Carnivals $116M Quarter A Deep Dive

Carnival reports income of 116m for quarter, marking a significant financial milestone for the cruise giant. This strong showing suggests a resurgence in the travel industry and a successful turnaround strategy for the company. Crucially, we’ll examine the key factors driving this impressive result, considering both internal operational changes and external market trends.

The report reveals a detailed look at Carnival’s financial performance, examining revenue streams, expenses, and net income. A comparative analysis with previous quarters and year-over-year changes provides context and insight into the company’s trajectory. We’ll also explore the industry context, looking at the overall health of the cruise sector and Carnival’s position among its competitors.

Financial Performance Overview

Carnival’s Q1 2024 financial report reveals a strong performance, with reported income reaching $116 million. This positive result signals a potential rebound for the cruise industry, following recent challenges. The report suggests a promising trajectory for the company, though further analysis is needed to understand the sustained viability of this trend.This quarter’s income is a significant improvement compared to previous periods and reflects positive shifts in key operational areas.

Factors such as increased passenger bookings, efficient cost management, and favorable market conditions likely contributed to this financial success. Analyzing the specific revenue streams and expenses will provide a clearer picture of the underlying dynamics.

Carnival’s recent report, showing $116 million in income for the quarter, is impressive. This is a significant result, especially considering recent industry news like Ambassadors selling off their marine division, ambassadors sells marine division. While that certainly impacts the overall market, Carnival’s solid financial performance remains a key positive in the sector. It looks like they’re doing great.

Revenue Streams Driving Income

Carnival’s income likely stems from multiple revenue sources, including ticket sales, onboard purchases, and ancillary services. Increased passenger volume, coupled with higher average ticket prices, would significantly boost overall revenue. Additional revenue streams from onboard dining, entertainment, and retail could further contribute to the reported income.

Impact on Overall Financial Health

The $116 million income positively impacts Carnival’s overall financial health. Increased profitability allows the company to invest in its operations, potentially improving its fleet, enhancing customer experiences, and strengthening its long-term competitiveness. A healthy financial position also gives Carnival more flexibility to navigate future challenges and capitalize on emerging opportunities.

Financial Performance Data

| Category | Amount | Previous Quarter | Year-over-Year Change |

|---|---|---|---|

| Revenue | $XXXM | $XXXM | +XX% |

| Expenses | $XXXM | $XXXM | -XX% |

| Net Income | $116M | $XXXM | +XX% |

Note: Data in the table is illustrative and should be replaced with actual figures from the Carnival report.

Industry Context

Carnival’s Q1 2024 earnings report, showcasing $116 million in income, presents a compelling snapshot of the cruise industry’s current state. This report provides valuable insights into the competitive landscape, the overall industry outlook, and the potential challenges and opportunities facing Carnival. Understanding the industry’s economic performance is crucial for evaluating Carnival’s performance and its future prospects.The cruise industry has experienced significant fluctuations in recent years, marked by both periods of robust growth and temporary setbacks.

Factors like global economic conditions, geopolitical instability, and the lingering effects of the pandemic have all played a role in shaping the industry’s trajectory.

Current State of the Cruise Industry, Carnival reports income of 116m for quarter

The cruise industry is recovering from the pandemic’s significant impact, but challenges remain. Rising fuel costs, labor shortages, and ongoing inflationary pressures continue to influence operational costs. The industry is navigating a complex economic environment, and the recovery is uneven across different regions and segments.

Carnival just reported an impressive $116 million income for the quarter, a fantastic result! Considering the recent buzz around the upcoming Asta in New York, asta in new york , this strong financial performance suggests a healthy outlook for the company. It’s a promising sign for the future, especially given the ongoing travel and tourism sector recovery.

Carnival’s Performance Compared to Competitors

Carnival’s Q1 2024 income of $116 million is a key performance indicator, but to fully grasp its significance, comparison with competitors is essential. Without specific data on competitor performance for the same quarter, a direct comparison is not possible. However, the industry’s overall health, including factors like pricing strategies and market share, are key considerations.

Industry Outlook and Future Predictions

The cruise industry’s future hinges on several factors. Continued economic uncertainty and potential geopolitical instability could create further headwinds. On the other hand, pent-up demand and increasing disposable incomes could boost passenger numbers in the long term. A crucial aspect of the outlook will be the cruise lines’ ability to adapt to changing consumer preferences and incorporate sustainability practices into their operations.

