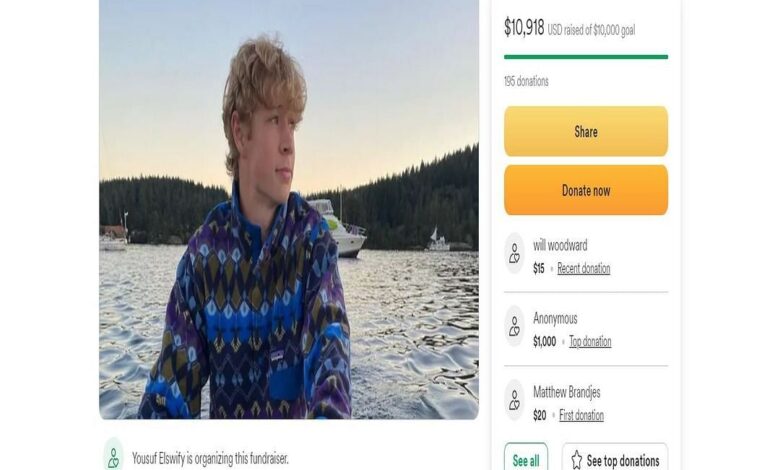

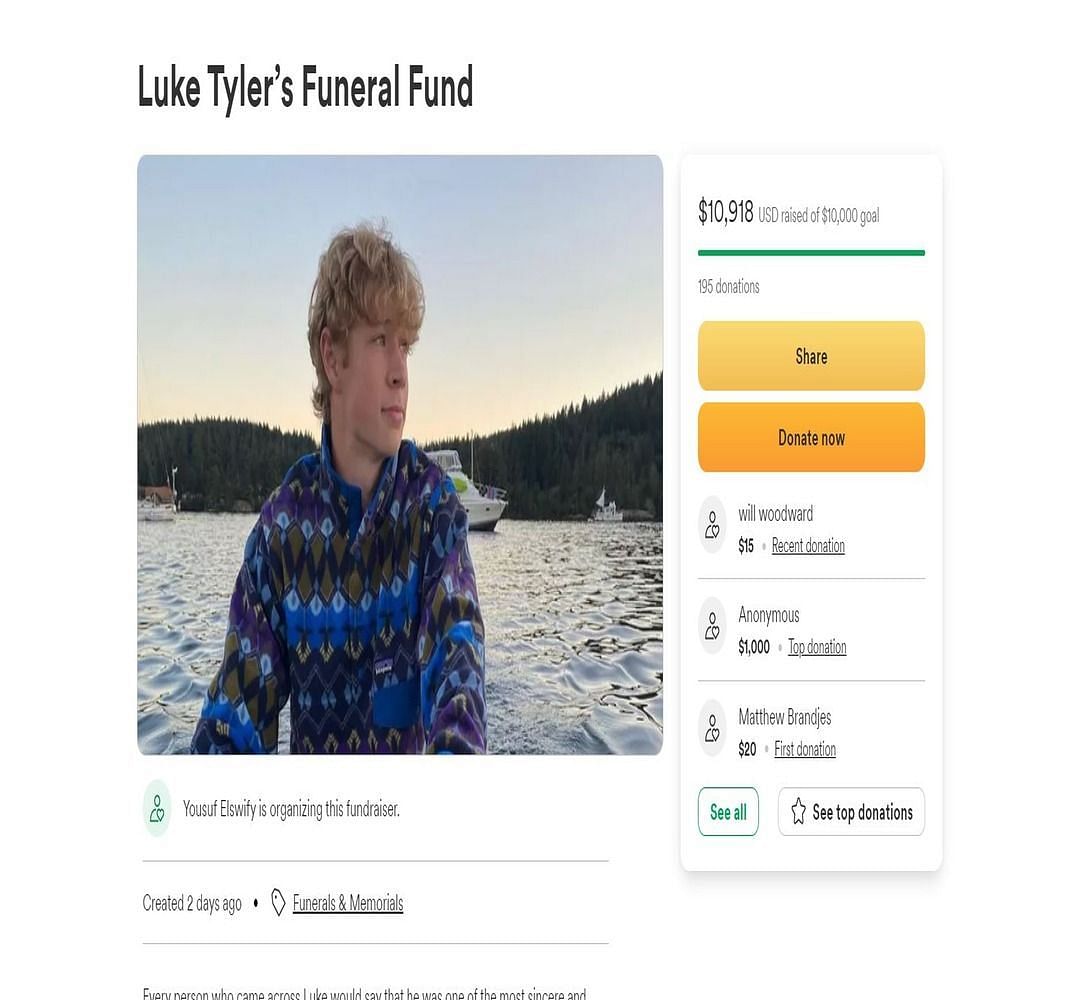

AmResorts Trust Fund Sales Directors Family

Amresorts opens trust fund for sales director s family – AmResorts opens trust fund for sales director’s family, sparking immediate interest and debate. This initiative raises questions about fairness, financial implications, and potential impacts on employee morale. Will this set a precedent for other companies, or stand as a unique gesture? Let’s delve into the details and explore the potential ripples this trust fund could create.

The trust fund, a substantial financial commitment from AmResorts, aims to provide long-term support for the sales director’s family. The specifics, however, remain unclear, prompting discussion about the motivations behind this move and its possible repercussions.

Background of the Trust Fund

AmResorts’ recent establishment of a trust fund for a sales director’s family raises several interesting points about corporate social responsibility and employee support. This initiative, while seemingly benevolent, also warrants a closer look at its potential implications for the company’s public image.This trust fund demonstrates a commitment to employee well-being beyond typical compensation packages. It signifies a proactive approach to supporting key personnel and potentially fostering a more loyal and engaged workforce.

Amresorts’ thoughtful gesture of opening a trust fund for their sales director’s family is heartwarming. It highlights the company’s commitment to supporting their employees during difficult times. Interestingly, this news comes shortly after the announcement that, after 8 years with NCL, Veitch departed , a notable shift in the travel industry. Ultimately, Amresorts’ actions underscore their strong company culture and caring approach to employee well-being.

However, the specific details surrounding the fund are crucial to fully understanding its impact.

Purpose and Motivation

The primary purpose of the trust fund is to provide financial security for the sales director’s family. This likely stems from a desire to recognize the director’s contributions and dedication to the company. Motivations may also include fostering a culture of appreciation and loyalty within the organization. Such initiatives can enhance employee morale and potentially reduce employee turnover.

Terms and Conditions

Unfortunately, precise details regarding the trust fund’s terms and conditions are not publicly available. This lack of transparency limits the ability to assess the fund’s structure, duration, and specific provisions. Without knowing the terms, it’s challenging to determine whether the fund’s value adequately reflects the director’s contributions.

