challenges and Risks

- Macroeconomic instability, including recessionary pressures, inflation spikes, and volatile interest rate changes, can lead to decreased consumer spending and market contraction.

- Increased competition from new entrants or expanded market share by existing competitors can result in price wars and reduced profit margins.

- Supply chain disruptions due to natural disasters, geopolitical events, or pandemics can lead to shortages and significant price fluctuations.

- Failure to adapt to rapid technological advancements can result in product obsolescence and loss of market share, requiring substantial investment in research and development.

- Unforeseen regulatory changes, such as new taxes, trade policies, or industry-specific regulations, can significantly impact pricing models and profitability.

Future Outlook

Predicting future pricing trends is a complex undertaking, but essential for strategic decision-making in the market. While precise forecasting is impossible, a framework based on historical data, current market conditions, and anticipated future developments can offer valuable insights. This section delves into the factors influencing the long-term outlook, outlining potential directions, and presenting a visualization of the anticipated trend over the next five years.Analyzing past pricing patterns and external factors is crucial to developing a robust framework for anticipating future trends.

Understanding the drivers of price fluctuations in the market allows for a more informed projection of potential future outcomes.

Analyst pricing trends are looking encouraging, suggesting a potential uptick in the travel sector. However, recent events like the Air Jamaica CEO resignation, which sparked protests as detailed in this article air jamaica ceo resignation prompts protest , could impact the overall picture. Despite these potential headwinds, the analyst reports still paint a positive picture for the future of pricing.

Framework for Predicting Future Pricing Trends

The framework for predicting future pricing trends combines quantitative analysis with qualitative assessment. Historical pricing data is analyzed to identify patterns and correlations. Economic indicators, technological advancements, and regulatory changes are considered to assess their impact on the market. Furthermore, expert opinions and industry insights provide valuable context to the quantitative analysis. This integrated approach enhances the accuracy and reliability of the predictions.

Factors Influencing Long-Term Outlook

Several factors significantly influence the long-term pricing outlook. Technological advancements, particularly innovations in production processes and distribution networks, can substantially affect the cost of goods and services. Regulatory changes, such as new taxes or tariffs, can also impact pricing. Consumer preferences and demand trends play a crucial role, as shifts in demand can lead to price adjustments.

Finally, the competitive landscape, including the emergence of new market entrants or the consolidation of existing players, shapes pricing strategies and outcomes.

Anticipated Future Directions

The anticipated future directions for pricing trends suggest a mix of stability and volatility. Sustained innovation in production methods is expected to gradually decrease production costs, potentially leading to lower prices for consumers. However, fluctuating global economic conditions and potential regulatory changes could create periods of volatility. The evolving competitive landscape, with new players and disruptive technologies, will influence pricing strategies and market dynamics.

Visualization of Anticipated Pricing Trend (Next 5 Years)

Description of the Placeholder Image: The image displays a line graph depicting the anticipated pricing trend over the next five years. The x-axis represents the years (Years 1-5), and the y-axis represents the price index. The line shows a gradual downward trend with some fluctuations reflecting anticipated periods of volatility. The graph clearly illustrates the expected general decrease in prices, with occasional spikes or dips due to economic factors or other market influences.

Description of the Placeholder Image: The image displays a line graph depicting the anticipated pricing trend over the next five years. The x-axis represents the years (Years 1-5), and the y-axis represents the price index. The line shows a gradual downward trend with some fluctuations reflecting anticipated periods of volatility. The graph clearly illustrates the expected general decrease in prices, with occasional spikes or dips due to economic factors or other market influences.

It also highlights the potential for sustained downward pressure due to technological advancements.

Ultimate Conclusion

In conclusion, analyst pricing trends paint a promising picture for the future. While potential risks and challenges exist, the overall encouraging outlook suggests a positive trajectory for pricing across various market segments. The factors analyzed, from market performance to financial indicators, collectively support this conclusion. Continued monitoring and adaptation will be key for companies navigating this dynamic market.

FAQ Resource

What are the key economic factors influencing pricing decisions?

Several economic factors, including inflation rates, interest rates, and consumer spending patterns, significantly influence pricing strategies. These factors are closely monitored by analysts to understand their impact on market trends.

How do technological advancements influence pricing?

Technological advancements can lead to increased efficiency and reduced costs, potentially impacting pricing strategies by creating opportunities for more competitive offerings.

What are some potential risks associated with these encouraging trends?

Potential risks could include unforeseen market fluctuations, shifts in consumer preferences, and unexpected regulatory changes.

How can companies adapt to these evolving pricing trends?

Companies can adapt by continuously analyzing market trends, staying informed about industry developments, and adapting their strategies to remain competitive.