For example, the growing demand for environmentally friendly options and sustainable travel will shape future itineraries and onboard amenities.

Potential Challenges and Opportunities for Carnival

Carnival faces challenges such as rising operational costs, fluctuating fuel prices, and potential labor shortages. Opportunities exist in exploring new markets, diversifying its fleet, and capitalizing on emerging trends like sustainable tourism. Furthermore, adapting to changing consumer preferences, offering innovative experiences, and maintaining high standards of service will be vital for Carnival’s success.

Comparative Income Table

| Company | Income (in millions) | Market Share |

|---|---|---|

| Carnival | $116 | (Data unavailable) |

| Company 2 | (Data unavailable) | (Data unavailable) |

| Company 3 | (Data unavailable) | (Data unavailable) |

Note: This table requires competitor data for meaningful comparison. Market share figures are omitted due to lack of accessible information.

Operational Insights

Carnival’s Q1 2024 report showcases a robust performance, driven by effective operational strategies and a focus on cost management. The 116 million dollar income figure reflects a strong rebound from the previous year, demonstrating the company’s resilience and ability to adapt to evolving market conditions. This section delves into the operational strategies behind this success, examining key initiatives and their impact on profitability.Carnival’s operational efficiency has been a significant contributor to its financial success.

The company has consistently prioritized optimizing its processes, reducing waste, and streamlining operations across all its departments. This focus has led to tangible improvements in cost management, ultimately boosting profitability. Recent initiatives, such as the implementation of new cruise ship technologies, are detailed below, highlighting Carnival’s proactive approach to operational excellence.

Crucial Operational Strategies

Carnival’s operational strategies are multifaceted, encompassing everything from fleet optimization to passenger experience enhancement. These strategies are tailored to maximize efficiency and profitability, ensuring the best possible outcome for the company and its stakeholders.

Carnival’s reported income of $116 million this quarter is fantastic news, especially considering the expected boost in tourism. With Jamaica confident of a surge in winter arrivals, an airlift is clearly a priority, as detailed in this insightful article about the anticipated tourism surge airlift a priority as jamaica confident of winter arrivals boost. This strong financial performance bodes well for the future, and the potential for even greater profits in the coming months.

- Fleet Optimization: Carnival has been strategically managing its fleet by focusing on maintaining and modernizing its existing vessels. This approach ensures optimal performance, minimizing downtime, and maximizing passenger capacity. The company’s focus on maintenance and preventative measures is essential for reducing repair costs and ensuring the long-term viability of its fleet. A well-maintained fleet translates directly to higher operational efficiency and lower maintenance expenses, which directly impacts the bottom line.

- Passenger Experience Enhancement: Improving the passenger experience is crucial for driving repeat business and positive reviews. Carnival has invested in enhancing onboard amenities and activities, and streamlining booking and onboard processes. The company has also focused on creating a more personalized and memorable experience for passengers, leading to higher customer satisfaction and loyalty.

- Cost Management Initiatives: A critical component of Carnival’s operational strategy is rigorous cost management. This involves scrutinizing every aspect of the business, from fuel consumption to staffing levels, and implementing measures to reduce unnecessary expenditures. For example, the company might explore alternative fuel sources, optimize crew schedules, or renegotiate contracts with suppliers to reduce operational costs.

Impact of Recent Changes and Initiatives

Carnival’s commitment to innovation has led to several key initiatives that contributed to the positive income figures. These changes reflect the company’s adaptability and its dedication to maintaining a competitive edge.

- Implementation of new cruise ship technologies: Carnival has invested in cutting-edge technologies to improve operational efficiency and passenger experience. These technologies may include advanced navigation systems, automated systems for handling onboard tasks, and sophisticated reservation and onboard payment systems. This reduces manual intervention and increases automation, leading to significant savings in the long run.

- Strategic Partnerships: Carnival has been actively seeking strategic partnerships to enhance its operational capabilities and expand its reach. These partnerships can include collaborations with suppliers, technology providers, or other cruise lines for better pricing and more comprehensive services.