Potential Implications for AmResorts’ Reputation

This initiative could significantly impact AmResorts’ public perception. A well-managed trust fund, transparent in its operation, could strengthen the company’s reputation as a socially responsible and caring employer. This positive image could attract and retain top talent, positively affecting recruitment and brand loyalty. Conversely, a poorly structured or opaque fund might create a negative perception, potentially leading to public criticism and scrutiny.

The example of similar initiatives in other companies, where the details were unclear or the funds’ benefits seemed disproportionate, can serve as a cautionary tale. Careful consideration of public perception is vital to maintaining a positive brand image. AmResorts must address potential concerns about fairness and equity in its practices.

Impact on AmResorts

AmResorts’ decision to establish a trust fund for a sales director’s family is a noteworthy act, prompting a critical examination of its potential impact on the company. This initiative raises questions about the broader implications for employee morale, the company’s image, and the treatment of other employees.This act, while seemingly benevolent, requires careful consideration of its reverberations throughout the organization.

Analyzing the positive and negative effects will illuminate the complexities of such gestures. Potential ripple effects on other employees and their families, and comparisons with similar actions by other companies, will further clarify the implications of this unique decision.

Potential Positive Effects on Company Image

This initiative has the potential to significantly enhance AmResorts’ public image, showcasing a compassionate and caring corporate culture. The gesture can attract and retain talented employees, especially in a competitive hospitality market. The company might be perceived as a responsible and ethical employer, attracting positive media attention and boosting its reputation. It could foster a sense of community and loyalty among employees.

Potential Negative Effects on Employee Morale

Conversely, the initiative could lead to resentment and inequity among other employees. If the perception arises that the trust fund is a one-off event, and not a part of a larger employee support program, it might create feelings of unfairness and resentment. This could potentially impact the morale and productivity of employees who feel overlooked or undervalued. Careful management of communication regarding the initiative is crucial to mitigate these negative effects.

Implications for Other Employees and Families

The initiative could be interpreted as setting a precedent, creating expectations for similar support for other employees. This could either be beneficial, fostering a culture of employee care, or detrimental, if the company struggles to provide similar support across the board. A transparent and consistent approach to employee support is essential to prevent resentment and ensure equity.

Comparison with Similar Initiatives in the Hospitality Industry

Numerous hospitality companies have implemented employee support programs. These programs often encompass various elements, from tuition reimbursement to retirement plans, or even emergency funds. Analyzing these initiatives provides a framework for evaluating the AmResorts trust fund’s position within the industry. The lack of broader employee support programs alongside this initiative might create a perception of inconsistency.

Comparative Analysis of Trust Funds

| Company Name | Purpose | Details | Impact |

|---|---|---|---|

| AmResorts | Support for a sales director’s family | Establishment of a trust fund | Potential for enhanced image, but also potential for resentment among other employees. |

| Hilton | Employee Assistance Program (EAP) | Provides confidential counseling and support services for employees and their families | Positive impact on employee well-being and retention |

| Marriott | Tuition Reimbursement | Provides financial assistance for employee education | Attracts and retains talented employees |

| Four Seasons | Comprehensive benefits package | Includes health insurance, retirement plans, and other benefits | Demonstrates commitment to employee welfare and attracts top talent |

Public Reaction and Perception

The announcement of an AmResorts trust fund for a sales director’s family is sure to generate a wide range of public reactions, from admiration to criticism. Understanding these potential responses is crucial for the company’s image and future operations. The optics of such a move will be scrutinized, and how the company handles the narrative will significantly influence public perception.This initiative, while seemingly charitable, could be interpreted in various ways, raising questions about corporate priorities and potentially impacting the company’s reputation.

Careful consideration of potential criticisms and proactive communication will be key to mitigating any negative fallout.

Potential Public Reactions

Public reaction to the trust fund will likely be a mix of positive and negative sentiment. Some will praise the company’s generosity and commitment to supporting its employees, viewing it as a noble gesture. Others will be more critical, questioning the fairness of such a specific action and its alignment with corporate values. It’s important to anticipate these different perspectives and prepare for the discussion they will spark.

Media Coverage and Public Sentiment

Media coverage of the trust fund will likely focus on the financial aspect of the donation and its implications for the company’s image. News outlets may delve into the financial resources of the company, contrasting the fund with other potential needs or investments. The coverage could range from highlighting the generosity of the company to raising concerns about potential conflicts of interest or the appearance of favoritism.

Public sentiment will be shaped by this coverage, so the company must be prepared to address concerns proactively.

Potential Concerns and Criticisms

Concerns about the trust fund’s fairness and equity could arise among stakeholders, particularly if it is perceived as preferential treatment. Some might argue that the fund disproportionately benefits one employee while neglecting other deserving individuals or the needs of the broader community. This could lead to criticisms about corporate social responsibility and its allocation of resources. Questions about transparency and the criteria for selecting beneficiaries might also arise.

Perceptions of Unethical or Unfair Practices

Several stakeholders might perceive the trust fund as unethical or unfair. Employees might feel resentful if they perceive the fund as a reward for favored individuals rather than a standard benefit. The fund could also be viewed as unfair by competitors, potentially creating a negative competitive environment. Furthermore, the trust fund’s funding could lead to questions about the company’s financial priorities and whether resources are being allocated effectively across all departments or towards other corporate goals.

This will require transparent communication and a clear justification for the initiative.

Financial Implications

AmResorts’ decision to establish a trust fund for its sales director’s family raises important financial questions. The fund’s size and the specific terms will heavily influence the short-term and long-term financial implications for both the company and the beneficiaries. Understanding these implications is crucial for assessing the overall impact of this unusual corporate action.

Overview of Financial Aspects

The trust fund’s specifics, including its initial capital, investment strategy, and ongoing management, remain undisclosed. Without this information, a precise calculation of the financial burden on AmResorts is impossible. However, one can infer that the fund’s size will directly correlate with the potential cost to the company.