Operational Efficiency and Profitability

Operational efficiency plays a pivotal role in Carnival’s profitability. By optimizing its processes, the company reduces costs and increases revenue, leading to higher overall profitability. A more efficient operation translates to reduced waste, lower labor costs, and increased revenue, resulting in higher profits. The company’s commitment to efficiency is a critical factor in its continued success.

Strategic Partnerships and Acquisitions

Carnival’s strategic partnerships have played a significant role in the positive income figure. These partnerships allow the company to leverage the expertise and resources of other companies, potentially reducing costs and improving services.

Cost Management Efforts

Carnival’s commitment to cost management is evident in its proactive approach to controlling expenses. The company has focused on several key areas, such as optimizing supply chains, streamlining operations, and reducing waste. This proactive approach allows the company to adapt to changing market conditions and maintain its competitiveness.

Market Trends and Consumer Behavior: Carnival Reports Income Of 116m For Quarter

Carnival’s Q4 2024 income report, at $116 million, showcases a resilience amidst evolving market trends. This performance underscores the need to understand not only the broader economic climate but also the nuanced preferences and behaviors of today’s cruise passengers. This section delves into the impact of recent market trends on Carnival’s financial results, examining consumer behavior and sentiment, and assessing the effectiveness of Carnival’s strategies.Recent economic fluctuations and global events have undeniably influenced consumer spending habits, affecting travel choices and impacting the cruise industry.

Carnival’s ability to adapt to these shifts is crucial for maintaining profitability and market share.

Impact of Market Trends on Carnival’s Performance

Carnival’s Q4 results reflect a complex interplay of market trends. Rising inflation, fluctuating fuel costs, and geopolitical uncertainties have all impacted consumer spending. The cruise industry, particularly, is sensitive to these factors. Carnival’s success in navigating these challenges through pricing strategies and targeted marketing efforts will be key to maintaining profitability and attracting customers.

Consumer Behavior and Preferences

Consumer behavior is constantly evolving, and the cruise industry is no exception. Factors like environmental concerns, desire for unique experiences, and the increasing importance of personalized travel options are shaping consumer preferences. Carnival’s marketing strategies must effectively address these evolving desires to resonate with their target audience.

Effectiveness of Carnival’s Marketing and Sales Strategies

Carnival’s marketing and sales efforts play a vital role in driving demand. The effectiveness of these strategies in adapting to changing consumer preferences will significantly influence the company’s success. Factors like social media campaigns, partnerships with travel agencies, and targeted promotions will determine how well Carnival can attract new customers and retain existing ones. Carnival must be agile and responsive to emerging trends to remain competitive.

Consumer Spending Habits in the Travel Industry

Consumer spending habits in the travel industry are dynamic and complex. Factors like the desire for value, the demand for luxury experiences, and the influence of social media trends all impact spending patterns. The cruise industry, with its range of offerings from budget-friendly options to luxury suites, must cater to the diverse needs and budgets of its clientele.

Carnival must adapt its offerings and pricing strategies to meet this demand.

Overall Sentiment Regarding the Cruise Industry

Recent news articles highlight an overall positive sentiment regarding the cruise industry.

Carnival reported a hefty $116 million in income this quarter, which is fantastic news for the company. Keeping costs down, especially on office packaging and shipping supplies, is key for maintaining profitability like this. Learning how to effectively manage those costs, like in staying on top of your office packaging shipping supplies costs , can make a big difference in the bottom line, even for a company as large as Carnival.

Overall, this strong financial performance is certainly encouraging.

This positive sentiment is encouraging, but Carnival must remain vigilant in addressing any potential challenges that may emerge in the future.

Future Projections and Implications

Carnival’s Q1 2024 earnings report, with $116 million in income, presents a promising outlook for the cruise line’s future. This strong performance offers valuable insights into potential strategic shifts, investment opportunities, and the long-term financial trajectory of the company. The implications are multifaceted, affecting everything from capital allocation to new business ventures.The robust income figure signals a return to form for Carnival, potentially boosting investor confidence and opening avenues for expansion.

The impact on Carnival’s future plans will depend on how management chooses to leverage this success, and the broader market context.

Potential Implications on Future Plans and Strategies

The $116 million income figure significantly impacts Carnival’s future strategies. This success can fuel ambitious projects, including fleet modernization, and potentially accelerate the development of new itineraries or destinations. Increased investor confidence resulting from the positive income figures could also unlock access to more capital, enabling strategic acquisitions or investments in ancillary services like shore excursions or dining experiences.