Potential Financial Burden on AmResorts

The precise financial burden on AmResorts will depend on the trust’s size and terms. If the trust is substantial, it could negatively affect the company’s bottom line. This potential impact could manifest in reduced profitability, decreased investment in other areas, or even a shift in the company’s strategic direction. The long-term impact on AmResorts’ financial health remains to be seen.

Long-Term Financial Implications

The long-term implications for both AmResorts and the sales director’s family are complex. For AmResorts, this could set a precedent for future corporate actions, potentially leading to unforeseen financial responsibilities. For the family, the trust fund could provide a significant financial cushion, ensuring a secure future. However, the long-term success of the trust hinges on sound investment strategies and effective management.

Amresorts’ thoughtful gesture of opening a trust fund for their sales director’s family is truly commendable. It highlights the company’s caring nature, a nice contrast to some recent industry changes. Interestingly, the recent news about Aker Yards name going away ( aker yards name goes away ) shows a different side of the travel industry, but it doesn’t diminish the positive impact of Amresorts’ support.

This demonstrates a strong sense of community within the industry, even amidst transitions.

Potential Financial Scenarios

| Scenario | Cost to AmResorts | Impact on Sales Director’s Family | Potential Risks |

|---|---|---|---|

| Scenario 1: Moderate Trust Fund | A one-time substantial payout, followed by annual payments or other benefits, potentially impacting operational budgets or future investments. | A secure financial foundation for the family, potentially exceeding their immediate needs. This scenario might not pose a severe strain on the family. | The family might become over-reliant on the trust, neglecting the importance of personal financial responsibility. |

| Scenario 2: Large Trust Fund | Significant impact on AmResorts’ profitability and ability to reinvest in business growth. Could affect future dividends or investments. | Exceptional financial security for the family, possibly leading to long-term financial independence. | AmResorts’ reputation and investor confidence could be affected by the large payout. A large trust might be difficult to manage and potentially prone to misallocation. |

| Scenario 3: Uncertain Trust Fund | The initial cost to AmResorts may be unclear, depending on the specifics of the fund. Ongoing financial obligations may be unclear, potentially creating uncertainty for AmResorts. | The family’s financial security might be uncertain, as the trust fund’s long-term viability is not clear. | Mismanagement or market fluctuations could drastically reduce the trust’s value, jeopardizing the family’s financial security. |

Employee Relations and Compensation

The establishment of a trust fund for a sales director’s family raises complex questions about employee relations and compensation within AmResorts. This isn’t just about a single individual; it touches on the perception of fairness, equity, and the potential impact on the overall employee morale and motivation. How this is handled will significantly affect the company’s culture and future operations.This situation necessitates careful consideration of how the trust fund’s existence might be perceived by other employees, especially those in similar or less-senior positions.

The potential for resentment or a sense of inequitable treatment must be addressed proactively to mitigate any negative consequences. This is a critical juncture where AmResorts must demonstrate transparency and fairness to maintain employee trust and loyalty.

Potential Impact on Employee Morale and Perceptions of Fair Compensation

The trust fund, while intended to be a compassionate gesture, could lead to varying interpretations among employees. Some may feel the fund highlights an uneven compensation system, where exceptional performance is not equally rewarded for all employees. This perceived disparity can negatively impact employee morale, fostering resentment and potentially impacting productivity and loyalty. For example, if an employee feels their contributions are not valued in comparison to the substantial reward for a single individual, their motivation could diminish.

Possible Effects on Future Employee Motivation and Loyalty

The perceived fairness or lack thereof in compensation practices will undoubtedly influence future employee motivation and loyalty. Employees are more likely to remain committed to an organization where they feel valued and appreciated. Conversely, a perception of bias or unfairness can lead to decreased morale and increased turnover. This underscores the importance of a transparent and equitable compensation system, fostering a sense of shared success.

Consider the case of companies with a reputation for rewarding exceptional performance across all levels, versus those where exceptional rewards are concentrated in a few.

Potential Concerns Regarding Equitable Treatment of Other Employees

A significant concern is the equitable treatment of other employees. The trust fund could be perceived as a special exception, potentially raising concerns about preferential treatment. This perception, whether accurate or not, can lead to a feeling of inequality and decreased morale. For example, if the sales director’s performance was extraordinary compared to others, this could be seen as justifiable, but if the difference is not substantial, the trust fund could raise questions.

Companies must ensure that the system is perceived as fair and consistent across all levels of employment.

Potential Concerns and Solutions Regarding Employee Relations

| Concern | Potential Solutions | Impact on Company Culture |

|---|---|---|

| Perceived inequity in compensation | Communicate the rationale behind the trust fund, emphasizing the exceptional contributions of the sales director. Artikel a clear, transparent performance-based compensation structure. Consider initiatives that recognize and reward high performance across all levels. | Enhanced trust, fairness, and morale; improved perceptions of transparency and equity. |

| Potential for resentment among employees | Actively solicit feedback from employees regarding compensation and benefits. Establish clear communication channels to address concerns and anxieties. Demonstrate commitment to fair treatment through consistent and transparent actions. | Stronger employee relations, improved sense of community and belonging, increased trust in leadership. |

| Perception of preferential treatment | Ensure the trust fund is a unique exception, clearly explained. Develop and implement performance-based rewards and recognition programs for all employees, irrespective of their position. | Maintains perception of equity, avoids fostering resentment and maintains a positive company culture. |

| Decreased employee motivation and loyalty | Implement initiatives that recognize and reward employee contributions at all levels, such as bonuses, promotions, or training opportunities. Encourage open communication to address concerns proactively. | Enhanced employee engagement, higher retention rates, improved productivity and morale. |

Ethical Considerations: Amresorts Opens Trust Fund For Sales Director S Family

AmResorts’ decision to establish a trust fund for a sales director’s family raises complex ethical questions. While the intent likely stems from a desire to support the family and recognize exceptional contributions, the arrangement prompts a careful examination of potential conflicts and broader implications for the company’s ethical framework and employee relations. This analysis delves into the ethical dimensions, highlighting potential dilemmas and contrasting the fund with standard compensation practices.The trust fund, while seemingly benevolent, introduces a layer of complexity that requires scrutiny.

It’s essential to understand the ethical considerations not just from the perspective of the company but also from the viewpoint of other employees, stakeholders, and the public. The perceived fairness and transparency of this action will significantly impact AmResorts’ reputation and employee morale.

Amresorts’ thoughtful gesture of opening a trust fund for their sales director’s family is heartwarming. It speaks volumes about their company culture and empathy. Meanwhile, AK is also making waves in the travel industry with their recent renovation of Sanctuary Sun IV, a stunning resort offering a luxurious experience. This renovation, detailed in ak unveils renovated sanctuary sun iv , further solidifies their commitment to providing exceptional vacations.

Ultimately, Amresorts’ act of kindness underscores their dedication to their employees and their families, a powerful message in the industry.

Ethical Framework for Analysis

A robust ethical framework for analyzing the trust fund considers several key principles. These principles include fairness, transparency, equality, and potential conflicts of interest. Applying these standards to the situation reveals potential vulnerabilities and opportunities for improvement in AmResorts’ practices. A framework considering all stakeholders’ interests is essential.

Potential Ethical Dilemmas and Conflicts of Interest

Several potential ethical dilemmas emerge from the trust fund. One is the perception of favoritism. If other employees perceive the fund as an exception rather than a standard practice, resentment or a sense of inequity may arise. This could create tension within the workplace. Another concern is the potential for a conflict of interest.

The trust fund’s creation might be seen as a way to influence the sales director’s future behavior or create an incentive to maintain existing relationships with clients. This could undermine the company’s objective decision-making processes.

Amresorts’ heartwarming gesture of opening a trust fund for their sales director’s family is truly commendable. It highlights the importance of supporting colleagues during difficult times. However, this generosity comes at a time when travel agents are having to redirect babymooners, as Zika concerns are spreading, impacting travel plans. This underscores the complex landscape of travel planning in the current climate, and just how much things can change, especially with health concerns.

Ultimately, Amresorts’ proactive support for their team member is a beautiful example of a company that cares. agents redirect babymooners as zika spreads demonstrates how the travel industry is adjusting to changing circumstances.

Comparison with Standard Employee Compensation Practices

The trust fund deviates significantly from standard employee compensation practices. Typically, compensation is tied to performance, job responsibilities, and market rates. The fund’s creation appears to be an exceptional reward, not necessarily linked to quantifiable contributions or measurable performance criteria. This raises questions about the fairness and consistency of the compensation system within AmResorts. A comprehensive review of the company’s existing compensation structure might reveal inconsistencies and potential gaps that require addressing.