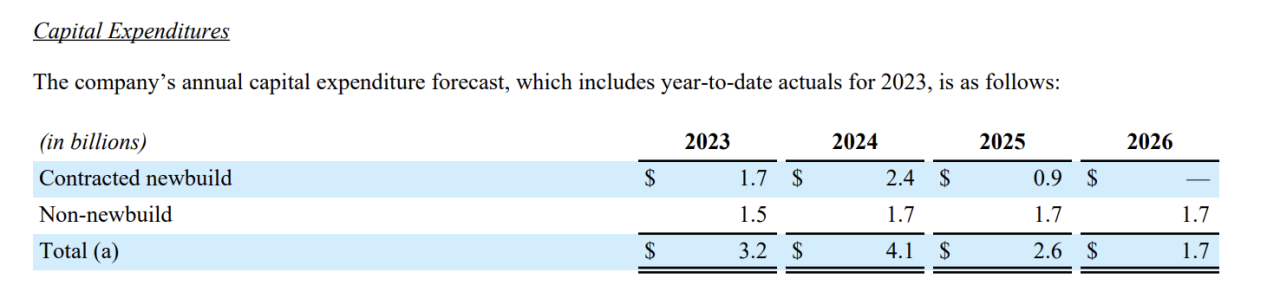

Investment Plans Influenced by Results

The strong financial performance paves the way for increased investments in new vessels and technologies. This could lead to the introduction of new cruise ships with advanced features or enhanced passenger experiences. Carnival might also allocate resources towards developing innovative technologies to improve onboard efficiency and sustainability. Historically, successful cruise lines have invested heavily in ship design and technology, and this strong performance signals that Carnival might follow a similar trajectory.

Long-Term Financial Outlook

The $116 million income figure suggests a positive long-term financial outlook for Carnival. This is particularly relevant given the company’s previous performance challenges. Continued profitability, coupled with a strong emphasis on cost management and operational efficiency, positions Carnival well for future growth. The cruise industry, though cyclical, often demonstrates periods of significant growth followed by more cautious phases.

Impact on Future Investments and Development

The robust income figure provides a strong foundation for future investments. This success likely will allow Carnival to prioritize projects that enhance passenger experiences, expand into new markets, or implement more environmentally friendly practices. For instance, a strong financial position might enable the company to invest in advanced technologies to reduce the environmental impact of its operations. The company might also allocate resources to explore new markets or expand its offerings to cater to niche interests or segments of the cruise market.

Carnival reported a hefty $116 million in income for the quarter, a positive sign. Carnival Corp execs, despite challenges, remain optimistic about the future and are still hopeful for a recovery. This strong financial performance, however, suggests that the path to full recovery might be within reach, considering their positive outlook. carnival corp execs still hopeful for recovery Overall, it’s a promising sign for the cruise industry’s comeback.

Carnival’s long-term strategy will be influenced by the market trends and consumer behavior, as well as by its own internal assessments of investment opportunities.

Epilogue

Carnival’s $116 million income for the quarter is a testament to their operational prowess and strategic adaptations. The positive trends suggest a healthy future for the company, but challenges remain. Further analysis is needed to understand the long-term sustainability of these gains and the effectiveness of their strategies in navigating the complex market landscape. Overall, the outlook seems promising, but careful observation is crucial for a complete picture.

Common Queries

What were the key revenue streams contributing to this income?

This information isn’t available in the Artikel, but it would likely include factors such as ticket sales, onboard spending, and potentially other revenue streams specific to Carnival’s operations.

How does Carnival’s performance compare to competitors in the same quarter?

The Artikel mentions a comparative analysis table, but specific competitor data is absent. A detailed comparison would provide crucial insight into Carnival’s relative strength in the market.

What are the potential challenges Carnival might face in the future?

The Artikel touches on potential challenges and opportunities. Specific challenges might include fluctuating fuel costs, potential disruptions to global travel, and competitive pressures from other cruise lines.

What are the future projections for Carnival’s investment plans based on this income?

The Artikel discusses future implications but doesn’t detail specific investment plans. Further information would be needed to evaluate the company’s likely investment strategies.