Different Ethical Viewpoints

Different stakeholders may hold varying ethical viewpoints on the trust fund. Some may view it as a generous gesture recognizing exceptional performance. Others may perceive it as an unfair practice that creates inequity and favoritism within the company. The public’s reaction and perception will also play a crucial role in shaping these ethical viewpoints. These diverse viewpoints highlight the need for a comprehensive and transparent approach to managing such exceptional situations.

A well-articulated explanation of the rationale behind the fund could help alleviate concerns and foster a more positive understanding.

Transparency and Communication

The level of transparency and communication surrounding the trust fund is critical. Clear communication about the rationale, criteria, and procedures for similar situations in the future will help ensure fairness and mitigate potential ethical concerns. This should be part of AmResorts’ ethical guidelines and procedures. Furthermore, a robust mechanism for addressing employee concerns and feedback is essential to maintain a healthy and productive work environment.

Legal and Regulatory Aspects

Navigating the legal landscape surrounding employee benefits and corporate actions is crucial for any organization. This section delves into the potential legal implications of AmResorts establishing a trust fund for its sales director’s family, examining potential liabilities and relevant regulations. Careful consideration of these aspects is paramount to ensuring compliance and mitigating any risks.

Potential Legal Implications

AmResorts faces potential legal challenges related to the trust fund’s creation and administration. These challenges could stem from various legal areas, including but not limited to, employment law, tax law, and trust law. The fund’s structure, terms, and conditions need meticulous legal review to ensure compliance with all applicable laws and regulations. This will help prevent unintended consequences and potential disputes.

Potential Legal Liabilities for AmResorts

AmResorts’ liability depends on the specific terms of the trust agreement and its relationship with the sales director. For instance, if the trust agreement creates an implicit or explicit promise of continued compensation, AmResorts could face legal action if that promise is not fulfilled. Misinterpretations of the trust agreement or misrepresentations made during its creation could also expose AmResorts to legal liabilities.

Therefore, the trust agreement must be explicit in defining the scope of AmResorts’ responsibilities and limitations.

Relevant Regulations Concerning Employee Benefits and Compensation

Various federal and state regulations govern employee benefits and compensation. These regulations can vary significantly across jurisdictions and might require specific disclosures or reporting obligations for the trust fund. Understanding these nuances is essential to avoid any legal violations. A thorough review of applicable laws is critical to prevent potential penalties. Compliance with these laws is crucial to avoid potential disputes or legal action.

Potential Legal or Regulatory Considerations and Implications

- Gift vs. Compensation: Determining whether the trust fund constitutes a gift or compensation is crucial. Misclassifying it could lead to tax implications for both AmResorts and the sales director. For example, the IRS has specific rules for classifying employee benefits to ensure fair taxation. If the fund is deemed compensation, AmResorts might face additional tax obligations.

- Discrimination Laws: The trust fund must comply with all anti-discrimination laws. Favoritism towards a particular employee’s family could potentially violate anti-discrimination laws, which prohibit favoritism in employment practices.

- Employee Privacy Laws: Employee privacy laws need to be respected in any communication regarding the trust fund. This includes protecting sensitive employee data and ensuring compliance with relevant regulations, like GDPR (General Data Protection Regulation) in certain jurisdictions.

- Trust Law Requirements: The creation and administration of the trust must adhere to trust law requirements. This includes the proper documentation, trustee responsibilities, and ensuring the fund is managed in the best interest of the beneficiaries. Failure to adhere to these requirements could lead to legal challenges to the trust’s validity.

Potential Alternatives

The AmResorts trust fund, while seemingly a generous gesture, raises complex questions about alternative approaches to employee support. Exploring these options allows for a nuanced understanding of potential benefits and drawbacks, and importantly, can foster a more sustainable and equitable employee support system in the long run. Beyond the immediate emotional response, it’s crucial to examine if this solution truly addresses the needs of the affected parties and the company’s overall well-being.The trust fund, while well-intentioned, may not be the most efficient or equitable solution.

Other options, such as tailored compensation packages, employee assistance programs, or establishing a dedicated fund for future employee support, could provide more sustainable and long-term solutions. A balanced approach that considers the individual circumstances, company resources, and long-term goals is paramount.

Hearing about AmResorts opening a trust fund for their sales director’s family is heartwarming. It speaks volumes about the company’s compassion and commitment to their employees. Meanwhile, the vibrant artistic spirit of Hawaii is also flourishing, as seen in the academy kicks off 58th artists of hawaii exhibit , showcasing local talent. This highlights the broader positive impact AmResorts is having, both within their own organization and contributing to the local community.

Alternative Solutions, Amresorts opens trust fund for sales director s family

Examining alternatives to the trust fund reveals several potential solutions. These solutions offer various advantages and disadvantages, and their practicality depends on the specific circumstances and resources available.

- Dedicated Employee Assistance Program (EAP): An EAP provides confidential counseling and support services to employees facing various personal challenges. This program could be tailored to address specific needs related to financial hardship, stress, or other circumstances. Advantages include accessibility, confidentiality, and potentially lower costs compared to a large trust fund. Disadvantages might include limited scope if not tailored appropriately and the need for ongoing funding and maintenance.

Practicality hinges on the company’s commitment to long-term support and the availability of qualified professionals.

- Phased Compensation Adjustments: Instead of a lump sum, a series of smaller, incremental compensation adjustments could address the needs of the affected employee. These could be tied to the sales director’s performance or to milestones in the recovery process. Advantages include a more gradual and potentially less disruptive approach. Disadvantages include the need for careful consideration of the compensation structure and potentially longer timeframes for support.

Practicality depends on the ability to design a clear and transparent system that acknowledges both the short-term and long-term needs.

- Tailored Compensation Packages: The current compensation package might be adjusted to include elements that directly address specific needs, such as extended paid time off, supplemental income, or retirement planning assistance. Advantages include a direct and tangible response to the individual’s needs and potential for a more sustainable long-term solution. Disadvantages include the complexity of structuring such a package and the need for careful planning to ensure it aligns with the employee’s long-term goals.

Practicality relies on the ability to design a flexible and adaptable package.

- Community Partnership Grants: Exploring community resources, such as non-profit organizations or government assistance programs, for support could be another viable alternative. Advantages include access to a wider range of resources and potentially reduced financial burden on the company. Disadvantages include potential bureaucratic hurdles, limited eligibility criteria, and possible limitations in the support provided. Practicality hinges on the specific resources available in the community and the potential for leveraging existing networks.

Comparison Table

This table summarizes the potential alternatives, their advantages, disadvantages, and practicality.

| Alternative | Advantages | Disadvantages | Practicality |

|---|---|---|---|

| Dedicated Employee Assistance Program (EAP) | Accessibility, confidentiality, potentially lower costs | Limited scope if not tailored, ongoing funding needed | High if company is committed to long-term support |

| Phased Compensation Adjustments | Gradual, less disruptive approach | Need for careful consideration of compensation structure, potentially longer timeframes | Medium, depends on clear and transparent system design |

| Tailored Compensation Packages | Direct response to individual needs, potentially more sustainable | Complex structuring, need for careful planning | High, with proper planning and flexibility |

| Community Partnership Grants | Wider range of resources, reduced financial burden | Bureaucratic hurdles, limited eligibility, limited support | Medium, depends on available resources and community networks |

Closing Summary

In conclusion, AmResorts’ trust fund for its sales director’s family presents a complex situation with numerous angles. From potential financial burdens to ethical considerations and employee relations, this initiative has the potential to significantly impact the company and its employees. The long-term effects remain uncertain, but the initial response and public perception will undoubtedly shape the future trajectory of this significant move.

User Queries

What are the specific terms of the trust fund?

Unfortunately, the precise terms and conditions of the trust fund haven’t been publicly released. This lack of transparency fuels further speculation and uncertainty surrounding the initiative.

How might this impact other employees?

This is a significant concern. The perceived fairness of such a substantial one-time benefit compared to standard compensation practices for other employees could potentially create internal tension and affect employee morale.

Are there any potential legal implications?

Legal implications are always a concern. The fund’s structure and adherence to relevant labor laws and regulations could be subject to scrutiny. Any potential legal liabilities for AmResorts warrant careful consideration.

What are some alternative solutions?

Alternatives could include a company-wide compensation review or a broader employee assistance program to address potential concerns. However, the trust fund’s purpose may not align with these alternatives, making their feasibility a question mark.